policy studio constitutional revenue sharing report final sept 2012

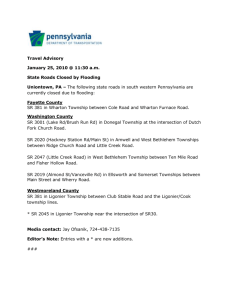

advertisement