ISSO New York Non-Resident tax forms with relevant instruction

NEW YORK STATE Non-Resident Tax Information

(Forms IT-203, IT-203-B, & IT-2): Due date April 18, 2016

You may use the SPRINTAX software to complete your New York State forms for a fee of $25 or use our instructions here. You may also access ALL of this information on our web site at: http://isso.cornell.edu/financial/taxes/new-york-state-tax-information

You are required to file a New York State tax return if you are a New York State non-resident for tax purposes (see the back of this page) AND:

•

New York State taxes were withheld from your income in 2015 and you want a refund, OR

•

You received more than $7,900 in 2015 from a US source, AND some of that is from a New

York source.

If the above do not apply to you, you are not required to file a New York State tax return!

**In order to file your New York State Tax forms, you need to first complete a federal nonresident tax form using the SPRINTAX software: http://www.isso.cornell.edu/financial/taxes

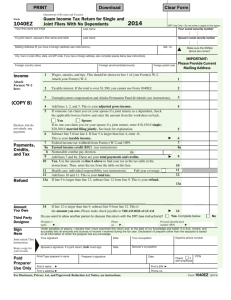

Tips for the IT-203: These are not the only lines you will need to fill in, but these tips cover the usual questions people have. You should ALSO read and follow the Instruction Booklet available here : http://www.tax.ny.gov/pdf/current_forms/it/it203i.pdf

1.

If you file US federal NON-resident tax forms (1040NR or 1040NR-EZ), you may NOT file your

New York State forms electronically.

2.

When filling out the state form, follow the amounts on your federal form as directed by our tips below and USE whole dollar amounts ONLY.

3.

You must use black ink on your New York State form.

4.

If you do not have a social security number or an ITIN, but you have filed an ITIN (W-7) application, then write “ITIN pending” at the upper right in the SSN box.

5.

Leave the boxes for county and school code blank or write “NR.”

6.

Fill in your mailing address in New York State in the mailing address section—and ALSO fill in your home country address in the permanent home address section

7.

Line A : You may ONLY choose either filing status 1 “single” or 3 “married filing separately”

8.

Line B : Answer “yes” ONLY if the software allowed you to itemize deductions on your federal return (line 11 on 1040NRez OR line 35 on 1040NR)

9.

Line C: If you are a NON-resident for U.S. federal tax purposes, answer “No”

10.

Line D1: Internationals filing as non-residents for federal tax purposes should check “No”

11.

Line D2: Leave this blank [don’t answer yes or no].

12.

Line E, F, and G: leave blank.

13.

Line H: Check “Yes” and fill out IT-203-B. Please note, you do NOT need to fill out the ENTIRE

IT-203-B, but only your name and SSN at the top AND the part entitled, “Schedule B, Living quarters maintained in New York.”

14.

Line I —Dependent exemption information. ONLY fill this in if the GTP software allowed you to include dependents on your federal form—citizens of very few countries can do this.

15.

LINE 1: Report wages from the wage line on your 1040NR line 8, or 1040NR-EZ line 3

(tips continued on the back)

Updated 2/4/16 sh

16.

LINE 4: If you reported your last year state refund on the federal form, enter it on line 4

(1040NR line 11; 1040NR-EZ line 4)

17.

Report fellowships and grants (on 1042-S or 1099) on Line 16 and identify (if you have a 1042-S and the exemption code in box 6 is “00,” then this income is fellowship or grants.

18.

You should leave off any treaty exempt income that is reported on a 1042-S (exemption code in box 6 would be “04”)— you do NOT have to report it anywhere on the NY state form.

19.

If you have treaty exempt income that was incorrectly included on your W-2 as taxable wage income, but was correctly recorded as treaty exempt on your federal tax form, you should send a copy of your federal tax form to show that the income is treaty exempt.

20.

Line 19 MUST equal the federal adjusted gross income on Form 1040NREZ or 1040NR.

21.

Line 33. Enter your Standard Deduction -- $7900

22.

Line 38: Figure the tax on your taxable income from the tax table (page 55-62 attached).

23.

Line 39: Household credit—most people CAN take this (page 29-30 attached).

24.

Line 45 : If you only received income from a New York State source, Line 45 will equal 1 .

25.

Line 56: Sales and use tax—fill this in! See instructions (page 32 attached).

26.

Line 62: Report how much state tax was withheld from you from your W-2 and / or 1042-S

27.

Lines 67-74 : Figure how much you owe or are owed and how you will pay or receive that amount.

28.

IT-2: Transfer all of the information from your W-2 forms to the IT-2 forms according to the directions on the back of the IT-2 (every box from the W-2 has a corresponding box on the IT-2).

29.

Putting it all together : Follow the instructions on pages 37-40 attached to this packet on how to make payments if required and how put together and mail your forms.

Updated 2/4/16 sh

Department of Taxation and Finance

Nonresident and Part-Year Resident

Income Tax Return

New York State • New York City • Yonkers • MCTMT

For the year January 1, 2015, through December 31, 2015, or fiscal year beginning ...........

For help completing your return, see the instructions, Form IT-203-I.

and ending ...........

Your first name and middle initial Your last name (for a joint return , enter spouse’s name on line below) Your date of birth (mmddyyyy)

IT-203

Your social security number

1 5

Spouse’s first name and middle initial Spouse’s last name

Mailing address (see instructions, page 14) (number and street or PO box)

City, village, or post office State ZIP code

Taxpayer’s permanent home address (see instr., pg. 14) (no. and street or rural route)

State ZIP code Country (if not United States)

A Filing status

(mark an

X in one box):

Single

Married filing joint return

(enter both spouses’ social security numbers above)

Married filing separate return

(enter both spouses’ social security numbers above)

Head of household (with qualifying person)

Qualifying widow(er) with dependent child

B Did you itemize your deductions on your 2015 federal income tax return? .........................................Yes

C Can you be claimed as a dependent on another taxpayer’s federal return? ..........................................Yes

D1 Did you have a financial account located in a foreign country? (see page 15) ...................................Yes

D2 Yonkers residents and Yonkers part-year residents only:

(1) Did you receive a property tax freeze credit?

(see page 15) .......................................................Yes

(2) If Yes , enter

the amount ............. .

00

No

No

No

No

Spouse’s date of birth (mmddyyyy) Spouse’s social security number

Apartment number New York State county of residence

Country (if not United States) School district name

Apartment no. City, village, or post office

School district

code number

Taxpayer’s date of death Spouse’s date of death

Decedent information

E New York City part-year residents only (see page 15)

(1) Number of months you lived in NY City in 2015 .....

(2) Number of months your spouse lived in NY City in 2015 ....................................................

F Enter your 2-character special condition code(s) if applicable (see page 15) ...............

G New York State part-year residents (see page 16)

Enter the date you moved into or out of NYS (mmddyyyy) .......................

On the last day of the tax year (mark an X in one box) :

1) Lived in NYS ...................................................................

2) Lived outside NYS; received income from

NYS sources during nonresident period .........................

3) Lived outside NYS; received no income from

NYS sources during nonresident period .........................

H New York State nonresidents (see page 16)

Did you or your spouse maintain living quarters in NYS in 2015? ...................Yes

(if Yes , complete Form IT-203-B)

No

I Dependent exemption information (see page 16)

First name and middle initial Last name Relationship Social security number Date of birth

(mmddyyyy)

If more than 6 dependents, mark an X in the box.

203001150094

For office use only

Page 2 of 4 IT-203 (2015) Enter your social security number

Federal income and adjustments

(see page 17)

1 Wages, salaries, tips, etc. ................................................. 1

2 Taxable interest income .................................................... 2

3 Ordinary dividends ............................................................ 3

4 Taxable refunds, credits, or offsets of state and local

income taxes (also enter on line 24) ................................

4

5 Alimony received .............................................................. 5

6 Business income or loss (submit a copy of federal Sch. C or C-EZ, Form 1040) 6

7 Capital gain or loss (if required, submit a copy of federal Sch. D, Form 1040) 7

8 Other gains or losses (submit a copy of federal Form 4797) .. 8

9 Taxable amount of IRA distributions. Beneficiaries: mark X in box 9

10 Taxable amount of pensions/annuities. Beneficiaries: mark X in box

11 Rental real estate, royalties, partnerships, S corporations,

10

trusts, etc. (submit a copy of federal Schedule E, Form 1040) 11

12 Rental real estate included

in line 11 (federal amount)

12 .

00

13 Farm income or loss (submit a copy of federal Sch. F, Form 1040) 13

14 Unemployment compensation ........................................... 14

15 Taxable amount of social security benefits (also enter on line 26) 15

16 Other income (see page 23) Identify: 16

17 Add lines 1 through 11 and 13 through 16 ..................... 17

18 Total federal adjustments to income (see page 23)

Identify: 18

19 Federal adjusted gross income (subtract line 18 from line 17) 19

New York additions (see page 25)

20 Interest income on state and local bonds and obligations

(but not those of New York State or its localities) .................. 20

21 Public employee 414(h) retirement contributions ............. 21

22 Other (Form IT-225, line 9) .................................................... 22

23 Add lines 19 through 22 .................................................... 23

New York subtractions (see page 26)

24 Taxable refunds, credits, or offsets of state and

local income taxes (from line 4) ......................................

24

25 Pensions of NYS and local governments and the

federal government (see page 26) .................................. 25

26 Taxable amount of social security benefits (from line 15) ... 26

27 Interest income on U.S. government bonds ..................... 27

28 Pension and annuity income exclusion ............................ 28

29 Other ( Form IT-225, line 18) ..................................................

29

30 Add lines 24 through 29 ................................................... 30

31 New York adjusted gross income (subtract line 30 from line 23 ) 31

Federal amount

Whole dollars only

.

.

.

.

.

.

.

.

.

.

.

00

00

00

00

00

00

00

00

00

00

00

13

14

15

16

17

18

19

20

21

22

23

.

00 24

.

00 25

.

00 26

.

00 27

.

00 28

.

00 29

.

00 30

.

00 31

32 Enter the amount from line 31, Federal amount column .............................................................

32

Standard deduction or itemized deduction (see page 28)

33 Enter your standard deduction (table on page 28) or your itemized deduction (from Form IT-203-D) .

Mark an X in the appropriate box : ... Standard – or – Itemized 33

34 Subtract line 33 from line 32 (if line 33 is more than line 32, leave blank) ........................................... 34

35 Dependent exemptions (enter the number of dependents listed in Item I; see page 28) .........................

35

36 New York taxable income (subtract line 35 from line 34) ................................................................ 36

.

00 1

.

00 2

.

00 3

.

00 4

.

00 5

.

00 6

.

00 7

.

00 8

.

00 9

.

00 10

.

00 11

New York State amount

Whole dollars only

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

000

.

.

.

.

.

.

.

00

00

00

00

00

00

.

00

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

203002150094

Name(s) as shown on page 1 Enter your social security number IT-203 (2015) Page 3 of 4

Tax computation, credits, and other taxes

37 New York taxable income (from line 36 on page 2) ......................................................................... 37

38 New York State tax on line 37 amount (see page 29) ..................................................................... 38

39 New York State household credit (page 29, table 1, 2, or 3) .............................................................. 39

40 Subtract line 39 from line 38 (if line 39 is more than line 38, leave blank) ............................................ 40

41 New York State child and dependent care credit (see page 30) ..................................................... 41

42 Subtract line 41 from line 40 (if line 41 is more than line 40, leave blank) ............................................ 42

43 New York State earned income credit (see page 30) ..................................................... 43

44 Base tax (subtract line 43 from line 42; if line 43 is more than line 42, leave blank) ................................. 44

45 Income percentage

(see page 30)

New York State amount from line 31

.

00

÷

Federal amount from line 31

.

00

=

45

Round result to 4 decimal places

46 Allocated New York State tax (multiply line 44 by the decimal on line 45) ........................................... 46

47 New York State nonrefundable credits (Form IT-203-ATT, line 8) ..................................................... 47

48 Subtract line 47 from line 46 (if line 47 is more than line 46, leave blank) ........................................... 48

49 Net other New York State taxes (Form IT-203-ATT, line 33) ............................................................. 49

50 Total New York State taxes (add lines 48 and 49) ......................................................................... 50

.

00

.

00

.

00

.

00

.

00

New York City and Yonkers taxes, credits, and surcharges, and MCTMT

51 Part-year New York City resident tax (Form IT-360.1) ....... 51

52 Part-year resident nonrefundable New York City

child and dependent care credit .................................. 52

52a Subtract line 52 from 51 .................................................. 52a .

.

.

00

00

00

52b MCTMT net

earnings base .... 52b .

00

52c MCTMT ............................................................................ 52c

53 Yonkers nonresident earnings tax (Form Y-203) ............... 53

.

00

.

00

54 Part-year Yonkers resident income tax surcharge

(Form IT-360.1) .............................................................. 54 .

00

55 Total New York City and Yonkers taxes / surcharges and MCTMT (add lines 52a, and 52c through 54) 55

See instructions on pages 30 and 31 to compute New York

City and Yonkers taxes, credits, and surcharges, and

MCTMT.

.

00

.

00 56 Sales or use tax (See the instructions on page 32. Do not leave line 56 blank.

) ..............................

56

Voluntary contributions (see page 33)

57a Return a Gift to Wildlife ................................................................ 57a

57b Missing/Exploited Children Fund ................................................. 57b

57c Breast Cancer Research Fund .................................................... 57c

57d Alzheimer’s Fund ......................................................................... 57d

57e Olympic Fund ($2 or $4) ................................................................ 57e

57f Prostate and Testicular Cancer Research and Education Fund .. 57f

57g 9/11 Memorial .............................................................................. 57g

57h Volunteer Firefighting & EMS Recruitment Fund .......................... 57h

57i Teen Health Education ................................................................. 57i

57j Veterans Remembrance ............................................................... 57j

57k Homeless Veterans ....................................................................... 57k

57l Mental Illness Anti-Stigma Fund .................................................. 57l

57m Women’s Cancers Education and Prevention Fund .................... 57m

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

57 Total voluntary contributions (add lines 57a through 57m) ........................................................... 57

58 Total New York State, New York City, Yonkers, and sales or use taxes, MCTMT,

and voluntary contributions (add lines 50 , 55 , 56 , and 57) ........................................................ 58

203003150094

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

Page 4 of 4 IT-203 (2015) Enter your social security number

59 Enter amount from line 58 ............................................................................................................ 59 .

00

Payments and refundable credits (see page 34)

60 Part-year NYC school tax credit (also complete E on front; see page 34) ... 60

61 Other refundable credits (Form IT-203-ATT, line 17) ............... 61

62 Total New York State tax withheld ..................................... 62

63 Total New York City tax withheld ....................................... 63

64 Total Yonkers tax withheld ................................................. 64

65 Total estimated tax payments/amount paid with Form IT-370 .. 65

.

00

.

00

.

00

.

00

.

00

.

00

66 Total payments and refundable credits (add lines 60 through 65) ............................................... 66

If applicable, complete

Form(s) IT-2 and/or IT-1099-R and submit them with your return (see page 12) .

.

00

Your refund, amount you owe, and account information (see pages 36 through 38)

67 Amount overpaid (if line 66 is more than line 59, subtract line 59 from line 66) ..................................

67

68 Amount of line 67 to be refunded

Mark one refund choice: direct deposit (fill in line 73) - or - debit card - or paper check ... 68

.

00

.

00

69 Amount of line 67 that you want applied

to your 2016 estimated tax (see instructions) .................... 69 .

00

70 Amount you owe (if line 66 is less than line 59, subtract line 66 from line 59) . To pay by electronic

funds withdrawal, mark an X in the box and fill in lines 73 and 74. If you pay by check

See page 36 for information about your three refund choices.

See page 37 for payment options.

or money order you must complete Form IT-201-V and mail it with your return. ...................... 70

71 Estimated tax penalty (include this amount on line 70,

or reduce the overpayment on line 67; see page 37)

72 Other penalties and interest (see page 37)

............... 71

................................ 72 .

.

00

00

.

00

See page 40 for the proper assembly of your return.

73 Account information for direct deposit or electronic funds withdrawal (see page 38) .

If the funds for your payment (or refund) would come from (or go to) an account outside the U.S., mark an X in this box (see pg. 38)

73a Account type: Personal checking - or Personal savings - or Business checking - or Business savings

73b Routing number 73c Account number

74 Electronic funds withdrawal (see page 38) ................................. Date Amount .

00

Third-party designee?

(see instr.)

Print designee’s name

Yes No E-mail:

▼ Paid preparer must complete ▼

(see instructions)

Preparer’s signature

Preparer’s NYTPRIN

Preparer’s printed name

NYTPRIN excl. code

Firm’s name (or yours, if self-employed)

Address

Preparer’s PTIN or SSN

Employer identification number

Date

E-mail:

Designee’s phone number

( )

Date

E-mail:

▼

Your signature

( )

Personal identification number (PIN)

Taxpayer(s) must sign here

Your occupation

Spouse’s signature and occupation (if joint return)

Daytime phone number

▼

See instructions for where to mail your return.

203004150094

Department of Taxation and Finance

Instructions for Form IT-201-V

Payment Voucher for Income Tax Returns

IT-201-V

(12/15)

How to use this form

If you are paying New York State income tax by check or money order, you must include Form IT-201-V with your payment.

Pay online

Before mailing in your payment, consider paying online.

• The Tax Department’s Web site is an easy, fast, and safe way to make payments.

• Visit www.tax.ny.gov

to learn more.

Check or money order

• Make your check or money order payable in U.S. funds to

New York State Income Tax .

• Be sure to write your social security number, the tax year, and Income Tax on it.

Completing the voucher

Be sure to complete all information on the voucher.

• If filing a joint return, include information for both spouses.

• Foreign address – Enter the city, province, or state all in the City box, and the full country name in the Country box.

Enter the postal code, if any, in the ZIP code box.

• Do not staple or clip your payment to Form IT-201-V.

Instead, just put them loose in the envelope.

Mailing address

E-filed and previously filed returns

If you e-filed your income tax return, or if you are making a payment for a previously filed return, mail the voucher and payment to:

NYS PERSONAL INCOME TAX

PROCESSING CENTER

PO BOX 4124

BINGHAMTON NY 13902-4124

Paper returns

If you are filing a paper income tax return (including amended returns), include the voucher and payment with your return and mail to this address:

STATE PROCESSING CENTER

PO BOX 15555

ALBANY NY 12212-5555

If you are not using U.S. Mail, be sure to consult

Publication 55, Designated Private Delivery Services .

◄ ►

Cut here

STOP: Pay this electronically on our Web site.

Tax year (yyyy)

Department of Taxation and Finance

Payment Voucher for Income Tax Returns

Make your check or money order payable in U.S. funds to New York State Income Tax . Be sure to write your social security number, the tax year, and Income Tax on your payment.

Your first name and middle initial Your last name (for a joint return, enter spouse’s name on line below) Your social security number (SSN)

Spouse’s first name and middle initial Spouse’s last name

Mailing address

City, village or post office State

040001150094

E-mail:

Spouse’s SSN (enter only if filing a joint return)

Apartment number Country (if not United States)

ZIP code

Payment amount

IT-201-V

(12/15)

Dollars Cents

00

For office use only

0401150094

IT-201-V (12/15) (back)

Fee for payments returned by banks – The law allows the Tax Department to charge a $50 fee when a check, money order, or electronic payment is returned by a bank for nonpayment. However, if an electronic payment is returned as a result of an error by the bank or the department, the department won’t charge the fee. If your payment is returned, we will send a separate bill for $50 for each return or other tax document associated with the returned payment.

Privacy notification

New York State Law requires all government agencies that maintain a system of records to provide notification of the legal authority for any request, the principal purpose(s) for which the information is to be collected, and where it will be maintained. To view this information, visit our Web site, or, if you do not have Internet access, call and request

Publication 54, Privacy Notification . See Need help?

for the

Web address and telephone number.

Need help?

Visit our Web site at www.tax.ny.gov

• get information and manage your taxes online

• check for new online services and features

Telephone assistance

Automated income tax refund status: (518) 457-5149

Personal Income Tax Information Center:

To order forms and publications:

(518) 457-5181

(518) 457-5431

Text Telephone (TTY) Hotline (for persons with

hearing and speech disabilities using a TTY): (518) 485-5082

Persons with disabilities: In compliance with the

Americans with Disabilities Act, we will ensure that our lobbies, offices, meeting rooms, and other facilities are accessible to persons with disabilities.

If you have questions about special accommodations for persons with disabilities, call the information center.

040002150094

0402150094

Department of Taxation and Finance

Nonresident and Part-Year Resident Income Allocation

And College Tuition Itemized Deduction Worksheet

IT-203-B

Name(s) and occupation(s) as shown on Form IT-203 Your social security number

Complete all parts that apply to you; see instructions (Form IT-203-I). Submit this form with your Form IT-203.

Schedule A – Allocation of wage and salary income to New York State

Complete a separate Schedule A for each job for which your wage and salary income is subject to allocation.

An additional Schedule A section is provided on the back of this form. If you are required to complete more than one Schedule A, total the amounts from line p on all schedules and include this total on Form IT-203, line 1, in the New York State amount column.

Do not use this schedule for income based on the volume of business transacted. See the Schedule A instructions if:

• You had more than one job;

• You had a job for only part of the year; or

• You and your spouse each had a job that requires allocation.

1a Total days (see instructions) ............................................................................................................................................... 1a

1b Saturdays and Sundays (not worked) .................................................................... 1b

Nonworking days included in line 1a:

1c

1d

1e

Holidays (not worked) ............................................................................................

Sick leave .............................................................................................................

Vacation ...............................................................................................................

1c

1d

1e

1f Other nonworking days ........................................................................................ 1f

1g Total nonworking days (add lines 1b through 1f) ................................................................................................................. 1g

1h Total days worked in year at this job (subtract line 1g from line 1a) ..................................................................................... 1h

1i Total days included in line 1h worked outside New York State ...................................................................

1i

1j Enter number of days worked at home included in line 1i amount ............................................................. 1j

1k Subtract line 1j from line 1i ..............................................................................................................................................

1k

1l Days worked in New York State (subtract line 1k from line 1h) ............................................................................................ 1l

1m Enter number of days from line 1h above .......................................................................................................................

1m

1n Divide line 1l by line 1m; round the result to the fourth decimal place ................................................................ 1n

1o Wages, salaries, tips, etc. (to be allocated) ................................................................................. 1o

1p New York State allocated wage and salary income (multiply line 1n by line 1o) ..............................

1p

Include the line 1p amount on Form IT-203, line 1, in the New York State amount column.

Schedule B – Living quarters maintained in New York State by a nonresident

Mark an X in the box if NYS living quarters were maintained for you or by you for the entire tax year .................................................

.

00

.

00

If you or your spouse maintained living quarters in NYS during any part of the year, give address(es) below. Submit additional sheets if necessary. For column E, mark an X in the box if the living quarters are still maintained for or by you.

A – Street address B – City, village, or post office C D – ZIP code E

NY

NY

NY

NY

Enter the number of days spent in New York State in this tax year .....

Any part of a day spent in New York State is considered a day spent in New York State.

234001150094

IT-203-B (2015) (back) Enter your social security number

Schedule C – College tuition itemized deduction worksheet (See the instructions for Schedule C.)

A

1 Are you claimed as a dependent on another taxpayer’s New York State tax return for this tax year? .... 1

• If Yes, stop; you do not qualify for the college tuition itemized deduction.

• If No, continue. Complete lines A through H below for each eligible student for whom you paid qualified

college tuition expenses. Use additional sheets if necessary.

1 – Student 1 2 – Student 2

B

C

Eligible student’s name ..........................

Eligible student’s social security number (SSN) ........................................

Is the student claimed as a dependent on your NYS return? (see instructions ) .....

Yes No Yes No Yes

Yes

3 – Student 3

No

No

D EIN of college or university (see instr.) ....

E

F

G

Name of college or university (see instr.) ...

Were expenses for undergraduate tuition? (see instructions) .............................

Yes

Amount of qualified college tuition expenses (see instructions) ......................

H Enter the lesser of line G or 10,000 ......

No

.

.

00

00

Yes No

.

.

00

00

Yes No

.

00

.

00

2 College tuition itemized deduction (add line H , columns 1, 2, and 3; include amounts from any additional sheets).

Also enter this amount on your itemized deduction schedule. ................................................................ 2 .

00

Schedule A – Allocation of wage and salary income to New York State

2a Total days (see instructions) ............................................................................................................................................... 2a

2b Saturdays and Sundays (not worked) .................................................................... 2b

Nonworking days included in line 2a:

2c

2d

2e

Holidays (not worked) ............................................................................................

Sick leave .............................................................................................................

Vacation ...............................................................................................................

2c

2d

2e

2f Other nonworking days ........................................................................................ 2f

2g Total nonworking days (add lines 2b through 2f) ................................................................................................................. 2g

2h Total days worked in year at this job (subtract line 2g from line 2a) .....................................................................................

2h

2i Total days included in line 2h worked outside New York State ...................................................................

2i

2j Enter number of days worked at home included in line 2i amount ............................................................. 2j

2k Subtract line 2j from line 2i ..............................................................................................................................................

2k

2l Days worked in New York State (subtract line 2k from line 2h) ............................................................................................ 2l

2m Enter number of days from line 2h above ....................................................................................................................... 2m

2n Divide line 2l by line 2m; round the result to the fourth decimal place ................................................................ 2n

2o Wages, salaries, tips, etc. (to be allocated) ................................................................................. 2o

2p New York State allocated wage and salary income (multiply line 2n by line 2o) ..............................

2p

Include the line 2p amount on Form IT-203, line 1, in the New York State amount column.

.

00

.

00

234002150094

Department of Taxation and Finance

Summary of W-2 Statements

New York State • New York City • Yonkers

IT-2

Do not detach or separate the W-2 Records below. File Form IT-2 as an entire page with your return. See instructions on the back.

W-2 Record 1

Box a Employee’s social security number for this W-2 Record

Box c Employer’s name and full address (including ZIP code)

Box b Employer identification number (EIN)

Box 1 Wages, tips, other compensation

Box 8 Allocated tips

00

Box 10 Dependent care benefits

00

Box 11 Nonqualified plans

00

00

Box 12a Amount

Box 12b Amount

Box 12c Amount

Box 12d Amount

Code

00

Code

00

Code

00

Code

00

Box 14a Amount

Box 14b Amount

Box 14c Amount

Box 14d Amount

00

00

00

00

Description

Description

Description

Description

Box 13 Statutory employee

NY State information:

Other state information:

Retirement plan

Box 15a

NY State

Box 15b other state

N Y

Third-party sick pay

Box 16a NYS wages, tips, etc. Box 17a NYS income tax withheld

00

Box 16b Other state wages, tips, etc.

00

Box 17b Other state income tax withheld

00 00

NYC and Yonkers information (see instr.) :

Box 18 Local wages, tips, etc.

Locality a

Locality b

Corrected (W-2c)

Box 19 Local income tax withheld

00 Locality a

00 Locality b

00

00

Locality a

Locality b

Box 20 Locality name

W-2 Record 2

Box a Employee’s social security number for this W-2 Record

Do not detach.

Box c Employer’s name and full address (including ZIP code)

Box b Employer identification number (EIN)

Box 1 Wages, tips, other compensation

Box 8 Allocated tips

00

Box 10 Dependent care benefits

00

Box 11 Nonqualified plans

00

00

Box 12a Amount

Box 12b Amount

Box 12c Amount

Box 12d Amount

Code

00

Code

00

Code

00

Code

00

Box 14a Amount

Box 14b Amount

Box 14c Amount

Box 14d Amount

00

00

00

00

Description

Description

Description

Description

Box 13 Statutory employee

NY State information:

Other state information:

Retirement plan

Box 15a

NY State

Box 15b other state

N Y

Third-party sick pay

Box 16a NYS wages, tips, etc. Box 17a NYS income tax withheld

00

Box 16b Other state wages, tips, etc.

00

Box 17b Other state income tax withheld

00 00

NYC and Yonkers information (see instr.) :

Box 18 Local wages, tips, etc.

Locality a

Locality b

Corrected (W-2c)

Box 19 Local income tax withheld

00 Locality a

00 Locality b

00

00

Locality a

Locality b

Box 20 Locality name

102001150094

IT-2 (2015) (back)

General instructions

Who must file this form – You must complete Form IT-2, Summary of W-2 Statements , if you file a New York State (NYS) income tax return and you received federal Form(s) W-2, Wage and Tax

Statement . Complete one W-2 Record section for each federal

Form W-2 you (and if filing jointly, your spouse) received even if your federal Form W-2 does not show any NYS, New York City (NYC), or

Yonkers wages or tax withheld.

If you received foreign earned income but did not receive a federal

Form W-2 you must also complete Form IT-2. Foreign earned income includes, but is not limited to salaries, wages, commissions, bonuses, professional fees, certain noncash income, and allowances or reimbursements.

Specific instructions

How to complete each W-2 Record – each box in the W-2 Record corresponds to a similarly named or numbered box or area on federal Form W-2. Enter the amount, code, or description provided on your federal Form W-2 in the corresponding boxes in the

W-2 Record . Enter only the information requested on Form IT-2.

Complete additional Forms IT-2 if necessary.

Multiple W-2 Records for one federal Form W-2 – If your federal Form W-2 shows more than four items in box 12 or box 14, complete an additional W-2 Record. Fill in boxes a , b , and c with the same information as on the first W-2 Record for the same federal

Form W-2. Then enter the additional items in box 12 or box 14. Do not fill in additional W-2 Records to report withholding by more than one other state for the same wages.

Entering whole dollar amounts – When entering amounts, enter whole dollar amounts only (zeros have been preprinted). Use the following rounding rules when entering your amounts; drop amounts below 50 cents and increase amounts from 50 to 99 cents to the next dollar. For example, $1.39 becomes $1 and $2.50 becomes $3.

Enter in box a your entire 9-digit SSN (or your spouse’s SSN) depending on whose federal Form W-2 it is. Enter in boxes b and c the EIN and employer’s name and address as they appear on the federal Form W-2. Filers with foreign earned income: if the employer’s identification number exceeds the space allowed, leave box b blank.

Box 1 – Enter federal wages, tips, and other compensation shown in

Box 1 of federal Form W-2.

Boxes 8, 10, and 11 – If applicable, enter the amounts from federal Form W-2 for allocated tips, dependent care benefits, and nonqualified plans.

Boxes 12a through 12d – Enter the amount(s) and code(s), if any, shown in the corresponding boxes on federal Form W-2 (such as code J, nontaxable sick pay , or code AA, designated Roth contributions under a section 401(k) plan , etc.). If there are more than four coded amounts, see Multiple W-2 Records for one federal

Form W-2 above.

Box 13 – If your federal Form W-2 has a check mark in any of the following boxes: Statutory employee , Retirement plan , or Third-party sick pay , mark an X in the corresponding box of the W-2 Record .

Otherwise, leave blank.

Corrected (W-2c) box – Mark an X in this box if the W-2 Record is for a federal Form W-2c, Corrected Wage and Tax Statement .

Enter the corrected information from the W-2c in addition to all other requested information from your federal Form W-2.

Instructions

Boxes 14a through 14d – Enter the amount(s) and description(s), if any, shown in box 14 of federal Form W-2 (such as 414(h) or

IRC 125 contributions, union dues, or uniform allowances, etc.). If there are more than four amounts and descriptions, see Multiple

W-2 Records for one federal Form W-2 above.

Boxes 15a through 17a (NYS only) – Complete only for New

York State wage and withholding information (the corresponding box 15a has been prefilled with NY) . Enter in box 16a the New York

State wages exactly as reported on federal Form W-2. Enter in box

17a the NYS withholding, labeled as State income tax on federal

Form W-2. If you have no New York State wages or withholding, leave boxes 16a and 17a blank.

Boxes 15b through 17b (Other state information) – If the federal

Form W-2 has wages and withholding for a state other than New

York, complete boxes 15b, 16b, and 17b with the corresponding W-2 box information for the other state information only .

Boxes 18 through 20 (NYC or Yonkers only) – Complete the locality boxes 18 through 20 only for NYC or Yonkers (or both) wages and withholding, if reported on federal Form W-2. Do not enter locality information from any other state. If applicable, enter in the Locality a boxes the local wages, income tax, and locality name (write NYC for New York City or Yonkers for Yonkers) from Form W-2. To report both localities, enter the other local wages, income tax, and locality name ( NYC or Yonkers ) in the

Locality b boxes.

Transfer the tax withheld amounts to your income tax return.

Include the total NYS tax withheld amounts, the total NYC tax withheld amounts, and the total Yonkers tax withheld amounts from all your Form(s) IT-2 as follows:

• NYS tax withheld – Include on Form IT-201, line 72; Form IT-203, line 62; or Form IT-205, line 34.

• NYC tax withheld – Include on Form IT-201, line 73;

Form IT-203, line 63; or Form IT-205, line 35.

• Yonkers tax withheld – Include on Form IT-201, line 74;

Form IT-203, line 64; or Form IT-205, line 36.

Submit Form(s) IT-2 (as an entire page; do not separate records; however, you do not need to submit instructions from the back page) with your New York State income tax return. Do not submit your federal Form(s) W-2 ; keep them for your records. See the instructions for Form IT-201, IT-203, or IT-205 for information on assembling your return.

102002150094

Access our Web site at www.tax.ny.gov

Step 6 – Compute your taxes

2015 Instructions for Form IT-203 Step 6

29

Line 38 – New York State tax

Is line 32 (your New York AGI) $106,200 or less?

If Yes , find your New York State tax using the 2015 New York State Tax Table on pages 55 through 62, or if line 37 is $65,000 or more, use the New York State tax rate schedule on page 63. Enter the tax due on line 38.

If No , see Tax computation – New York AGI of more than $106,200, beginning on page 64.

Line 39 – New York State household credit

If you marked the Yes box at item C on the front of Form IT-203, you do not qualify for this credit and should go to line 40. If you marked No , use the appropriate table (1, 2, or 3) and the notes on page 30 to determine the amount to enter on line 39.

• Filing status only (Single) - Use New York State household credit table 1 .

• Filing status , and Use New York State household credit table 2 .

• Filing status only (Married filing separate return) - Use

New York State household credit table 3 .

New York State household credit table 1

Filing status only (Single)

If your federal AGI (see Note 1 ) is over:

$ (see Note 2 ) but not over enter on Form IT-203, line 39:

................................................ $ 5,000 ........................................................... $ 75

5,000 ........................................................... 6,000 ........................................................... 60

6,000 ........................................................... 7,000 ........................................................... 50

7,000 ........................................................... 20,000 ........................................................... 45

20,000 ........................................................... 25,000 ........................................................... 40

25,000 ........................................................... 28,000 ........................................................... 20

28,000 ........................................................... No credit is allowed; do not make an entry on Form IT-203, line 39.

New York State household credit table

Filing status , and

2

If your federal AGI (see Note 1 ) is:

Over but not over

And the number of exemptions listed on Form IT-203, item I, plus one for you (and one for your spouse if

1 2 3 4 5

Married filing joint return)

6 7 over 7

(see

Enter on Form IT-203, line 39:

$ (see Note 2 ) ................ $ 5,000

5,000 ........................... 6,000

6,000 ........................... 7,000

7,000 ........................... 20,000

20,000 ........................... 22,000

22,000 ........................... 25,000

25,000 ........................... 28,000

28,000 ........................... 32,000

$ 90

75

65

60

60

50

40

20

105 120 135 150 165 180

90 105 120 135 150 165

80

75

70

60

45

25

95 110 125 140 155

90 105 120 135 150

80 90 100 110 120

70 80 90 100 110

50 55 60

30 35 40

65

45

70

50

15

15

15

15

10

10

5

5

32,000 ................................................ No credit is allowed; do not make an entry on Form IT-203, line 39.

is:

Note 3 )

New York State household credit table 3 (see Note 5)

Filing status only (Married filing separate return)

If your federal AGI (see Note 4 ) total from both returns is:

Over but not over

And the number of exemptions (from both returns) listed on

Form IT-203, item I (Form IT-201, item H) plus one for you and one for your spouse is:

1 2 3 4

Enter on Form IT-203, line 39:

5 6 7 over 7

(see Note 3 )

$ (see Note 2 ) ................. $ 5,000

5,000 .......................... 6,000

6,000 .......................... 7,000

7,000 .......................... 20,000

20,000 .......................... 22,000

22,000 .......................... 25,000

25,000 .......................... 28,000

28,000 .......................... 32,000

32,000 ...................................................

$45

38

33

30

30

25

20

10

53

45

40

38

35

30

23

13

60

53

48

45

40

35

25

15

68

60

55

53

45

40

28

18

75

68

63

60

50

45

30

20

83

75

70

68

55

50

33

23

90

83

78

75

60

55

35

25

No credit is allowed; do not make an entry on Form IT-203, line 39.

3

3

5

5

8

8

8

8

30

2015 Instructions for Form IT-203 Step 6 Access our Web site at www.tax.ny.gov

Use these notes for New York State household credit tables 1 through 3

Note 1 For most taxpayers, federal AGI is the amount from Form IT-203, line 19, Federal amount column. However, if on

Form IT-203 you entered special condition code A6 (for Build America Bond (BAB) interest), your federal AGI is the line 19 amount minus any BAB interest that was included in the line 19 amount.

Note 2 This amount could be 0 or a negative amount.

Note 3 For each exemption over 7, add the amount in this column to the column 7 amount.

Note 4 For most taxpayers, federal AGI is the amount from Form IT-203, line 19 , Federal amount column (or Form IT-201, line 19).

However, if on your NYS return(s) you or your spouse entered special condition code A6 (for Build America Bond (BAB) interest), federal AGI is the line 19 amount minus any BAB interest that was included in the line 19 amount. If your spouse was not required to file a New York State return, use your spouse’s federal AGI as reported on his or her federal return

(minus any BAB interest included in that amount).

Note 5 The credit amounts have been rounded (see page 5).

Line 41 – New York State child and dependent care credit

Did you qualify to claim the federal child and dependent care credit for 2015 (whether or not you actually claimed it)?

If No , you do not qualify for this credit. Go to line 42.

If Yes , complete Form IT-216, Claim for Child and Dependent

Care Credit , and transfer the amount from Form IT-216 to

Form IT-203, line 41. Submit Form IT-216 with your return.

For more information, see the instructions for Form IT-216.

Line 43 – New York State earned income credit

Did you claim the federal earned income credit for 2015 on your federal income tax return?

If No , you do not qualify for this credit. Go to line 44.

If Yes , complete Form IT-215, Claim for Earned Income Credit, and transfer the amount from Form IT-215 to Form IT-203, line 43. Submit Form IT-215 with your return. For more information, see the instructions for Form IT-215.

If the IRS is computing your federal earned income credit, write

EIC in the box to the left of the money column and leave the money column blank on line 43. You must complete Form IT-203, lines 45, 47, 49, 51 through 57, and 60 through 65, but do not complete lines 66 through 71.

Complete Form IT-215, lines 1 through 9 (and lines 21, 23, and 24, if you are a part-year resident), and submit it with your return. The Tax Department will compute your New York State earned income credit and the resulting refund or amount due.

If you are due a refund, we will send you the refund along with an explanatory statement. If you owe tax, you will receive a bill that must be paid within 21 days, or by April 18, 2016, whichever is later.

Line 45 – Income percentage

To compute your income percentage, divide the amount from line 31 in the New York State amount column by the amount from line 31 in the Federal amount column. (These amounts must be entered in the boxes to the left of line 45.) Round the result to the fourth decimal place.

For example, if the amounts used were $12,000 divided by $36,000, the result would be .3333.

Enter this decimal on line 45; do not convert to a percentage .

If the amount on line 31 in either the Federal amount column or New York State amount column is zero or less, enter 0 on line 45.

If the amount on line 31 in the New York State amount column is more than the amount on line 31 in the Federal amount column, the income percentage will be more than 100% . For example, if the amounts used were $25,000 divided by $15,000, the result would be 1.6667.

If you used Form IT-230, Part 2, you must complete the

Nonresident and part-year resident income percentage schedule of Form IT-230-I, Instructions for Form IT-230 , to compute the income percentage to enter on line 45.

Line 47 – New York State nonrefundable credits

See the credit charts beginning on page 8 for a list of nonrefundable credits. If you are claiming any nonrefundable credits, complete the appropriate credit forms and

Form IT-203-ATT. Transfer the amount of nonrefundable credits to line 47. You must submit the completed credit forms and

Form IT-203-ATT with your return.

Line 49 – Net other New York State taxes

If you are subject to any other taxes, complete the appropriate forms and Part 2 of Form IT-203-ATT. Transfer the total amount of net other New York State taxes to line 49. You must submit the completed forms and Form IT-203-ATT with your return.

Line 51 – Part-year New York City resident tax

If you were a New York City resident for part of 2015, complete

Form IT-360.1, Change of City Resident Status.

Enter the tax amount on line 51 and submit Form IT-360.1 with your return.

For more information see Form IT-360.1-I, Instructions for

Form IT-360.1

.

Line 52 – Part-year resident nonrefundable

New York City child and dependent care credit

If you qualify to claim the federal child and dependent care credit for 2015 (whether or not you actually claimed it) and:

1) have federal AGI * of $30,000 or less, and

2) have a qualifying child under 4 years of age as of

December 31, 2015, you may qualify for this credit. Review the instructions for

Form IT-216 and, if you qualify, complete Form IT-216 and transfer the amount from Form IT-216 to Form IT-203, line 52.

Submit Form IT-216 with your return.

* For most taxpayers, federal AGI is the amount from

Form IT-203, line 19, Federal amount column. However, if on

Form IT-203 you entered special condition code A6 (for Build

America Bond (BAB) interest), your federal AGI is the line 19 amount minus any BAB interest that was included in the line 19 amount.

Line 52b – Metropolitan Commuter Transportation

Mobility Tax (MCTMT) net earnings base

Are you subject to the MCTMT?

If No , go to line 53.

If Yes , report your net earnings base on this line.

32

2015 Instructions for Form IT-203 Step 6

Line 56 – Sales or use tax

Report your sales or use tax liability on this line.

You owe sales or compensating use tax if you:

• purchased an item or service subject to tax that is delivered to you in New York State without payment of New York State and local tax to the seller; or

• purchased an item or service outside New York State that is subject to tax in New York State (and you were a resident of

New York State at the time of purchase) with subsequent use in New York State.

Note: You may be entitled to a credit for sales tax paid to another state. See the exact calculation method in the instructions for Form ST-140, Individual Purchaser’s Annual

Report of Sales and Use Tax.

For sales and use tax purposes, a resident includes persons who have a permanent place of abode in the state. Accordingly, you may be a resident for sales tax purposes even though you may not be a resident for income tax purposes. See the instructions for Form ST-140 for more information.

You may not use this line to report:

• any sales and use tax on business purchases if the business is registered for sales and use tax purposes. You must report this tax on the business’s sales tax return.

• any unpaid sales and use tax on motor vehicles, trailers, all-terrain vehicles, vessels, or snowmobiles. This tax is paid directly to the Department of Motor Vehicles ( DMV ). If you will not be registering or titling it at the DMV, you should remit the tax directly to the Tax Department using Form ST-130,

Business Purchaser’s Report of Sales and Use Tax , or

Form ST-140.

An unpaid sales or use tax liability commonly arises if you made purchases through the Internet, by catalog, from television shopping channels, or on an Indian reservation, or if you purchased items or services subject to tax in another state and brought them back to New York for use here.

Example 1: You purchased a computer over the Internet

that was delivered to your house in Monroe County,

New York, from an out-of-state company and did not

pay sales tax to that company.

Example 2: You purchased a book on a trip to

New Hampshire that you brought back to your residence

in Nassau County, New York, for use there.

Access our Web site at www.tax.ny.gov

You may also owe an additional local tax if you use property or services in another locality in New York State, other than the locality to which you paid tax. You owe use tax to the second locality if you were a resident of that locality at the time of the purchase and its rate of tax is higher than the rate of tax originally paid.

Failure to pay sales or use tax may result in the imposition of penalty and interest. The Tax Department conducts routine audits based on information received from third parties, including the

U.S. Customs Service and other states.

If you owe sales or use tax , you may report the amount you owe on your personal income tax return rather than filing

Form ST-140.

Using the sales and use tax chart below is an easy way to compute your liability for all your purchases of items or services costing less than $1,000 each (excluding shipping and handling) that are not related to a business, rental real estate, or royalty activities.

You must use Form ST-140 to calculate your sales and use tax liability to be reported on this return if any of the following apply:

• You prefer to calculate the exact amount of sales and use tax due.

• You owe sales or use tax on an item or service costing $1,000 or more (excluding shipping and handling).

• You owe sales or use tax for purchases related to a business not registered for sales tax purposes, rental real estate, or royalty activities.

Include the amount from Form ST-140, line 4, on Form IT-203, line 56. Do not submit Form ST-140 with your return.

If the amount reported on line 56 is $1,700 or more, you must complete Form IT-135, Sales and Use Tax Report for Purchases of Items and Services Costing $25,000 or More , and submit it with your return.

If you do not owe any sales or use tax, you must enter 0 on line 56.

Do not leave line 56 blank.

For additional information on when you may owe sales or use tax to New York, see TB-ST-913, Use Tax for Individuals

(including Estates and Trusts) . For more information on taxable and exempt goods and services, see TB-ST-740, Quick

Reference Guide for Taxable and Exempt Property and Services.

Sales and use tax chart

If your federal adjusted gross income

(line 19, Federal amount column) is: Enter on line 56: up to $15,000 * ............................................ $ 10

$ 15,001 - $ 30,000 ................................. 19

30,001 - 50,000 ................................. 32

50,001 - 75,000 .................................

48

75,001 - 100,000 ................................. 64

100,001 - 150,000 ................................. 85

150,001 - 200,000 ................................. 102

200,001 and greater ................................. .052% (.00052) of income, or

$ 250, whichever amount is smaller

* This may be any amount up to $15,000,

including 0 or a negative amount.

You may use this chart for purchases of items or services costing less than $1,000 each (excluding shipping and handling). You may not use this chart for purchases related to a business, rental real estate, or royalty activities, regardless of the amount.

If you maintained a permanent place of abode in New York State for sales and use tax purposes for only part of the year, multiply the tax amount from the chart by the number of months you maintained the permanent place of abode in New York State and divide the result by 12. (Count any period you maintained the abode for more than one-half month as one month.)

Access our Web site at www.tax.ny.gov

We will notify you if we keep your overpayment because of a past-due legally enforceable debt to the IRS or a tax debt to another state. You cannot use Form IT-280 to disclaim liability for a legally enforceable debt to the IRS, or to disclaim a tax liability owed to another state. You must contact the other state to resolve your responsibility for the asserted liability.

Line 69 – Estimated tax

Enter the amount of overpayment from line 67 that you want applied to your New York State, New York City, Yonkers, and

MCTMT estimated tax for 2016. The total of lines 68 and 69 should equal the amount on line 67.

Line 70 – Amount you owe

Enter on line 70 the amount of tax you owe plus any estimated tax penalty you owe (see line 71 instructions) and any other penalties and interest you owe (see line 72 instructions).

If you choose to pay by electronic funds withdrawal, mark an X in the box, enter your account information on line 73 and enter your electronic funds withdrawal information on line 74.

To avoid other penalties and interest, pay any tax you owe by April 18, 2016.

For additional information on penalties and interest, visit our Web site.

Line 71 – Estimated tax penalty

Begin with these steps to determine if you may owe an estimated tax penalty.

1. Locate the amount of your 2014 New York AGI as shown on your 2014 return;

2. Locate the amount of your 2014 New York income tax; then

3. Calculate the amount of your 2015 prepayments (the amount of withholding and estimated tax payments you have already made or have been paid on your behalf by a partnership or

S corporation for 2015).

In general, you are not subject to a penalty if your 2015 prepayments equal at least 100% of your 2014 income tax based on a 12-month return.

However:

• If your 2014 New York AGI was more than $150,000 (or

$75,000 if you are married filing separately for 2015) and you are not a farmer or a fisherman, your prepayments must equal at least 110% of your 2014 income tax based on a 12-month return;

• You may owe a penalty if line 70 is $300 or more and represents more than 10% of the income tax shown on your

2015 return; and

• You may owe a penalty if you underpaid your estimated tax liability for any payment period.

For more information, see Form IT-2105.9, Underpayment of

Estimated Tax by Individuals and Fiduciaries.

If you owe an estimated tax penalty, enter the penalty amount on line 71. Also add the same amount to any tax due and enter the total on line 70. It is possible for you to owe an estimated tax penalty and also be due a refund. In that case, subtract the estimated tax penalty amount from the overpayment and enter the net result on line 67. Do not include any other penalty or interest amounts on line 67.

Be sure to submit Form IT-2105.9 with your return.

2015 Instructions for Form IT-203 Step 9

37

Line 72 – Other penalties and interest

If you owe a late filing penalty, late payment penalty, or interest, enter the penalty and interest amount on line 72. Also add the same amount to any tax due and enter the total on line 70. You may compute the penalty and interest using the Penalty and

Interest Calculator on our Web site.

Payment options

By automatic bank withdrawal

You may authorize the Tax Department to make an electronic funds withdrawal from your bank account either by completing line 73, or on our Web site.

This payment option is not available if the funds for your payment would come from an account outside the U.S.

(see Note on banking rules on page 38).

File now/Pay later!

You must specify a future payment date up to and including April 18, 2016. If you file before April 18, money will not be withdrawn from your account before the date you specify. To avoid interest and penalties, you must authorize a withdrawal on or before the filing deadline. If you designate a weekend or a bank holiday, the payment will be withdrawn the next business day. See line 73 instructions.

By check or money order

If you owe more than one dollar, include full payment with your return. Make check or money order payable in U.S. funds to New

York State Income Tax and write your social security number and 2015 Income Tax on it. Do not send cash.

You must submit Form IT-201-V if you are making a payment by check or money order. For additional information, see

Form IT-201-V.

Fee for payments returned by banks

The law allows the Tax Department to charge a $50 fee when a check, money order, or electronic payment is returned by a bank for nonpayment. However, if an electronic payment is returned as a result of an error by the bank or the department, the department won’t charge the fee.

If your payment is returned, we will send a separate bill for

$50 for each return or other tax document associated with the returned payment.

By credit card

You can use your American Express®, Discover®/Novus®,

MasterCard , or Visa credit card to pay the amount you owe on your New York State income tax return. You can pay your tax due by credit card through the Internet. You will be charged a convenience fee for each credit card payment you make to cover the cost of this service.

You can make your payment by credit card regardless of how you file your income tax return. For returns filed before the due date, you can make credit card payments any time up to the due date.

For returns filed on or after the due date, you should make your credit card payment at the same time you file your return.

For additional information on the credit card payment program, go to our Web site.

38

2015 Instructions for Form IT-203 Step 9

You must have an Online Services account to make a payment by credit card. You will need the amount of the payment

(line 70 of Form IT-203) , the credit card number, and expiration date. Have a copy of your completed New York State income tax return available. You will be told the amount of the convenience fee that you will be charged to cover the cost of this service.

At that point you may elect to accept or cancel the credit card transaction.

If you accept the credit card transaction you will be given a confirmation number. eep this confirmation number as proof of payment.

Unable to pay?

To avoid interest and penalty charges, you must file and pay the amount due by April 18, 2016.

If you cannot pay in full, you should file your return on time, and pay as much of the tax due as possible by automatic bank withdrawal, check, or money order. Also consider alternative payment methods such as a commercial or private loan, or a credit card transaction to pay any remaining balance.

You will be billed for any unpaid tax plus interest (see Amount you owe) . Pay the bill immediately if you can; if you cannot, call the number provided on the bill to make other arrangements. If you fail to pay the amount due, New York State may file a tax warrant, seize your assets, and/or garnishee your wages to ensure payment.

Line 73 – Account information

If you marked the box that indicates your payment (or refund) would come from (or go to) an account outside the U.S.; stop . Do not complete lines 73a, 73b, or 73c (see Note below). All others, supply the information requested for lines 73a, 73b, and 73c.

Note: Banking rules prohibit us from honoring requests for electronic funds withdrawal or direct deposit when the funds for your payment (or refund) would come from (or go to) an account outside the U.S. Therefore, if you marked this box, you must pay any amount you owe by check, money order, or credit card

(see above); or if you are requesting a refund, we will send your refund to the mailing address on your return.

The following requirements apply to both direct deposit and electronic funds withdrawal:

On line 73a, mark an X in the box for the type of account:

• If you mark personal or business checking, enter the account number shown on your checks. (On the sample check below, the account number is 1357902468 . Do not include the check number.)

• If you mark personal or business savings, you can get your savings account number from a preprinted savings account deposit slip, your passbook or other bank records, or from your bank.

Access our Web site at www.tax.ny.gov

Enter your bank’s 9-digit routing number on line 73b. If the first two digits are not 01 through 12, or 21 through 32, the transaction will be rejected. On the sample check below, the routing number is 090090099 .

JOHN SMITH

MARY SMITH

999 Maple Street

Someplace, NY 10000

Pay to the

Order of

Sample

Date

$

1234

15-0000/0000

SOME BANK

Someplace, NY 10000

For

Routing

Number

(line 73b)

Account

Number

(line 73c) qQqqQqqQQe Th?bQqiAc:e TihA

Dollars

Do not include the check number

The routing and account numbers may appear in different places on your check.

Note: The routing and account numbers may appear in different places on your check.

If your check states that it is payable through a bank different from the one where you have your checking account, do not use the routing number on that check. Instead, contact your bank for the correct routing number to enter on line 73b.

Enter your account number on line 73c. The number can be up to

17 characters (both numbers and letters). Include hyphens (-) but omit spaces and special symbols. Enter the number from left to right and leave any unused boxes blank.

Contact your bank if you need to verify routing and account numbers or confirm that it will accept your direct deposit or process your electronic funds withdrawal.

If you encounter any problem with direct deposit to, or electronic withdrawal from, your account, call (518) 457-5181. Please allow six to eight weeks for processing your return.

Line 74 – Electronic funds withdrawal

Enter the date you want the Tax Department to make an electronic funds withdrawal from your bank account and the amount from line 70 you want electronically withdrawn. Enter a due date that is on or before the due date of your return. If we receive your return after the due date or you do not enter a date, we will withdraw the funds on the day we accept your return.

Your confirmation will be your bank statement that includes a

NYS Tax Payment line item.

We will only withdraw the amount that you authorize. If we determine that the amount you owe is different from the amount claimed on your return, we will issue you a refund for any amount overpaid or send you a bill for any additional amount owed, which may include penalty and interest.

You may revoke your electronic funds withdrawal authorization only by contacting the Tax Department at least 5 business days before the payment date.

If you complete the entries for electronic funds withdrawal, do not send a check or money order for the same amount due unless you receive a notice.

Access our Web site at www.tax.ny.gov

2015 Instructions for Form IT-203 Step 10

39

Step 10 – Sign and date your return

Third-party designee

Do you want to authorize a friend, family member, return preparer, or any other individual (third-party designee) to discuss this tax return and questions arising from it with the New York

State Tax Department?

If No , mark an X in the No box.

If Yes , mark an X in the Yes box. Print the designee’s name, phone number, and any five numbers the designee chooses as his or her personal identification number (PIN). If you want to authorize the paid preparer who signed your return to discuss it with the Tax Department, print the preparer’s name and phone number in the spaces for the designee’s name and phone number (you do not have to provide a PIN).

If you mark the Yes box, you (and your spouse, if filing a joint return) are authorizing the Tax Department to discuss with the designee any questions related to this return. You are also authorizing the designee to give and receive confidential taxpayer information relating to:

• this return, including missing information,

• any notices or bills arising from this filing that you share with the designee (they will not be sent to the designee),

• any payments and collection activity arising from this filing, and

• the status of your return or refund.

This authorization will not expire but will only cover matters relating to this return. If you decide to revoke this designee’s authority at any time, call us (see Need help?

).

You are not authorizing the designee to receive your refund, bind you to anything (including any additional tax liability), or otherwise represent you before the Tax Department. If you want someone to represent you or perform services for you beyond the scope of the third-party designee, you must designate the person using another method such as Form DTF-280, Tax Information

Authorization , or a power of attorney. For additional information on third-party designees and other types of authorizations, visit our Web site.

Paid preparer’s signature

If you pay someone to prepare your return, the paid preparer must also sign it and fill in the other blanks in the paid preparer’s area of your return. A person who prepares your return and does not charge you should not fill in the paid preparer’s area.

Paid preparer’s responsibilities – Under the law, all paid preparers must sign and complete the paid preparer section of the return. Paid preparers may be subject to civil and/or criminal sanctions if they fail to complete this section in full.

When completing this section, enter your New York tax preparer registration identification number (NYTPRIN) if you are required to have one. If you are not required to have a NYTPRIN, enter in the NYTPRIN excl. code box one of the specified 2-digit codes listed below that indicates why you are exempt from the registration requirement. You must enter a NYTPRIN or an exclusion code. Also, you must enter your federal preparer tax identification number (PTIN) if you have one; if not, you must enter your social security number.

Code Exemption type

01 Attorney

03 CPA

05 PA (Public Accountant)

07 Enrolled agent

09 Volunteer tax preparer

Code Exemption type

02 Employee of attorney

04 Employee of CPA

06 Employee of PA

08 Employee of enrolled agent

10 Employee of business preparing that business’ return

See our Web site for more information about the tax preparer registration requirements.

Your signature(s)

In the spaces provided at the bottom of page 4, sign and date your original return and enter your occupation. If you are married and filing a joint return, and you are not required to submit Form IT-203-C, you must both sign Form IT-203. If you are required to submit Form IT-203-C, only the spouse with New

York source income must sign Form IT-203. Your return cannot be processed if you do not properly sign it and submit a signed

Form IT-203-C, if required. Keep your signature(s) within the spaces provided.

If the return is for someone who died and there is no surviving spouse to sign it, print or type the name and address of the person signing it below the signature. For additional information about deceased taxpayers, see page 48.

Daytime phone number

This entry will enable the Tax Department to correct minor errors or omissions by calling you rather than writing or sending back your return.

40

2015 Instructions for Form IT-203 Step 11

Step 11 – Finish your return