New Opportunities - Metro Holdings Limited

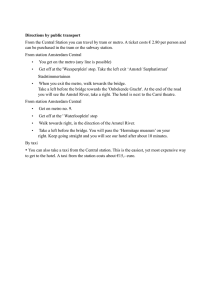

advertisement