Credit Suisse Mortgage Interest Rate Forecasts

February 4, 2016

Ups and Downs in Fix Mortgage Interest Rates Set to Continue

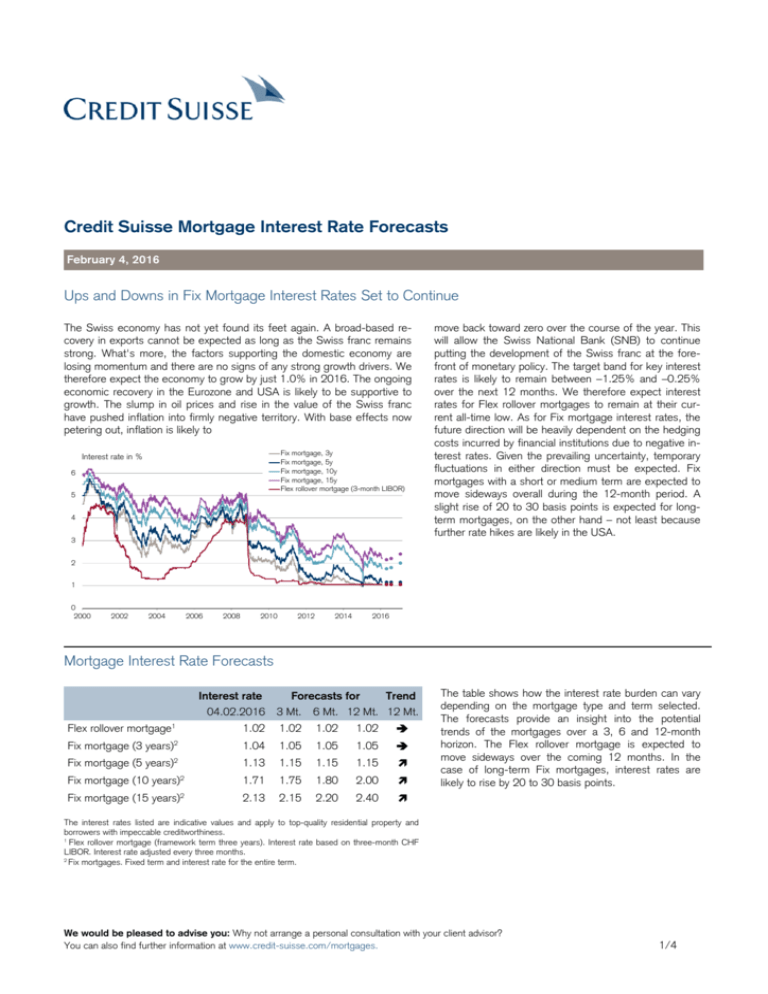

The Swiss economy has not yet found its feet again. A broad-based recovery in exports cannot be expected as long as the Swiss franc remains

strong. What's more, the factors supporting the domestic economy are

losing momentum and there are no signs of any strong growth drivers. We

therefore expect the economy to grow by just 1.0% in 2016. The ongoing

economic recovery in the Eurozone and USA is likely to be supportive to

growth. The slump in oil prices and rise in the value of the Swiss franc

have pushed inflation into firmly negative territory. With base effects now

petering out, inflation is likely to

Fix mortgage, 3y

Fix mortgage, 5y

Fix mortgage, 10y

Fix mortgage, 15y

Flex rollover mortgage (3-month LIBOR)

Interest rate in %

6

5

4

3

move back toward zero over the course of the year. This

will allow the Swiss National Bank (SNB) to continue

putting the development of the Swiss franc at the forefront of monetary policy. The target band for key interest

rates is likely to remain between –1.25% and –0.25%

over the next 12 months. We therefore expect interest

rates for Flex rollover mortgages to remain at their current all-time low. As for Fix mortgage interest rates, the

future direction will be heavily dependent on the hedging

costs incurred by financial institutions due to negative interest rates. Given the prevailing uncertainty, temporary

fluctuations in either direction must be expected. Fix

mortgages with a short or medium term are expected to

move sideways overall during the 12-month period. A

slight rise of 20 to 30 basis points is expected for longterm mortgages, on the other hand – not least because

further rate hikes are likely in the USA.

2

1

0

2000

2002

2004

2006

2008

2010

2012

2014

2016

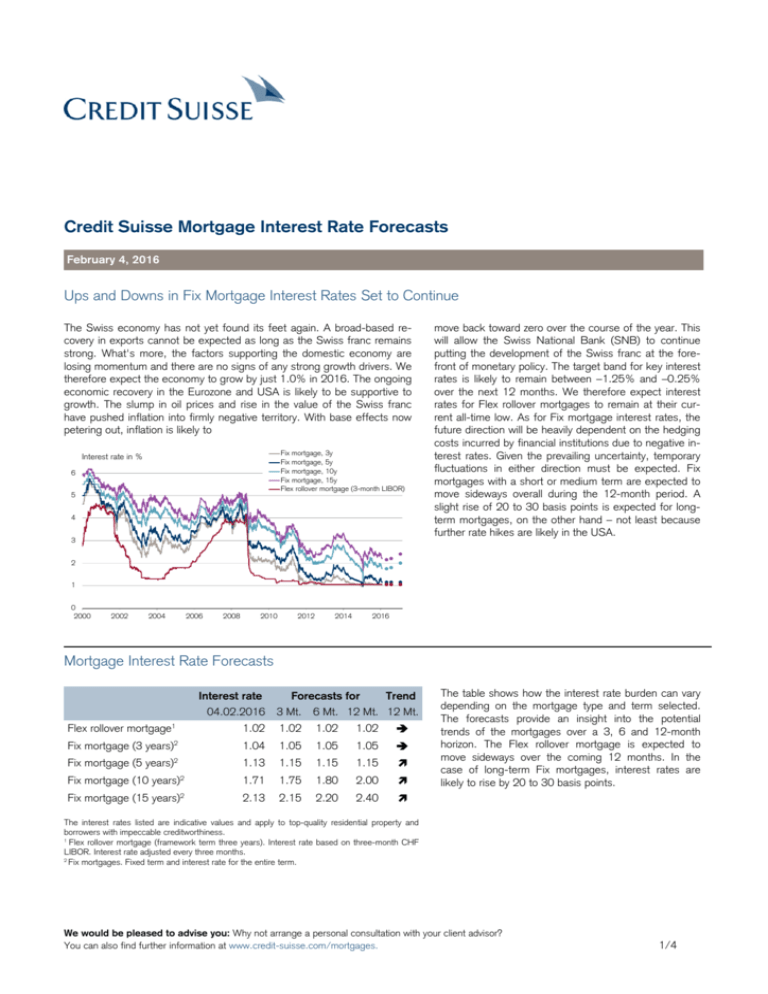

Mortgage Interest Rate Forecasts

Interest rate

Forecasts for

Trend

04.02.2016 3 Mt. 6 Mt. 12 Mt. 12 Mt.

Flex rollover mortgage

1

Fix mortgage (3 years)2

Fix mortgage (5 years)

1.02

1.02

1.02

1.02

1.04

1.05

1.05

1.05

1.13

1.15

1.15

1.15

2

Fix mortgage (10 years)

1.71

1.75

1.80

2.00

Fix mortgage (15 years)2

2.13

2.15

2.20

2.40

2

The table shows how the interest rate burden can vary

depending on the mortgage type and term selected.

The forecasts provide an insight into the potential

trends of the mortgages over a 3, 6 and 12-month

horizon. The Flex rollover mortgage is expected to

move sideways over the coming 12 months. In the

case of long-term Fix mortgages, interest rates are

likely to rise by 20 to 30 basis points.

The interest rates listed are indicative values and apply to top-quality residential property and

borrowers with impeccable creditworthiness.

1

Flex rollover mortgage (framework term three years). Interest rate based on three-month CHF

LIBOR. Interest rate adjusted every three months.

2

Fix mortgages. Fixed term and interest rate for the entire term.

We would be pleased to advise you: Why not arrange a personal consultation with your client advisor?

You can also find further information at www.credit-suisse.com/mortgages.

1/4

Credit Suisse Financing

February 4, 2016

A suitable product mix depends on your individual risk profile as well as the choice, term and

composition of the products.

Your risk profile reflects the amount of flexibility you want and your willingness to tolerate interest

rate fluctuations.

Combining different products allows you to take possible interest rate risks into account. Staggering the terms lessens the risk of the entire mortgage amount having to be extended in a period of high interest rates.

Please contact your client advisor to receive the optimal product solution for your individual

needs. He or she will put together the right product with the appropriate term and weighting.

Product Mix Suggestion

Suggestions are based on the latest mortgage interest forecast. They may deviate from your personal needs.

Risk profile

Possible product options

Explanation

Security-oriented:

Fix mortgages with different terms, e.g.:

Low tolerance of interest-rate

fluctuations

Little flexibility required

Medium to long-term horizon

40%: 8-year Fix mortgage

60%: 12-year Fix mortgage

Current interest rates allow you to lock in the low interest rates on a Fix mortgage for a long period.

Splitting the mortgage into two terms is advisable because, if rates go up in the future, only part of the

mortgage principal will need to be renewed. We recommend putting 40% to 60% in a long-term Fix

mortgage.

Balanced:

Combined Fix and Flex rollover mortgage,

e.g.:

Willing to accept average

fluctuations in interest

Medium flexibility desired

Medium-term horizon

Dynamic:

Low mortgage interest rates at present speak in favor of a combination of Fix and Flex rollover mortgages. Placing a significant 50% to 70% of your financing in a Fix mortgage takes into account your

70%: 12-year Fix mortgage

30%: 3-month Flex rollover mortgage need for security, and ensures low interest rates for

the long term.

Low Fix mortgage interest rates at present speak in

favor of hedging part of the loan for the long term.

Therefore, we recommend locking 20% to 30% of

your financing into a long-term Fix mortgage. At the

30%: 12-year Fix mortgage

70%: 3-month Flex rollover mortgage same time, having a significant share in a Flex

rollover mortgage is attractive. Alternatively, the

current interest rate situation also allows for a

significant portion to be fixed on a medium-term

basis.

Combined Fix and Flex rollover mortgage,

e.g.:

Willingness to accept high

fluctuations in interest

High flexibility required

Relatively short-term horizon

Long-Term Mortgages: A Comparison

A sample calculation demonstrates the current attractiveness of long-term mortgages

Start date

Characteristics

2008

(Oct. 1, 2008)

2016

(Feb. 1, 2016)

Mortgage

CHF 500,000

CHF 500,000

10 years

10 years

Interest rate

4.50%

1.72%

Interest cost over term

CHF 225,000

CHF 86,000

Term

1

Interest saving over term

1

The interest rates shown are indicative. They apply to prime,

owner-occupied residential real estate and borrowers with firstclass credit status. All information is subject to change without

notice.

CHF 139,000

We would be pleased to advise you: Why not arrange a personal consultation with your client advisor?

You can also find further information at www.credit-suisse.com/mortgages.

2/4

Credit Suisse Mortgage Solutions

February 4, 2016

Fix Mortgage

10

Interest rates for new mortgages in %

Fix mortgage (3 years)

Fix mortgage (5 years)

Fix mortgage (10 years)

Fix mortgage (15 years)

Average Fix mortgage (5 years)

9

8

7

6

5

4

3

2

1

0

1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016

Lock in to Lower Long-Term Interest Rates

Interest rates on Fix mortgages are at a very low level. Their future direction is heavily dependent on the

hedging costs incurred by financial institutions due to

negative interest rates. Given the prevailing uncertainty, temporary fluctuations in either direction must

be expected. On a 12-month view, we expect a

sideways movement for Fix mortgages with a short

and medium term and a slight rise in interest rates for

those with a long term. A Fix mortgage enables borrowers to secure an attractive interest rate for a

number of years.

Description of the Fix Mortgage/Forward Fix

mortgage

The Fix mortgage comes with a fixed interest rate

over a fixed term. This type of mortgage is particularly

suitable if you are looking for security and predictable

mortgage interest costs. Our Forward Fix mortgage

enables you to fix your mortgage interest rate early or

extend your mortgage by up to 36 months in advance.

Schematic illustration:

Flex Rollover Mortgage

5

Interest-rate development for mortgage taken out in February 2011

Flex rollover mortgage (3M tranches)

Fix mortgage (5 years)

4

Variable-rate mortgage

3

2

1

0

02. 2011

02. 2012

02. 2013

02. 2014

02. 2015

Schematic illustration:

Stay Flexible

The Flex rollover mortgage, which is based on the 3month LIBOR, gives borrowers the flexibility to react

to a changed situation. With interest rates expected

to remain low, the Flex rollover is still an attractive option. Although the Fix mortgage allows the borrower

to lock in to a low interest rate for a long period of

time, the Flex rollover mortgage is an attractive option

in the current period of low interest rates – at least

for partial financing.

02. 2016

Description of the Flex Rollover Mortgage

The Flex rollover mortgage lets you choose the overall term and decide the periods (tranches) following

which the mortgage interest rate will be recalculated.

The mortgage interest rate is linked to the LIBOR

rate and recalculated at the start of each new tranche

based on current market conditions. The Flex rollover

mortgage is particularly suitable for those wishing to

take advantage of current interest rates throughout

their chosen term of tranche.

Optimum Combination of Security and Flexibility

Combining mortgage products is a good way to obtain an optimum mix of security and flexibility. For example, by taking out various Fix

mortgages with different terms you can reduce the risk of having to extend the entire mortgage amount during a period of high interest

rates. Alternatively, depending on the personal risk profile, the Fix mortgage can be combined with a Flex rollover mortgage. The Flex

rollover portion of the mortgage allows the client to react to interest rate changes flexibly. As far as interest costs are concerned, the Fix

mortgage component provides the required budget security.

We would be pleased to advise you: Why not arrange a personal consultation with your client advisor?

You can also find further information at www.credit-suisse.com/mortgages.

3/4

This document was produced for information purposes and use by the recipient only. It does not constitute an offer or invitation to enter into any type of financial transaction.

No guarantee is made regarding the reliability or completeness of this document, nor shall any liability be accepted for any losses that arise from its use. All opinions and estimates expressed in this document constitute our judgment at the time of publication and do not constitute general or specific investment/financing, legal, tax or accounting advice of any kind. The information and opinions contained in this document originate from sources that we consider to be reliable. This document may not be distributed in the

United States or passed on to any US person (within the meaning of the current version of Regulation S of the US Securities Act 1933). The same applies in all other jurisdictions, except where permitted under the applicable laws. Copyright © 2016 Credit Suisse Group AG and/or its affiliates. All rights reserved.

CREDIT SUISSE AG

P.O. Box 100

CH-8070 Zurich

www.credit-suisse.com

4/4