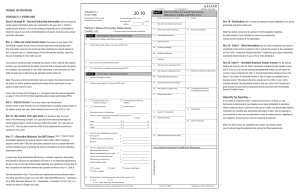

Property Transactions: Dispositions of Trade or Business

advertisement