Section 1231: Best of Both Worlds?

advertisement

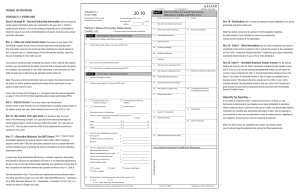

Section 1231: Best of Both Worlds? IRC Section 1231 deals with gains and losses from the sale of property used in a trade or business as well as certain involuntary conversions. Section 1231 has been labeled as providing the “best of both worlds” for allowing net losses to be treated as “Ordinary Losses” and net gains to be treated as “Long-Term Capital Gains”. That is, if there is a loss, you to get to reduce your ordinary income that could be taxed at high brackets, but if there is a gain, the gain is taxed at the low Long-Term Capital Gain rates. This article discusses the general rule as well as some important exceptions. What is 1231 Property? Section 1231 applies to property that is used in the trade or business as well as involuntary conversions. Section 1231(b)(1) defines “property used in the trade or business” as being property used in a trade or business that satisfies all 3 of the following requirements: 1. Can be depreciated under Section 167; 2. Is held for more than 1 year; and 3. Real property that is used in the trade or business. There are some assets that are specifically excluded from Section 1231. The most common are: 1. Property that is inventory in the hands of the taxpayer; 2. Certain copyright, literary, musical, or artistic compositions created by the taxpayer’s own efforts; (One would wonder why inventory would have to be specifically excluded given that it is generally not depreciable under Section 167 anyway.) There are some assets that are specifically included as being subject to Section 1231even though they do not satisfy the general definition of Section 1231(b)(1). The most common are: 1. Certain timber, coal and iron ore; 2. Certain livestock; and 3. Certain unharvested crops. 1 How it works Each tax year you combine your sales of all of your Section 1231 property to determine if you have a net gain or a loss. This is considered to be your Net Section 1231 Gain or Loss. Here is how a taxpayer determines the Net Section 1231 Gain or Loss: 1. The first step is determining the basis of the property and what the asset was sold for (or in the case of an involuntary conversion, the fair market value “FMV” at the time it was converted). 2. The next step is to compare these two figures to determine whether there is a net gain or loss for each particular Section 1231 asset. 3. Finally, taxpayers must aggregate all of their Section 1231 sales for the year to determine the Net Section 1231 Gain or Loss Net Section 1231 Loss: If there is a Net Section 1231 Loss then it is treated as an “ordinary” loss. Among other things, this means that a taxpayer: • May offset this loss against their ordinary income; • Is not limited as to how much of the loss may be used (i.e. no $3,000 per year limitation); • The loss is eligible to give rise to a Net Operating Loss that may be carried back or forward. Net Section 1231 Gain: If there is a Net Section 1231 Gain then it is treated as a “longterm capital gain”. Among other things, this means that a taxpayer: • Gets to offset this gain against other capital losses from sales of non-Section 1231 property; • Gets the benefit of the lower long-term capital gains lower tax rates; However, there is a catch. In a “recapture” situation, a taxpayer will not get the benefit of the long-term capital gain treatment and instead be stuck with treating it as ordinary income. Recapture IRC Section 1231(c) may deny the benefit of long-term capital gain treatment where the taxpayer had a Non-recaptured Section 1231Loss in the 5 preceding years. So, for every year in which a taxpayer has a Net Section 1231Gain, they must look back to the 5 preceding years to determine whether they had an aggregate Net Section 1231Loss. 2 A taxpayer must take the Net Section 1231 Gains and Losses from each of the 5 preceding years. The taxpayer must then add all those Net Section 1231 Gains and Losses to determine if there is a “Non-recaptured Section 1231 Loss”. A Nonrecaptured Section 1231 Loss occurs if the total Net Section 1231 Losses exceed the total Section 1231 Gains for the 5 preceding years. In the event there is a Non-recaptured Section 1231 Loss, the Net Section 1231 Gain (in the current tax year) will be treated as ordinary income to the extent of the Nonrecaptured Section 1231 Loss. The excess Net Section 1231 Gain, if any, in the current tax year will get the beneficial long-term capital gain treatment. Here is an example: Jordan, Corp. is preparing its 2011 Return. It had the following Net Section 1231 Gains and Losses between 2006 and 2011: • • • • 2006- Net Section 1231Loss of $3,000. 2007-2009-No Section 1231 Gains or Losses. 2010- Net Section 1231Loss of $10,000. 2011-Net Section 1231 Gain of $20,000. Since 2011 is our current tax year, the five year lookback period is from 2006 through 2010. Therefore, the taxpayer must add all the Net Section 1231Gains and Losses from 2006 through 2010 to determine the Non-recaptured Section 1231 Loss. In our example, there is a Non-recaptured Section 1231 Loss of $13,000 in the lookback period. Based upon this, $13,000 of the Net Section 1231 Gains will be taxed at ordinary income rates (i.e. recaptured) and the balance, $7,000 ($20,000 - $13,000 = $7,000) gets the benefit of long-term capital gain treatment. Although beyond the scope of this article, it should be noted that there could be depreciation recapture on Section 1231 property. Reporting Section 1231 Gains and Losses: IRS Form 4797 is used to report the sale of Section 1231 property. This same Form 4797 is used regardless of the type of entity or how the entity is taxed (i.e. individuals, partnerships, S Corporations, etc.). Section 1231 Gains and Losses (including Gains subject to recapture as Ordinary Income) are determined on Form 4797. To the extent that there is a Section 1231 Gain that is not subject to recapture it is reported on Schedule D. 3 3/2012 Copyright ©, Keith B. Baker - 2012 This article is designed to be a public resource of general information. It does not constitute “legal advice” nor does it create a “client-attorney” relationship. While the information is intended to be accurate, this cannot be guaranteed. Tax laws are complex and constantly changing as a result of new laws, regulations, court interpretations and IRS pronouncements. Often, there are also various possible interpretations. Further, the applicable rules can be affected by the facts and circumstances of a particular situation. Because of this, some of the information may no longer be correct or may not apply to all situations. We are not responsible for any consequences or losses resulting from your reliance on such information. You are urged to consult an experienced lawyer concerning your particular factual situation and any specific legal questions you may have. IRS Circular 230 Disclosure: Any discussion of federal tax issues in this correspondence may constitute "written tax advice". Any such advice is limited to the issues specifically addressed, and the conclusions expressed may be affected by additional considerations not addressed herein. Any tax information or written tax advice contained herein (including any attachments) is not intended to be, and cannot be used by any taxpayer for the purpose of avoiding tax penalties that may be imposed on the taxpayer. (The foregoing legend has been affixed pursuant to U.S. Treasury Regulations governing tax practice.) You agree not to copy content from our article without permission. Any requests to use our content should be submitted to us by email to pawel@keithbakerlaw.com. 4