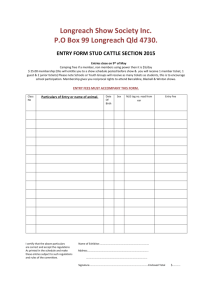

Account of ……………..(Business

advertisement