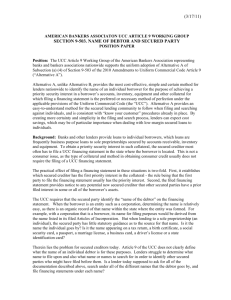

a potpourri of article 9 issues

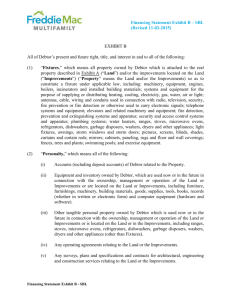

advertisement