My Wheels Gary Benson's Commute 1 Name

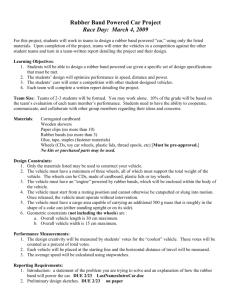

advertisement