The Activewear Industry Cluster - Portland Economic Development

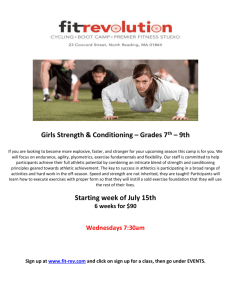

advertisement