The Expenditure Cycle Part I: Purchases and Cash Disbursements

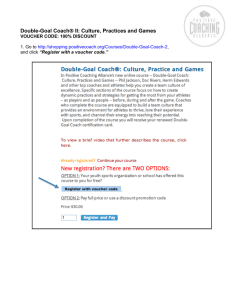

advertisement