Modeling Flexible Capacity Strategy with Flexibility Degree

under Competition and Demand Uncertainty

C.T. Ng and L. Yang*

Department of Logistics and Maritime Studies

The Hong Kong Polytechnic University, Hung Hom, Kowloon, Hong Kong SAR, China

{lgtctng@polyu.edu.hk, willow.yang@inet.polyu.edu.hk}

Abstract

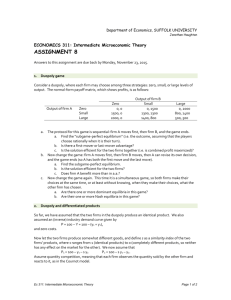

Observing that flexible capacity strategies with different levels of flexibility exist prevailingly in

real business, we aim to quantify the performance of different flexible capacity strategies, and

distinguish and analyze different flexibility levels of firms in making decision adjustments. To do

so, we propose a uniform measure of flexibility named flexibility degree to model all such flexible

capacity strategies. Specifically, our model covers not only the traditional chase strategy and level

strategy, but also all the mixed strategies in between of these two strategies. To the best of our

knowledge, there is no paper on modeling flexibility degree under competition and uncertain demand in the

literature. We pioneer to develop and analyze a duopoly competition model in which two firms have their

individual flexibility degrees under demand uncertainty. In this model, each firm goes through a four-stage

decision-making process, spanning stages of capacity decision, stable production, flexible production and

pricing. The objective of each firm is to determine its capacity, stable production level and flexible

production level to maximize its own expected profit under the Cournot competition (i.e., firms compete on

quantity in the market), given the decisions of the other firm. Then, the final values of these decision

variables for both firms are determined under the Nash equilibrium. We characterize and analyze the

decisions of both firms at equilibrium, and obtain some results which can facilitate the managers in

making decisions on flexible capacity strategies with flexibility degrees.

*

: Contact author

1

Research Problem

To hedge against demand uncertainty, different capacity strategies are adopted in real business, including

chase strategy, level strategy and mixed strategy. On the one hand, the chase strategy is competitive because

it enables a firm to better match supply to demand by varying its throughput. One successful example is

Dell’s make-to-order strategy (Magretta, 1998). On the other hand, the level strategy is advantageous to

guarantee good quality products and benefit to employees’ loyalty (Colvin, 2009) by keeping a stable

production level. Firms like Toyota and Nissan keep production at uniform levels (Heizer and Render, 2008).

Interestingly, there are more and more firms, if not the most, adopting the mixed strategy, which is in

between of the chase strategy and level strategy. By using the mixed strategy, a firm is able to guarantee a

certain level of production on the one hand, and has flexibility to adjust its throughput to hedge against

demand uncertainty on the other. For example, ABB Motors in Sweden has two types of orders, i.e., maketo-stock (70%) and make-to-order (30%) (Bengtsson and Olhager, 2002). As observed, firms have different

abilities in adjusting their throughputs responding to different demands, which is regarded as volume

flexibility. Firms’ different volume flexibilities are reflected by the extents to which firms can adjust its

production after knowing the actual demand.

In this paper, we aim at providing insights into two issues regarding firms’ flexibility in adjusting their

throughputs. First, we are interested in the impact of a firm’s capability of throughput adjustment on its

operations. Is it possible to quantify and distinguish each strategy? What is a firm’s response to market when

it has a high (or low) ability in flexibility? Answering these questions can shed light on firms’ optimal

capacity strategy and operations under various abilities. Second, we investigate the effects of competition on

decisions of firms with different individual abilities in flexibility. How do we evaluate all the possible

strategies (i.e., abilities in flexibility) in competition? What is the relationship between firms’ strategy

choices and their production decisions in competition? Would two competing firms respond to market in the

same way or in different ways? Should a firm with a higher flexibility invest more in capacity, or just keep

its capacity the same as the rival?

To address these questions, we propose a uniform measure named flexibility degree to distinguish each

strategy in this paper. Under this measure, all strategies are considered as flexible capacity strategy with

different flexibility degrees. We pioneer to develop and analyze a duopoly competition model in which two

firms have their individual flexibility degrees under demand uncertainty. The description of our model and

definition of flexibility degree are given below. Although there are plenty of studies on manufacturing

flexibility in different forms (Van Mieghem, 2003), to the best of our knowledge, there is no paper on

modeling flexibility degree of volume flexibility under competition and uncertain demand in the literature.

In this model, each firm goes through a four-stage decision-making process, spanning stages of capacity

decision, stable production, flexible production and pricing. At the capacity decision stage, each firm

determines its own capacity, with consideration of all the possible decisions of the other firm. At the stable

2

production stage, before knowing the actual demand, each firm produces at a stable production level which

is not affected by the fluctuating demand. At the flexible production stage, after knowing the actual demand,

each firm produces at a flexible production level which is adjustable under its capacity constraint. The total

production of each firm is the sum of its stable production and flexible production, and is bounded above by

its capacity. At the pricing stage, both firms compete on quantity in the market, i.e., Cournot competition.

The objective of each firm is to determine its capacity, stable production level and flexible production level

to maximize its expected profit, given the decisions of the other firm. Then, the final values of these decision

variables for both firms are determined under the Nash equilibrium.

A firm’s total production is adjustable between its stable production level and capacity. This adjustment

range reflects a firm’s ability in varying its throughput. It also reflects the extent to which a firm saves its

capacity to hedge against demand uncertainty. Therefore, flexibility degree is defined as the percentage of

the difference between a firm’s capacity and stable production (unchanged or guaranteed production) over

its capacity, i.e., Flexibility degree =

capacity − stable production

⋅ 100%.

capacity

According to this definition, full flexibility strategy (chase strategy) can be formulated by setting flexibility

degree as 100 percent; while nil flexibility strategy (level strategy) can be formulated by setting flexibility

degree as 0 percent. Any other percentage between 0 and 100 represents a firm’s flexibility capability

between nil flexibility and full flexibility, and so it is able to represent all possible mixed strategies.

Key Methodology and Assumptions

In this model, we adopt a step method to formulate the problem at each stage of a firm, given its decisions in

the previous stages and all the decisions of the other firm. To find the optimal decisions of each firm, we

solve each optimization problem in a backward sequence. Then, we find the Nash equilibrium of the firms in

the competition market.

Specifically, we assume the market clearance rule in the model, i.e., all products are sold in the market and

firms do not hold back to affect the price. To formulate the relationship between the market price and total

production in the market, responsive pricing is adopted and the market price is determined endogenously.

Major Results and Significance

This study fills a research gap to theoretically investigate the mixed strategy. We define and formulate the

flexibility degree, which represents a firm’s ability in adjusting its production level. We further establish a

general formula which is able to quantify and distinguish each strategy. In particular, chase strategy and

level strategy are particular cases with flexibility degrees 100% and 0%, respectively.

Moreover, to investigate the competition effect, we build up a duopoly competition model in which two

firms have their own individual flexibility degrees. In a symmetric competition, where two firms have the

3

same flexibility degree, we solve the problem in Nash equilibrium and show that the two firms make the

same decisions at equilibrium. The individual capacity and expected profit increase with the flexibility

degree. In an asymmetric duopoly model, where two firms have different flexibility degrees, it is found that

the production pattern is very different from that in a monopoly model or a symmetric duopoly model. We

characterize the equilibrium and find the relationship between the firms’ flexibility degrees and their

expected profits. It is found that the firm with a higher flexibility degree invests more in capacity, but

produces less in the stable production stage. In such case, the firm is able to use its flexible capacity as much

as possible. Further, it is shown that the firm with a higher flexibility degree better hedges against demand

uncertainty by its more specific responses to the demand. Specifically, when the demand is within the

adjustment range of the firm with a lower flexibility degree, the two firms respond to the demand in the

same way; and when the demand is beyond this adjustment range, there are still two domains where only the

firm with a higher flexibility degree is able to adjust and achieve its optimal production level to respond to

the demand.

Numerical examples demonstrate that the equilibrium with various flexibility degrees of two firms falls into

a limited closed area. It is also shown that a firm’s optimal capacity at equilibrium is increasing in its own

flexibility degree, while decreasing in its rival’s flexibility degree. However, a firm’s own flexibility degree

has more influence on its decisions than its rival’s flexibility degree. Moreover, the total capacity of the two

firms is increasing in the sum of the two firms’ flexibility degrees.

To sum up, we develop and analyze a duopoly competition model with flexibility degrees and use the results

to explain, or predict, the decision making of the firms. Such understanding will facilitate the managers in

designing their capacity strategies in competition. Future research directions on flexibility degrees may

include, but not limited to, extending our model to oligopoly model, and studying other competition models

with flexibility degrees and other price settings. Thus, our research not only fills a gap in the literature, but

also lays a foundation for future research.

References

1. Bengtsson, J. and J. Olhager, 2002. Valuation of product-mix flexibility using real options. International

Journal of Production Economics, 78, 13-28.

2. Colvin, G., 2009. Layoffs cost more than you think. Fortune, March 30, No. 6, 18.

3. Heizer, J. and B. Render, 2008. Operations Management, Pearson Prentice Hall, Upper Saddle River,

N.J.

4. Magretta, J., 1998. The power of virtual integration: an interview with Dell Computer’s Michael Dell.

Harvard Business Review, 76, March-April, 72-85.

5. Van Mieghem, J. A., 2003. Capacity management, investment, and hedging: review and recent

developments. Manufacturing & Service Operations Management, 5(4), 269-302.

4