Financial Accounting Tutorial 3

advertisement

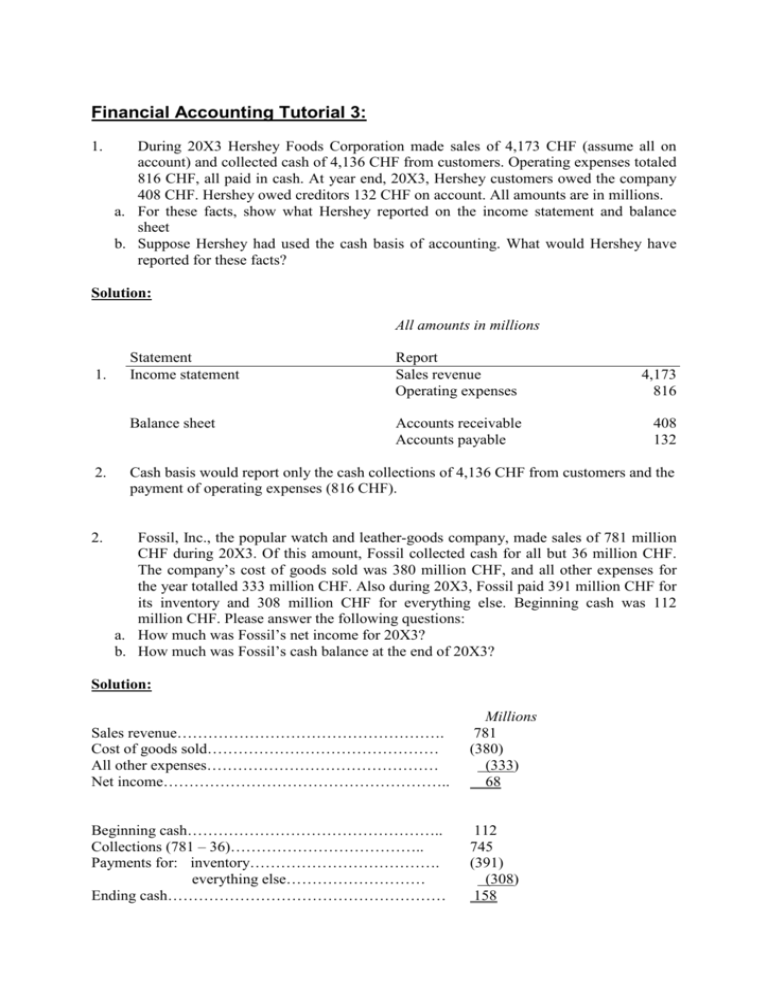

Financial Accounting Tutorial 3: 1. During 20X3 Hershey Foods Corporation made sales of 4,173 CHF (assume all on account) and collected cash of 4,136 CHF from customers. Operating expenses totaled 816 CHF, all paid in cash. At year end, 20X3, Hershey customers owed the company 408 CHF. Hershey owed creditors 132 CHF on account. All amounts are in millions. a. For these facts, show what Hershey reported on the income statement and balance sheet b. Suppose Hershey had used the cash basis of accounting. What would Hershey have reported for these facts? Solution: All amounts in millions 1. Statement Income statement Report Sales revenue Operating expenses 4,173 816 Balance sheet Accounts receivable Accounts payable 408 132 2. Cash basis would report only the cash collections of 4,136 CHF from customers and the payment of operating expenses (816 CHF). 2. Fossil, Inc., the popular watch and leather-goods company, made sales of 781 million CHF during 20X3. Of this amount, Fossil collected cash for all but 36 million CHF. The company’s cost of goods sold was 380 million CHF, and all other expenses for the year totalled 333 million CHF. Also during 20X3, Fossil paid 391 million CHF for its inventory and 308 million CHF for everything else. Beginning cash was 112 million CHF. Please answer the following questions: a. How much was Fossil’s net income for 20X3? b. How much was Fossil’s cash balance at the end of 20X3? Solution: Sales revenue……………………………………………. Cost of goods sold……………………………………… All other expenses……………………………………… Net income……………………………………………….. Millions 781 (380) (333) 68 Beginning cash………………………………………….. Collections (781 – 36)……………………………….. Payments for: inventory………………………………. everything else……………………… Ending cash……………………………………………… 112 745 (391) (308) 158 3. Suppose The Home Depot, Inc. faced the following situations. Journalize the adjusting entry needed at December 31 for each situation. Consider each fact separately. a. The business will pay interest expense of 9,000 CHF early in the next period. Of this amount, two-thirds is expense of the current year b. Interest revenue of 900 CHF has been earned but not yet received. The business holds a 20,000 CHF note receivable that it will collect, along with the interest, next year. c. On July 1, when we collected 6,000 CHF rent in advance, we debited Cash and credited Unearned Rent Revenue. The tenant was paying for 2 years’ rent. d. Salary expense is 1,000 CHF per day—Monday through Friday—and the business pays employees each Friday. This year, December 31 falls on a Thursday. e. The unadjusted balance of the Supplies account is 3,100 CHF. The total cost of supplies on hand is 800 CHF. f. Equipment was purchased at the beginning of this year at a cost of 60,000 CHF. The equipment’s useful life is 5 years. Record depreciation for this year and then determine the equipment’s book value. g. On September 1, we prepaid 1,200 CHF for a 1-year insurance policy. Solution: Adjusting Entries DATE ACCOUNT TITLES a. b. c. d. e. f. DEBIT Interest Expense (9,000 × 2/3)…………….. Interest Payable……………………………. 6,000 Interest Receivable…………………………… Interest Revenue…………………….…….. 900 Unearned Rent Revenue (6,000 / 2 × 6/12) Rent Revenue………………………………. 1,500 Salary Expense (1,000 × 4)……………….... Salary Payable……………………………… 4,000 Supplies Expense…………………………….. Supplies (3,100 – 800)……………….…. 2,300 Depreciation Expense (60,000 / 5)………... Accumulated Depreciation………………. 12,000 CREDIT 6,000 900 1,500 4,000 2,300 12,000 Book value = 48,000 (60,000 – 12,000) g. Insurance Expense…………………………… Prepaid Insurance (1,200 × 4/12)………. 400 400 4. Please use the above data to answer the following questions: a. Refer to item f above. Show what Home Depot will report on its: a1) Balance sheet (show all the data items needed to report the asset's book value) a2) Income Statement b. Refer to item g above. Show what Home Depot will report on the following financial statements: b1) Income statement of the current year b2) Balance sheet at the end of the current year b3) Income statement of the following year b4) Balance sheet at end of the following year Solution: f. g. 5. a. b. c. d. Statement Report (a1) Balance sheet Equipment……………... Less Accumulated depreciation…… Equipment book value 60,000 (12,000) 48,000 (a2) Income statement Depreciation expense..…… 12,000 (b1) Income statement, current year Insurance expense…… 400 (b2) Balance sheet, current year Prepaid insurance (1,200 – 400)…….. 800 (b3) Income statement, next year Insurance expense…… 800 (b4) Balance sheet, next year Nothing to report The accounting records of Studio Art Gallery include the following unadjusted balances at May 31: Accounts Receivable 1,100 CHF; Supplies 900 CHF; Salary Payable 0 CHF; Unearned Service Revenue 800 CHF; Service Revenue 4,700 CHF; Salary Expense 1,200; Supplies Expense 0 CHF. Studio Art Gallery's accountant develops the following data for the May 31 adjusting entries: Supplies on hand 500 CHF Salary owed to employee 700 CHF Service revenue accrued 600 CHF Unearned service revenue that has been earned 550 CHF Open the foregoing T-accounts with their beginning balances. Then record the adjustments directly in the accounts, keying each adjustment amount by letter. Show each accounts adjusted balance. Journal entries are not required. Solution: Accounts Receivable 1,100 (c) 600 Bal. 1,700 Supplies Bal. Salary Payable (b) Bal. 700 700 (c) (d) Bal. 4,700 600 550 5,850 Service Revenue 900 500 (a) Unearned Service Revenue (d) 550 Bal. 400 800 250 Salary Expense 1,200 (b) 700 Bal. 1,900 Supplies Expense (a) 400 Bal. 400 6. The adjusted trial balance of Upper 10 Cola Company (adapted) follows: Adjusted Trial Balance Debit Credit Cash 900 Accounts Receivable 1,800 Inventories 1,100 Prepaid expenses 1,900 Property, plant, equipment 6,600 Accumulated depreciation 2,400 Other assets 9,900 Account payable 7,700 Income tax payable 600 Other liabilities 2,200 Common stock 4,900 Retained earnings (beginning December 31 200X) 4,500 Dividends 1,700 Sales revenue 20,500 Cost of goods sold 6,200 Selling, administrative and general expense 9,700 Income tax expense 3,000 Total 42,800 42,800 Prepare Upper 10 Cola Company's income statement and statement of retained earnings for the year ended December 31, 20X6, and its balance sheet on that date. Show how the three statements are linked. Solution: Upper 10 Cola Company Income Statement Year Ended December 31, 20X6 Millions Revenues: Sales revenue..................................................... Expenses: Cost of goods sold...................................................... Selling, administrative, and general expense............. Total expenses............................................................. Income before tax........................................................ Income tax expense.................................................... Net income................................................................ 20,500 6,200 9,700 15,900 4,600 3,000 1,600 Upper 10 Cola Company Statement of Retained Earnings Year Ended December 31, 20X6 Retained earnings, December 31, 20X5................................................... Add: Net income .............................................................................. Less: Dividends..................................................................................... Retained earnings, December 31, 20X6................................................... Millions 4,500 1,600 6,100 (1,700) 4,400 Upper 10 Cola Company Balance Sheet December 31, 20X6 ASSETS Cash................................................... Accounts receivable...................... Inventories................................... Prepaid expenses............................ Prop., plant, equip. 6,600 Less: Accum. Deprec (2,400) Other assets................................... Total assets................................... 900 1,800 1,100 1,900 4,200 9,900 19,800 LIABILITIES Accounts payable.................... Income tax payable................. Other liabilities......................... Total liabilities........................ STOCKHOLDERS’ EQUITY Common stock........................... Retained earnings...................... Total stockholders’ equity.......... Total liabilities and stockholders’ equity 7,700 600 2,200 10,500 4,900 4,400 9,300 19,800 Link between the statements: Net income is used in the statement of retained earnings. Retained earnings show up in the balance sheet. 7. The unadjusted trial balance and income statement amounts from the March adjusted trial balance of Wall street Workout Company follow. Wall Street Workout is a turnaround specialist. Wall street work out company Account title Cash Supplies Prepaid rent Equipment Accumulated depreciation Accounts payable Salary payable Unearned service revenue Income tax payable Common stock Retained earnings Dividends Service revenue Salary expense Rent expense Depreciation expense Supplies expense Income tax expense Total Net income Total Unadjusted Trial From the adjusted Balance trial balance 10,200 2,400 1,100 32,100 6,200 4,600 8,400 8,700 10,300 1,000 12,800 3,000 1,200 51,000 17,900 3,800 1,400 300 400 1,600 51,000 10,400 17,900 17,900 a. Journalize the adjusting and closing entries of Wall Street Workout Company at March 31. There was only one adjustment to Service Revenue. b. After solving a., use the data to prepare Wall Street Workout Company's classified balance sheet at March 31 of the current year. Use the report format. c. Compute Wall Street Workout's current ratio at March 31. A year ago, the current ratio was 1,30 and the debt ratio was 0,29. Indicate whether the company's ability to pay its debts improved or deteriorated during the current year. Solution: a. Journal DATE Mar. 31 31 31 31 31 31 31 31 31 ACCOUNT TITLES AND EXPLANATION Adjusting Entries Unearned Service Revenue………………. Service Revenue (17,900 – 12,800)... CREDI DEBIT T 5,100 5,100 Salary Expense (3,800 – 3,000)………... Salary Payable……………………….…... 800 Rent Expense (1,400 – 1,200)………….. Prepaid Rent……………………………… 200 Depreciation Expense (300 – 0)……….. Accumulated Depreciation…………….. 300 Supplies Expense (400 – 0)……………. Supplies…………………………………… 400 Income Tax Expense (1,600 – 0)……… Income Tax Payable…………………….. 1,600 Closing Entries Service Revenue……………………………. Retained Earnings………………………. 800 200 300 400 1,600 17,900 17,900 Retained Earnings………………………….. Salary Expense…………………………... Rent Expense…………………………….. Depreciation Expense…………………... Supplies Expense…………………….…. Income Tax Expense……………………. 7,500 Retained Earnings………………………….. Dividends…………………………….…… 1,000 3,800 1,400 300 400 1,600 1,000 b. Wall Street Workout Company Balance Sheet March 31, 20XX ASSETS Current: Cash………………………………………………….…… Supplies (2,400 – 400)………………………………. Prepaid rent [1,100 – (1,400 – 1,200)]…………... Total current assets…………………………………. Plant: Equipment………………………………… 32,100 Less accumulated depreciation (6,200 + 300)…………………….….. (6,500) Total assets…………………………………………………. LIABILITIES Current: Accounts payable………………………………………. Salary payable (3,800 – 3,000)…………………….. Unearned service revenue [8,400 – (17,900 – 12,800)]……………………... Income tax payable…………………………………….. Total current liabilities……………………………… STOCKHOLDERS’ EQUITY Common stock……………………………………………... Retained earnings (10,300 + 17,900 – 3,800 – 1,400 – 300 – 400 – 1,600 – 1,000)…….…………………………………. Total stockholders’ equity……………………………….. Total liabilities and stockholders’ equity……………… 10,200 2,000 900 13,100 25,600 38,700 4,600 800 3,300 1,600 10,300 8,700 19,700 28,400 38,700 c. Current Year Current ratio = Total current assets Total current liabilities = 13,100 10,300 = 1.27 Prior Year 1.30 The ability to pay current liabilities with current assets deteriorated a little. Debt ratio = Total liabilities Total assets = 10,300 38,700 The overall ability to pay total liabilities improved a little. = 0.27 0.29 8. a. b. c. d. e. Johnson & Johnson, the health-care products company, reported these ratios at December 31, 20X3 (in million CHF): Current ratio = 23/13 = 1,77; Debt ratio = 21/48 = 0,44. Assume that Johnson & Johnson completed these transactions during 20X4: Purchased equipment on account, 4 CHF. Paid long-term debt, 5 CHF. Collected cash from customers in advance, 2 CHF. Accrued interest expense, 1 CHF. Made cash sales, 6 CHF. Determine whether each transaction improved or hurt Johnson & Johnson’s current ratio and debt ratio. Round all ratios to two decimal places. Solution: a. Current ratio = 23 13 + 4 = 1.35 Debt ratio = 21 + 4 48 + 4 = 0.48 = 21 – 5 48 – 5 = 0.37 The purchase of equipment on account hurts both ratios. b. Current ratio = 23 – 5 13 = 1.38 Debt ratio The payment of long-term debit hurts the current ratio and improves the debt ratio. c. Current ratio = 23 + 2 13 + 2 = 1.67 Debt ratio = 21 + 2 48 + 2 = 0.46 Debt ratio = 21 + 1 48 = 0.46 Debt ratio = 21 48 + 6 = 0.39 Collecting cash in advance hurts both ratios. d. Current ratio = 23 13 + 1 = 1.64 Accruing an expense hurts both ratios. e. Current ratio = 23 + 6 13 A cash sales improves both ratios. = 2.23