F-4.0 Petty Cash Funds - City of Corpus Christi

advertisement

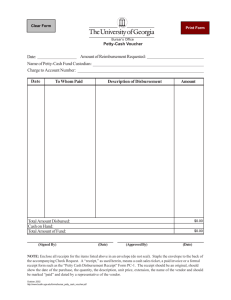

CITY PROCEDURE SUBJECT: No. F-4.0 Petty Cash Funds Effective: Revised: Revised: Revised: Approved: L.~,,. , _, L ~ ,.!o Date: January 4, 1988 August 30,1991 September 1. 2008 October 14, 2013 _ /_o_-_ , ~---'....3.....___ Constance P. Sanchez Director of Financial Services PURPOSE: The policy and procedure replaces the previously numbered F-2.2 "Petty Cash Fund". The purpose of this policy is to document procedures for requesting petty cash funds maintained by Central Cashiering in City Hall and by individual departments; to set dollar levels for which petty cash handling is appropriate; and to document procedures for replenishment of petty cash funds maintained by the individual departments. POLICY: Petty cash funds were established for convenience and effectiveness in conducting City business. Occasionally, a purchase needs to be made from a vendor who does not accept City purchase orders, procurement cards, or the amount is so small that it is more efficient to pay cash than to write a check. Petty cash funds are located throughout the City. See Appendix C. The responsibility for petty cash funds lies with the custodian who is responsible for making sure that the money plus receipts for disbursements equal the amount recorded on the general ledger. A petty cash fund can be established by issuing an Accounts Payable check with department director approval. All requests for setting up petty cash funds must be approved by the Director of Financial Services and the department director. PROCEDURES: I. Petty Cash Maintained at Central CashieringExpenditures up to $50 may be made from petty cash funds. Disbursements of more than $50 should be made by either by procurement card or by a check F-4.0 Petty Cash Funds Page 1of7 through Accounts Payable but may be paid from petty cash funds with department director approval. A. All petty cash expenditures are charged to the requesting departments' organization codes. Petty cash funds cannot be used to pay for temporary labor since total amounts in the year must be accumulated for IRS Form 1099 purposes reporting payments for services. B. Additionally, no petty cash funds will be used to pay for any travel-related expenditure. These expenditures are covered by City Policy F-13.0 "Travel Policy". C. Every attempt should be made not to pay sales tax since the City is tax exempt. Employees purchasing items should take a sales tax exempt certificate with them to show no tax is due on purchases. Tax exempt certificates may be obtained from the Purchasing Division of the Department of Financial Services. D. Employees must fill out a Standard Form 83, "Petty Cash Voucher" (Appendix A) for payment of petty cash expenditures. If the employee pays for an item and is requesting reimbursement, then the receipt must be attached to the properly completed and signed Form 83. E. If the employee is requesting an advance for an approved purchase, then the word "ADVANCE" must be written in red on the top right-hand corner of Form 83, and the form must be submitted to Central Cashiering with the proper signatures. The employee is then given the pink copy of Form 83 and the cash advance. Within 24 hours, the employee making the purchase must return to Central Cashiering with the pink copy of Form 83 and three photocopies of Form 83, along with the receipt from the purchase. The transaction is then finalized with money either being returned to the City or money being reimbursed to the employee. The employee is given one validated copy of Form 83, and Central Cashiering processes the pink copy and the remaining two validated copies in their normal batch processing. 11. Petty Cash Maintained by Individual Departments A. Departments must appoint a petty cash custodian. B. The custodian of the petty cash fund is responsible for maintaining an accurate accounting of the fund. 1. The funds must be secured at all times in a locked box or safe. 2. All receipts for funds disbursed must be included with the petty cash F-4.0 Petty Cash Funds Page2of7 fund so that the sum of the petty cash on-hand and receipts equal the total amount of the fund. C. The custodian of the petty cash fund should replenish the petty cash once a month using Standard Form 34 (Appendix 8). This form is processed through Accounts Payable monthly. Requests received in Accounts Payable by Tuesday at 10:00 a.m. will be processed that week, and the check will be available for pick-up in Cash Management by Friday of that week. Petty cash reimbursement checks can be cashed at any of the City's depository banks or by Central Cashiering. Custodians will not be allowed to replenish the department's petty cash fund by filling out individual Form 83's and submitting to Central Cashiering. Form 34 must be completed. D. Custodians should monitor the petty cash fund to assure that it is neither too large nor too small to accommodate efficient operation. If it has to be replenished more often than once a month, it is probably too small. If at the end of the month, half of the fund is still available, it is probably too large. 1. Petty cash accounts that are dormant or inactive for a period of one Financial Services encourages fiscal year will be closed. departments to close out their petty cash funds and utilize the City's procurement card or utilize the petty cash fund maintained by Central Cashiering. 2. Periodic audits of the petty cash accounts will be made by the Internal Audit Department. 3. Charges to cash over and short should be monitored by the custodian's supervisor. If a pattern seems to be developing, the supervisor may want to consider establishing dual control on the fund or use other controls. The supervisor may also want to periodically review disbursements for proper authorization. 4. Expenditures up to $50 may be made from petty cash funds. Disbursements of more than $50 should be made by either City procurement card or by check through Accounts Payable, but may be reimbursed from petty cash funds with department director approval. All petty cash expenditures are charged to the requesting departments' organization code. Petty cash funds cannot be used to pay for temporary labor since total amounts in the year must be accumulated for IRS Form 1099 purposes reporting payments for services. F-4.0 Petty Cash Funds Page 3 of 7 5. Additionally, no petty cash funds will be used to pay for any travelrelated expenditures. These expenditures are covered by City Policy F-13.0 "Travel Policy''. 6. Every attempt should be made not to pay sales tax since the City is tax exempt. Employees purchasing items should take a sales tax exempt certificate with them to show no tax is due on purchases. Tax exempt certificates may be obtained from the Purchasing Division of the Financial Services Department. The custodian of the petty cash fund will be responsible for ensuring that sales tax was not charged. The City will not pay sales tax on any purchase, and any sales tax paid will have to be borne by the employee making the purchase. CONSEQUENCES FOR VIOLATION OF THIS POLICY: Failure to comply with this policy will result in disciplinary action up to and induding termination. QUESTIONS REGARDING THIS POLICY: Questions regarding this Policy shall be directed to the Director of Financial Services or designee, who may be contacted at (361) 826-3613. F-4.0 Petty Cash Funds Page 4 of 7 APPENDIX A Std. Form 83(Rev10/23/99) City of Corpus Christi, Texas Petty Cash Ticket $_ _ _ _ __ Amount Purchase Date Vendor: Item: Department Name: ____________ Account Fund Ore Project/ Grant Amount Approved by: Section Head Department Head Payment received by: _ _ _ _ _ _ _ _ _ _ _ __ Date Petty Cash C u s t o d i a n : - - - - - - - - - - - Date Vendor's sale ticket or receipt must be attached Note: $50.00 limit unless approved by Department head Original & Yellow - Central Cashiering or Accounting Pink - Originating Department F-4.0 Petty Cash Funds Page 5 of 7 APPENDIX B Std Form 34 (Rev. 2-15-99) City of Corpus Christi, Texas Petty Cash Reimbursement Request Pay to: _ _ _ _ _ _ _ _ _ Petty Cash Fund To: Accounts Payable Date: -------------'Custodian Name Listed below are the Petty Cash expenditures from --------- to - - - - - - Totals By 0 rg ID eptN ame Accoun t Fund 0 rg PrOJ"/Grt Am oun t Accoun t No. of Tickets _ _ _ _ __ Amount of this Request Cash on hand this Date Total of Petty Cash Fund $ -------$ -------$ _ _ _ _ _ _ __ All the Petty Cash Tickets supporting this request have been examined and are being approved as proper expenditures. Custodian F-4.0 Petty Cash Funds Department Director Page 6of7 APPENDIXC City of Corpus Christi, Texas Active Petty Cash Accounts As of November 30, 2012 Fund Account 1020 1020 1020 1020 1020 1020 1020 1020 1020 1068 4130 4200 4610 4010 5110 5110 4010 110050 110055 110060 110070 110075 110080 110100 110125 110145 110165 110170 110170 110180 110185 110195 110200 110205 F-4.0 Petty Cash Funds Title Petty cash - City Secretary Petty cash - Solid Waste Petty cash - Municipal Court Petty cash - Parks & Recreation Petty cash - Health Administration Petty cash - Health Animal Control Petty cash - Central Library Petty cash - Fire Administration Petty cash - Police Administration Petty cash - South Texas Library System Petty cash -Administration (Gas) Petty cash - Administration (Wastewater) Petty cash - Airport 0 & M Petty cash - Stevens Plant Petty cash - Parts Room Petty cash - Building Petty cash - Stormwater Page 7 of 7