a pdf - The Case Centre

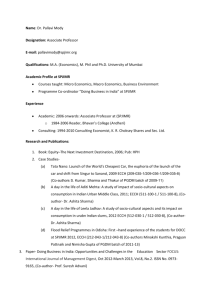

advertisement