Request for Comment Proposed Repeal and Replacement of NP 58

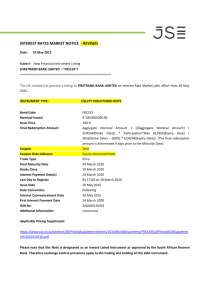

advertisement