Reflection on supply and demand imbalance

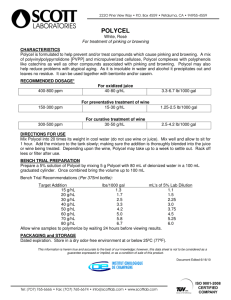

advertisement

Your Vineyard Your Voice The Newsletter of Wine Grape Growers Australia January 2014 Reflection on supply and demand imbalance - or is it misalignment? The elephant in the room in respect to supply and demand is, well, the elephant. It’s the vast quantities of C, D and E grade wine which are the most consumed in the marketplace – and the most produced. The Expert Review commissioned by the Winemakers' Federation of Australia (WFA) expert review characterises C, D and E wine to be mainly D and E grade by volume. But to any observer of the industry over the past 15 years, today’s D and E had the right to be called C and D grade wine some years ago. This was based on quality but it is now mainly called D and E and based on price. to fit into this small space and much of it ended up in the C and D segment. Moreover, with the perfect storm of the GFC, the high dollar and a declining demand for Australian wine in the posthoneymoon period after its initial surge into overseas markets, an increasing proportion of C and D became D and E. Secondly, in the import sector, the strong Australian dollar assisted the influx of imports. Of course, the dollar worked in combination with New Zealand Sauvignon Blanc product excellence and supporting marketing. Nevertheless, the outcome was the same – a continued bulge of C and D, and eventually E, on the domestic market. The result varied by stakeholder but growers didn’t win. The scorecard looks like this: The precedents to this shift came from events in two separate segments of the market – both with the same effect on the quality/price dynamic. • Consumers win (lower prices). Firstly, on the domestic scene, a sizeable proportion of the supply growth over the past 15 years has been cooler-temperate fruit aspiring to the lucrative A and B segment of the market. Unfortunately, A and B accounts for less than 10 per cent of the market and the swelling volume of aspirant newcomer wine was never going • Winemakers win and lose (win cheap fruit to maintain processing throughput, lose markets and margins). • Retailers win (lower prices, greater access to distressed industry assets). • Growers lose (lower prices, evaporated margins). Improving quality is frequently cited as Chief the means to recapture competitiveness and margin. Such ideas miss the point there is no short-term problem with quality. It is better than ever and ‘value’ (quality for price) is over the top. Oversupply is driven by A and B aspirant fruit – that’s good gear – it’s just that it’s being called something else. Consider this – at the beginning of the journey of the past 15 years sultana was a meaningful proportion of the crush but virtually no sultana is in the mix today. National oversupply, or under-demand, is and has been acknowledged for a long time by WGGA. The Expert Review confirmed what we knew – C, D and E is oversupplied. So the question about what is being done to improve the market prospects of C, D and E has to be asked. WFA’s proposed actions from the Expert Review included a massive boost to funding the industry’s marketer – Wine Australia Corporation (WAC). The unquestioned support for WAC’s programs seems misaligned with where the problem is. The mid- to lower-grades are most of the consumption base and it’s the gear that is oversupplied. The market prospects of this fruit need to be improved. WAC is the designated agent for improving the market prospects of the Australian wine category as a whole, not just the top end. ® Take Control! Available in iprodione 500 g/L and 250 g/L Manage late season Botrytis with Chief® Aquaflo or Chief® Liquid. Level 1, Industry House, National Wine Centre Cnr Botanic and Hackney Roads, Adelaide, SA 5000 Telephone (08) 8133 4400 Fax (08) 8133 4466 Email info@wgga.com.au Website www.wgga.com.au Keep your fruit protected, visit www.farmoz.com.au Sponsored by WGGA News WGGA’s Wine Tax Policy is open for discussion Since wine taxes are by definition, taxes on wine, WGGA has in the past deferred to the Winemakers' Federation of Australia (WFA) Wine Tax Policy for its policy settings. However, the fact that the value of winegrapes is derived from the value of wine, means in a volatile tax environment such as the present, growers are increasingly exposed to wine tax risks and a more active stance was required. In the light of this, WGGA devised its own Wine Tax Policy in June 2013. Initially, the policy was approved by the WGGA Executive Committee for feeding into WFA Expert Review consultations. The Review is now complete however and nothing came out of this process to alter WGGA’s position. Hence, the policy is open for discussion. The policy deals with both the Wine Equalisation Tax (WET) and the WET Rebate. In summary, WGGA: • Considers increases in wine taxation cannot be justified on public health grounds. • Does not support a change to a volumetric based tax. • Supports WET Rebate reform to ensure it is received by intended recipients as currently defined by the Australian Tax Office. 2013 WGGA AGM well attended, well informed With few resources to get out and about, WGGA takes the opportunity to interface with as many of the industry as it can at its Annual General Meeting and to provide them with a meaningful experience by attending. By these measures, the 2013 WGGA AGM was a success. Attendance was high with around 42 at the event including 20 members (eight are required for a quorum), and they came from more than a dozen winegrape growing regions around Australia – ranging from WA to the Alpine Valleys and Riverina to the Limestone Coast. It was pleasing to have two GWRDC Board members Phil Laffer and Jan O’Connor and the Executive Director, Stuart Thomson, in attendance together with Wine Australia personnel in Board member Brian Walsh and the Chief Operating Officer, Steve Weinert. Unfortunately, with commitments in Sydney that day, WFA management tendered apologies. Guest appearances were instrumental in the information component of the day. The GWRDC Report updated the state of the RD&E agenda for the past year and set the scene for the merger of GWRDC and Wine Australia Corporation in the middle of this year. Greg Fraser, Executive Director of Plant Health Australia, handed-over the freshly prepared Viticulture Industry Biosecurity Plan (IBP). This occurred in combination with the GWRDC, the funding agency, and was received by WGGA as the wine sector’s signatory to the Emergency Plant Pest Response Deed. The event also provided the opportunity to introduce WGGA’s new appointment, the National Winegrape Biosecurity Program Coordinator Rachel Barratt. A strong point of interest at the event was a presentation by Shane Tremble - Head of Corporate Development for Woolworths Liquor Group, who provided valuable insights into the current wine market (see a summary in this issue of United Grower). There was no doubt left in anyone’s mind that retailers are major players in the market who are here to stay and there was much to be gained in learning their insights into wine consumption trends in Australia. Pleasingly, closer cooperation on this score was offered by Shane. All in all, there was a sense of growing interest in WGGA’s activities and achievements and recognition that the organisation’s achievements are starting to mount up. This tone of the meeting was rewarding for the WGGA staff, who all work so hard to serve the interests of Australia’s winegrape growers. We look forward to building further on this in 2014. Lawrie Stanford, Executive Director • Is cautious about more fundamental reform to reduce claimed market distortions. • Commits to working with the WFA and the Commonwealth Government to ensure the WET Rebate is paid to Australian Tax Office intended recipients, being winegrape and wine producers who convert grapes they own to wine. Further information can be found on our website at www.wgga.com.au or by calling Lawrie Stanford at the WGGA office on (08) 8133 4400. Control weeds, manage glyphosate resistance glufosinate ammonium 200 g/L Use Exonerate to control grass and broadleaf weeds in vines all season long. ® For weed control solutions, visit www.farmoz.com.au 2 WGGA News Woolworths delivers straight talk on consumer trends A frank, funny and very open presentation by Shane Tremble, Head of Corporate Development for Woolworths Liquor Group (WLG) was a highlight of WGGA’s 2013 AGM. In his talk, Mr Tremble stressed the relationship between grape supply and WLG’s consumer insights from its sales data. He speculated that the wine industry would be in better shape if it adopted a more holistic approach to supply chain management, delivering wines customers want to drink. Mr Tremble noted that Woolworths sells more Australian wine than any other company in the world, which gives it a massive stake in the industry’s success – even though it deals with less than 1 per cent of Australia’s growers directly. While direct grower relationships were few, WLG had nevertheless tripled the number of growers it was involved in and was sourcing from ten extra regions of Australia. On the topic of consumption trends Australians are drinking 30 per cent less alcohol than in the 1980s. Australian wine consumption had been declining for at least the past four years. with all of the recent decline being in the sub-$8 category. The greatest growth has been in the $16 - $25 (per bottle) category. There has been a strong growth in imports, particularly from Spain and South America, not to mention the NZ Bottled Table Red Wine shoppers constantly look for the “New & Exciting” as 100% Volume growth delivered through Product Churn Total Australia Retail Bottled Table Red Wine Sales (Volume L) 2.8% 84.4m 94.2m 21.7m -4.6m -7.2m 4180 SKUs 2354 SKUs 1826 SKUs 2015 SKUs 4369 SKUs 2009 EXISTING SKUs DELETED SKUs INNOVATION | NPD 2013 SOURCE: AZTEC MAT 03/08/09 & MAT 03/08/13 “Savalanche”. Interestingly Tremble showed there has been growth in bottle red wine which has all come from new products. While 1800 products have disappeared from the market, growth came from 2000 new products on the shelves. Growth in Aussie whites has been polarised to either ends of the market – indicating the influence of the NZ “Savalanche” in the middle. There has been a revival of top end Chardonnay, and (contrary to reds) big growth in the sub-$8 segment as consumers transfer from bag-in-box to bottle. In final comments, Tremble explained there is an increasing fragmentation of the market as consumers search for new and different tastes. In response to this, the ‘great challenge’ for the wine industry, due to the fixed nature of the industry’s agricultural investments and long production lead times, was to respond rapidly to changes in consumer taste and preferences. Shane Tremble’s presentation is available on the WGGA website (www.wgga.com.au) Mixed bag of results for a WGGA audit of winegrape supply contracts A review of winegrape supply contracts used in the wine sector was recently conducted by WGGA to determine how well they comply with the Australian Wine Industry Code of Conduct, and hence the general standard of contracting in the industry. The report card provided ‘mixed results’. In a positive sense, the contracts generally complied with the majority of the core requirements of the Code: specification of price, terms of payment, identification of parties to the agreement, description of the grapes to be purchased and duration of contract. It was found that 29 of 32 provisions specified in the Code were met by at least 75 per cent of the contracts. dimethomorph 500 g/L ® For preventative control of Downy Mildew that will stand the test of time, use Sphinx . 3 On the other hand, there was only one contract which fully complied with the Code, although five stated they were covered by the Code. While the audit was not a rigorous review of Code compliance, being based on 20 contracts some of which pre-dated the Code, the review pointed to some key issues growers need to consider when contracting. For timely advice, visit www.farmoz.com.au WGGA News Some of the concerns from the audit were: • 50 per cent of contracts did not include a dispute resolution clause. • Very few contracts stipulated penalties for late payment. • There was a lack of basic protection clauses such as a force majeure clause. • Some did not have an explicit expiry date. • Some had no mechanism for terminating a contract early in a nofault situation. • Some were them hard to read and understand including many with complex clauses relating to the all-important determination and notification of pricing. • Contracts with one-sided price-setting mechanisms. • Vague quality standards used in the final determination of price. • The ability for decisions to be made by the purchaser at their “sole discretion”. • Errors and poorly worded clauses. Some of the problems could potentially be just as damaging to the winery as to the grower in a dispute and this points to the value of wineries signing the Code as the most convenient, industry-sponsored means of improving contracting standards. Noting the concerns raised in this audit, growers are encouraged to seek legal advice on any contracts they are offered. The full report can be viewed on WGGA’s website (www.wgga.com.au) along with other guidance on how to negotiate contracts that protect grower interests. Grapegrowers from across Australia join forces to tackle biosecurity Remembering Kym Ludvigsen November 14, 2013 marked a significant step forward in developing a united and concerted effort to tackle biosecurity threats facing the grape industry. Wine Grape Growers Australia wishes to acknowledge and celebrate the life of Kym Ludvigsen, who died in a tragic farm accident on Tuesday 3 December 2013. Grapegrowers, horticultural experts and industry leaders came together in Adelaide to discuss the challenges facing grapegrowers in preventing, preparing for and responding to any biosecurity outbreaks. An outbreak could potentially cost the industry millions of dollars, damage producer livelihoods and others along the value chain, jeopardise trade (domestic and international) and potentially wipe out regional economies. Increasingly government and industry are sharing responsibility for implementing the biosecurity system including the covering of funding and decision making. Participants at the workshop in November agreed that an ongoing Wine Grape Biosecurity Industry Reference Group (WBIRG) was needed to assist in developing and overseeing biosecurity for the industry and provide practical, grassroots perspectives on biosecurity matters to the WGGA and WFA executive committees and the National Viticulture Biosecurity Committee. Prue Henschke from Henschke Wines said: “Biosecurity management and prevention is everyone’s business. As growers we need to be aware of our responsibilities and actions to prevent any outbreaks as well as ensuring that our industry needs are well covered in any future arrangements. The new Biosecurity Industry Reference Group is a great opportunity to have these two way conversations” Kym will be sorely missed – his largerthan-life personality will leave a hole in many people’s lives and WGGA and the industry in general will be poorer for the loss of his generous services. Kym had been a committed member of the WGGA Executive Committee since early 2012. There is an extended tribute on Page 6 of this issue of Grapegrower & Winemaker. We remember him with affection. The new Biosecurity Industry Reference Group will meet again in early 2014 to map out industry priorities for biosecurity management over the next few years and discuss how to better collaborate with other viticulture industries. At a glance… National Winegrape Grower Book 2013-14 • NEW - WGGA launches the National Winegrape Grower Book in 2014 – a compilation of ABS grower information useful for “mapping” growers by type, location, production capacity and production. Free with current WGGA membership. metalaxyl 150 g/kg + copper oxychloride 350 g/kg Stay ahead of Downy Mildew this season. Membership • Reminder – 2013-14 Membership. With record membership it is the perfect time to join and help make the grower’s voice stronger. SA grapegrower • If you are a SA grapegrower paying the SA Industry Fund levy it makes you a WGGA member. Privacy laws restrict us from knowing your contact details so contact us to register and receive YOUR membership benefits. e-Alert • Interested in national industry events and opportunities for growers? Join our e-Alert mailing list today. Keep your fruit protected, visit www.farmoz.com.au 4