1 noteworthy decision summary

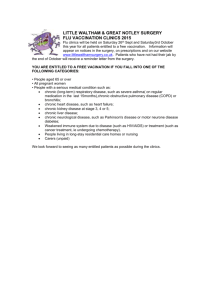

advertisement