Skimming or Penetration? Strategic Dynamic Pricing for New Products

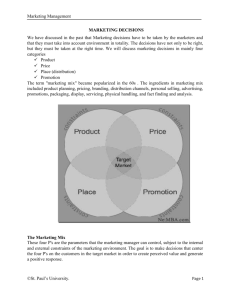

advertisement