PDF - K

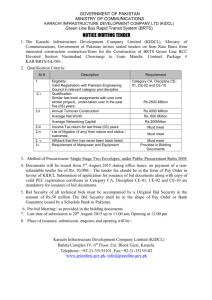

advertisement