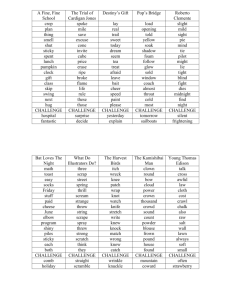

Understanding Cost Management: What Can We Learn from the

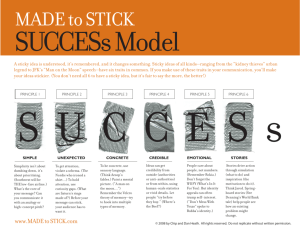

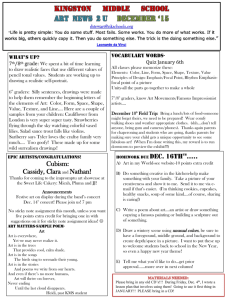

advertisement