Market Structures in an economical context

advertisement

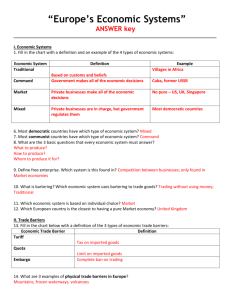

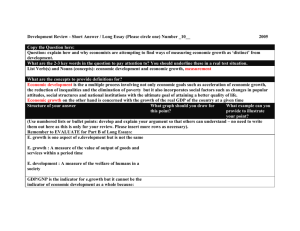

ENTELEQUIA revista interdisciplinar eumed•net www.eumed.net/entelequia Nadia Hushke * MARKET STRUCTURES IN AN ECONOMICAL CONTEXT. THE EVOLUTION OF THE ECONOMIC MARKET ** ESTRUCTURAS DE MERCADO EN UN CONTEXTO ECONÓMICO. L A EVOLUCIÓN DEL MERCADO ECON ÓMICO Abstract This work aims to identify and analyze similarities between the economic evolution and market structures in a historical context. However, this work mostly specializes on the development of the European Union in the modern globalization period: that is the stage of oligopoly. A brief explanation of the previous stages (perfect competition and monopolistic competition), will be given. The final stage of monopoly is seen to have not been achieved yet and is seen as the initial final goal of Globalization. Keywords: Globalisation, market structures, market evolution, European Union. Resumen Este trabajo trata de identificar y analizar similitudes entre la evolución económica y las estructuras de mercado en un contexto histórico. Se centra, no obstante, específicamente en el desarrollo de la Unión Europea, en el periodo de la moderna globalización: la etapa de los oligopolios. Se dará una breve explicación de las etapas previas (competencia perfecta y competencia monopolística). La última etapa del monopolio es entendida como no alcanzada aún y como el fin último de la globalización desde sus inicios. Palabras clave: Globalización, estructuras de mercado, evolución del mercado, Unión Europea. JEL: L11, L12, L13, N14, O19. * Bachelor of arts in Leisure and Tourism Management at the European University Barcelona (Spain). Master of Accounting and Corporate Finance at the James Cook University Singapore. Address: Harfenweg 3, 13127 Berlin (Germany). email: nadiahuschke@msn.com ** For this work I have been using my Thesis, which is the complete version of this document. In case of interest for the whole document, please let me know. Núm. 11 (primavera 2010) Nadia Hushke / 215 ENTELEQUIA N revista interdisciplinar eumed•net www.eumed.net/entelequia owadays economies throughout the world are experiencing the impact of modern globalization. In the last past decades many economies have developed and grown consistently, whereby some of these were able to acquire a major economic status. The concept of modern globalization, which is based on the neo­liberalistic view, suggests the cooperation between economies, where each economy specializes in its comparative advantage and removes trade barriers in order to achieve maximum effectiveness, that should contribute to global equally distributed wealth. However, the situation faced in the beginning of the 21st century does not look like this. Although economies have experienced major economic growth, and countries like China and India are now receiving increased attention due to their progress, there is still the major domination of very few economies. In fact, economies that had been relatively developed previously to the Second World War, have further increased their economic strength. As a result there is Japan, together with the US and the European Union (EU), that account for around 68% of the World Gross Domestic Product (GDP). Hence, there is a clear domination of these economies. This phenomenon can also be seen in the industrial market structure of an oligopoly. An oligopoly is usually described as a market in which there are just a small number of dominant companies that hold the major shares of the market’s revenues, and where each of the main competitors is sensitive to the other’s marketing strategies. Indeed, many of the trade agreements that have been established over the last decades have increased the connectivity and interdependence among economies. As a result sensitivity among these has been growing as well. One of the main developments, where interdependence has been probably by far the highest, is the creation of the European Union. In 1957 a custom union consisting of six European countries was established. It has grown to an economic union with 27 member states and simultaneously achieved greater economic importance than the sum of its pieces. Today the EU represents one of the strongest economies in the world. Through the removal of trade barriers the EU is able to allocate resources most effectively and so improve the productive capacity of its economy, which so enforces and facilitates intra­ and extra­EU trade. This gained position of the EU, in context of the time of Globalization, together with the other main players of the economic market, raises the question of the comparability of this situation with the one of an oligopoly. The analysis of this will provide a clearer picture of the current state of today’s economies, as well as it will indicate parallels with historical economic developments. The EU will hereby be the major focus of this work, as its creation and development is seen as a main pioneer of economic integration and thus the realization of the neo­liberalist theory. Market Structures in an economical context Generally the concept of market structures can be essential to marketing and economics. Both emphasize the environment in which these companies operate and its importance it has on strategic decision­making. Economics is more concerned about the degree of market Núm. 11 (primavera 2010) Nadia Hushke / 216 ENTELEQUIA eumed•net www.eumed.net/entelequia revista interdisciplinar competition and the pricing strategies of these firms. Marketing, on the other hand, concentrates its focus on consumer behaviour. Basically there are four major market structures – perfect competition, monopolistic competition, oligopoly and monopoly. Market Structures categorize companies based on different characteristics like the number of sellers in the overall market, the kind of product, market share, barriers to entry, pricing power, efficiency and profits. For each of these specific criteria is used to describe the circumstances and the environment in which they operate. Table I will illustrates this criteria in more depth. Table I. Market Structures in the Industrial Context Number of Sellers Perfect Competition Very high number of sellers Pricing Power Price takers Supply Perfect Information Criteria Barriers to Entry Efficiency None/very low Monopolistic Competition Oligopoly Monopoly Many sellers Few Sellers One dominant seller Price makers Price Makers Minimal information No information High Very high Some control over price High degree of information Relatively low High Medium Relatively low Low Limited High Competition High No competition competition interdependence Small positive Profits Zero­profit Abnormal Profits Abnormal profits profits Based on: “Market Structures,” www.bized.co.uk/educators/1619/economics/firms/.../structure.ppt, 9 July 2009. This concept, how it is illustrated above, will now be applied on a macroeconomic scale. To do so, a redefinition of the categorization criteria will be necessary and will be as follows: • Pricing: Degree of economic power GDP, Share in world trade, Foreign Direct Investment (FDI) • Supply: Development perspective based on the endogenous growth theory • Barriers to entry: Capital and human endowment, Level of advancement • Efficiency: Income growth, GDP growth rates, Inflation • Degree of Cooperation: degree of collaboration and dependence • Profits: Human Development Index (HDI) Based on this criteria a new framework can be created (Table II): Table II. Market Structures in the economic context Criteria Perfect Núm. 11 (primavera 2010) Monopolistic Oligopoly Monopoly Nadia Hushke / 217 ENTELEQUIA eumed•net www.eumed.net/entelequia revista interdisciplinar Competition Competition Existence of Dominance No Yes Yes No Share of World GDP Equally distributed Relatively equal, some with slightly bigger share Dominance of share by few economies One big share High Medium to relatively low Low Relatively low High Very high Development Medium Perspective Barriers to None/very low Entry Economic Low Efficiency Degree of No cooperation cooperation HDI Low Source: The Author Medium Few cooperation Relatively low Medium to potentially high Relatively high interdependence Medium Low Very high High This study will use the above framework in order to explain the development of the EU in its international economic context. It will be the main aim to analyse to which extent the EU nowadays can be considered to be an oligopolistic player. However, a brief introduction about the other market structures and their fountainheads will be given, as well as a brief elaboration about the development of Globalization will be provided, as this is the environment the EU operates in. Furthermore this study will use another classification of the economic players. By putting all economies in the concept of a market structure, each economy will therefore represent a “player” in the market. As each player holds a different share, a categorization will be necessary. This will be based on two major indicators – the share of World GDP and GDP growth rates. Therefore the Boston Consulting Group­ Matrix (BCG­Matrix) will be used. This matrix is a concept that is often used in Marketing, in order to determine the position and profitability of a product or service, but will here be reformulated (see Figure I). Núm. 11 (primavera 2010) Nadia Hushke / 218 ENTELEQUIA revista interdisciplinar eumed•net www.eumed.net/entelequia The categorization will be based on two determinants. Firstly there is the market/GDP Growth, showing at which percentage­rate a product/economy is growing. This can occur at a high rate, which exceeds percentage growth rates of over 3% and low rates (below this percentage). Secondly, there is the market share a product holds within the overall market. For the economy this would represent the relative share it holds in terms of World GDP. To hold a strong position in the World GDP share the economy will need to have a share of 10%. In very general terms, the majority of today’s developed countries will represent a cash cow, whereas emerging economies will represent a question mark. Dogs will be developing and underdeveloped countries, which hold a very small World GDP share and experience a relatively low growth of GDP. A star will be an economy that already holds a large share of World GDP and it still growing at a rate that exceed 3% annually. This position could be achieved already, but only on a short­term basis, as for example for the EU in 2006 with a GDP growth rate of 3.1%. Figure III tries to illustrate the development of World GDP share throughout the past. As it can be seen the distribution of World GDP was relatively equal until the end of the 17h century. After this time period small changes occurred, which continued with the beginning of the 19th century, and are furthermore enforced until nowadays. And thus shows the economic progression, which will here be the major focus of this work. Núm. 11 (primavera 2010) Nadia Hushke / 219 ENTELEQUIA revista interdisciplinar eumed•net www.eumed.net/entelequia Perfect Competition Prior the 15th century most economies in the world were self­sufficient and were mainly based on agricultural production. Families and households grew their own goods like corps and cattle. Production surpluses would be traded in order to acquire other goods. There was very little transnational trade. The majority of trade rather took place on a regional level. Most economies had relatively identical conditions in terms of productive capacity. There were differences in labour and capital endowment, as well as natural resources and climate that affected production. However, as agriculture is an almost zero­profit business, the economies themselves grew by very little and the majority of the world can be claimed to have had the same share of GDP1. World GDP was relatively equally distributed and growth rates were considerably low. This categorises most of the economies at that time as a Dog. As such, it can be claimed, that there was no economic anarchy and that the majority of the countries enjoyed a high degree of sovereignty and there was just little interaction and trade with other economies. Productivity and so economic efficiency at that time was relatively low.2 Economic performance and thus the performance in the agricultural sector was mainly based on human resources and the natural endowment of the economy, including its natural resources, geographical conditions and climate. Entry barriers, as defined previously, can be said to have not existed. 1 China here represented an exception in terms of GDP, this is however not due to a higher level of production, but to the size of its land mass, which so gives it a higher aggregate GDP: 2 Rondo E. Cameron, A Concise Economic History of the World, (Oxford University Press, 1993) 15. Núm. 11 (primavera 2010) Nadia Hushke / 220 ENTELEQUIA revista interdisciplinar eumed•net www.eumed.net/entelequia Monopolistic Competition With the beginning of the 15th century international trade was starting to catch up and experienced its first peak during the era of the British Industrial Revolution. This time period, which covers the 15th century until the early 19th century, is often also said to be the first Globalization period. International Trade and the idea of Mercantilism Definition: Globalization is the increasing world integration through trade, financial flow and knowledge.3 By defining globalization as such, it is not a new phenomenon. Already in the 15th century until the 18th century, increased trade among national economies was common. Eurasian 4 countries during that time based their economic performance of trade on the mercantilist idea, which was popularized by Adam Smith (1776). However, it was Thomas Mun who first introduced the idea of Mercantilism. In the late 1620s he stated in his book “England’s Treasure by Forraign Trade” that “The ordinary means therefore to increase our wealth and treasure is by Forraign Trade, wherein wee must ever observe this rule, to sell more to strangers yearly than wee consume of theirs in value” 5. It is this main idea on which Mercantilism is built. It says that each national economy must aim to achieve a positive trade balance, where exports exceed imports, so that more precious metals would flow into the country, that could be used to invest in the country’s military and so enhance its national wealth and power.6 Government intervention played a key role in shaping and controlling the national economy. Trade has been seen as a zero­sum game, where one economy gains and the other loses out. In order to achieve this favourable trade balance high tariffs were set on imports. These were considerably higher for manufactured goods, whereas the tariffs on raw materials were relatively low.7 The state thus held a high degree of control over the nation’s economy, by controlling corporations and trading companies, as well as regulating production in order to secure goods of high quality at a relatively low cost, so that the nation was able to maintain its position in the foreign markets.8 Manufacturing goods were here favoured over agriculture. However, agricultural production was essential, so that there is a low need for the import of these goods, as well as national security would be provided. Hence it was seen as important to engage in international trade in order to increase the holding of precious metal and thus power. Indeed, international trade began to blossom by the late 15th century which also led to an increase in money circulation. The increase in precious metals that several European countries experienced, was reinvested in strengthening the army, navy and merchant marine. As a consequence of these investments several improvements for example for the marine, could be achieved, as longer distance and faster shipping was enabled and so fostered trade additionally. 3 4 5 6 7 8 “Economic Globalization,” http://www.freeworldacademy.com/newbizzadviser/fw6.htm, 8 June 2009. Eurasia compromises the European and Asian continents. “Thomas Mun,” http://www.maths.tcd.ie/local/JUNK/econrev/ser/html/tommy.html, 14 July 2009. “Mercantilism,” http://www.newworldencyclopedia.org/entry/Mercantilism, 8 June 2009. Ibid. Ibid. Núm. 11 (primavera 2010) Nadia Hushke / 221 ENTELEQUIA revista interdisciplinar eumed•net www.eumed.net/entelequia In order to improve the nation’s success it would be highly favourable to access larger markets and expand the sources for raw materials, which was often achieved in this time through colonisation, which experienced its peak in the 16th century, due to the technological improvements in navigation.9 As many of the colonising states exploited these colonies, these were able to increase their productivity in trade and thus increase their power. Trade was consequently fostered by colonisation, as it could be used as a low­cost source of raw materials, agricultural products and as a potential market for manufactured exports from the colonising state.10 Nation states at this time were still relatively sovereign and cooperation between national economies was rather limited, as it just served the purpose of purchasing raw materials for production, as well as for the general trade. Following on, growing integrated world markets were created. In 1851 the English Channel developed the first successful submarine telegraph cable, linking financial markets in London with other European capitals.11 This increase in trade and productivity was furthermore enforced through the industrial revolution towards the end of the 18th century. With the British industrial revolution many economies entered the second stage of the structural change, that is, the shift of the main focus on the primary sector to the secondary sector. With that the distribution of labour force changed. Priory 80­90% of the labour force was occupied in agricultural production. This proportion decreased to 50% by the end of the nineteenth century.12 Through industrialization some countries were able to enjoy improved productivity and high economic growth. Due to that some countries like Britain, Germany, France and other European countries were starting to develop a slight dominance in terms of World GDP share and thus economic power. Simultaneously with the industrialization, the development of industry, capital investment and increased productivity and know­how the first barriers to entry were established. However, these were still relatively low as the process of industrialization was still in its early stages. Also increased international trade and increased interdependence took place, due to growing demand for natural resources, such as coal and oil. Hence a shift in the factors of production took place. Before the factors of production were mainly based on human and natural resources, afterwards physical resources in form of industry add on to this. Thus the high degree of sovereignty could not be sustained anymore, and the belief in the mercantilist idea started to erode Oligopoly The stage of oligopoly represents the current time of the modern globalization that emerged in the 1980s. In this time international trade was starting to increase in importance as trade barriers were removed and the opening up of several economies after the fall of the Berlin Wall, are seen as major historical events and as the beginning of the stage of Oligopoly. 9 “Colonialism,” http://plato.stanford.edu/entries/colonialism/, 8 June 2009. 10 Dennis R. Appleyard, International Economics, (McGraw­Hill Irwin, 2006) 19. 11 Kevin H. O’Rourke & Jeffrey G. Willliamson, Nineteenth­Century Atlantic Economy, (The MIT Press, 2001) xiii. 12 Rondo E. Cameron, A Concise Economic History of the World, (Oxford University Press, 1993) 15. Núm. 11 (primavera 2010) Nadia Hushke / 222 ENTELEQUIA revista interdisciplinar eumed•net www.eumed.net/entelequia Through the growing international trade that takes places nowadays resources can be allocated most efficiently and each economy is enabled to specialize on its comparative advantage and so engage in international trade. As a consequence there is a growing interdependence among economies, as these depend on each others imports and exports. Furthermore through the free movement of the factors of production increased efficiency is achieved and can often together with FDI, contribute to positive GDP and GDP per Capita growth. As a consequence of major investments that have been taken place in many developing countries such as in China and India, there is a growing proportion of the middle­class, and thus there seems to be more equally distributed wealth. However, still the major economic position and World GDP Share is held by three major economic players. The European Union Table VIII aims to show the distribution of World GDP share, under which it becomes clear that North­America, the EU and South­East Asia clearly own the major share. The US13, EU and Japan account for over 68% of world GDP. This underlies the concept of an oligopolistic market structure, as a minority of players hold the major share of World GDP and so of the world’s wealth. This concept is also manifested in Pareto’s principle, which claims 13 The US accounted for 26% of World GDP in 2006. “World GDP Share,” http://mjperry.blogspot.com/2008/04/world­gdp­shareemerging­economies.html, 7 August 2009. Núm. 11 (primavera 2010) Nadia Hushke / 223 ENTELEQUIA revista interdisciplinar eumed•net www.eumed.net/entelequia that roughly 20% of (in this case) the world’s population hold about 80% of wealth. 14 As already mentioned, there are just few dominant economic players in world, of which the EU is one. The following section will provide a more detailed explanation of the reasons and aims of its creation and how the EU has performed and developed since its creation. The r ise of developing countr ies as a tool for economic growth However, although Neo­liberalism suggests positive economic growth, wealth and international cooperation, this development can also be seen from a different perspective. The development of developing economies brings several favourable aspects. Through increased FDI in several economic sectors, as well as infrastructure, technology and other sectors can be made. By doing so the economy will be able to improve its productive capacity and therefore be more competitive. Consequently economies experience positive GDP growth. It is clear that FDI, which often comes from developed economies, tends to invest in an economy by, for example, outsourcing supply chain activities to a country with relatively low labour costs, as it is often the case for companies that use the Global Product Development­ strategy (GPD)15. This creates benefits for both parties. In the long run the developing economy grows, which mostly comes along with increased GDP per Capita. Increased incomes, as it would the case in India, often occurs in a parallel fashion with increased demand for consumer goods. Most notably this increased demand will be for goods from developed countries, and so increases the demand for imports. This fact increases exports for the developing countries and contributes again to economic growth. Statistically developing countries grow at a much faster rate, due to the catch­up effect. Developed economies in turn seem to grow at a much lower rate. Therefore the developed economy is able to increase demand for its exports, thus making more sales. With increased wealth in developing countries developed countries can so expand the size of their current target markets and in best case find new markets. In marketing this process is often described as market expansion and market development – sales and demand are stimulated and created in markets where they have not been before. This situation can be compared to a specific extend with the US’s European Recovery Program (ERP) in Europe – through the development and strengthening of the European economy the demand for US goods has grown significantly, which at the same time benefited the economy of the US. Therefore the increased demand from today’s developing countries also strengthens the economic position and competitiveness of develop countries. However, what the main purpose behind the stimulation of growth of developing countries is remains an open question. Just time will be able to show, to which extend all developing 14 “Pareto’s Principle: The 80­20 Rule,” http://www.bsu.edu/libraries/ahafner/awh­th­math­pareto.html, 29 July 2009. 15 GPD: Global Product Development­Strategy, that aims to maximize the financial and operational productivity of the product development process by spreading product development activities across multiple regions of the world in order to better match value­add to cost.”, “Gaining Competitive Advantage through Global Product Development,” www.ptc.com/WCMS/files/76863/en/3425_GPD_WP_EN_FINAL.pdf, 12 March 2009. Núm. 11 (primavera 2010) Nadia Hushke / 224 ENTELEQUIA revista interdisciplinar eumed•net www.eumed.net/entelequia countries can liberalize sufficiently and thereby enjoy a “developed” level of income and wealth, and how much this will be equally distributed. As such the world is now economically dominated by three major players, and so marks the time of the Oligopoly. The Eastern European Enlargement Another similarity can be drawn in the case of the eastern European enlargement of the EU. The continuous expansion of the EU towards the eastern European economies was a critical step in many ways. Firstly many of these countries showed a considerably lower level of development and technological advancement. The economic integration of the eastern European members seemed to be a critical process due to the countries’ negative balance of trade and account balance. The difficulties and costs that arose with the eastern European integration raised the question whether these are seen as extractive economies16, which in this case represented the eastern European members which received only a low and declining share in the global distribution of wealth. 17 As Gernet Köhler and Emilio José Chaves claim the east seems to be unable to reap the benefits of technical progress and is being forced to export heavily which makes the economy increasingly reliant on the export sector. At the same time there did not seem to be any advances in energy and income balance. Due to this they proposed the throw­back into this old pattern of extractive economy. 18 However, if this will be the case remains to be seen. The enlargement of the European market led to an increase of human capital and the benefits associated with it, increased capital, economic and natural resources. The size of the European common market increased from about 370 million to 470 million people. Furthermore all members are going to benefit from the reduced barriers to trade, investment and movement of labour. Through this increased trade liberalization in the European zone economic growth and strength will be enhanced.19 Following the increase of the common market economies of scale can be achieved much easier and productivity of capital and labour increases, which will drive down prices in the long run, and thus make the EU increasingly competitive and enhance its economic strength and power. As such the EU is having an increased access to new markets and resources, as there are no trade barriers. This increased access however, can be compared to a specific extend to colonization, which took place during the Mercantilist­area, in a way that a further expansion of the own market, which here is the EU that established out of six member states, expanded to 27 member states. Surely the membership of the new states was voluntarily, but the fact of market and resource expansion shows similarities. 16 This term is used to describe a situation of unequal exchange whereby raw material exporting sectors in the periphery 17 Gernot Köhler & Emilio José Chaves, Globalization, (Nova Biomedical, 2003), 173. 18 Ibid., p. 173. 19 “EU Enlargement,” http://www.cato.org/pubs/pas/pa489.pdf, 3 August 2009. Núm. 11 (primavera 2010) Nadia Hushke / 225 ENTELEQUIA revista interdisciplinar eumed•net www.eumed.net/entelequia For the new EU­members Latvia, Poland, Eastland, Lithuania, Slovakia, Czech Republic, Slovenia and Hungary the membership has been showing many positive effects. With the adaptation of the EU more stability could be achieved and so made the countries more attractive for direct investment.20 Overall, since the membership all eight countries record an average increase of 25% in GDP, which represents an increase three­times as high as the old EU­ member states (see Figure IX). Additionally the GDP per Capita increased and corruption problems decreased. The further development of Eastern European countries will continue to be a main issue in the future. For example the markets of Poland, the Czech Republic and Hungary represent three of Germany’s main 15 export­partners, and are representing an even bigger importance for trade than Japan, Brazil and India.21 The London Centre for European Reform claims that the new enlargement helps the EU as a whole to be more competitive in the world market. Furthermore with the widening of the European markets and enforced economic integration where trade barriers are removed, the EU is widening its production­scale. As a result economies of scale can be achieved easier, thereby decreasing production cost, which makes the European economy more competitive. Based on the main idea of this study the widening of the European market could be compared with company­mergers. Companies merge in order to benefit from various aspects, like sharing and reducing various costs, strengthening of market power, access to increased know­how and assets. In simple terms the merging or takeover of the eastern European countries is not very different from this. 20 Nils Kreimeier, “Großer Sprung nach vorn,” Financial Times Deutschland, 30 April 2009, 13. 21 Ibíd. Núm. 11 (primavera 2010) Nadia Hushke / 226 ENTELEQUIA revista interdisciplinar eumed•net www.eumed.net/entelequia The EU as an oligopolistic player In order to give a more in­depth insight into the current market structure of oligopoly, a detailed analysis of the EU will be conducted, as it is considered to be one of the major players. Therefore the categorization­criteria will be recalled. Pricing : Degree of economic power GDP, Share in world trade, FDI Supply: Development perspective based on the endogenous growth theory Barriers to entry: Capital and human endowment, Level of advancement Efficiency: Income growth, GDP growth rates, Inflation Degree of Cooperation: degree of collaboration and dependence Profits: HDI Pr icing Foreign Direct Investment (FDI) is defined as a “category of international investment that indicates an intention to acquire a lasting interest in an enterprise operating in another economy”22, FDI is an important indicator for the international economic climate. Furthermore, in the time of globalization, it plays a major role as it is an important indicator for international relations and development, as it can encourage increased efficiency in production, increase technological and managerial know­how and thus improve the productive capacity of the economy and its competitiveness. Reasons for FDI can be access to new markets and the better knowledge of these markets, the need for local market presence and lower labour, raw material and intermediary input costs, and thus the overall decreased production costs. From 2004 to 2005 world FDI inward flows increased by 9%. The EU records an increase of 77% in the same time.23 The EU recorded a holding of 19% of the world FDI inflows in the year 2005. The majority of this investment (43%) came from the European continent (non­EU countries), followed by North­America with a share of 18%. 24 Main destination for EU­FDI outflow were the United States, Switzerland and Canada, and thus underlines the fact, that most of the FDI­flows take place among developed countries, rather than to developing countries. Just 36% of the EU total FDI outflows went to emerging markets, whereby East Asia was the main receiver. The EU’s Net FDI income recorded a high of 68 € Billion in 2005. 22 “European Union foreign direct investment yearbook 2007,” http://epp.eurostat.ec.europa.eu/cache/ITY_OFFPUB/KS­BK­07­001/EN/KS­BK­07­001­EN.PDF, 5 July 2009. 23 “European Union foreign direct investment yearbook 2007,” http://epp.eurostat.ec.europa.eu/cache/ITY_OFFPUB/KS­BK­07­001/EN/KS­BK­07­001­EN.PDF, 5 July 2009. 24 Ibid. Núm. 11 (primavera 2010) Nadia Hushke / 227 ENTELEQUIA revista interdisciplinar eumed•net www.eumed.net/entelequia As illustrated in Figure XII there is a positive trend for FDI inward and outward flows. EU inward stocks increased by 10% in 2005, and outward stocks increased by 16%. Overall net assets increased in 2005, after recording a continuous decline in the years before. Supply Research and development expenditures which are considerably good, can promise long term growth and development .Based on the endogenous theory of growth it is crucial for a country to invest in Research and Development (R&D25), as technological innovations are becoming increasingly important contributor for economic growth. R&D contributes to the overall stock of knowledge of the economy and so enhances its productive capacity, which in turn increases its competitiveness. Technological development, scientific research and innovation are a key factor for economic growth and competitiveness and are therefore important to be developed on a continuous basis. In 2004 R&D expenditures accounted for 1.90% of GDP in the EU­25. At the moment Japan and the US still record the highest expenditures on R&D development. However, launched at the Lisbon European Council and later on established at the Barcelona European Council in March 2000, the EU planned to increase this percentage to 3% until 2010.26 With this percentage the EU would catch up with the US (2.8%) and Japan (more than 3%). However, the amount of R&D allocated to applied research in the EU is considerably higher, compared to the US (see Figure XIII). 25 R&D Definition: “ Activities that compromise creative work undertaken on a systematic basis in order to increase the stock of knowledge, including knowledge of man, culture and society and the use of this stock of knowledge to devise new applications”, “R&D expenditure in Europe,” http://epp.eurostat.ec.europa.eu/cache/ITY_OFFPUB/KS­NS­06­006/EN/KS­NS­06­006­EN.PDF, 6 July 2009. 26 “R&D expenditure in Europe,” http://epp.eurostat.ec.europa.eu/cache/ITY_OFFPUB/KS­NS­06­006/EN/KS­ NS­06­006­EN.PDF, 6 July 2009. Núm. 11 (primavera 2010) Nadia Hushke / 228 ENTELEQUIA revista interdisciplinar eumed•net www.eumed.net/entelequia Countries like Japan and China tend to focus their expenditures more on experimental development.27 The biggest spending sector is manufacturing, followed by the service sector. For the manufacturing sector the EU records similar R&D expenditures as the US. 28 Following on, the highest amount of R&D investments was provided to Germany, France and the United Kingdom. Increased efforts is also planned to be invested on information and communication technologies, biotechnology and nanotechnology, aeronautics and hydrogen energy technology.29 For the service sector positive trends for the EU are predicted, this would close the gap between in the R&D spending with the US, on which at the moment the US is spending considerably higher amounts.30 Over the years the EU recorded constant growth in R&D expenditures. From 2001 until 2004 EU expenditures rose by 2.7% per year. This fact will be another important issue that will contribute to the EU future economic outlook and performance. 27 “R&D expenditure in Europe,” http://epp.eurostat.ec.europa.eu/cache/ITY_OFFPUB/KS­NS­06­006/EN/KS­ NS­06­006­EN.PDF, 6 July 2009. 28 Ibid. 29 “Communication from the Commission,” ftp://ftp.cordis.europa.eu/pub/era/docs/com2004_353_en.pdf, 7 July 2009. 30 “R&D expenditures in Europe and the US,” http://www.euractiv.com/en/science/rd­expenditures­europe­ us/article­180737, 6 July 2009. Núm. 11 (primavera 2010) Nadia Hushke / 229 ENTELEQUIA revista interdisciplinar eumed•net www.eumed.net/entelequia Barr iers to entr y The EU’s economic and trade policies are generally created in a way that makes the EU the strongest and most competitive single economy in the world. 31 With the continuous enlargement of the EU, human resources have been increasing greatly. With over 491 Million inhabitants the EU holds 7% of the world’s population share. Several strong partners and trade agreements the EU holds, puts it in a strong economic position throughout the world. The continuous strengthening of common fundamental values with trading partners, the rule of law, property rights and the practise of free trade, the European economy has been able to benefit and grow greatly. The EU together with the US represent the largest bilateral trade relationship in the world, and make both of them the key players in the global trade system, 32 Together both economies account for almost 60% of the global GDP, 33% of world trade in goods and for about 42% of world trade in services, and thus shows the strong power of these two economies. Eff iciency GDP growth rates, the inflation rates and unemployment rates are three of the main economic indicators. These are said to be important, as they can give some information about future economic performance. Favourable Real GDP growth rates33 are essential for an economy, as it will reflect the health of an economy. The healthier an economy is, the more likely it will be a target for FDI and be more likely to enjoy positive economic growth and development, this in turn might also contribute to decreased unemployment rate and thus increased consumer spending. 34 The EU is considered as a cash cow – as it holds a big share of World GDP and small GDP growth. Throughout the years the EU enjoyed constant economic growth (see Figure XIV). 31 “Trade,” http://www.eurunion.org/eu/index.php?option=com_content&task=view&id=52&Itemid=48, 7 July 2009. 32 “Bilateral Trade Relations,” http://ec.europa.eu/trade/issues/bilateral/countries/usa/index_en.htm, 7 July 2009. 33 Real GDP growth rates take inflation into account, and will consequently here not be considered separately. 34 “Economic Indicators: Gross Domestic Product (GDP),” http://www.investopedia.com/university/releases/gdp.asp, 28 July 2009. Núm. 11 (primavera 2010) Nadia Hushke / 230 ENTELEQUIA revista interdisciplinar eumed•net www.eumed.net/entelequia Although the world is facing an economic recession at the current time, it is still predicted, that the EU will be able to stand up again quickly, due to its economic strengths and advantages. The EU’s economy is considered as being highly stable, as well as the continues growth in the past and the development and growth of the new member states, it can be predicted that the EU is furthermore going to have positive GDP growth rates and will so additionally strengthen its economic position. But not only the high level of advancement in the industrial and technological sector contribute to these favourable growth rates. Also the development and increased productivity furthermore strengthens the EU’s position throughout the world. The role as one of the main agricultural producers could additionally be enforced in the future by the World Climate Change. Through increased temperatures, droughts, floods and increased sea­levels more and more countries find their agricultural future threatened. For the future Middle­ and South­America will suffer heavily from the climate change. 35 Although the EU is also surely affected by this, the degree of damage will still be relatively lower than in South­ America. This could give the EU additional power, as agricultural exports from the EU will be increasingly demanded. Unemployment rate is often used an indicator of general economic activity. This so reflects the labour force utilization of an economy. A high unemployment rate would thus indicate that human resources are idling and productive capacity is foregone.36 35 Appendix II shows a World Map of the consequences of Global Warming 36 “The Unemployment Rate as an Economic Indicator,” http://research.stlouisfed.org/publications/review/76/09/Unemployment_Sep1976.pdf, 29 July 2009. Núm. 11 (primavera 2010) Nadia Hushke / 231 ENTELEQUIA revista interdisciplinar eumed•net www.eumed.net/entelequia As the evidence shows (Figure XV) the EU enjoyed a lower unemployment rate than Japan and the US from the end of the 1970s on. Generally the EU’s unemployment rate shows a decreasing trend, whereas Japan and the US show positive unemployment rate growth. Following on, the EU seems to have used its resources more efficiently as well as it was able to increase their productive capacity, which goes hand in hand with GDP growth. Degree of Cooperation The degree of economic cooperation, in form of trade agreements, has increased significantly since the 1980s. More and more countries liberalized their economy, lowered or reduced trade barriers, in order to facilitate trade. As a result of economic liberalization the amount of imports and exports has grown significantly, and strategies, such as GPD and outsourcing have become more common. Because many companies receive their raw materials and services from other countries, produce their products throughout the world and sell their goods to different markets, today’s degree of cooperation and interdependence among nation­ states became crucial. As such, it is the goal of the neo­liberalistic idea to create this stronger cooperation, in order to allocate resources more efficiently, ensure stability and so reduce the potential and risk for conflict. Companies and economies can so work together, which will so benefit all participants in the long run. This fact can be explained by the Nash Equilibrium. This theory is used to describe the relationships among companies and industries in an oligopoly. Each participant will be affected by the actions of the other – they are interdependent. Following on, it will be most beneficial if participants decide to cooperate with each other. In international relations this can Núm. 11 (primavera 2010) Nadia Hushke / 232 ENTELEQUIA revista interdisciplinar eumed•net www.eumed.net/entelequia take place in forms of negotiations over mutual tariff reductions, the formation and reservation of custom unions, issues of international common property and others. Further on, if all participants and economies agree on one strategy and to cooperate, none of them will lose. In this way today’s economies will try to adjust their behaviour to the one of the other’s in the game, so that strategy choices will be created in a way that all participants will experience better results.37 As a result the created Nash equilibrium will be a self­enforcing agreement among most economies nowadays. As the agreement of mutual economic cooperation was reached, it will be in the self interest of each player to follow this agreement. As a consequence economic cooperation and integration could be furthermore developed and enforced than in the beginning of the modern globalization. Profits Profits normally refer to surplus remaining after all total costs have been deducted from the total revenue of a company. It is often used as a measure of the success and is often important for stockholders, as an increase in profits can lead to increased profits for equity holders. Thus it is an indicator of the comparative performance of the company. 38 In economic terms the sales of the company would reflect the country’s GDP. Increased sales/GDP thus often seem favourable and is what most economies aim for. However, how well off a country is really is, is often described by the Human Development Index (HDI), and shows how much the society really takes “profit” out of increased GDP. Comparable to a company this would mean, how much did the increased sales really reflected in the increased profits, or could only increased sales be achieved through lowering profits, which could be compared with economic growth for the suffering of the society. The Human Development Index is a widely accepted measure for economic development and thus the standard of living of the country’s society. The HDI takes into account the following indicators: 1­ 2­ 3­ 4­ Life expectancy Literacy Educational attainment GDP per Capita The closer the HDI of a country is to one the “better” the society’s standard of living. 37 “The Nash Equilibrium: A perspective,” http://kuznets.harvard.edu/~aroth/papers/HoltRoth.nash_perspective.pdf, 8 August 2009. 38 “Profit,” http://www.businessdictionary.com/definition/profit.html, 18 July 2009. Núm. 11 (primavera 2010) Nadia Hushke / 233 ENTELEQUIA revista interdisciplinar eumed•net www.eumed.net/entelequia As it can be seen in Table X Japan here records the highest HDI, followed by the USA. For the EU the HDI has been divided into three groups, based on the different memberships. This comparison might be useful, as the new members, especially in the last eastern European enlargement still face major imbalances with the rest of Western Europe in terms of GDP per capita as well as the productive capacity. Following this the HDI of the EU is decreasing consistently by adding its new member­states. However, apart from China it can be said, that these countries enjoy a considerably high HDI compared to the world average HDI of 0.741.39 It can be concluded, that the countries that enjoy high GDP together with a high share in world trade also enjoy a high HDI, from which the society benefits as a whole, eventually. For these countries economic liberalization thus has been a favourable step in order to improve wealth. Results from the EU’s current economic status The economic development of the EU and other rising economies, has changed the economic power relationships in the last past decades. After the Second World War, there were the two superpowers – the United States and the Soviet Union. As the U.S. took on responsibility to help and rebuild Europe, it increased its own share of economic, but also of political power and thus made it the 20th century hegemony. 39 Appendix III shows a Map of the World HDI distribution. Núm. 11 (primavera 2010) Nadia Hushke / 234 ENTELEQUIA revista interdisciplinar eumed•net www.eumed.net/entelequia The successful implementation of the neo­liberalistic approach, embedded in the EU, which expanded and grew over the past time, made the EU rise and become one of the world’s main economic players. As a result the U.S. lost its hegemonic status, although it is still holding the position of a dominant player. The new era of Globalization, together with the increased connectivity and interdependence, changed economic and international relations, whereby each participant had to gave up a certain degree of sovereignty, in order to benefit. The implementation of the neo­liberalist idea has increased international security, in which international organizations and institutions play a key role for the stabilization of the international system, as these have established a set of international rules, which are precise and well obeyed. The European Union, which is the economy that has realized the neo­liberalist idea to probably the largest extend, has lead to the further strengthening of countries, that have been powerful before, such as Germany, but is also contributing to the development of countries, that have not been as fortunate, like Slovakia, and are now experiencing the benefits of economic integration. Therefore the positive results from the implementation of the neo­liberalist thinking can be best seen in the European Union. Although the European Union has been criticized to a major extend, and although some of its policies are highly questionable and do create inefficiency in some areas, the EU has improved economically and so underline the main goals of its creation. Some economies, namely the question marks, are about to acquire a major economic status, and would so change the composition and increase the number of dominant players in the economic market. But these should not represent a threat for the European Union, as it would be in the past, where trade has been seen as a zero­sum game. With the retention of the European strategy and the further development of its new member states, this should result in the maintenance of the EU’s powerful economic status and will so make it remain competitive in the future, whereby other economies are also able to develop and so will increasingly show the results of the positive­sum game of international trade. As such, the overall results of the development of the EU can be evaluated as being highly positive, and can so serve as a role model for other developing economies and encourage these to shift more to a neo­liberalistic thinking and open themselves up to international trade. Surely there is no perfect model for economic growth. Each economy will have to develop a model for economic growth and development for itself, whereby domestic factors and circumstances have to be taken into consideration. However, the increased need for connectivity and collaboration, together with increased interdependence should be seen as necessary and positive, as it so contributes to international security and development. The overall development within the world might be uneven, whereby some economies will develop quicker and more efficient than others, however this might, step by step, contribute not necessarily to overall wealth, but to a more equally distributed wealth. Núm. 11 (primavera 2010) Nadia Hushke / 235 ENTELEQUIA revista interdisciplinar eumed•net www.eumed.net/entelequia Monopoly This final stage of monopoly would represent a world of fully globalized free trade and a high degree of interdependence among all economies. In this scenario resources would be allocated most efficiently throughout the world, whereby each country can focus on its comparative advantage without facing barriers. This in the long run would result in a relatively low economic efficiency, as the results of the catch­up effect have been overcome. Following on, wealth would be distributed more evenly and would so contribute more to global justice, where no dominant economy exists anymore. As a consequence of the international economic integration there exists one overall market within the world – thus a monopoly. Whether and when this scenario will happen remains questionable, as there are still many other factors, such as political, environmental, social, religious and others, that can diminish the possibility for sufficient economic development. Conclusion In the modern globalization a few economies were able to acquire and maintain a major economic status, whereby several other economies that opened themselves up to international trade, are about to grow and develop. The European Union, as one of the pioneers of the economic integration, has risen from six initial members countries to 27 and so increased it’s competitiveness by far, as a large amount of markets, resources and capital can be accessed. However, the EU, such as other economies remains and even enforces its interdependence with others economies and nation­states. This fact represents one of the main differences to the first globalization, where countries were rather sovereign and governments controlled trade heavily, whereas today economic growth is said to be based on a free market and collaboration among economies. However, the modern Globalization has not brought all the benefits yet, for which many economies were aiming for. In fact, up until now, just three major players have developed and grown so much, that these can be considered to dominate world trade. The EU together with the US and Japan can be considered as one of the main holders of the World GDP share. These cash cows grow at a relatively low rate, compared to question marks, but can be forecasted to remain strong in the future, whereby the EU with its further expansion and the development of the eastern European countries could even contribute to a bigger economic weight in the future. Other economies such as China and India, which are some of the emerging markets at the present time that will contribute to growth and so probably lead to an expansion of the oligopolistic market, will be some of the stronger players to come. According to the specific criteria that has been used for the analysis on the EU, and due to the fact that there is a presence of economic powers, a relation to an oligopolistic market structure can be drawn. Globalization has contributed to increased interdependence, economic growth and international security. However, it remains highly questionable whether globalization is going to reach the final stage of monopoly. Núm. 11 (primavera 2010) Nadia Hushke / 236 ENTELEQUIA revista interdisciplinar eumed•net www.eumed.net/entelequia Bibliography “2008 Economic Outlook for East Asia.” http://www.ide.go.jp/English/Press/2008_index.html, 29 June 2009. “An East Asian Model of Economic Development: Japan, Taiwan, and South Korea.” http://www.jstor.org/pss/1566537, 28 July 2009. “Anatol Lieven: The Push for War.” http://www.lrb.co.uk/v24/n19/liev01_.html, 25 June 2009. “Bilateral Trade Relations. ” http://ec.europa.eu/trade/issues/bilateral/countries/usa/index_en.htm, 7 July 2009. “Colonialism.” http://plato.stanford.edu/entries/colonialism/, 8 June 2009. “Definition of Current Account Balance.” http://economics.about.com/cs/economicsglossary/g/current_account.htm, 30 June 2009. “Economic Globalization.” http://www.freeworldacademy.com/newbizzadviser/fw6.htm, 8 June 2009. “Economic Growth, international technological spillovers and public policy: Theory and empirical evidence from Asia .” http://www.uoit.ca/sas/Information%20Technology/spilloverasia.pdf, 29 June 2009. “Economic Indicator s: Gross Domestic Product (GDP).” http://www.investopedia.com/university/releases/gdp.asp, 28 July 2009. “EU Enlargement. ” http://www.cato.org/pubs/pas/pa489.pdf, 3 August 2009. “EU GDP growth expected to fall in 2009 but climb back in 2010.” http://www.eucommerz.com/index.php?/article/0148_eu_gpd_growth/51/202/, 28 June 2009. “European Union foreign direct investment yearbook 2007.” http://epp.eurostat.ec.europa.eu/cache/ITY_OFFPUB/KS­BK­07­001/EN/KS­BK­07­001­EN.PDF, 5 July 2009. “European Union.” https://www.cia.gov/library/publications/the­world­factbook/geos/EE.html, 24 June 2009. “Gaining Competitive Advantage through Global Product Development.” www.ptc.com/WCMS/files/76863/en/3425_GPD_WP_EN_FINAL.pdf, 12 March 2009. “Globalization.” http://encarta.msn.com/encyclopedia_1741588397/Globalization.html, 8 June 2009. “Gross Domestic Expenditure on R&D.” http://www.swivel.com/data_sets/show/1004958, 18 July 2009. “Hegemony, Institutionalism and US Foreign Policy: Theory and Practice in Comparative Historical Perspective.” http://espace.library.uq.edu.au/eserv.php?pid=UQ:10402&dsID=mb_rh_birm_03.pdf, 25 June 2009. “Human Development Index. ” http://www.bized.co.uk/learn/economics/international/eu/notes/eu_hdi.htm, 18 July 2009. “Statistics of the Human Development Report.” http://hdr.undp.org/en/statistics/, 18 July 2009. “In relation to GDP, EU27 R&D expenditure stable at 1.84% in 2005.” http://europa.eu/rapid/pressReleasesAction.do? reference=STAT/07/6&format=PDF&aged=1&language=EN&guiLanguage=en, 29 June 2009. “Indicators of science and technology in ASEAN member countries.” http://www.astnet.org/index.php? name=Main&file=content&cid=52, 29 June 2009. “International Companies.” http://leeiwan.wordpress.com/2007/06/18/difference­between­a­global­ transnational­international­and­multinational­company/, 11 August 2009. Núm. 11 (primavera 2010) Nadia Hushke / 237 ENTELEQUIA revista interdisciplinar eumed•net www.eumed.net/entelequia “International Political Economy: Beyond Hegemonic Stability.” http://www.mtholyoke.edu/acad/intrel/milner.htm, 27 July 2009. “IR Paradigms, Approaches and Theories.” http://www.irtheory.com/know.htm, 25 June 2009. “Lowest unemployment rate in seven years.” http://www.eurofound.europa.eu/eiro/2006/07/articles/sk0607019i.htm, 28 June 2009. “Mercantilism.” http://www.newworldencyclopedia.org/entry/Mercantilism, 8 June 2009. “Organisation for European Economic Co­Operation.” http://www.oecd.org/document/48/0,3343,en_2649_201185_1876912_1_1_1_1,00.html, 10 June 2009. “Profit. ” http://www.businessdictionary.com/definition/profit.html, 18 July 2009. “R&D expenditure in Europe” http://epp.eurostat.ec.europa.eu/cache/ITY_OFFPUB/KS­NS­06­ 006/EN/KS­NS­06­006­EN.PDF, 6 July 2009. “Selected basic ASEAN indicators.” http://www.aseansec.org/stat/Table1.pdf, 29 June 2009. “Structural Change and Economic Growth.” http://www.un.org/esa/policy/wess/wess2006files/chap2.pdf, 26 June 2009. “The Nash Equilibrium: A perspective.” http://kuznets.harvard.edu/~aroth/papers/HoltRoth.nash_perspective.pdf, 8 August 2009. “The Cold War. ” http://www.historylearningsite.co.uk/suez.htm, 25 June 2009. “The Doha Development Round of trade negotiations: understanding the issues.” http://www.oecd.org/document/45/0,2340,en_2649_201185_35738477_1_1_1_1,00.html, 10 July 2009. “The European Union: eastern enlargement and taxation.” http://www.entrepreneur.com/tradejournals/article/118987155.html, 26 June 2009. “The IR Theory Knowledge Base.” http://www.irtheory.com/know.htm, 25 July 2009. “The need for holistic approaches.” http://www.interacademycouncil.net/CMS/Reports/11840/11901/11907.aspx, 18 July 2009. “The Unemployment Rate as an Economic Indicator.” http://research.stlouisfed.org/publications/review/76/09/Unemployment_Sep1976.pdf, 29 July 2009. “Thomas Mun.” http://www.maths.tcd.ie/local/JUNK/econrev/ser/html/tommy.html, 14 July 2009. “Trade Balance.” http://www.fxwords.com/t/trade­balance­euro­zone.html, 29 June 2009. “Trade.” http://www.eurunion.org/eu/index.php?option=com_content&task=view&id=52&Itemid=48, 7 July 2009. “Treaty of Maastricht on European Union.” http://europa.eu/scadplus/treaties/maastricht_en.htm, 7 June 2009. “Understanding the WTO.” http://www.wto.org/english/thewto_e/whatis_e/tif_e/utw_chap1_e.pdf, 16 June 2009. “Washington Consensus leads to productivity stagnation in South­America.” http://www.epi.org/economic_snapshots/entry/webfeatures_snapshots_20051102/ 18 July 2009. “What was the cold War.” http://www.historylearningsite.co.uk/what%20was%20the%20cold %20war.htm, 25 June 2009. “World Bank and IMF conditionality: a development injustice.” http://www.eurodad.org/aid/report.aspx? id=130&item=0454, 4 July 2009. “World trade and production accelerated.” http://www.wto.org/english/thewto_e/whatis_e/tif_e/fact3_e.htm, 18 July 2009. “World Trade Developments.“ Núm. 11 (primavera 2010) Nadia Hushke / 238 ENTELEQUIA revista interdisciplinar eumed•net www.eumed.net/entelequia http://www.wto.org/english/res_e/statis_e/its2007_e/its07_world_trade_dev_e.pdf, 24 June 2009. Appleyard , Dennis R.. International Economics. McGraw­Hill Irwin, 2006. Aydinli, Ersel and James N. Rosenau. Globalization, security, and the nation­state. State University of New York Press, 2005. Bade, Klaus J. and Allison Brown. Migration in European History. Blackwell Publisher, 2003. Cameron, Rondo E.. A Concise Economic History of the World. Oxford University Press, 1993. DeMartino, George. Global Economy, Global Justice. Routledge, 2000. Gerhard Linski, Current issues and research in macrosociology, (Brill, 1997) 101. Gross Domestic Product (GDP) Growth.” http://www.euroekonom.com/graphs­data.php?type=gdp­ growth­czech, 27 June 2009. Jackson, Robert and Georg Sorensen. International Relations. Oxford University Press, 1999. James, Harold and Barry Eichengreen. Golden Fetters: The Gold Standard and the Great Depression. Oxford University Press, 1996. Klak, Thomas. Globalization and Neoliberalism. Rowman & Littlefield Publishers, Inc, 1997. Köhler, Gernot and Emilio José Chaves. Globalization. Nova Biomedical, 2003. Kreimeier, Nils. “Großer Sprung nach vorn,” Financial Times Deutschland, 30 April 2009, 13. Laissez­faire: “The freedom of the market from all kinds of political restriction and regulation.”, Robert Jackson & Georg Sorensen, International Relations, (Oxford University Press, 1999) 185. Maddison, Angus. The World Economy. OECD Publishing, 2006. Mc Donald, Frank and Stephen Dearden. European Economic Integration. Prentice Hall, 2005. Nye, Joseph S.. The paradox of American power. Oxford University Press, 2002. O’Rourke, Kevin H. and Jeffrey G. Willliamson. Nineteenth­Century Atlantic Economy. The MIT Press, 2001. Robert Jackson & Georg Sorensen, International Relations, (Oxford University Press, 1999) 184. Squire, Lyn. Globalization and Equity: Perspectives from the Developing World. Edward Elgar Publishing Ltd., 2005. Glossary CAP = Common Agriculture Policy CEECs = Central and Eastern European Countries CEFTA= Central European Free Trade Agreement ECA = Economic Cooperation Administration EMU= Economic and Monetary Union EEA = European Economic Area EC = European Community EEC =European Economic Community ERP = European Recovery Plan (Marshall Plan) EU = European Union FDI= Foreign Direct Investment GATT = General Agreement on Tariffs and Trade GDP = Gross Domestic Product HDI = Human Development Index Núm. 11 (primavera 2010) Nadia Hushke / 239 ENTELEQUIA revista interdisciplinar eumed•net www.eumed.net/entelequia IMF = International Monetary Fund MNC = Multinational Corporations NAFTA = North American Free Trade Agreement OEEC = Organization for European Economic Co­Operation OPEC = Organization of Petroleum Exporting Countries R&D = Research & Development SEM = Single European Market SU= Soviet Union SAFTA = Singapore­Australian Free Trade Agreement TNC = Transnational Corporations UN = United Nations UNDP = United Nations Development Programme WB = World Bank WTO = World Trade Organization Núm. 11 (primavera 2010) Nadia Hushke / 240 Attribution-NonCommercial-NoDerivs 2.5 You are free: • to copy, distribute, display, and perform the work Under the following conditions: • • • Attribution. You must attribute the work in the manner specified by the author or licensor.* Noncommercial. You may not use this work for commercial purposes. No Derivative Works. You may not alter, transform, or build upon this work. For any reuse or distribution, you must make clear to others the license terms of this work. Any of these conditions can be waived if you get permission from the copyright holder. Your fair use and other rights are in no way affected by the above. This is a human-readable summary of the Legal Code, for the full license: http://creativecommons.org/licenses/by-nc-nd/2.5/legalcode * It should include author/s name/s and the text “Article originally published in Entelequia. Revista Interdisciplinar. Available at <http://www.eumed.net/entelequia>”.