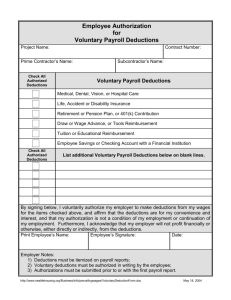

Employers™ Guide Payroll Deductions (Basic

advertisement