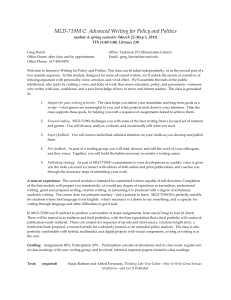

1 NBA 5130, Cases in International Finance Warren Bailey Fall

NBA 5130, Cases in International Finance

Warren Bailey

Fall 2015 (second half of semester)

Tuesdays and Thursdays, 2:55pm to 4:10pm, B10

International finance is different because of two issues, exchange rate volatility and barriers to the flow of capital. Furthermore, political risk is heightened when money crosses borders, and governance, disclosure, law, and regulation are more varied than in a single-country context. The purpose of this course is to practice applying the ideas and methods of finance to cross-border problems. The course is centered on six cases including discussions of related research and other materials.

Course Materials

Other materials to be distributed online or in class

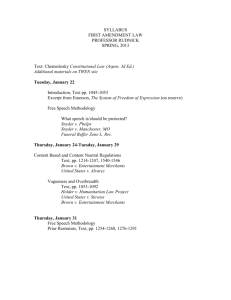

I. Introduction

1.

Thursday 15 October

Formation of student groups

II. Derivatives and Financing

Kim, Yong Cheol, and Rene M. Stulz, 1988, “The Eurobond Market and Corporate Financial Policy: A

Test of the Clientele Hypothesis”, Journal of Financial Economics 22, 189-205.

“Chapter 10: Currency and Interest Rate Swaps” in Eun, Cheol S., and Resnick, Bruce G., 2004,

International Financial Management, 3 rd

Edition, New York: McGraw-Hill/Irwin, 227-246.

“The Walt Disney Company’s Yen Financing” HBS Case #9-287-058

2.

Tuesday 20 October

Formation of student groups and allocation of cases

Lecture and discussion, including articles

Introduce the Disney case

3.

Thursday 22 October

1

Presentation and discussion of the Disney case

III. Law, Politics, and Finance

La Porta, Rafael, et al, 1998, “Law and Finance”, Journal of Political Economy 106, 1113-1155

Johnson, Simon, et al, 2000, “Tunneling”, American Economic Review 90, p. 22-27

Bertrand, Marianne, et al, 2008, “Mixing Family with Business: A Study of Thai Business Groups and the Families behind Them,” Journal of Financial Economics 88, 466-498.

“Czech Mate: CME and Vladimir Zelezny (A)” HBS Case #9-204-118

4.

Tuesday 27 October

Lecture and discussion, including articles

Introduce the Czech Mate case

5.

Thursday 29 October

Presentation and discussion of the Czech Mate case

6.

Tuesday 3 November

Further discussion of the Czech Mate case, including subsequent developments and video

IV. The Cost of Capital and Valuation

Henry, Peter Blair, 2000, “Stock Market Liberalization, Economic Reform, and Emerging Market

Equity Prices”, Journal of Finance 55, 529-564.

Miller, Darius P., 1999, “The Market Reaction to International Cross-Listings: Evidence from

Depositary Receipts”, Journal of Financial Economics 51, 103-123.

Shendevad, C., et al, 2006, “Breaking the Code: The Cost of Capital for Emerging Markets”, Citigroup

Global Banking, September 26 th

.

“Globalizing the Cost of Capital and Capital Budgeting at AES” HBS Case #9-204-109

“Financing the Mozal Project” HBS Case #9-200-005

7.

Thursday 5 November

Lecture and discussion, including articles

2

Introduce the AES case

8.

Tuesday 10 November

Presentation and discussion of the AES case

9.

Thursday 12 November

Further discussion of the AES case, including video

Introduce the Mozal case

10.

Tuesday 17 November

Presentation and discussion of the Mozal case

V. Managing Exchange Rate Risk

Bodnar, Gordon M., and William M. Gentry, 1993, “Exchange Rate Exposure and Industry

Characteristics: Evidence from Canada, Japan, and the USA”, Journal of International Money and

Finance 12, 29-45.

Williamson, Rohan, 2001, “Exchange Rate Exposure and Competition: Evidence from the Automotive

Industry”, Journal of Financial Economics 59, 441-475.

“Foreign Exchange Hedging Strategies at General Motors: Transactional and Translational Exposures”

HBS Case #9-205-095

“Jaguar plc” HBS Case #9-290-005

11.

Thursday 19 November

Lecture and discussion, including articles

Introduce the GM case

12.

Tuesday 24 November

Presentation and discussion of the GM case

13.

Tuesday 1 December

Lecture and discussion, including articles

Introduce the Jaguar case

3

14.

Thursday 3 December

Presentation and discussion of the Jaguar case

Lecture and discussion, including articles (time permitting)

Group Assignments

There will be two types of group assignments, case briefs and full case presentations as detailed below.

Each group will write a detailed analysis of one case and a brief for the other five. These assignments will be due for the sessions devoted to case presentation and discussion. This implies that everyone, not just the groups presenting, is expected to be well-prepared for every case.

Because this is a half-semester course, groups must be formed quickly, particularly given the first case will be presented in the third session, Thursday 22 October . At the end of the first day of class, I will specify group size, which will depend on enrollment, to yield 6 groups, that is, one group per case.

Groups must be formed before the start of the second session, Tuesday 20 October . At the start of that class, I will randomly create new groups, or add to existing groups, from students who have not already been included in a group.

Cases will be assigned on a first-come first-serve basis. If your group wishes to volunteer for a particular case, I must hear from you before the start of the second session, Tuesday 20 October . Else, I will randomly assign cases to groups at the beginning of that session

. At that time or earlier, any group that volunteers for the first case, “Disney”, will receive extra credit (5 additional points out of the total possible 100 points for the class, first come first served).

After cases have been allocated, groups are free to trade cases with one another, but I will not broker any such transactions.

Case Briefs

For each case, each group will write a case brief and submit it electronically on the course website at http://www.blackboard.cornell.edu

. The briefs should summarize the issues at stake and propose methods for tackling them (but no solutions). The length of these briefs will be two pages maximum.

1.

Case brief files time-stamped by Blackboard at or after the start of the class when due receive no credit.

2.

Each case brief file must be named with course number, assignment identifier, and group identifier. For example, “NBA5130_Disney_GROUP_A.doc” is the filename for the brief on the

Disney case submitted by Group A. The subject line (which appears in the uploading dialog box) must also contain this filename.

3.

The upload consists of the complete WORD or PDF file only. No zipped files or other formats will be accepted.

4

4.

I will not accept or acknowledge any case brief file by email or hard copy form.

5.

Each group should designate only one student to upload briefs. He or she is responsible for being properly enrolled in the blackboard system and for understanding how to upload files.

6.

Full credit will be earned for a complete, careful brief, even if the details are not perfect.

7.

No credit will be earned for any assignment that does not meet the above requirements.

8.

The group that is presenting a particular case should upload its full presentation, rather than creating a case brief as the other groups will do.

Case Analysis

The detailed analysis of the case should start with a one-half page executive summary with the issue and the major recommendations. It will then include an introduction, where the students illustrate the problem faced by the firm and its background, a main section that will provide the details and evaluate the alternatives, and a conclusion with the specific recommendations. For each case, I will provide a few questions to help with analysis. However the write up should not be limited to answering such questions.

I expect the reports to be 10 pages (double-spaced, 12 point font) maximum, excluding the summary, tables and graphs. Supporting tables, spreadsheets and graphs ( the exhibits ) are limited to 10 pages. The exhibits should be referred to in the text of the paper as they are needed to support the argument being made. Exhibits that are not needed should not be included and all exhibits should be referenced in the paper. A hard copy must be handed to me before the start of the class when it will be presented.

The presentation of the case occurs in class on the day assigned and is based on the previously-described case analysis document. The group that is presenting should plan for a presentation of 30 minutes, with questions and discussion afterwards.

Board of Directors

For each case presentation by a particular group, another group will be assigned to serve as the “Board of Directors”, offering questions and comments to touch off broader discussion of the issues.

Individual Take-Home Case

At the end of the last day of class, I will distribute individual copies of a case that will form the basis of the take-home exam. Each student will complete an individual detailed case analysis (not a brief) individually (not as a group). The case shall be prepared in the manner specified for group “Case

Analysis” above. Each student must deliver (to my office or to support staff in Room 304, to be specified later) a hard copy of his or her solution by noon on Thursday 10 December . Early submissions are welcome. Late submissions will receive no credit. Uploads to the course website or emails to me will not be accepted.

Professional Behavior

5

Disruptions to the learning environment in class will be judged by the instructor, and final grades will be adjusted accordingly. Disruptive activities include but are not limited to: the use of laptop computers, tablet computers, smart phones, and cell phones; ringing phones; private conversations that do not cease when class begins; private conversations initiated once class is underway. Cheating and other violations of academic integrity will be addressed in the final letter grade and with formal administrative proceedings as mandated by Johnson School and other Cornell regulations. Name cards should be brought to every class and displayed.

Because this is a case course and some lectures are oriented towards presentation and discussion of cases, the use of laptop and tablet computers for viewing case materials and solutions is permitted in those class sessions when a case is being discussed.

Final Letter Grades

A rough guide to how final grades will be determined is case analysis 1/3, case briefs and “board of directors” 1/3, and take-home case 1/3. Implicit in the grade for case briefs is each individual’s contribution to discussions of the case after presentations. Therefore, group work comprises 2/3 of the possible total of 100 points for the class. Irresponsible behavior as an individual member of a group may also affect your grade: a “peer evaluation” system (to be detailed later) allows group members to vote on the behavior of other group members if they choose. If a majority of group members give a particular individual a poor grade, this can lead to the loss of a maximum of 1/3 of 100 points for that individual.

The instructor reserves the right to determine the final letter grade assigned to each student.

GPA in Electives

Grades in Johnson School elective courses are expected to average around 3.5. There will be some variation, of course, and some small courses may be significantly different.

Warnings

If you register for this class, you agree to accept all course requirements, dates, deadlines, and other procedures outlined in this syllabus and in class discussions. There will be no discussions, pleas, or arguments about the administration of the course under any circumstances. There will be no changes to the course requirements or due dates under any circumstances except when mandated by Johnson School or University rules.

All students must adhere strictly to the Johnson School Honor Code and other university rules and regulations regarding academic integrity.

In particular, I reserve the right to check the case briefs and case analyses uploaded to the course website to ensure that there is no plagiarism from the internet or other sources.

6

Note that course materials (those posted on Blackboard, those contained in the course packet, and those distributed in class including exams, exam solutions, and spreadsheet solutions) are intellectual property.

Students are not permitted to buy or sell any course materials. Any such behavior is unauthorized and constitutes academic misconduct.

All information and decisions regarding enrollment are handled by the Johnson School’s registrar. I do not monitor or participate in this activity. I do not sign add or drop forms.

Acknowledgement

Preparation of this course has benefited tremendously from advice, suggestions, and teaching materials generously offered by my colleagues Francesca Carrieri (McGill University), Mihir Desai (Harvard

Business School), Craig Doidge (University of Toronto), Jerry Hass (Cornell University), Andrew

Karolyi (Ohio State University, now Cornell University), and Darius Miller (Southern Methodist

University).

7