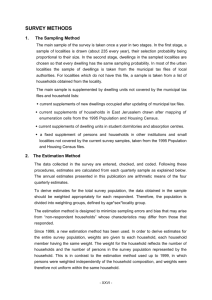

Inter-household Allocations within Extended Family

advertisement