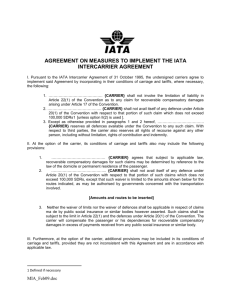

To: All Travel Agents (BSP Countries) Date: 04 March 2015 Subject

advertisement