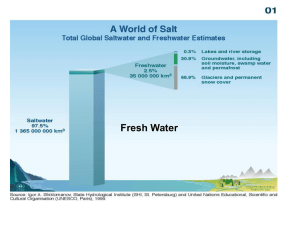

Profile of the Macedonian Fresh Vegetables Value Chain

advertisement