2016 tax planning - Mackenzie Investments

advertisement

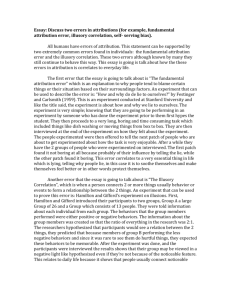

2016 TAX PLANNING Quick Reference Guide Provincial/Territorial Income Tax Rates* 2016 Top Marginal Tax Rates (Federal and Provincial Rates Combined)* (current to Jan. 2016) British Columbia First $38,210 $38,210 – $76,421 $76,421 – $87,741 $87,741 – $106,543 106,543 and over Alberta First $125,000 $125,000 – $150,000 $150,000 – $200,000 $200,000 – $300,000 $300,000 and over Saskatchewan First $44,601 $44,601 – $127,430 $127,430 and over Manitoba First $31,000 $31,000 – $67,000 $67,000 and over Ontario First $41,536 $41,536 – $83,075 $83,075 – $150,000 $150,000 – 220,000 $220,000 and over Quebec First $42,390 $42,390 – $84,780 $84,780 – $103,150 $103,150 and over New Brunswick First $40,492 $40,492 – $80,985 $80,985 – $131,664 $131,664 – $150,000 $150,000 and over Nova Scotia First $29,590 $29,590 – $59,180 $59,180 – $93,000 $93,000 – $150,000 $150,000 and over Prince Edward Island First $31,984 $31,984 – $63,969 $63,969 and over Newfoundland First $35,148 & Labrador $35,148 – $70,295 $70,295 – $125,500 $125,500 – $175,700 $175,700 and over Yukon First $45,282 $45,282 – $90,563 $90,563 – $140,388 $140,388 – $500,000 $500,000 and over Northwest Territories First $41,011 $41,011 – $82,024 $82,024 – $133,353 $133,353 and over Nunavut First $43,176 $43,176 – $86,351 $86,351 – $140,388 $140,388 and over 5.06% 7.70% 10.50% 12.29% 14.70% 10.00% 12.00% 13.00% 14.00% 15.00% 11.00% 13.00% 15.00% 10.80% 12.75% 17.40% 5.05% 9.15% 11.16% 12.16% 13.16% 16.00% 20.00% 24.00% 25.75% 9.68% 14.82% 16.52% 17.84% 20.30% 8.79% 14.95% 16.67% 17.50% 21.00% 9.80% 13.80% 16.70% 7.70% 12.50% 13.30% 14.30% 15.30% 6.40% 9.00% 10.90% 12.80% 15.00% 5.90% 8.60% 12.20% 14.05% 4.00% 7.00% 9.00% 11.50% *The table includes and assumes all proposed rates from 2016 provincial budgets, where applicable, have been passed. Interest/Foreign Dividends 47.70% 48.00% 48.00% 50.40% 53.53% 53.31% 53.30% 51.37% 54.00% 48.30% 48.00% 47.05% 44.50% British Columbia Alberta Saskatchewan Manitoba Ontario Quebec New Brunswick PEI Nova Scotia Newfoundland/Labrador Yukon NWT Nunavut Capital Gains** Eligible Dividends 23.85% 24.00% 24.00% 25.20% 26.77% 26.66% 26.65% 25.69% 27.00% 24.15% 24.00% 23.53% 22.25% 31.30% 31.71% 30.33% 37.78% 39.34% 39.83% 36.27% 34.22% 41.58% 38.47% 24.81% 28.33% 33.08% Non-Eligible Dividends 40.61% 40.24% 40.06% 45.69% 45.30% 43.84% 45.37% 43.87% 46.77% 39.40% 40.18% 35.72% 36.36% *Rates include federal and provincial combined marginal tax rates, including provincial surtaxes. **The capital gains rate for qualifying securities donated to registered charities in-kind is 0%. RRSP/TFSA Contribution Limits 18% of previous year’s earned income to a maximum of: 2016 – $25,370 2017 – $26,010 TFSA Contribution Limit 2016 – $5,500 Withholding Tax Rates for RRSP/RRIF Withdrawals Up to $5,000 $5,001 – $15,000 Over $15,000 Quebec 21% 26% 31% All Other Provinces 10% 20% 30% 2016 Federal Income Tax Rates First $45,282 $45,282 – $90,563 $90,563 – $140,388 $140,388 – $200,000 $200,000 and over Basic personal exemption 15.0% 20.5% 26.0% 29.0% 33.0% $11,474 Attribution Rules Recipient Gift No or low interest loan Loan at prescribed or commercial rate Attributed to “giftor” Attributed to “giftor” No attribution Attributed to lender Attributed to lender No attribution No attribution No attribution No attribution Attributed to “giftor” No attribution No attribution Attributed to lender No attribution No attribution No attribution No attribution No attribution No attribution No attribution No attribution* No attribution No attribution No attribution Spouse or Partner Income Capital Gains 2nd Generation Income Child under 18 Income Capital Gains 2nd Generation Income Child over 18 Income Capital Gains Corporation (excluding small business corporation) Attribution may result if reason for transfer is to confer a benefit on a family member and reduce family tax payable Attribution may result if No attribution reason for transfer is to confer a benefit on a family member and reduce family tax payable *Normally, loan must be for education, investment in a house, or to earn business income to avoid attribution. Note: Attribution generally ceases on death or in cases of non-residency. 2016 TAX PLANNING 2016 Employment Insurance (EI) Premiums All provinces/territories except Quebec $50,800 1.88% 2.63% $955.04 $1,337.06 Quebec $50,800 1.52% 2.13% $772.16 $1,081.02 All provinces/territories except Quebec $54,900 $3,500 $51,400 4.95% $2,544.30 $5,088.60 Quebec* $54,900 $3,500 $51,400 5.325% $2,737.05 $5,474.10 2016 Canada Pension Plan Premiums Maximum Pensionable Earnings Basic Exemption Maximum Contributory Earnings Employee and Employer Rate Maximum Employee/Employer contribution Maximum Self-employed contribution *In Quebec contributions are made to the Quebec Pension Plan. 2016 CPP and QPP Retirement Benefit Age 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 Withdrawal 3.33% 3.45% 3.57% 3.70% 3.85% 4.00% 4.17% 4.35% 4.55% 4.76% 5.00% 5.28% 5.40% 5.53% 5.67% 5.82% 5.98% 6.17% 6.36% Age Withdrawal 79 6.58% 80 6.82% 81 7.08% 82 7.38% 83 7.71% 84 8.08% 85 8.51% 86 8.99% 87 9.55% 88 10.21% 89 10.99% 90 11.92% 91 13.06% 92 14.49% 93 16.34% 94 18.79% 95+ 20.00% Maximum monthly benefit (assuming payments begin at age 65): $1,092.50 Marginal versus Effective Tax Rates – What’s the Difference? 2016 Old Age Security (OAS) Payment Rates (current to Jan. 2016) Marginal Tax Rate: Tax rate applicable to last dollar of income earned. Does not consider deductions and credits available to taxpayer. Maximum Monthly Benefit $570.52 Maximum Annual Income Pensioners with a net income of $73,637 or more are subject to OAS clawback. Clawback rate is 15% for each dollar beyond $73,637. OAS is fully eliminated once net income reaches $119,398. Mackenzie Tax Brochures Commonly Used CRA Guides P105 Students and Income Tax P113 Gifts and Income Tax RC4092Registered Education Savings Plans (RESPs) RC4110 Employee or Self-employed? RC4112 Lifelong Learning Plan (LLP) RC4169Tax Treatment of Mutual Funds for Individuals RC4466 Tax Free Savings Account Guide for Individuals RC4177 Death of an RRSP Annuitant RC4178 Death of a RRIF Annuitant T4002 Business and Professional Income T4011 Preparing Returns for Deceased Persons T4036 Rental Income T4037 Capital Gains T4040RRSPs and Other Registered Plans for Retirement T4055 Newcomers to Canada T4058 Non-Residents and Income Tax For more information, please visit mackenzieinvestments.com/taxandestate Telephone: 1-888-653-7070 Fax: 1-866-766-6623 180 Queen Street West, Toronto, ON M5V 3K1 02323 Effective Tax Rate: Actual rate of tax paid by taxpayer. Considers deductions, credits and graduated tax brackets. mackenzieinvestments.com/taxandestate •Education Planning •Income Splitting •Guide to Tax-Efficient Investing: Corporate Class Funds – Series T •Mackenzie Charitable Giving Fund Program Guide •Strategies for Trusts in Tax and Estate Planning Advisor Guide •TFSA Investor Guide •Registered Disability Savings Plan Guide •Tax & Estate Planning for Business Owners kit •Canadians & US Estate Tax TE1005 1/16 Maximum Yearly Insurable Earnings Employee’s Premium Rate Employer’s Premium Rate Maximum Yearly Employee Premium Maximum Yearly Employer Premium RRIF Minimum Withdrawals