Cost & Production: Microeconomics Presentation

advertisement

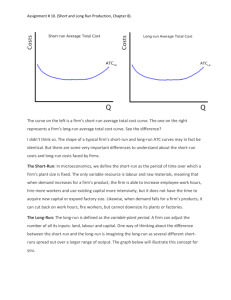

Cost and Production MPL and APL Short-Run Production/Short-Run Cost Costs in the Long Run Chapter 11. Technology, Production, and Costs Instructor: JINKOOK LEE Department of Economics / Texas A&M University ECON 202 504 Principles of Microeconomics Cost and Production MPL and APL Short-Run Production/Short-Run Cost Costs in the Long Run Short Run and Long Run in Economics Short run: The period of time during which at least one of a firms inputs is fixed. fixed input: firm’s technology and the size of physical plant. variable input: the number of workers. Long run: The period of time in which a firm can vary all its inputs (adopt new technology and increase or decrease the size of its physical plant). all inputs are variable. Cost and Production MPL and APL Short-Run Production/Short-Run Cost Costs in the Long Run Fixed Costs and Variable Costs Variable costs (VC): Costs that change as output changes. labor costs, raw material costs. Fixed costs (FC): Costs that remain constant as output changes. lease payments, payments for fire insurance. Total cost (TC): The cost of all the inputs a firm uses in production. in the short run: TC = FC + VC in the long run: TC = VC Cost and Production MPL and APL Short-Run Production/Short-Run Cost Costs in the Long Run Implicit Costs and Explicit Costs Economists always measure costs as opportunity costs. Opportunity cost: The highest-valued alternative that must be given up to engage in an activity. Explicit cost: A cost that involves spending money (accounting costs). Implicit cost: A non-monetary opportunity cost. Sunk cost: A cost that has already been paid and cannot be recovered. Cost and Production MPL and APL Short-Run Production/Short-Run Cost Costs in the Long Run Implicit Costs and Explicit Costs Calculate Noel’s opportunity cost. Noel has just graduated from medical college. He has been offered a job at one of the most prestigious hospitals in town. The job would pay him $45,000 a year. However, his uncle, who runs a health care and fitness center, has also offered him a position for $35,000 a year. However, Noel wishes to enroll for a medical research program at a foreign university, which would cost him $38,000, and eventually does so. Cost and Production MPL and APL Short-Run Production/Short-Run Cost Costs in the Long Run Implicit Costs and Explicit Costs Calculate Sally’s opportunity cost. Sally quit her job as an auto mechanic earning $50,000 per year to start her own business. To save money she operates her business out of a small building she owns. Until she started her own business, she had rented out for $10,000 per year. She also invested her $20,000 savings (which earned a market interest rate of 5% per year) in her business. Cost of labor: $40,000 Cost of materials: $15,000 Equipment rental: $5,000 Cost and Production MPL and APL Short-Run Production/Short-Run Cost Implicit Costs and Explicit Costs How do we calculate the opportunity cost? Opportunity cost = Explicit cost + Implicit cost Be careful!! Explicit cost should not include Sunk cost. Jill owns a pizza restaurant. What is Jill’s explicit, implicit, and opportunity cost? Costs in the Long Run Cost and Production MPL and APL Short-Run Production/Short-Run Cost Costs in the Long Run Production Function Production function: The relationship between the inputs employed by a firm and the maximum output it can produce with those inputs. Assume that in the short run, Jill uses one variable input (labor) and one fixed input (pizza oven) to produce a single good (pizza). Cost and Production MPL and APL Short-Run Production/Short-Run Cost Costs in the Long Run Total Cost and Average Total Cost Function Cost and Production MPL and APL Short-Run Production/Short-Run Cost Costs in the Long Run The Law of Diminishing Returns Marginal product of labor (MPL): The additional output a firm produces as a result of hiring one more worker. MPL at Jill Johnsons Restaurant workers (1→ 2): MPL increases (division of labor and specialization). workers (3→ 6): MPL declines (workers get in each other’s way). Cost and Production MPL and APL Short-Run Production/Short-Run Cost Costs in the Long Run The Law of Diminishing Returns Law of diminishing returns: at some point, adding more of a variable input will cause the marginal product of the variable input to decline. Output increases as more workers are hired Second worker causes production to increase by a greater amount than did the hiring of the previous worker After the third worker, hiring more workers results in diminishing returns. When the point of diminishing returns is reached, production increases at a decreasing rate. The marginal product of labor rises initially because of the effects of specialization and division of labor, and then it falls due to the effects of diminishing returns. Cost and Production MPL and APL Short-Run Production/Short-Run Cost Costs in the Long Run Marginal Cost Now, we partly understand why average total cost (ATC) curves are U-shaped from the relationship between ATC and MPL. To completely understand, however, we should know the relationship between marginal cost (MC) curve and MPL. Marginal cost (MC): The change in a firms total cost from producing one more unit of a good or service (MC = ∆TC ∆Q ). Cost and Production MPL and APL Short-Run Production/Short-Run Cost Costs in the Long Run MPL and MC Relationship between MPL and MC When MPL is rising, MC is falling. When MPL is falling, MC is rising. Since MPL rises and then falls, MC falls and then rises (U shape) Jill pays each new worker the same $650 per week, thus MC (= depends on that worker’s additional output. ∆TC ∆Q ) Cost and Production MPL and APL Short-Run Production/Short-Run Cost Costs in the Long Run MC and ATC Relationship between MC and ATC As long as MC is below ATC, ATC will be falling. When MC is above ATC, ATC will be rising. The relationship between MC and ATC explains why ATC curve also has a U shape. Cost and Production MPL and APL Short-Run Production/Short-Run Cost Costs in the Long Run Summary on Cost Curves Recall that average total cost is the sum of average fixed cost plus average variable cost (ATC = AFC + AVC ). Average total cost: ATC = Average fixed cost: AFC = TC Q FC Q Average variable cost: AVC = VC Q Cost and Production MPL and APL Short-Run Production/Short-Run Cost Costs in the Long Run Summary on Cost Curves Key facts about cost curves The marginal cost (MC), average total cost (ATC), and average variable cost (AVC) curves are all U shaped. MC curve intersects both AVC curve and ATC curve at their minimum points. As output increases, average fixed cost (AFC) gets smaller and smaller. As output increases, the difference between ATC and AVC decreases. Cost and Production MPL and APL Short-Run Production/Short-Run Cost Costs in the Long Run The Long Run Costs In the long run, the cost of purchasing more pizza ovens becomes variable Jill can choose whether to expand her business by buying more ovens. In the long run, all costs are variable. There are no fixed costs in the long run. Total cost = variable cost Average total cost (ATC) = Average variable cost (AVC) Cost and Production MPL and APL Short-Run Production/Short-Run Cost Costs in the Long Run Long-Run Average Cost Curve Long-run average cost curve: A curve that shows the lowest cost at which a firm is able to produce a given quantity of output in the long run, when no inputs are fixed. Economies of scale: when a firm’s long-run average costs fall as it increases the quantity of output it produces. Constant returns to scale: a firm’s long-run average costs remain unchanged as it increases output. Minimum efficient scale: the level of output at which all economies of scale are exhausted. Diseconomies of scale: a firm’s long-run average costs rise as the firm increases output. Cost and Production MPL and APL Short-Run Production/Short-Run Cost Costs in the Long Run Long-Run Average Cost Curve for Bookstores If a small bookstore expects to sell only 1,000 books, it will be able to sell that quantity at the lowest average cost of $22 per book. A larger bookstore will be able to sell 20,000 books at a lower cost of $18 per book (economies of scale). A bookstore selling 20,000 books and a bookstore selling 40,000 books per month will have the same average cost (constant returns to scale). The bookstore selling 20,000 books will have reached minimum efficient scale. For very large bookstores, their average costs will rise as sales increase beyond 40,000 books (diseconomies of scale).