Financial Statements

advertisement

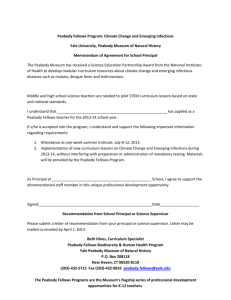

Financial Statements 31 March 2014 Contents 2 3 4 5 6 7 Independent auditor’s report to the board of Peabody Income and Expenditure Accounts Statement of Total Recognised Surpluses and Deficits Balance Sheets Cash Flow Statements Notes to the Accounts 2 Peabody Report and financial statements for the year ended 31 March 2014 Independent auditor’s report to the board of Peabody We have audited the financial statements of Peabody for the year ended 31 March 2014 which comprise the Peabody and Group Income and Expenditure accounts, the Statements of Total Recognised Surpluses and Deficits, the Reconciliations of Movement in Peabody and Group Funds, the Peabody and Group Balance Sheets, the Peabody and Group Cash Flow Statements and the related notes. The financial reporting framework that has been applied in their preparation is applicable law and United Kingdom Accounting Standards (United Kingdom Generally Accepted Accounting Practice) This report is made solely to the Board of Governors, as a body, in accordance with section 144 of the Charities Act 2011 and section 137 of the Housing and Regeneration Act 2008. Our audit work has been undertaken so that we might state to the board those matters we are required to state to them in an auditor’s report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the board as a body, for our audit work, for this report, or for the opinions we have formed. Respective responsibilities of the board and auditor As explained more fully in the Statement of Board Responsibilities (set out on page 45), the board is responsible for the preparation of the financial statements and for being satisfied that they give a true and fair view. Our responsibility is to audit and express an opinion on the financial statements in accordance with applicable law and International Standards on Auditing (UK and Ireland). Those standards require us to comply with the Auditing Practices Board's (APB's) Ethical Standards for Auditors. Opinion on financial statements In our opinion the financial statements: – give a true and fair view of the state of Peabody's and the Group's affairs as at 31 March 2014 and of Peabody's and the Group's income and expenditure for the year then ended; – have been properly prepared in accordance with United Kingdom Generally Accepted Accounting Practice; and – have been prepared in accordance with the requirements of the Peabody Donation Fund Act 1948 as amended by the Charities (The Peabody Donation Fund Act) Order 1997, the Charities Act 2011, the Housing and Regeneration Act 2008 and the Accounting Direction for Private Registered Provider of Social Housing 2012. Opinion on other matter prescribed by the Companies Act 2006 In our opinion the information given in the Operating and Financial Review for the financial year for which the financial statements are prepared is consistent with the financial statements. Matters on which we are required to report by exception We have nothing to report in respect of the following matters where the Charities Act 2011 and the Housing Association and Regeneration Act 2008 require us to report to you if, in our opinion: – adequate accounting records have not been kept by the parent company; or returns adequate for our audit have not been received from branches not visited by us; or Scope of the audit of the financial statements – Peabody’s financial statements are not in agreement with the accounting records and returns; or A description of the scope of an audit of financial statements is provided on the Financial Reporting Council’s website at www.frc.org.uk/apb/scope/private.cfm. – Certain disclosures of director’s remuneration specified by law are not made; or – we have not received all the information and explanations we require for our audit. Grant Thornton UK LLP Registered Auditor, Chartered Accountants Milton Keynes, England 9 July 2014 The financial position and results for the year are set out in the Financial Statements section of these statements. 3 Income and Expenditure Accounts Income and Expenditure Accounts Peabody Group 2014 £'000 2013 £'000 2014 £'000 2014 £'000 2013 £'000 138,201 118,275 151,825 – 128,503 – – 14,358 – – 34 – – – – 2 138,201 118,275 – 165,113 128,503 Cost of sales 2 (3,882) – – (11,215) – Operating costs 2 (86,630) – (104,741) (85,100) Note Turnover Continuing activities Acquisitions Less share of joint venture (1,070) (79,540) Operating Surplus/ (Deficit) 47,689 Continuing activities Acquisitions Share of joint venture profit/(loss) 34 38,735 50,693 (1,536) – 43,403 – – – – – – 196 – – 47,689 38,735 – 49, 353 43,403 Surplus on sale of fixed assets 26 5,349 1,361 – 7,584 1,497 Gift on acquisition 31 – – – 256,447 – Interest receivable and other income 7 5,654 3,510 – 364 2,814 Interest payable and similar charges 8 (24,881) (20,864) – (22,679) (21,781) 21 33,811 22,742 – 291,069 25,933 Surplus on ordinary activities before and after taxation for the financial year The accompanying notes form part of these financial statements. These financial statements were approved by the board on 9 July 2014 and signed on their behalf by: Christopher Strickland Chair The Group’s principal accounting policies are set out in the Financial Statements section of these statements. 4 Peabody Report and financial statements for the year ended 31 March 2014 Statement of total recognised surpluses and deficits Statement of total recognised surpluses and deficits Peabody Group 2014 £'000 2013 £'000 2014 £'000 2013 £'000 33,811 22,742 291,069 25,933 (1,719) 328 (2,713) 669 Group share of actuarial loss in joint venture pension scheme – – (306) – Unrealised surplus on revaluation – – 4,887 – 32,092 23,070 292,937 26,602 Note Surplus for the financial year Pension scheme actuarial (loss)/ gain 6 Total recognised surpluses relating to the year Reconciliation of movement in Peabody and group funds Reconciliation of movement in Peabody and group funds Peabody Note Opening funds Total recognised surpluses and deficits relating to the year Closing total funds 21 Group 2014 £'000 2013 £'000 2014 £'000 2013 £'000 263,738 240,668 290,042 263,440 32,092 23,070 292,937 26,602 295,830 263,738 582,979 290,042 The financial position and results for the year are set out in the Financial Statements section of these statements. 5 Balance Sheets Balance Sheets Peabody Group Note 2014 £'000 2013 £'000 2014 £'000 2013 £'000 Housing properties 11 1,218,925 1,178,488 1,913,905 1,299,107 Social Housing Grant 11 (374,225) (363,368) (486,987) (366,837) Other Public Grants 11 (53,900) (60,846) (88,381) (85,310) 790,800 754,274 1,338,537 846,960 Fixed Assets Other tangible fixed assets 12 14,521 10,069 28,546 16,604 Fixed asset investments 13 7,724 5,050 458 – Starter homes initiative investment 32 1,056 – 1,300 – 814,101 769,393 1,368,841 863,564 Share of joint venture – gross assets 34 – – 67,317 – – gross liabilities 34 – – (19,550) – 814,101 769,393 1,416,608 863,564 Current Assets Properties for sale 14 7,836 5,994 80,760 22,499 Debtor due in more than one year 15 180,042 87,684 – – Debtors due in less than one year 15 26,000 20,404 23,286 16,255 16,613 5,261 148,004 11,224 230,491 119,343 252,050 49,978 (41,413) (34,327) (72,820) (34,962) 189,078 85,016 179,230 15,016 1,003,179 854,409 1,595,838 878,580 17 677,056 562,451 967,121 557,563 6 30,293 28,220 44,050 30,975 33 – – 1,688 – 21 295,830 263,738 578,092 290,042 – – 4,887 – 1,003,179 854,409 1,595,838 878,580 Cash at bank and in hand Creditors: Amounts Falling Due Within One Year 16 Net Current Assets Total Assets Less Current Liabilities Creditors: Amounts Falling Due After More Than One Year Pension Deficit Provisions For Liabilities And Charges Reserves Revenue reserve Revaluation reserve The accompanying notes form part of these financial statements. These financial statements were approved by the board on 9 July 2014 and signed on their behalf by: Christopher Strickland Chair The Group’s principal accounting policies are set out in the Financial Statements section of these statements. 6 Peabody Report and financial statements for the year ended 31 March 2014 Cash Flow Statements Cash Flow Statements Peabody Group Note 2014 £'000 2013 £'000 2014 £'000 2013 £'000 22 43,696 35,266 21,017 27,334 5,654 3,510 364 2,814 (25,914) (20,786) (25,913) (23,497) (20,260) (17,276) (25,549) (20,683) Construction of, investment in, and purchase of housing properties (66,333) (38,090) (134,125) (81,306) Capital grant received 13,687 6,290 13,687 9,757 Other grants received 282 27 282 27 22,694 6,404 31,169 3,164 – – 5,623 – Net cash inflow from operating activities Returns on investments and servicing of finance Interest received Interest paid Capital expenditure and financial investment Sale of properties Net cash received on acquisition Purchase of other tangible fixed assets (6,040) (4,380) (11,037) (4,857) (35,710) (29,749) (94,401) (73,215) Acquisitions and disposals (3,730) Net cash outflow on acquisition Net cash outflow before financing – – – (16,004) (11,759) (98,933) (66,564) 24,250 15,750 337,713 14,096 201,816 2,992 – – Loan to subsidiary (100,296) (55,348) – – Repayment of loans – external lenders (106,661) (2,000) Financing New loans – external lenders New loans – received from subsidiary 7,938 Repayment of loans – received from subsidiary – (102,000) (2,000) – – 27,047 (38,606) 235,713 12,096 11,352 (50,365) 136,780 (54,468) (Decrease)/Increase in cash 11,352 (50,365) 136,780 (54,468) Cash inflow/(outflow) from financing (27,047) 38,606 (235,713) (12,096) Increase/(Decrease) in cash Reconciliation of net cash outflow to movement in net debt Change in net debt resulting from cash flows 23 (15,695) (11,759) (98,933) (66,564) Non cash transactions 23 (310) (47) (179,716) (43) (16,005) (11,806) (278,649) (66,607) (465,219) (453,413) (541,971) (475,364) (481,224) (465,219) (820,620) (541,971) Movement in net debt in the year Net debt at the beginning of the year Net debt at the end of the year 23 The financial position and results for the year are set out in the Financial Statements section of these statements. 7 Notes to the Accounts 8 Peabody Report and financial statements for the year ended 31 March 2014 1. Accounting Policies Basis of Preparation Turnover The financial statements have been prepared in accordance with UK Generally Accepted Accounting Principles (UK GAAP), the Statement of Recommended Practice ‘Accounting by Registered Social Landlords’ issued in October 2010 (SORP 2010) and comply with the Accounting Direction for Private Registered Providers of Social Housing 2012, the Charities Act 2011. The financial statements have been prepared under the historical cost convention, as modified by the revaluation of investment properties held by the joint venture entity. A summary of the more important accounting policies is set out below. Turnover represents rental and service charge income receivable, income from shared ownership first tranche sales, fees and revenue grants from local authorities, the Homes and Communities Agency and other funding bodies, and income from the sale of housing properties built for sale. Going concern The Group’s business activities, its current financial position and factors likely to affect its future development are set out within the Operating and Financial Review. The Group has in place long-term debt facilities which provide adequate resources to finance committed reinvestment and development programmes, along with the Group’s day to day operations. The Group also has a long-term business plan which shows that it is able to service these debt facilities whilst continuing to comply with lenders’ covenants. On this basis, the Board has a reasonable expectation that the Group has adequate resources to continue in operational existence for the foreseeable future, being a period of at least twelve months after the date on which the report and financial statements are signed. For this reason, it continues to adopt the going concern basis in the financial statements. Basis of Consolidation The Group accounts consolidate the accounts of Peabody and all its subsidiaries (excluding Peabody Pension Trust on the basis of materiality) at 31 March using acquisition accounting. Joint venture The Group profit includes the Group’s share of results in its joint venture based on their latest available audited accounts. The consolidated balance sheet shows the investment in the joint venture at cost plus the share of post-acquisition retained profits and reserves attributable to the Group’s interest therein. Income from first tranche sales and sales of properties built for sale is recognised at the point of legal completion of the sale. Rental income is recognised from the point when properties under development reach practical completion or otherwise become available for letting. Revenue grants are receivable when the conditions for receipt of agreed grant funding have been met. Housing Properties for Sale Shared ownership first tranche sales, completed properties for outright sale and property under construction are valued at the lower of cost and net realisable value. Cost comprises materials, direct labour and direct development overheads. Net realisable value is based on estimated sales price after allowing for all further costs of completion and disposal. Housing Properties and Depreciation Housing properties under construction are stated at cost and are not depreciated. These are reclassified as Housing Properties on practical completion of construction. Freehold land is not depreciated. The Group depreciates freehold housing properties by component on a straight line basis over the estimated useful economic lives of component categories. The lives of these key components are outlined below: Key components Useful life General structure 100 years Roofs 50 – 70 years Windows and doors 30-35 years Bathroom 30 years Lifts 20 – 30 years Water / Mechanical installations 15 – 30 years Electrical installations 25 – 40 years Kitchens 25 years Heating 15 years Transferred stock structure, transferred stock grant* 60 years * Transferred stock relates to properties transferred to Gallions Housing Association during the year 2000 from Thamesmead Town Limited Notes to the Accounts 1. Accounting Policies (continued) Internal works to properties for market rent are capitalised where applicable and depreciated over the average market rent tenancy. The Group depreciates housing properties held on long leases in the same manner as freehold properties, except where the unexpired lease term is shorter than the longest component life envisaged, in which case the unexpired term of the lease is adopted as the useful economic life of the relevant component category. Impairment reviews are carried out on an annual basis on assets whose useful economic lives are expected to exceed 50 years, in accordance with Financial Reporting Standard 11. Assessing impairment requires use of estimation techniques. In making this assessment, management considers publicly available information, external valuations and internal forecasts of future activity. Where there is evidence of impairment, assets are written down to their recoverable amount, being the higher of the net realisable value or the value in use in the Group. Works to existing properties which replace a component or result in an increase in net rental income over the lives of the properties, thereby enhancing the economic benefits of the assets, are capitalised as improvements. Capitalisation of Interest Interest on borrowings is charged to housing properties under construction up to the date of completion of each scheme. The interest charged is on net borrowings to the extent that they are deemed to be financing a scheme and is charged at the average interest rate in the period. This treatment applies irrespective of the original purpose for which the loan was raised. Sale of Housing Properties Where properties built for sale are disposed of during the year, the disposal proceeds are included in turnover, and the attributable costs are included as cost of sales within operating costs. The surplus or deficit on the disposal of housing properties held previously as fixed assets is shown on the face of the income and expenditure account. Shared Ownership Housing Properties and Staircasing Shared ownership properties are split proportionally between current and fixed assets based on the element relating to expected first tranche sales. The first tranche proportion is classed as a current asset and related sales proceeds included in turnover and the remaining element is classed as a fixed asset and included in housing properties at cost, less any provisions needed for depreciation or impairment. Capital Grant Where developments have been financed wholly or partly by Social Housing Grant (SHG) or other capital grants the amount of grant received and receivable in respect of housing properties is deducted from the cost of housing properties. SHG is subordinated to the repayment of loans by agreement with the Homes and Communities Agency. SHG released on sale of a property may be repayable but is normally available to be recycled and is credited to a Recycled Capital Grant Fund and included in the balance sheet in creditors. Capitalisation of Development Administration Costs Revenue Grant The cost of housing properties comprises their purchase price, together with directly attributable costs in bringing them into working condition for their intended use. Directly attributable costs, in accordance with FRS 15, include salary costs of own employees incurred directly in respect of the construction or acquisition of the property, and incremental costs that would have been avoided only if individual properties had not been constructed or acquired. Grants in respect of revenue expenditure are credited to the income and expenditure account in the same period as the expenditure to which they relate. Overheads and other indirect costs are written off as incurred. Recycled Capital Grant Fund / Disposal Proceeds Fund On disposal of relevant housing properties Peabody is allowed to retain any social housing grant applied to that property for eligible re-investment. This amount is disclosed separately within creditors. If unused within a three year period, it will be repayable to the Homes and Communities Agency with interest. 9 10 Peabody Report and financial statements for the year ended 31 March 2014 1. Accounting Policies (continued) Other Fixed Assets and Depreciation Pension Costs Other fixed assets are stated at cost less accumulated depreciation. i. Local Government Defined Benefit Pension Scheme Depreciation is charged on a straight line basis over the estimated useful economic lives of assets at the following annual rates: Freehold offices 2 years Office 5 –10 years IT equipment 3 years Plant and machinery 4 – 5 years Vehicles including vans 6 –10 years Solar equipment – panel 25 years – invertor 10 years – other solar 15 years Depreciation is charged on the above assets from the month of purchase until the month of disposal. Operating Leases Assets held under finance leases are included in the balance sheet and depreciated in accordance with the group’s normal accounting policies. The present value of future rentals is shown as a liability. The interest element of rental obligations is charged to the income and expenditure account over the period of the lease in proportion to the balance of capital repayments outstanding. Rentals payable under operating leases are charged to the income and expenditure account on a straight-line basis over the lease term. Fixed Asset Investments Investments in subsidiary undertakings are shown at cost less any provision for impairment. Value Added Tax Value Added Tax is accounted for on an accruals basis. The primary activities of the Group, social housing lettings, constitute exempt supplies, and accordingly no input tax borne is recoverable. For business supplies chargeable to tax, or where special dispensations have been agreed, input tax directly relating to goods and services that have enabled the supply, and relating to a fair proportion of the cost of central services in support of these, are recovered from HM Revenue & Customs. The Group provides membership of the Local Government Pension Scheme, the London Pension Fund Authority, for all employees who elected to take up this option prior to 31 March 2008. This is a funded final salary pension scheme. The assets of the pension fund are managed by third-party investment managers and are held separately in trust. Regular valuations are prepared by independent professionally qualified actuaries. These determine the level of contributions required to fund the benefits set out in the rules of the fund and allow for the periodic increase of pensions in payment. Following the full adoption of FRS 17, the current service cost of providing retirement benefits to employees during the year, together with the cost of any benefits relating to past service is charged against the operating surplus in the year. The pension scheme assets are measured at fair value. The pension scheme liabilities are measured using the projected unit method and discounted at the current rate of return on a high quality corporate bond of equivalent term and currency. A pension scheme asset is recognised on the balance sheet only to the extent that the surplus may be recovered by reduced future contributions or to the extent that the trustee has agreed a refund from the scheme at the balance sheet date. A pension scheme liability is recognised to the extent that the Group has a legal or constructive obligation to settle the liability. A credit representing the expected return on the assets of the pension fund during the year is included within other finance income. This is based on the market value of the assets of the fund at the start of the financial year. A charge within other finance charges representing the expected increase in the liabilities of the pension fund during the year is included within net interest. This arises from the liabilities of the fund being one year closer to payment. The difference between the market value of assets and the present value of accrued pension liabilities is shown as an asset or liability in the balance sheet net of deferred tax. Differences between actual and expected returns on assets during the year are recognised in the statement of total recognised surpluses and deficits in the year, together with differences arising from changes in assumptions. ii. Friends Provident Defined Contribution Pension Scheme Employees of the Peabody Group are able to join the Peabody Group Pension Scheme which is a defined contribution scheme operated by Friends Provident. The assets of this scheme are held separately from those of the Group. Employer contributions in respect of this scheme are charged to the income and expenditure account as incurred. Notes to the Accounts 1. Accounting Policies (continued) iii. Aegon Group Stakeholder Pension Scheme Employees of Gallions are able to join the Aegon Group Stakeholder Scheme which is a defined contribution scheme operated by Aegon. The assets of this scheme are held separately from those of the Group. Employer contributions in respect of this scheme are charged to the income and expenditure account as incurred. Loans and Other Financial Instruments Loans and other financial instruments are stated in the balance sheet at the amount of the gross proceeds less the initial cost of raising the finance which is amortised over the period of the loan using the effective interest rate. Where loans and other financial instruments are redeemed during the year, any redemption penalty is recognised in the income and expenditure account of the year in which redemption takes place. Financial assets and liabilities are recognised when the Group becomes a party to the contractual provisions of the financial instrument and are measured initially at fair value adjusted by transaction costs. Homes Managed by Other Parties on Behalf of Peabody A number of Peabody’s supported homes are managed by third parties on behalf of Peabody. Where the risks and benefits of managing these homes have been transferred to the third party the transactions relating to such homes are excluded from Peabody’s income and expenditure account. Where the risk remains with Peabody the transactions are recognised in the income and expenditure account. Related Party Transactions Peabody has taken advantage of the exemption permitted by FRS 8 – ‘Related Party Disclosures’, and does not disclose transactions with wholly owned Group undertakings that are eliminated on consolidation. Taxation The charge for taxation is based on the surplus for the year and takes into account taxation deferred. Deferred tax is recognised in respect of all timing differences that have originated but not reversed at the balance sheet date where transactions or events that result in an obligation to pay more tax in the future or a right to pay less tax in the future have occurred at the balance sheet date. Timing differences are differences between the Group's taxable profits and its results as stated in the financial statements that arise from the inclusion of gains and losses in tax assessments in periods different from those in which they are recognised in the financial statements. A net deferred tax asset is regarded as recoverable and therefore recognised only to the extent that, on the basis of all available evidence, it can be regarded as more likely than not that there will be suitable taxable profits from which the future reversal of the underlying timing differences can be deducted. Deferred tax is measured at the average tax rates that are expected to apply in the periods in which the timing differences are expected to reverse, based on tax rates and laws that have been enacted or substantively enacted by the balance sheet date. 11 12 Peabody Report and financial statements for the year ended 31 March 2014 2(a). Turnover and Operating Surplus Peabody Turnover Cost of sales Operating costs 2014 £'000 2014 £'000 2014 £'000 Operating surplus / (deficit) 2014 £'000 94,652 – (70,393) 24,259 90,665 (63,331) 27,334 Shared ownership 1,743 – (603) 1,140 1,699 (772) 927 Keyworker 3,855 – (1,212) 2,643 3,478 (957) 2,521 Affordable Rent 2,293 – (843) 1,450 1,131 (627) 504 Leasehold properties 1,214 – (1,797) 1,170 (1,996) 103,757 – (74,848) 28,909 98,143 (67,683) 30,460 Donations received (intra-group) 7,572 – – 7,572 163 – 163 Development 1,000 – (930) 70 25 (1,104) Supporting People contract income 135 – (135) – 302 (302) – First tranche shared ownership sales 4,710 – 828 – – – Turnover Operating costs 2013 £'000 2013 £'000 Operating surplus / (deficit) 2013 £'000 Social housing lettings General needs housing (583) (826) Other social housing activities (3,882) (1,079) Non-social housing activities Market renting 7,100 – (2,171) 4,929 6,185 (1,500) 4,685 Commercial lettings 3,001 – (905) 2,096 2,939 (645) 2,294 Community regeneration (Note 2c) 1,023 – (3,007) (1,984) 1,520 (3,608) (2,088) Other * 9,903 – (4,634) 5,269 8,998 (4,698) 4,300 (86,630) 47,689 118,275 (79,540) 38,735 Total * 138,201 (3,882) Includes intermediate market rent properties Breakdown of Community Regeneration Income for 2014 (£'000) Peabody Turnover Operating costs Operating surplus/ (deficit) Big Lottery Programme 839 (820) 19 Other programmes 184 (2,187) (2,003) 1,023 (3,007) (1,984) Total Community Regeneration Notes to the Accounts 13 2(a). Turnover and Operating Surplus Group Turnover Cost of sales 2014 2014 Operating costs 2014 £'000 Operating surplus / (deficit) 2014 £'000 Turnover 2013 Operating costs 2013 £'000 £'000 Operating surplus / (deficit) 2013 £'000 £'000 £'000 110,849 – (83,688) 27,161 98,848 (67,680) 31,168 Shared ownership 2,785 – (975) 1,810 1,699 (772) 927 Keyworker 3,855 – (1,212) 2,643 3,478 (957) 2,521 Affordable Rent 2,293 – (843) 1,450 1,131 (627) 504 Leasehold properties 1,283 – (1,897) 1,170 (1,996) 121,065 – (88,615) 32,450 106,326 (72,032) 869 – 869 – 1,917 – (1,577) 340 410 (1,409) Supporting People contract income 135 – (135) – 366 (363) First tranche shared ownership sales 6,803 – 275 – – – – 30 Social housing lettings General needs housing (614) (826) 34,294 Other social housing activities Donations received (intra-group) Development costs (6,528) – – – (999) 3 21 – (5) 16 30 Market renting 7,100 – (2,171) 4,929 6,185 (1,500) 4,685 Commercial lettings 4,336 – (933) 3,403 3,752 (650) 3,102 Community regeneration 1,106 – (4,107) (3,001) 1,628 (3,997) Other Non-social housing activities Commercial Sales 11,179 Other 10,582 6,492 – (7,198) 3,384 9,806 (5,149) 4,657 (104,741) 49,157 128,503 (85,100) 43,403 – (977) 87 – – – (11) – (7) (18) – – – 1 – (1) – – – – 16 – 112 128 – – – – – (1) (1) – – – 1,070 – (874) 196 – – – (116,830) 49,353 128,503 165,113 (4,687) – (11,215) – (2,369) – – Share of joint venture turnover Property investment Property trading Landfill Property management Property sales Total 1,064 166,183 (11,215) The figures for the year ended 31 March 2014 include the following amounts relating to acquisitions: cost of sales £4,288,000 and operating cost £10,536,000. (85,100) 43,403 14 Peabody Report and financial statements for the year ended 31 March 2014 2(b).Particulars of Income and Expenditure from Social Housing Lettings Peabody General Needs Housing Supported Housing and Housing for older people Shared ownership Keyworker Affordable Rent Leasehold Properties Total Total 2014 £'000 2014 £'000 2014 £'000 2014 £'000 2014 £'000 2014 £'000 2014 £'000 2013 £'000 81,801 4,246 1,198 3,793 2,275 185 93,498 87,928 Service charges receivable 5,222 573 478 27 5 911 7,216 7,410 Charges for support services 1,106 176 27 – – 104 1,413 1,144 1 1,527 40 35 13 14 1,630 1,661 88,130 6,522 1,743 3,855 2,293 1,214 103,757 98,143 Income from lettings Rents receivable Other income Total income from social housing Expenditure Services (11,562) (698) (349) (525) (174) (175) (13,483) (12,642) Management (21,848) (2,667) (35) (55) (270) (911) (25,786) (23,303) Routine maintenance (14,003) (590) (4) (390) (378) (25) (15,390) (11,640) Cyclical maintenance (9,395) (118) (4) (28) (21) 168 (9,398) (9,935) – – – – – (522) (6) – (3) – (8) (539) (733) Depreciation of housing properties (8,561) (423) (211) (211) – (846) (10,252) (9,430) Operating costs on social housing (65,891) (4,502) (603) (1,212) (1,797) (74,848) (67,683) Operating surplus on social housing lettings 22,239 2,020 28,909 30,460 Major maintenance Rent losses from bad debts Rent losses from voids – (1,047) (44) 1,140 (17) 2,643 (48) (843) 1,450 (26) (583) (3) – (1,185) – (1,338) Notes to the Accounts 15 2(b).Particulars of Income and Expenditure from Social Housing Lettings Group General Needs Housing Supported Housing and Housing for older people Shared ownership Keyworker Affordable Rent Leasehold Properties Total Total 2014 £'000 2014 £'000 2014 £'000 2014 £'000 2014 £'000 2014 £'000 2014 £'000 2013 £'000 97,196 4,246 2,062 3,793 2,275 185 109,757 96,042 Service charges receivable 6,024 573 656 27 5 980 8,265 7,479 Charges for support services 1,107 176 27 – – 104 1,414 1,144 – 1,527 40 35 13 14 1,629 1,661 104,327 6,522 2,785 3,855 2,293 1,283 121,065 106,326 Income from lettings Rents receivable Other income Total income from social housing Expenditure Services (13,314) (698) (532) (525) (174) (178) (15,421) (12,711) Management (25,207) (2,667) (75) (55) (270) (911) (29,185) (25,826) Routine maintenance (17,184) (590) (4) (390) (378) – (18,618) (12,810) Cyclical maintenance (10,917) (118) (48) (28) (21) 118 (11,014) (10,276) Major maintenance (215) – – – – – (215) Rent losses from bad debts (586) (6) (3) (3) – (8) (606) (756) Depreciation of housing properties (10,497) (423) (211) – (846) (12,290) (9,653) Impairment of housing properties (1,266) Operating costs on social housing (79,186) (4,502) Operating surplus on social housing lettings 25,141 2,020 Rent losses from voids (1,250) – (44) (313) – (975) 1,810 (47) – (1,212) 2,643 (48) – (843) 1,450 (26) – (1,897) (614) (3) (1,266) – – (88,615) (72,032) 32,450 34,294 (1,418) (1,346) 16 Peabody Report and financial statements for the year ended 31 March 2014 3. Accommodation Owned and in Management At 31 March Peabody Group 2014 Units 2013 Units 2014 Units 2013 Units 13,633 13,764 20,100 15,132 – affordable 291 188 649 192 Shared ownership 465 456 1,073 492 Rent to Homebuy – – 125 – 69 69 69 69 370 359 430 359 – directly managed 412 441 467 496 – managed by others 356 380 356 380 Leasehold managed 1,439 1,330 2,053 1,371 Non-social housing 1,973 2,035 2,222 2,041 19,008 19,022 27,544 20,532 General needs housing – social Keyworker – other – intermediate market rent Supported housing Total Notes to the Accounts 17 4. Emoluments of Governors and Executive Officers None of the Governors received any emoluments during the year (2013: £nil). Governors were reimbursed expenses totalling £231 (2013: £212). The remuneration paid to the Group Chief Executive, Peabody Executive Officers (as listed on page 5) and the Chief Executive of CBHA, was as follows: Total emoluments (including pension contributions and benefits in kind) 2014 £ 2013 £ 1,168,497 984,206 233,261 210,277 Highest Paid Director: Emoluments (including pension contributions) paid to the Group Chief Executive The new Executive Director – Development and Regeneration joined the Executive Team in November 2013. The Group Chief Executive is no longer an ordinary member of Peabody’s pension scheme. The Nominations and Remuneration Committee of the Governors meets twice a year and fixes the remuneration of the Group Chief Executive and the Peabody Executive Team. 18 Peabody Report and financial statements for the year ended 31 March 2014 5. Employee Information Peabody Group 2014 2013 2014 2013 The average number of full-time equivalent employees (based on a standard working week of 35 hours) No. No. No. No. Head office functions 146 143 178 147 Housing management 413 396 604 422 – 2 16 2 Community services 101 107 109 119 Total 660 648 907 690 Maintenance Peabody Group 2014 2013 2014 2013 £’000 £’000 £’000 £’000 Wages and salaries 23,913 21,752 28,100 22,995 Social security costs 2,199 2,033 2,523 2,155 Other pension costs (note 6) 1,844 1,772 2,120 1,929 Other employee costs 1,060 334 1,088 341 29,016 25,891 33,831 27,420 Employee costs Total Notes to the Accounts 19 5. Employee Information (continued) The numbers of employees and directors who received remuneration (excluding pension contributions) in excess of £60,000 per annum are stated below in bandings of £10,000: Peabody Group 2014 No. 2013 No. 2014 No. 2013 No. £60,001 to £70,000 13 8 19 9 £70,001 to £80,000 5 10 11 11 £80,001 to £90,000 4 4 11 5 £90,001 to £100,000 4 2 4 2 £100,001 to £110,000 2 – 2 – £110,001 to £120,000 – – 1 – £120,001 to £130,000 – 3 – 3 £130,001 to £140,000 1 1 1 1 £140,001 to £150,000 2 – 2 – £150,001 to £160,000 1 – 1 – £160,001 to £170,000 – 1 – 1 £170,001 to £180,000 – – – – £180,001 to £190,000 1 – 1 – £190,001 to £200,000 – – – – £200,001 to £210,000 – 1 – 1 £210,001 to £220,000 – – – – £220,001 to £230,000 – – – – £230,001 to £240,000 1 – 1 – 34 30 54 33 The relationship of pay between the highest and lowest earner is 12.7:1 (2013: 11.5:1) The Chief Executive’s remuneration on a per unit basis (owned and managed) is £8.14 per property (2013: £9.93). 20 Peabody Report and financial statements for the year ended 31 March 2014 6. Pension Liabilities The London Pensions Fund Authority – Peabody Peabody participates in the London Pensions Fund Authority Scheme (LPFA) for those employees who elected to join prior to 31 March 2008. The scheme is now closed to new entrants. The pension cost, which includes liability for pension increases, has been determined in accordance with the advice of professionally qualified consulting actuaries based on an actuarial valuation made as at 31 March 2013 using the projected unit method. The most significant actuarial assumptions used in this valuation were: Discount rate 4.5% per annum Rate of general pay increases 4.6% per annum Rate of increase in pensions in payment 2.8% per annum Price inflation 2.8% per annum Valuation of assetsvalued at a 12 month smoothed market value Peabody's service cost under the LPFA was £1,164,000 (2013: £1,189,000). The Group’s service cost under the LPFA was £1,472,500 (2013: £1,342,000). The major assumptions used to value the liabilities of the scheme under FRS 17 are: At 31 March 2014 % per annum At 31 March 2013 % per annum CPI inflation increase rate 2.8 2.6 Pension increase rate 2.8 2.6 Rate of increase in salaries 4.6 4.3 Expected return on assets 6.4 5.6 Discount rate 4.5 4.5 Projected unit Projected unit Valuation method The demographic assumptions are consistent with those used for the formal funding valuation as at 31 March 2014. The post retirement mortality tables adopted were based on the Club Vita mortality analysis. The assumed life expectations are: Retiring today – male 86.6 Retiring today – female 89.8 Retiring in 20 years – male 88.9 Retiring in 20 years – female 92.0 Notes to the Accounts 21 6. Pension Liabilities (continued) The assets in the Scheme and expected rates of return (based on long-term future expected investment return for each asset class) were: Expected long term rate of return Value at 31 March 2014 £’000 Expected long term rate of return Value at 31 March 2013 £’000 Equities 6.9% 29,277 6.0% 39,573 LDI/Cashflow matching 3.6% 3,314 n/a – Target return portfolio 6.3% 16,572 4.6% 5,421 n/a – 5.0% 8,132 Infrastructure 6.5% 2,210 n/a – Commodities 6.3% 552 n/a – Property 5.7% 1,657 n/a – Cash 3.4% 1,657 0.5% 1,084 Alternative assets 55,239 54,210 Present value of scheme liabilities (85,474) (82,379) Net (under) funding in funded plans (30,235) (28,169) Present value of unfunded liabilities (58) (51) (30,293) (28,220) Total fair value of assets Net pension liability Amounts charged to operating profit 2014 £’000 2014 (% of payroll) 2013 £’000 2013 (% of payroll) Current service cost 1,164 24.0 1,189 22.3 Interest cost 3,685 76.1 3,484 65.4 (3,014) (62.2) (2,822) (53.0) – – – – (101) 2.1 8 0.2 Total 1,734 40.0 1,859 34.9 Actual return on plan assets 1,850 Expected return on employer assets Past service cost Losses on curtailments and settlements 6,799 22 Peabody Report and financial statements for the year ended 31 March 2014 6. Pension Liabilities (continued) Reconciliation of defined benefit obligation 2014 £’000 2013 £’000 82,430 76,174 Current service cost 1,164 1,189 Interest cost 3,685 3,484 Contribution by members 329 362 Actuarial (gains) / loss 577 3,649 Past service credit – – Losses on curtailments – 8 Opening defined benefit obligation Liabilities assumed / (extinguished) on settlements Estimated unfunded benefits paid Estimated benefits paid Closing defined benefit obligation (333) – (4) (4) (2,316) (2,432) 85,532 82,430 2014 £’000 2013 £’000 Opening fair value of employer assets 54,210 48,078 Expected return on employers assets 3,014 2,822 Contribution by members 329 362 Contribution by employer 1,376 1,403 4 4 Reconciliation of fair value of employer assets Contribution in respect of unfunded benefits Actuarial gains (losses) Unfunded benefits paid Benefits paid Settlement prices received / (paid) Closing fair value of employer assets (1,142) 3,977 (4) (4) (2,316) (2,432) (232) – 55,239 54,210 2014 £’000 2013 £’000 Present value of Funded Obligation 85,474 82,379 Fair Value of Scheme Assets (bid value) (55,239) (54,210) Net Liability 30,235 28,169 58 51 – – 30,293 28,220 The best estimate of employer contributions for the year ending 31 March 2015 is £1,295,000. Net Pension Asset as at Present Value of Unfunded Obligation Unrecognised Past Service Cost Net Liability in Balance Sheet Notes to the Accounts 23 6. Pension Liabilities (continued) Amounts for the current and previous accounting periods 2014 £’000 2013 £’000 2012 £’000 2011 £’000 2010 £’000 Fair Value of employer assets 55,239 54,210 48,078 47,893 43,945 Present value of defined benefit obligation (85,532) (82,430) (76,174) (63,345) (75,923) Deficit (30,293) (28,220) (28,096) (15,452) (31,978) Experience gains on assets Experience gains / (losses) on liabilities Past service credit Actuarial (losses) and gains (1,164) (555) – (1,719) 3,977 (2,745) 1,420 7,681 (3,649) (10,122) 8,081 (25,162) – 328 – (12,867) 8,606 – 18,107 (17,481) 2014 £’000 2013 £’000 The past service credit of £8,606,000 in 2011 relates to the government’s announcement on 22 June 2010 that future pensions increases would be linked to CPI as opposed to RPI. Peabody has recognised this amount in the statement of total recognised surpluses and deficits in accordance with Urgent Issues Task Force (UITF) Abstract 48, as the directors consider that no constructive obligation existed prior to the announcement to link such benefit increases to CPI. As such, the resulting gain has been accounted for as a change in actuarial assumption. Analysis of amount recognisable in the statement of total recognised surpluses and deficits (STRSD) Actuarial (losses)/ gains (1,719) 328 Actuarial (losses)/ gains recognisable in the STRSD (1,719) 328 Cumulative Actuarial losses recognised in the STRSD (9,786) (8,067) 24 Peabody Report and financial statements for the year ended 31 March 2014 6. Pension Liabilities (continued) The London Pension Fund Authority – CBHA The following are the disclosures presented in the financial statements of the Peabody’s wholly owned subsidiary CBHA in respect of the LPFA pension scheme. The assets in the Scheme and expected rates of return (based on long-term future expected investment return for each asset class) were: Expected long term rate of return Value at 31 March 2014 £’000 Expected long term rate of return Value at 31 March 2013 £’000 Equities 6.9% 2,444 6.0% 3,334 LDI/Cashflow matching 3.6% 277 n/a – Target return funds 6.3% 1,384 4.6% 457 n/a – 5.0% 685 Infrastructure 6.5% 184 n/a – Commodities 6.3% 46 n/a – Property 5.7% 138 n/a – Cash 3.4% 138 0.5% 91 Alternative assets 4,612 4,567 Present value of scheme liabilities (7,559) (7,322) Net (under) funding in funded plans (2,947) (2,755) Net pension liability (2,947) (2,755) Total fair value of assets The demographic assumptions are consistent with those used for the formal funding valuation as at 31 March 2014. The post retirement mortality tables adopted were based on the Club Vita mortality analysis. The assumed life expectations are: Retiring today – male 86.4 Retiring today – female 89.6 Retiring in 20 years – male 88.7 Retiring in 20 years – female 91.8 Notes to the Accounts 25 6. Pension Liabilities (continued) Amounts charged to operating profit 2014 £’000 2014 (% of payroll) 2013 £’000 2013 (% of payroll) Current service cost 121 24.3 153 24.3 Interest cost 339 68.1 328 52.1 Expected return on employer assets (251) (50.4) (242) (38.5) – – – – Total 209 42.0 239 37.9 Actual return on plan assets 153 – 584 – 2014 £’000 2013 £’000 7,322 7,245 Current service cost 121 153 Interest cost 339 328 34 43 107 2 – – (364) (449) 7,559 7,322 2014 £’000 2013 £’000 Opening fair value of employer assets 4,567 4,219 Expected return on employers assets 251 242 34 43 Contribution by employer including unfunded benefits 145 169 Actuarial (losses) gains (20) 343 (364) (449) 4,612 4,567 2014 £’000 2013 £’000 Present value of Funded Obligation 7,559 7,322 Fair Value of Scheme Assets (bid value) (4,612) (4,567) Net Liability in Balance Sheet 2,947 2,755 Past service cost Reconciliation of defined benefit obligation Opening defined Benefit obligation Contribution by members Actuarial (gains) / losses Past service (gains) / costs Estimated benefits paid Closing defined benefit obligation Reconciliation of fair value of employer assets Contribution by members Benefits paid including unfunded benefits paid Closing fair value of employer assets Net Pension Asset as at 26 Peabody Report and financial statements for the year ended 31 March 2014 6. Pension Liabilities (continued) The London Pensions Fund Authority – CBHA (continued) Amounts for the current and previous accounting periods 2014 £’000 2013 £’000 2012 £’000 2011 £’000 2010 £’000 Fair Value of employer assets 4,612 4,567 4,219 4,087 3,638 Present value of defined benefit obligation (7,559) (7,322) (7,245) (5,796) (7,166) Deficit (2,947) (2,755) (3,026) (1,709) (3,528) Experience gains on assets (97) 343 (238) 12 Experience (losses) / gains on liabilities (30) (2) (1,096) 1,243 – – Past service credit Actuarial (losses) and gains (127) 341 – (1,334) 739 1,994 623 (2,637) – (2,014) The past service credit of £739,000 in 2011 relates to the government’s announcement on 22 June 2010 that future pension increases would be linked to CPI as opposed to RPI. CBHA has recognised this amount in the statement of total recognised surpluses and deficits in accordance with Urgent Issues Task Force (UITF) Abstract 48, as the directors consider that no constructive obligation existed prior to the announcement to link such benefits to CPI. As such, the resulting gain has been accounted for as a change in actuarial assumptions. Analysis of amount recognisable in the statement of total recognised surpluses and deficits (STRSD) 2014 £’000 2013 £’000 Actuarial (losses)/ gains (127) 341 Actuarial (losses)/ gains recognisable in the STRSD (127) 341 Cumulative Actuarial losses recognised in the STRSD (1,854) (1,727) The London Pensions Fund Authority – Gallions The following are the disclosures presented in the financial statements of the Peabody’s wholly owned subsidiary Gallions in respect of the LPFA pension scheme. The assets in the Scheme and expected rates of return (based on long-term future expected investment return for each asset class) were: Expected long term rate of return Value at 31 March 2014 £’000 Equities 6.9% 14,466 LDI/Cashflow matching 3.6% 1,638 Target return funds 6.3% 8,189 n/a – Infrastructure 6.5% 1,092 Commodities 6.3% 273 Property 5.7% 819 Cash 3.4% 819 Alternative assets Total fair value of assets 27,295 Present value of scheme liabilities (38,105) Net (under) funding in funded plans (10,810) Net pension liability (10,810) Notes to the Accounts 27 6. Pension Liabilities (continued) The demographic assumptions are consistent with those used for the formal funding valuation as at 31 March 2014. The post retirement mortality tables adopted were based on the Club Vita mortality analysis. The assumed life expectations are: Retiring today – male 86.6 Retiring today – female 89.8 Retiring in 20 years – male 88.9 Retiring in 20 years – female 92.1 Amounts charged to operating profit 2014 £’000 2014 (% of payroll) Current service cost 750 24.1 Losses on curtailments and settlements 108 3.4 1,608 51.6 (1,469) (47.2) Total 997 31.9 Actuarial return on plan assets 899 Interest cost Expected return on employer assets Reconciliation of defined benefit obligation Opening defined Benefit obligation Current service cost Interest cost Contribution by members Actuarial losses 2014 £’000 35,041 750 1,608 213 1,552 Losses on curtailments 108 Estimated benefits paid (1,167) Closing defined benefit obligation Reconciliation of fair value of employer assets 38,105 2014 £’000 Opening fair value of employer assets 26,358 Expected return on employers assets 1,469 Contributions by group Actuarial (losses) 894 (259) Benefits paid including unfunded benefits paid (1,167) Closing fair value of employer assets 27,295 The best estimate of employer contributions for the year ending 31 March 2015 is £387,000. 28 Peabody Report and financial statements for the year ended 31 March 2014 6. Pension Liabilities (continued) The London Pensions Fund Authority – Gallions (continued) Net Pension Asset as at 2014 £’000 Present value of Funded Obligation (38,105) Fair Value of Scheme Assets (bid value) 27,295 Net Liability in Balance Sheet (10,810) Amounts for the current and previous accounting period 2014 £’000 Fair Value of employer assets 27,295 Present value of defined benefit obligation (38,105) Deficit (10,810) Experience (losses) on assets (569) Experience gains on liabilities 1,004 Changes in assumptions (2,246) Actuarial gains and losses (1,811) Analysis of Amount Recognisable in Statement of Total Recognised Surpluses and Deficits (STRSD) 2014 £’000 Actuarial (losses) gains (1,811) Actuarial (losses) gains recognisable in the STRSD (1,811) Cumulative actuarial gains and losses (9,376) Notes to the Accounts 6. Pension Liabilities (continued) Friends Provident Defined Contribution Pension Scheme Employees of the Peabody Group from 1 April 2008 are able to join the Peabody Group Pension Scheme which is a defined contribution scheme operated by Friends Provident. The assets of this scheme are held separately from those of the Group. Employer contributions in respect of this scheme are charged to the income and expenditure account as incurred. During the year ended 31 March 2014 employer contributions totalling £786,204 (2013: £568,916) were made into the scheme. Aegon Group Stakeholder Pension Scheme (Gallions only) Since 1 January 2011, all new employees are able to join the Aegon Group Stakeholder Pension Scheme. On 31 March 2014 there were 5 current employees (2013: 5) in total who were members of the Aegon Group Stakeholder Pension Scheme. There were also no deferred pensioners and no active pensioners. Peabody Pension Trust Limited (PPT) Peabody Pension Trust acts as Trustee and administrator for the Governors of Peabody for the operation of a retirement benefits scheme for those Peabody employees who were eligible at 31 December 1977. Peabody has entered into commitments to pay the shortfall of pension payments over income for PPT for each year. The excess of liabilities over commitments is measured with respect to RPI in April of each year and in the year ended 31 March 2014 was £14,924 (2013: £14,229). PPT is not a pension scheme under the terms of the Pension Scheme Disclosure Regulations. 29 30 Peabody Report and financial statements for the year ended 31 March 2014 7. Interest Receivable and Similar Income Peabody Group 2014 £’000 2013 £’000 2014 £’000 2013 £’000 295 131 353 2,814 – – 11 – Interest received from Group entities 5,359 3,379 – – Total 5,654 3,510 364 2,814 Other interest receivable and similar income Share of joint venture interest receivable 8. Interest Payable and Similar Charges Peabody Group 2014 £’000 2013 £’000 2014 £’000 2013 £’000 Interest payable on borrowings 12,550 13,188 27,300 23,457 Interest payable to Group entities 13,364 7,644 – – – – (17) – 671 662 898 748 26,585 21,494 28,181 24,205 Share of joint venture interest Net interest cost on pension scheme (note 6) Less: Interest capitalised (1,704) Total 24,881 Capitalisation rate used to determine the finance costs capitalised during the period 3.75% (5,502) (2,424) 20,864 22,679 21,781 2.36% 3.75% 2.36% (630) Notes to the Accounts 31 9. Surplus on Operating Activities Peabody Group 2014 £’000 2013 £’000 2014 £’000 2013 £’000 11,844 12,218 14,191 12,792 – – 1,194 – – – 102 72 79 62 – – 35 16 35 16 Surplus on ordinary activities before taxation is stated after charging: Depreciation on tangible fixed assets Impairment on housing assets Auditors’ remuneration: In their capacity as auditors: Group Peabody In respect of non-audit services 10. Taxation Charge The tax assessed for the period is lower than that resulting from applying the standard rate of 23% corporation tax in the UK. The differences are explained below: Peabody Surplus on ordinary activities before taxation Tax on profit on ordinary activities at standard rate of 23% (2013: 24%) Group 2014 £’000 2013 £’000 2014 £’000 2013 £’000 34,174 22,742 229,091 25,933 7,860 5,458 52,691 6,224 (7,860) (5,458) (52,691) (6,224) Factors affecting charge for the year: Charitable surplus exempt taxation – – – – 32 Peabody Report and financial statements for the year ended 31 March 2014 11. Housing Properties Completed Properties Peabody Properties under construction Housing properties held for letting £’000 Shared ownership housing properties £’000 Housing properties held for letting £’000 Shared ownership housing properties £’000 Total £’000 1,201,380 40,429 16,895 5,343 1,264,047 Cost At 1 April 2013 Reclass of Social Homebuy loans (10,386) – – – (10,386) Reclass to office accommodation (788) – – – (788) 7,678 6,053 14,326 4,875 32,932 19,765 – – – 19,765 Additions – new build properties – – 21,276 5,699 26,975 Interest capitalised – – 1,046 372 1,418 6,530 3,931 (7,660) (2,028) (11,171) (6,043) (4,007) (247) Properties acquired Works to existing properties Schemes completed Disposals At 31 March 2014 773 (21,468) 1,213,008 44,370 41,876 14,014 1,313,268 82,837 2,722 – – 85,559 Charge for the year 9,752 504 – – 10,256 Disposals (1,373) – – Depreciation At 1 April 2013 At 31 March 2014 (99) (1,472) 91,216 3,127 – – 94,343 At 31 March 2014 1,121,792 41,243 41,876 14,014 1,218,925 At 31 March 2013 1,118,543 37,707 16,895 5,343 1,178,488 341,722 14,089 6,989 568 363,368 – – – – 12,978 709 Depreciated cost Social housing grant At 1 April 2013 Reclass of DFG Recycled capital grant fund (receipt) Recycled capital grant fund (payment) Completed development properties (1,948) – (57) (825) 709 341,968 – 13,687 (882) (2,251) (709) 13,973 17,716 568 374,225 60,846 – – – 60,846 Reclass of Social Homebuy Grant (9,176) – – – (9,176) Reclass of DFG 1,948 – – – 1,948 282 – – – 282 53,900 – – – 53,900 At 31 March 2014 725,924 27,270 24,160 13,446 790,800 At 31 March 2013 715,975 23,618 9,906 4,775 754,274 At 31 March 2014 2,251 – (1,948) – Other public grants At 1 April 2013 Received At 31 March 2014 Net book value The DFG grant received in previous years has been adjusted this year to be correctly reflected under Other public grants rather than Social housing grant. Notes to the Accounts 33 11. Housing Properties (continued) Completed Properties Group Properties under construction Housing properties held for letting £’000 Shared ownership housing properties £’000 Housing properties held for letting £’000 Shared ownership housing properties £’000 Total £’000 1,268,859 43,891 62,981 9,586 1,385,317 (6,537) 4,095 (4,676) Cost At 1 April 2013 Transfer to / from current assets (768) (1,466) Reclass of Social Homebuy loans (10,386) – – – (10,386) Reclass to office accommodation (787) – – – (787) – – 51,781 10,184 61,965 22,757 – – – 22,757 Additions – new build properties – – 45,615 12,866 58,481 Interest capitalised – – 3,379 680 4,059 7,308 4,041 (8,438) (2,138) (11,605) (6,746) (1,620) 495,807 39,536 9,186 4,335 548,864 1,771,185 79,256 156,347 39,608 2,046,396 At 1 April 2013 83,579 2,990 – – 86,569 Charge for the year 11,561 600 – – 12,161 Impairment 1,194 – – – 1,194 Disposals (1,374) (99) – – (1,473) 33,066 974 – – 34,040 128,026 4,465 – – 132,491 At 31 March 2014 1,643,159 74,791 156,347 39,608 1,913,905 At 31 March 2013 1,185,280 40,901 62,590 10,336 1,299,107 341,722 14,089 8,945 2,081 366,837 – – – – 11,536 867 Properties acquired Works to existing properties Schemes completed Disposals Acquisition of Gallions At 31 March 2014 – 773 (19,971) Depreciation Acquisition of Gallions At 31 March 2014 Depreciated cost Social housing grant At 1 April 2013 Reclass of DFG Recycled capital grant fund (receipt) Recycled capital grant fund (payment) (1,948) – (826) (6,920) 2,251 911 (2,251) Disposals – 223 Transfers 1 (495) Completed development properties Acquisition of Gallions At 31 March 2014 (56) – (1,234) – (709) – (187) (1,948) 12,403 (7,802) 202 223 (1,915) 88,644 19,033 10,682 628 118,987 430,614 32,935 20,758 2,680 486,987 34 Peabody Report and financial statements for the year ended 31 March 2014 11. Housing Properties (continued) Completed Properties Group Properties under construction Housing Shared properties ownership held for housing letting properties £’000 £’000 Housing properties held for letting £’000 Shared ownership housing properties £’000 78,538 2,525 3,451 797 Total £’000 Other public grants At 1 April 2013 85,311 Reclass of Social Homebuy loans (9,176) – – – (9,176) Reclass of DFG 1,948 – – – 1,948 286 – – – 286 Acquisition of Gallions 10,012 – – – 10,012 At 31 March 2014 81,608 2,525 3,451 797 88,381 1,130,937 39,331 132,138 36,131 1,338,537 761,569 23,491 53,645 8,255 846,960 Received Net book value At 31 March 2014 At 31 March 2013 Peabody Total expenditure on works to existing properties for the year amounts to £19.8 million which consists of £12.3 million of improvements and £7.4 million of the replacement of components. Housing properties includes £744 million of land which has not been depreciated. Group Total expenditure on works to existing properties for the year amounts to £22.8 million. Housing properties includes £799 million of land which has not been depreciated. Notes to the Accounts 35 11. Housing Properties (continued) Peabody Housing properties comprise: Freeholds Long leaseholds Peabody The total Social Housing Grant receivable to date is £374 million (2013: £363 million). Group The total Social Housing Grant receivable to date is £493 million (2013: £367 million). The Group’s assets have been reviewed for impairment. The recoverable amount has been determined on a value-in-use basis. The key assumptions used in determining the value in use are as follows: Assumption Revenue rate average weekly rent £75 – £107 Growth rate 0.5% - 2.0% (year 10) Discount rate 5.6% real; 8.3% nominal Group 2014 £’000 2013 £’000 2014 £’000 2013 £’000 1,217,980 1,161,595 1,911,108 1,283,224 95,288 102,452 95,288 102,452 1,313,268 1,264,047 2,046,396 1,385,676 36 Peabody Report and financial statements for the year ended 31 March 2014 12. Other Tangible Fixed Assets Peabody Freehold offices £’000 Office equipment £’000 Total £’000 13,648 5,865 19,513 – (726) 1,639 4,135 (1,477) (1,477) Cost At 1 April 2013 Reclass of investment (726) Additions 2,496 Disposals – Work in progress 1,294 1,324 2,618 At 31 March 2014 16,712 7,351 24,063 7,426 2,018 9,444 516 1,072 1,588 (1,490) (1,490) Depreciation At 1 April 2013 Charge for the year Disposals – At 31 March 2014 7,942 1,600 9,542 Net book value at 31 March 2014 8,770 5,751 14,521 At 31 March 2013 6,222 3,847 10,069 Solar equipment Total £’000 Equipment, F&F, Motor vehicles £’000 £’000 £’000 14,110 6,052 6,537 26,699 – – 7,060 149 Group Freehold offices Cost At 1 April 2013 Reclass of investment (726) Additions 8,512 Disposals – (726) 15,721 (1,639) – (1,639) Work in Progress 1,294 1,324 – 2,618 At 31 March 2014 23,190 12,797 6,686 42,673 7,493 2,142 460 10,095 Charge for the year 584 1,115 331 2,030 Additions 304 3,286 – 3,590 Disposals – (1,587) – (1,587) Depreciation At 1 April 2013 At 31 March 2014 Net book value at 31 March 2014 At 31 March 2013 8,381 4,955 791 14,127 14,809 7,842 5,895 28,546 6,617 3,910 6,077 16,604 Notes to the Accounts 37 13. Fixed Asset Investments Peabody Investment in subsidiary undertakings Group Investment in non-subsidiary undertakings 2014 2013 2014 2013 £’000 £’000 £’000 £’000 At 1 April 5,050 5,050 – – Additions 2,674 – 458 – At 31 March 2014 7,724 5,050 458 – The financial statements consolidate the results of all entities (detailed in Note 24) which were subsidiaries of Peabody at the end of the year. Peabody is the ultimate parent undertaking. 14. Properties for Sale Peabody Group 2014 2013 2014 2013 £’000 £’000 £’000 £’000 5,994 5,994 22,499 22,499 – – 16,253 – 5,928 – 69,502 – (773) – (6,480) – (3,313) – (21,013) – Properties Work in progress Acquisition of Gallions Additions – work in progress Schemes completed Disposals Capitalised interest included in the above 7,836 5,994 80,760 22,499 477 223 1,939 456 Properties held for sale represents the costs of outright sales units and first tranche proportion of shared ownership units of development schemes currently under construction. It is anticipated that the net realisable value of the units will exceed the value held in current assets at the year end. 38 Peabody Report and financial statements for the year ended 31 March 2014 15.Debtors Peabody Group 2014 2013 2014 2013 £’000 £’000 £’000 £’000 Rent and service charges in arrears 13,559 12,671 16,390 13,435 Less: provision for bad debts (5,082) (4,967) 8,477 7,704 10,207 8,188 6,280 7,337 – – 139 126 167 136 11,104 5,237 12,912 7,931 26,000 20,404 23,286 16,255 180,042 87,684 – – Amounts falling due within one year: Amounts owed by subsidiary undertakings Loans to employees Other debtors and prepayments (6,183) (5,247) Amounts falling due within one year: Amounts owed by subsidiary undertakings At the balance sheet date, £137,505,000 (2013: £50,522,000) is on-lent to CBHA, a fixed interest rate of 7.1% is applicable to £16 million of the loan. The balance of the amount falling due after one year relates to Peabody (Services) Ltd totalling £36 million (2013: £37m) and Peabody Enterprises Ltd totalling £7m (2013: nil). 16. Creditors: Amounts Falling Due Within One Year Peabody Group 2014 2013 2014 2013 £’000 £’000 £’000 £’000 Trade creditors 2,521 2,100 5,592 2,627 Rent and service charges received in advance 7,070 7,893 7,460 8,274 Amounts owed to subsidiary undertakings 1,714 3,395 – – – – – – 1,338 1,023 8,991 1,110 24,770 17,916 46,777 20,951 4,000 2,000 4,000 2,000 41,413 34,327 72,820 34,962 Recycled capital grant fund (note 18) Other taxation and social security costs Accruals and deferred income Debt (note 20) Notes to the Accounts 39 17. Creditors: Amounts Falling Due After More Than One Year Peabody Group 2014 2013 2014 2013 £’000 £’000 £’000 £’000 325,330 551,503 962,960 551,195 Recycled capital grant fund (note 18) 1,511 1,789 2,495 1,870 Disposal proceeds fund (note 19) 1,666 4,498 1,666 4,498 348,549 4,661 – – 677,056 562,451 967,121 557,563 Debt (note 20) Amounts owed to subsidiary undertakings (note 20) 18. Recycled Capital Grant Fund Peabody At 1 April Reclassification from SHI Acquisition of Gallions Grant recycled Interest accrued Transfer to subsidiary Withdrawals – schemes started on site At 31 March There are no amounts repayable before 31 March 2015 (2014: nil). Group 2014 2013 2014 2013 £’000 £’000 £’000 £’000 1,789 7,696 5,338 7,783 543 – 543 – – – 904 – 1,909 2,060 1,907 2,060 4 42 5 42 – – – (2,050) (684) 1,511 (8,009) (6,202) (8,015) 1,789 2,495 1,870 40 Peabody Report and financial statements for the year ended 31 March 2014 19. Disposal Proceeds Funds Peabody At 1 April Net sale proceeds recycled Interest accrued Group 2014 2013 2014 2013 £’000 £’000 £’000 £’000 4,498 4,433 4,498 4,433 8 43 8 43 10 23 10 23 Withdrawals (2,850) At 31 March 1,666 (1) 4,498 (2,850) 1,666 (1) 4,498 There are no amounts repayable as at 31 March 2014 (2013: nil). Withdrawals from the disposal proceeds fund were used for approved works to existing housing properties. 20. Debt Analysis (a). Book Value of Debt Peabody Group 2014 2013 2014 2013 £’000 £’000 £’000 £’000 Bank and building society loans 327,000 408,750 510,600 408,750 Amounts owed to subsidiary undertaking 348,549 150,000 – – 2043 Bond – – 208,446 150,000 2053 Bond – – 251,750 – 675,549 558,750 970,796 558,750 Nominal Value Unamortised issue costs Bank and building society loans Amounts owed to subsidiary undertaking (1,670) – (1,670) (1,980) (1,598) (5,247) (3,836) – (3,836) (2,288) (1,598) (5,555) Book value and fair value Bank and building society loans 325,330 406,770 506,764 406,462 Amounts owed to subsidiary undertaking 348,549 148,402 – – 2043 Bond – – 208,446 148,402 2053 Bond – – 251,750 – 673,879 553,503 966,960 553,195 Notes to the Accounts 41 20. Debt Analysis (b). Maturity of Debt Peabody Group 2014 2013 2014 2013 £’000 £’000 £’000 £’000 4,000 2,000 4,000 2,000 – – – – 2043 Bond 25,000 14,000 25,000 14,000 2053 Bond 646,549 529,000 941,796 529,000 675,549 558,750 970,796 558,750 Bank and building society loans Amounts owed to subsidiary undertaking 20. Debt Analysis (c). Interest Analysis Peabody Fixed Floating Group 2014 2013 2014 2013 £’000 £’000 £’000 £’000 578,549 356,000 817,982 356,000 97,000 202,750 152,814 202,750 675,549 558,750 970,796 558,750 42 Peabody Report and financial statements for the year ended 31 March 2014 Bank and building society loans Bond 2053 (coupon rate 4.625%) The Group’s bank and building society loans are secured by specific charges over housing properties. The borrowings bear interest rates of between 0.7% and 6.9% and are repayable in instalments as disclosed in (b) above. On 6 December 2013, Peabody Capital No 2 PLC issued a £250 million Sterling Secured bond repayable in 40 years with an effective rate of 4.63% as shown in the Group figures. An additional £100 million was retained (issued at nil consideration) to be sold to the secondary market at a later date. This remains unsold at 31 March 2014. Amounts owed to subsidiary undertaking Peabody Capital PLC has made a loan to Peabody with a nominal value of £200m (2013: £150m) repayable in March 2043. The loan incurs an interest charge of 5.25% per annum paid semi-annually. Also in the year Peabody Capital No 2 PLC issued a loan of £140m at a rate of 4.625% also paid semi-annually. Bond 2043 (coupon rate 5.25%) On 17 March 2011, Peabody Capital PLC issued a £150 million Sterling Secured bond repayable in 32 years with an effective rate of 5.32% as shown above in the Group figures. An additional £50 million was retained (issued at nil consideration) to be sold to the secondary market at a later date. On 29 April 2013, Peabody Capital PLC sold the remaining £50 million of the 2043 Bond. The sale was transacted at a spread of 0.95% over the benchmark 2042 gilt, resulting in an all in cost of funding of 3.94% and proceeds of £61 million. Risks The main risks associated with the Group’s borrowings are interest rate risk and liquidity risk. The Finance and Investment Committee reviews and agrees policies for managing these risks and these are summarised below: Interest rate risk The Group regularly reviews its policy on the proportion of debt that should be held at fixed and floating interest rates. Liquidity risk Liquidity risk is the risk that the Group might be unable to meet its obligations. Expected cash flows from financial assets, in particular its cash resources and trade receivables, are used by the Directors in assessing and managing liquidity risk. At 31 March 2014 the Group had undrawn committed facilities of £275 million (2013: £106.75 million). The remaining £100 million of the 2053 Bond is held within Peabody Capital No 2 PLC which retains all rights and obligations relating to the retained bond. 21.Reserves Peabody Group 2014 2013 2014 2013 Peabody £’000 £’000 £’000 £’000 At 1 April 263,738 240,668 290,042 263,440 33,811 22,742 291,069 25,933 Surplus in the year Pension scheme acturial (loss) / gain Unrealised surplus on revaluation At 31 March (1,719) 328 (3,019) 669 – – 4,887 – 295,830 263,738 582,979 290,042 At 31 March 2014 reserves were all used in financing investment in social housing or in the programme of community regeneration activities. Any surpluses are reinvested in the above activities thus ensuring that Peabody is able to continue to deliver its mission to make London a city of opportunity for all by ensuring as many people as possible have a good home, real sense of purpose and a strong feeling of belonging. Notes to the Accounts 43 22.Reconciliation of Operating Surplus to Net Cash Inflow from Operating Activities Peabody Group 2014 2013 2014 2013 £’000 £’000 £’000 £’000 Operating surplus 47,689 38,735 49,353 43,403 Depreciation 11,844 12,218 15,385 12,792 – – (4,858) Decrease in investments – (Increase) / decrease in properties for sale (1,842) 1,285 (47,245) (15,220) (Increase) / decrease in debtors (5,596) (6,789) (2,039) (3,224) (Decrease) / increase in creditors (8,082) (9,973) 12,182 (10,277) Adjustment for pension funding (317) (210) Net cash inflow from operating activities (1,760) (140) 43,696 35,266 21,017 27,334 At 1 April 2013 Cash flow £’000 £’000 Other non-cash changes £’000 At 31 March 2014 £’000 5,261 11,352 – 16,613 5,261 11,352 – 16,613 23. Reconciliation of Movement in Net Debt Peabody Cash at bank and in hand Debt due after one year Debt due within one year Debtor due after more than one year Group Cash at bank and in hand Debt due before one year Debt due after one year (558,164) – (115,405) (310) (4,000) – 87,684 92,358 – (465,219) (15,695) (310) (673,879) (4,000) 180,042 (481,224) £’000 Other non-cash changes £’000 At 31 March 2014 £’000 11,224 136,780 – 148,004 11,224 136,780 – 148,004 At 1 April 2013 Cash flow £’000 (2,000) – (2,000) (4,000) (551,195) (235,713) (177,716) (964,624) (541,971) (98,933) (179,716) (820,620) 44 Peabody Report and financial statements for the year ended 31 March 2014 24. Legislative Provisions, Taxation and Subsidiary Undertakings Peabody is a registered charity formed under an Act of Parliament, and a registered provider registered with the Home and Communities Agency (HCA). Peabody has the following wholly owned subsidiaries, all of which are incorporated in Great Britain and have been included in the Group results (with the exception of Peabody Pension Trust Limited, which has been excluded on the grounds of materiality): – CBHA (a charitable company, limited by guarantee and a registered social landlord) – Peabody Enterprises Limited (registered social landlord) – Gallions Housing Association Limited (an Industrial and Provident society and a registered social landlord) – Peabody Capital PLC – Peabody Capital No 2 PLC – Peabody Land Limited – Peabody (Services) Limited – Peabody Group Maintenance Limited – Peabody Pension Trust Limited – Create Communities Limited – Freshleaf Homes Limited – Southmere Village Management Company Limited – Thamesmead Landscape Limited – Gateway Sustainable Investments Limited Peabody Land Limited, Peabody Enterprises Limited, Peabody (Services) Limited, Create Communities Limited and Freshleaf Homes Limited are trading subsidiaries involved in the development and sale of land and private residential property. Peabody Group Maintenance provides repairs & maintenance services to CBHA. Peabody Capital PLC and Peabody Capital No 2 PLC raise finance for the use of Peabody Trust and its subsidiaries. Southmere Village Management Company Limited provides management services for Gallions Housing Association. Gallions Housing Association Limited holds a 50% joint venture of Tilfen Land Limited (a commercial property company) and Freshleaf Homes Limited holds a 50% joint venture of Galley Ilford LLP (commercial development company). Freshleaf Homes Limited also holds an investment in Igloo Insurance PCC Limited (registered in Guernsey) which provides insurance services to Gallions Housing Association Limited. Notes to the Accounts 45 25. Transactions with Related Parties At 31 March 2014 there were two members of the Board or other Committees who had tenancy agreements with Peabody. There were seven residents involved with the Governance of CBHA at 31 March 2014. The tenancy agreements have been granted on the same terms as for all other residents, and the housing management procedures, including those relating to management of arrears have been applied consistently to these residents. Transactions with Tilfen Land Ltd – joint venture During the year, the group earned £10k of turnover in relation to property development and maintenance costs and costs of £4k being rent of a property from Tilfen. Gift aid paid from Tilfen to the Group totalled £2m. 26. Sale of Fixed Assets Peabody 2014 Group 2014 Proceeds Costs Surplus Proceeds Costs Surplus No £’000 £’000 £’000 No £’000 £’000 £’000 Shared ownership – fully staircased 20 2,738 1,703 1,035 26 3,450 2,187 1,263 Shared ownership – subsequent tranches 12 990 622 368 13 1,083 681 402 Social Homebuy 4 1,019 342 677 4 1,019 342 677 Right to Buy 2 260 67 193 18 2,125 481 1,644 Old stock 6 3,479 651 2,828 6 3,479 651 2,828 Disposal of land 3 14,013 13,960 53 4 888 303 585 Subsidised Housing loan repayment 6 73 – 73 6 73 – 73 Reclass of SHI Proceeds – 122 – 122 – 122 – 122 SHI Disposals – – – – – – (5) 5 Disposal other fixed assets – – – – – – 15 (15) 53 22,694 17,346 5,349 77 12,239 4,655 7,584 Total 46 Peabody Report and financial statements for the year ended 31 March 2014 27. Capital Commitments Peabody Capital expenditure contracted for but not provided for within the financial statements Capital expenditure authorised by the board, but not contracted Group 2014 2013 2014 2013 £’000 £’000 £’000 £’000 138,418 3,070 378,602 16,277 80,948 85,507 691,637 208,557 All of this anticipated expenditure is covered by Social Housing Grant, reserves and debt finance. 28. Contingent Liabilities There are no known material contingent liabilities as at 31 March 2014 (2013: £nil). 29. Intra Group Transactions Between Regulated and Non-Regulated Entities Peabody, Peabody Enterprises Ltd and Peabody (Services) Ltd develop mixed tenure sites together under single construction contracts. The social elements of the sites belong to Peabody and the open market sale elements to Peabody Enterprises Ltd. Peabody (Services) Ltd provides build and design services to both companies. Costs are allocated to individual units within the developments on a square metre basis. Create Communities Limited and Freshleaf Homes Limited develop mixed tenure sites for Gallions Housing Association Limited whereby the social elements belong to Gallions and the open market sale elements to Freshleaf Homes Limited. The material recharges for services between non-regulated entities and regulated entities are: From Non-regulated entity To Regulated entity Total Peabody (Services) Limited Peabody Trust £10.8m Peabody (Services) Limited Peabody Enterprises £32.5m Create Communities Limited Gallions £9.6m 30. Post Balance Sheet Events On 1 April 2014 Trust Thamesmead joined the Peabody Group bringing the remaining 50% share of Tilfen Land Limited which is now a 100% member of the Group. As shown in note 13, acquisition costs of £458,000 are recognised as an investment at the balance sheet date. Notes to the Accounts 47 31. Gift on Acquisition On 3 January 2014 Gallions Housing Association, a registered housing provider based in Sidcup, joined the Group. As the substance of the transaction is gifting control for nil consideration this has been accounted for as a non-exchange transaction under Statement of Recommended Practice: Accounting by Registered Social Housing Providers Update 2010 accounting rules and has been included in the Group’s consolidated balance sheet as follows: Group Balance sheet on acquisition Fair value adjustment Fair value Balance Sheet to Group £’000 £’000 £’000 261,343 126,883 388,226 2,725 – 2,725 44,633 – 44,633 244 – 244 Current assets 24,611 – 24,611 Creditors: amounts falling due within one year (11,117) – (11,117) (178,711) – (178,711) Housing Properties Tangible Fixed Assets Joint venture Investment in Starter Home Initiative Creditors: amounts falling due after one year Provisions (10,241) Net assets acquired 133,487 (944) 125,939 Costs on acquisition (11,185) 259,426 (2,979) Gain recognised on acquisition 256,447 The financial results of Gallions for the year to 31 March 2013 and for the period to the date of acquisition were as follows: Turnover £’000 Operating surplus £’000 Deficit before tax £’000 Deficit after tax £’000 Financial year to 31 March 2013 54,761 5,389 (870) (864) 1 April 2013 to 3 January 2014 47,870 756 (3,354) (3,476) 48 Peabody Report and financial statements for the year ended 31 March 2014 32. Investments in Starter Home Initiative Peabody Group 2014 2014 £’000 £’000 – 1,831 Reclassification from housing properties 10,386 10,386 Disposals in the year (3,568) (3,664) At 31 March 6,818 8,553 – 1,576 Reclassification from housing properties 9,175 9,175 Disposals in the year (3,413) (3,498) At 31 March 5,762 7,253 Net book value at 31 March 1,056 1,300 Peabody Group 2014 2014 £’000 £’000 Acquisition of Gallions – 1,688 At end of the year – 1,688 Loans At 1 April Grant At 1 April 33. Provisions for Liabilities and Charges This provision was made in Gallions during year ended 31 March 2009 for non-structural uninsured and required remedial works as a result of developer failure. Notes to the Accounts 49 34. Investment in Joint Venture Gallions holds a 50% interest in Tilfen Land Limited with Trust Thamesmead. Details of the results of this joint venture are detailed below: 2014 £’000 Share of turnover before gift aid Share of profit before and after tax 1,070 196 Movement in net assets Being: Share of operating surplus in joint venture 196 Share of joint venture interest receivable 11 Share of joint venture interest payable (17) Share of assets: Fixed assets 48,110 Current assets 19,207 Share of gross assets 67,317 Share of liabilities: Creditors due within one year Creditors due after more than one year Provision for liabilities and charges Provision for defined benefit obligations Share of gross liabilities Share of net assets (12,423) – (6,539) (588) (19,550) 47,767 50 Peabody Report and financial statements for the year ended 31 March 2014 Contact Details Peabody 45 Westminster Bridge Road London SE1 7JB Tel: 020 7021 4000 Fax: 0 20 7021 4004 Email: info@peabody.org.uk Website: w ww.peabody.org.uk Peabody is constituted under the Peabody Donation Fund Act 1948, as amended by The Charities (The Peabody Donation Fund) Order 1997. PUB_14_011 © Peabody 2014