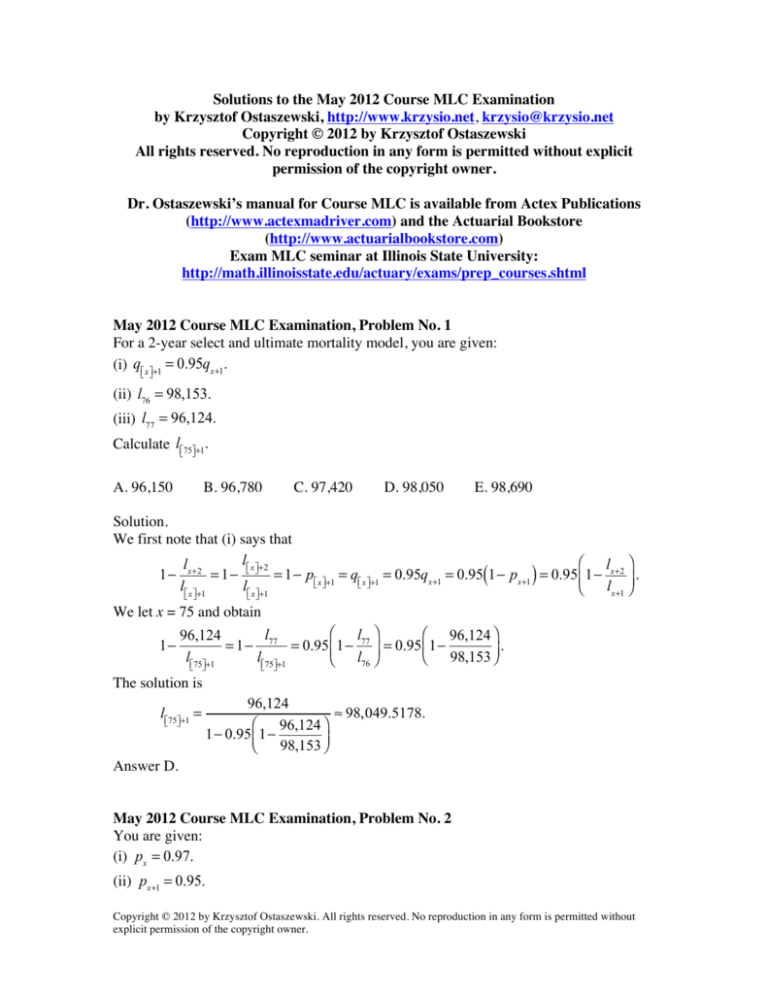

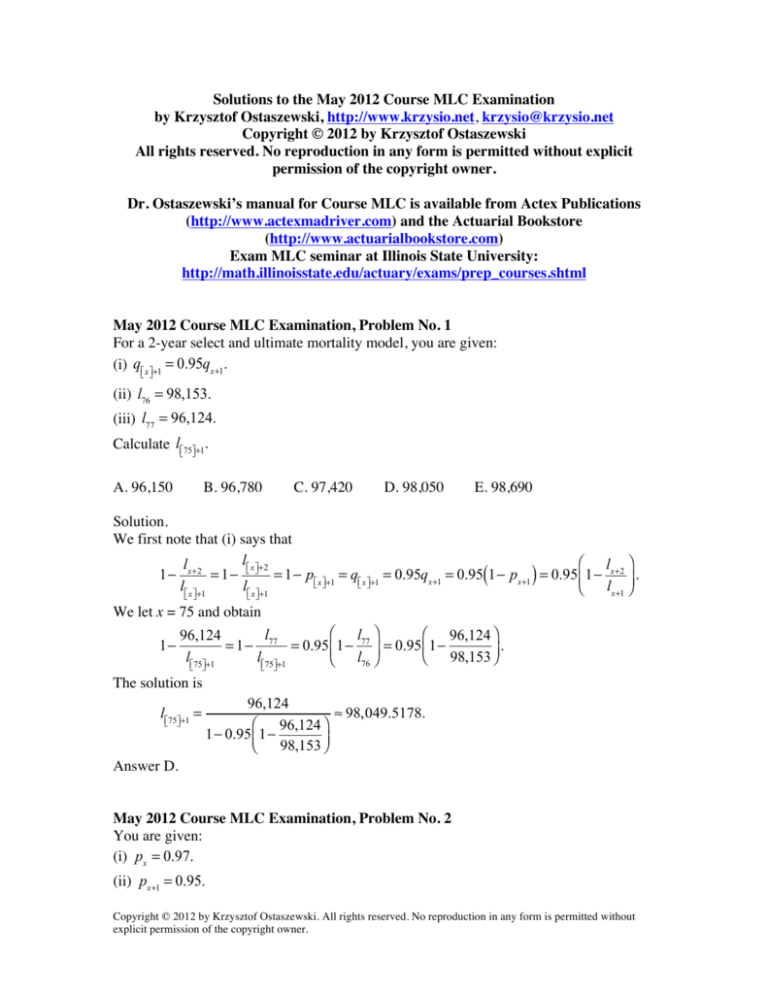

Solutions to the May 2012 Course MLC Examination

by Krzysztof Ostaszewski, http://www.krzysio.net, krzysio@krzysio.net

Copyright © 2012 by Krzysztof Ostaszewski

All rights reserved. No reproduction in any form is permitted without explicit

permission of the copyright owner.

Dr. Ostaszewski’s manual for Course MLC is available from Actex Publications

(http://www.actexmadriver.com) and the Actuarial Bookstore

(http://www.actuarialbookstore.com)

Exam MLC seminar at Illinois State University:

http://math.illinoisstate.edu/actuary/exams/prep_courses.shtml

May 2012 Course MLC Examination, Problem No. 1

For a 2-year select and ultimate mortality model, you are given:

(i) q⎡ x ⎤+1 = 0.95qx+1.

⎣ ⎦

(ii) l76 = 98,153.

(iii) l77 = 96,124.

Calculate l⎡75⎤+1.

⎣ ⎦

A. 96,150

B. 96,780

C. 97,420

D. 98,050

E. 98,690

Solution.

We first note that (i) says that

l⎡ x ⎤+2

⎛ l ⎞

l

1− x+2 = 1− ⎣ ⎦ = 1− p⎡ x ⎤+1 = q⎡ x ⎤+1 = 0.95qx+1 = 0.95(1− px+1 ) = 0.95 ⎜ 1− x+2 ⎟ .

⎣ ⎦

⎣ ⎦

l⎡ x ⎤+1

l⎡ x ⎤+1

lx+1 ⎠

⎝

⎣ ⎦

⎣ ⎦

We let x = 75 and obtain

⎛ l ⎞

l

⎛ 96,124 ⎞

96,124

= 1− 77 = 0.95 ⎜ 1− 77 ⎟ = 0.95 ⎜ 1−

.

l⎡75⎤+1

l⎡75⎤+1

⎝ 98,153 ⎟⎠

⎝ l76 ⎠

1−

⎣

⎦

⎣

⎦

The solution is

l⎡75⎤+1 =

⎣

⎦

96,124

≈ 98,049.5178.

⎛ 96,124 ⎞

1− 0.95 ⎜ 1−

98,153 ⎟⎠

⎝

Answer D.

May 2012 Course MLC Examination, Problem No. 2

You are given:

(i) px = 0.97.

(ii) px+1 = 0.95.

Copyright © 2012 by Krzysztof Ostaszewski. All rights reserved. No reproduction in any form is permitted without

explicit permission of the copyright owner.

(iii) ex+1.75 = 18.5.

(iv) Deaths are uniformly distributed between ages x and x +1.

(v) The force of mortality is constant between ages x +1 and x + 2.

Calculate ex+0.75 .

A. 18.6

B. 18.8

C. 19.0

D. 19.2

E. 19.4

Solution.

The unusual twist in this problem is that the curtate life expectancy is calculated at

fractional age. But we can just apply the standard formula for curtate life expectancy and

see how things work out:

ex+0.75 = 1 px+0.75 + 2 px+0.75 + 3 px+0.75 + .... =

= 1 px+0.75 + 1 px+0.75 ⋅ 1 px+1.75 + 1 px+0.75 ⋅ 2 px+1.75 + ... =

= 1 px+0.75 (1+ 1 px+1.75 + 2 px+1.75 + ...) = 1 px+0.75 (1+ ex+1.75 ) .

(

)

Of course you could just memorize the formula ey = 1 p y 1+ ey+1 and apply it for

y = x + 0.75. Using the value given, we get

ex+0.75 = 1 px+0.75 (1+ ex+1.75 ) = 1 px+0.75 (1+ 18.5) = 19.5⋅ 1 px+0.75 .

Thus we need to calculate the probability 1 px+0.75 . Note that of the year between the age x

+ 0.75 and x + 1.75, a quarter of a year is between age x and age x + 1, under the UDD

assumption, and the remaining three quarters are between age x + 1 and age x + 2, under

the constant force assumption. We observe that

p

= 0.25 px+0.75 ⋅ 0.75 px+1 .

1 x+0.75

UDD assumption CF assumption

applies

applies

We use the UDD assumption to calculate

0.25

px+0.75 :

0.25

0.25

px+0.75 = 1− 0.25 qx+0.75 = 1−

= 1−

0.25

d x+0.75

lx+0.75

= 1−

UDD

0.25

dx

lx+0.75

= 1−

dx

lx

lx+0.75

lx

= 1−

qx

=

p

0.75 x

0.25

0.25(1− px )

qx

0.25qx

0.25⋅0.03

= 1−

= 1−

= 1−

≈ 0.9923.

1− 0.75 qx UDD 1− 0.75qx

1− 0.75⋅0.03

1− 0.75(1− px )

0.25

Again, it is a good idea to just memorize the formula used in the above calculation:

sqx

p = 1−

.

s x+t UDD

1− tqx

Now we will use the constant force assumption to calculate

0.75

px+1. Let us denote that

constant force between ages x + 1 and x + 2 by µ and observe that px+1 = 0.95 = e− µ , so

that µ = − ln0.95. Based on this:

0.75

px+1 = e−0.75µ = e

−0.75( − ln0.95)

= 0.950.75 ≈ 0.9623.

Copyright © 2012 by Krzysztof Ostaszewski. All rights reserved. No reproduction in any form is permitted without

explicit permission of the copyright owner.

Combining these results we obtain

ex+0.75 = 19.5⋅ 1 px+0.75 = 19.5⋅ 0.25 px+0.75 ⋅ 0.75 px+1 ≈ 19.5⋅0.9923⋅0.9623 ≈ 18.6201.

Answer A.

May 2012 Course MLC Examination, Problem No. 3

For a fully discrete 3-year term insurance of 10,000 on (40), you are given:

(i) µ40+t , t ≥ 0, is a force of mortality consistent with the Illustrative Life Table.

(ii) µ40+t + 0.02, t = 0, 1, 2, is the force of mortality for this insured.

(iii) i = 0.06.

Calculate the annual benefit premium for this insurance.

A. 196

B. 214

C. 232

D. 250

E. 268

Solution.

Let us denote probabilities referring to the Illustrative Life Table by a superscript (ILT),

and probabilities referring to this insured by a superscript (I). We have

∫ ( µ40+s +0.02) ds

t

( I)

p40 = e

Therefore,

−

( ILT)

0

t

( ILT) 0.02t

= t p40

⋅e .

()

()

() ()

a40:3

= 1+ vp40

+ v 2 p40

p41 =

I

I

I

I

( ILT) −0.02

( ILT) −0.02 ( ILT) −0.02

= 1+ 1.06−1 ⋅ p40

⋅e

+ 1.06−2 ⋅ p40

⋅e

⋅ p41 ⋅ e

=

(

)

(

)(

)

( ILT)

( ILT)

( ILT)

= 1+ 1.06−1 ⋅ 1− q40

⋅ e−0.02 + 1.06−2 ⋅ 1− q40

⋅ 1− q41

⋅ e−0.04 =

= 1+ 1.06−1 ⋅ (1− 0.00278) ⋅ e−0.02 + 1.06−2 ⋅ (1− 0.00278) ⋅ (1− 0.00298) ⋅ e−0.04 ≈

≈ 2.7723

and

()

()

A40:3

= 1− d

a40:3

≈ 1−

I

I

0.06

⋅ 2.7723 ≈ 0.8431.

1.06

Furthermore,

( I) ( I) ( I)

( ILT) ( ILT) ( ILT) −0.06

p40

⋅ p41 ⋅ p42 p40

⋅ p41 ⋅ p42 ⋅ e

E =

=

=

3 40

3

1.06

1.063

( I)

1− q( ) ) ⋅ (1− q( ) ) ⋅ (1− q( ) ) ⋅ e

(

=

ILT

40

=

ILT

41

ILT

42

−0.06

=

1.063

(1− 0.00278) ⋅ (1− 0.00298) ⋅ (1− 0.00320) ⋅ e−0.06

1.063

≈ 0.7837.

Therefore,

1

I

I

( I)

A40:3 ( ) = A40:3

− 3 E40( ) ≈ 0.8431− 0.7837 = 0.0594.

The premium sought is

Copyright © 2012 by Krzysztof Ostaszewski. All rights reserved. No reproduction in any form is permitted without

explicit permission of the copyright owner.

10,000 ⋅ A40:3 ( )

1

I

I

( )

a40:3

≈

10,000 ⋅0.0594

≈ 214.3183.

2.7723

Answer B.

May 2012 Course MLC Examination, Problem No. 4

For a 3-year term insurance of 1000 on [75], you are given:

(i) Death benefits are payable at the end of the year of death.

(ii) Level premiums are payable at the beginning of each quarter.

(iii) Mortality follows a select and ultimate life table with a two-year select period:

x

x+2

lx+2

l⎡ x ⎤

l⎡ x ⎤+1

⎣ ⎦

⎣ ⎦

75

15,930

15,668

15,286

76

15,508

15,224

14,816

77

15,050

14,744

14,310

(iv) Deaths are uniformly distributed over each year of age.

(v) i = 0.06.

Calculate the amount of each quarterly benefit premium.

A. 5.3

B. 5.5

C. 5.7

D. 5.9

77

78

79

E. 6.1

Solution.

The single benefit premium is

A⎡175⎤:3 = vq⎡75⎤ + v 2 p⎡75⎤ q⎡75⎤+1 + v 3 p⎡75⎤ p⎡75⎤+1q77 =

⎣

⎣

⎦

⎦

⎣

⎦ ⎣

⎦

⎣

⎦

⎣

⎦

1 15930 − 15668

1 15668 15668 − 15286

⋅

+

⋅

⋅

+

1.06

15930

15668

1.062 15930

1 15668 15286 15286 − 14816

+

⋅

⋅

⋅

15286

1.062 15930 15668

1

262

1

362

1

470

=

⋅

+

⋅

+

⋅

≈ 0.0620.

2

2

1.06 15930 1.06 15930 1.06 15930

The annuity factor is

1 15668

1 15668 15286

a⎡75⎤:3 = 1+ vp⎡75⎤ + v 2 p⎡75⎤ p⎡75⎤+1 = 1+

⋅

+

⋅

⋅

≈ 2.7819.

⎣ ⎦

⎣ ⎦ ⎣ ⎦

⎣ ⎦

1.06 15930 1.062 15930 15668

Furthermore,

l 75 +3 1

l

1

14816 1

3 p[ 75 ]

= [ ] ⋅

= 78 ⋅

=

⋅

≈ 0.7809.

3 E[ 75 ] =

3

3

3

1.06

l[ 75 ] 1.06

l[ 75 ] 1.06 15930 1.06 3

=

We obtain the values α ( 4 ) = 1.00027 and β ( 4 ) = 0.38424 from the Illustrative Life

Table, although we should note that we can use the Table because the interest rate used,

i = 6%, is the one used in the Table as well. Otherwise we would have to struggle with

i − i(4)

id

these formulas: α ( 4 ) = ( 4 ) ( 4 ) and β ( 4 ) = ( 4 ) ( 4 ) . Based on the UDD assumption, we

i d

i d

Copyright © 2012 by Krzysztof Ostaszewski. All rights reserved. No reproduction in any form is permitted without

explicit permission of the copyright owner.

calculate

(

)

4)

a[(75

= a[ 75 ]:5 ⋅ α ( 4 ) − β ( 4 ) 1− 3 E[ 75 ] ≈

]:5

UDD

≈ 2.7819 ⋅1.00027 − 0.38424 ⋅ (1− 0.7809 ) ≈ 2.6985.

The annual level benefit premium for the policy (remember that this policy has 1000

benefit, not unit benefit) is

1000 ⋅ A[175 ]:3 1000 ⋅ 0.0620

=

≈ 22.84.

4)

2.6985

a[(75

]:5

But the question asks about the quarterly premium, which is a quarter of this, i.e., 5.71.

Answer C.

May 2012 Course MLC Examination, Problem No. 5

For a whole life insurance on (80):

(i) Level premiums of 900 are payable at the start of each year.

(ii) Commission expenses are 50% of premium in the first year and 10% of premium in

subsequent years, payable at the start of the year.

(iii) Maintenance expenses are 3 per month, payable at the start of each month.

(iv) δ = 0.0488.

(v) a80 = 6.000.

(vi) µ80 = 0.033.

Using the first 3 terms of Woolhouse’s formula, calculate the expected value of the

present-value-of-expenses random variable at age 80.

A. 920

B. 940

C. 1010

D. 1100

E. 1120

Solution.

Recall that the Woolhouse's formula with three terms is

m − 1 m2 − 1

(m)

ax ≈ ax −

−

(δ + µx ).

2m 12m 2

You must memorize this formula for the test. While the premium is payable annually, the

maintenance expenses are paid monthly, and we will use this Woolhouse’s formula for

the calculation of their present value. For the maintenance expenses, m = 12,

ax = a80 = 6.000, µ80 = 0.033, δ = 0.0488, so that

12 − 1 12 2 − 1

−

( 0.0488 + 0.033) ≈ 5.5349.

2 ⋅12 12 ⋅12 2

The first year commission is 50% of 900, i.e., 450. The renewal commissions are 10% of

900, i.e., 90 each. Thus the expected present value of expenses as calculated at age 80 is

(12 )

450 + 90a80

+

3⋅12 ⋅ a80

=

(12 )

a80

≈6−

Actuarial present value of commissions

Actuarial present value of maintenance expenses

(12 )

= 360 + 90

a80 + 36

a80

= 360 + 540 + 36 ⋅ 5.5349 ≈ 1099.

Answer D.

Copyright © 2012 by Krzysztof Ostaszewski. All rights reserved. No reproduction in any form is permitted without

explicit permission of the copyright owner.

May 2012 Course MLC Examination, Problem No. 6

Two whales, Hannibal and Jack, occupy the Ocean World aquarium. Both are currently

age 6 with independent future lifetimes. Hannibal arrived at Ocean World at age 4 and

Jack at age 6. The standard mortality for whales is as follows:

x

qx

6

0.06

7

0.07

8

0.08

9

0.09

Whales arriving at Ocean World have mortality according to the following:

• 150% of standard mortality in year 1

• 130% of standard mortality in year 2

• 110% of standard mortality in year 3

• 100% of standard mortality in years 4 and later.

As whales can get lonely on their own, a fund is set up today to provide 100,000 to

replace a whale at the end of 3 years if exactly one survives. You are given that i = 0.06.

Calculate the initial value of the fund using the equivalence principle.

A. 24,500

B. 29,200

C. 29,300

D. 30,900

E. 31,900

Solution.

Hannibal arrived at Ocean World at age 4, and is now 6, thus Hannibal’s future mortality

rates are

q6H = 1.1⋅ 0.06 = 0.066, q7H = 1⋅ 0.07 = 0.07, q8H = 1⋅ 0.08 = 0.08.

Jack arrived at Ocean World at age 6, and is now 6, thus Jack’s future mortality rates are

q6J = 1.5 ⋅ 0.06 = 0.09, q7J = 1.30 ⋅ 0.07 = 0.091, q8J = 1.5 ⋅ 0.08 = 0.088.

Based on this,

p6H = 0.934, p7H = 0.93, p8H = 0.92, p6J = 0.91, p7J = 0.909, q8J = 0.912,

H

H

H

H

3 p6 = p6 ⋅ p7 ⋅ p8 = 0.934 ⋅ 0.93⋅ 0.92 ≈ 0.7991304,

J

J

J

J

3 p6 = p6 ⋅ p7 ⋅ p8 = 0.91⋅ 0.909 ⋅ 0.912 ≈ 0.75439728,

and, thanks to independence of lives,

H

J

3 p6:6 = 3 p6 ⋅ 3 p6 ≈ 0.7991304 ⋅ 0.75439728 ≈ 0.6028618.

The probability of exactly one surviving three years, given that the lifetimes are

independent, is

H

J

H

J

3 p6:6 − 3 p6:6 = ( 3 p6 + 3 p6 − 3 p6:6 ) − 3 p6:6 = 3 p6 + 3 p6 − 2 3 p6:6 ≈

= 3 p6:6 by Poohsticks

≈ 0.7991304 + 0.75439728 − 2 ⋅ 0.6028618 ≈ 0.34780408.

The initial value of the fund using the equivalence principle is simply the actuarial

present value of the payment of 100,000 at time 3, i.e.,

100,000 ⋅ 0.34780408 ⋅1.06 −3 ≈ 29,202.30.

Answer B.

Copyright © 2012 by Krzysztof Ostaszewski. All rights reserved. No reproduction in any form is permitted without

explicit permission of the copyright owner.

May 2012 Course MLC Examination, Problem No. 7

For a single premium product replacement insurance on a computer, you are given:

(i) The insurance pays a percentage of the cost of a new computer at the end of the year

of failure within the first 5 years.

(ii) The insurance will pay only once.

(iii) The insurance is bought at the time of the purchase of the computer.

(iv) The cost of a new computer increases by 2% each year, compounded annually. The

insurance pays based on the increased cost.

(v) The insurance benefit and probabilities of failure are as follows:

Year of

Percentage of cost of new

Probability of computer

failure k

computer covered

failure k−1 q0

1

100%

0.01

2

80%

0.01

3

60%

0.02

4

40%

0.02

5

20%

0.02

(vi) The commission is c% of the gross premium.

(vii) Other expenses are 5% of the gross premium.

(viii) The gross premium, calculated using the equivalence principle, is 10% of the

original cost of the computer.

(ix) i = 0.04.

Calculate c%.

A. 40%

B. 45%

C. 50%

D. 55%

E. 60%

Solution.

Note that the last column, the probability of computer failure, is the probability expressed

as a fraction of the initial computer population at policy inception (because this is

deferred probability). Let us write G for the gross single premium for this policy. Let us

also write c for the commission, written as a fraction (instead of c%, we will switch back

to percentages at the end of the solution). Let us also write K for the current cost of the

computer. We use the equivalence principle and equate, at time 0, the actuarial present

value of the premium (left-hand side) with the actuarial present value of benefits and

expenses (right-hand side):

K ⋅1.02 ⋅ 0.01 0.8 ⋅ K ⋅1.02 2 ⋅ 0.01

G = 0.1K = ( 0.05 + c ) G +

+

+

1.04

1.04 2

0.6 ⋅ K ⋅1.02 3 ⋅ 0.02 0.4 ⋅ K ⋅1.02 4 ⋅ 0.02 0.2 ⋅ K ⋅1.02 5 ⋅ 0.02

+

+

+

.

1.04 3

1.04 4

1.04 5

This means that

K ⋅1.02 ⋅ 0.01 0.8 ⋅ K ⋅1.02 2 ⋅ 0.01

0.1K = ( 0.05 + c ) ⋅ 0.1K +

+

+

1.04

1.04 2

0.6 ⋅ K ⋅1.02 3 ⋅ 0.02 0.4 ⋅ K ⋅1.02 4 ⋅ 0.02 0.2 ⋅ K ⋅1.02 5 ⋅ 0.02

+

+

+

1.04 3

1.04 4

1.04 5

We divide both sides by K and solve for c:

Copyright © 2012 by Krzysztof Ostaszewski. All rights reserved. No reproduction in any form is permitted without

explicit permission of the copyright owner.

0.1− 0.005 1.02 ⋅ 0.01 0.8 ⋅1.02 2 ⋅ 0.01

−

−

−

0.1

1.04 ⋅ 0.1

1.04 2 ⋅ 0.1

0.6 ⋅1.02 3 ⋅ 0.02 0.4 ⋅1.02 4 ⋅ 0.02 0.2 ⋅1.02 5 ⋅ 0.02

−

−

−

≈ 0.55144085.

1.04 3 ⋅ 0.1

1.04 4 ⋅ 0.1

1.04 5 ⋅ 0.1

Answer D.

c=

May 2012 Course MLC Examination, Problem No. 8

For a fully discrete whole life insurance of 1000 on (80):

(i) i = 0.06.

(ii) a80 = 5.89.

(iii) a90 = 3.65.

(iv) q80 = 0.077.

Calculate 10V FTP , the full preliminary term reserve for this policy at the end of year 10.

A. 340

B. 350

C. 360

D. 370

E. 380

Solution.

Note that

5.89 = a80 = 1+ 1.06 −1 ⋅ p80 ⋅ a81 = 1+

Therefore,

a81 = 4.89 ⋅

1− 0.077

⋅ a81 .

1.06

1.06

4.89 ⋅1.06

=

≈ 5.6158.

1− 0.077

0.923

We have

1000α FPT = 1000 ⋅

0.077

77

=

,

1.06 1.06

and

0.06

1−

⋅ a81

A

1−

d

a

81

1000 β FPT = 1000 ⋅ P81 = 1000 ⋅ 81 = 1000 ⋅

= 1000 ⋅ 1.06

=

a81

a81

a81

0.06 4.89 ⋅1.06

⋅

0.923 ≈ 121.4647.

= 1000 ⋅ 1.06

4.89 ⋅1.06

0.923

We do not really need the value of α FPT but calculating it is a good exercise. We then

conclude that

FTP

= 1000 ⋅ A90 − 1000 β FPT ⋅ a90 = 1000 ⋅ (1− d

a90 ) − 1000 β FPT ⋅ a90 =

10V

1−

⎛ 0.06

⎞

= 1000 ⋅ ⎜ 1−

⋅ 3.65 ⎟ − 121.4647 ⋅ 3.65 ≈ 350.0502.

⎝ 1.06

⎠

Answer B.

Copyright © 2012 by Krzysztof Ostaszewski. All rights reserved. No reproduction in any form is permitted without

explicit permission of the copyright owner.

May 2012 Course MLC Examination, Problem No. 9

A special fully discrete 3-year endowment insurance on (x) pays death benefits as

follows:

Year of Death

Death Benefit

1

30,000

2

40,000

3

50,000

You are given:

(i) The maturity benefit is 50,000.

(ii) Annual benefit premiums increase at 10% per year, compounded annually.

(iii) i = 0.05.

(iv) qx = 0.09, qx+1 = 0.12, qx+2 = 0.15.

Calculate 2V, the benefit reserve at the end of year 2.

A. 28,000

B. 29,000

C. 30,000

D. 31,000

E. 32,000

Solution.

Let us write P for the first year premium. The benefit reserve at the end of year 2 is the

actuarial present value of future benefits minus the actuarial present value of future

premiums, i.e.,

−1

− P ⋅1.12.

2V = 50000 ⋅1.05

We do not know the value of P but we can find it. The use of the expressions “benefit

reserve” and “benefit premiums” implies that we are using the equivalence principle.

Therefore, the actuarial present value of future benefits is equal to the actuarial present

value of future premiums at policy inception, resulting in:

30,000 ⋅ qx ⋅1.05 −1 + 40,000 ⋅ px ⋅ qx+1 ⋅1.05 −2 + 50,000 ⋅ px ⋅ px+1 ⋅1.05 −3 =

= P + 1.1⋅ P ⋅ px ⋅1.05 −1 + 1.12 ⋅ P ⋅ px ⋅ px+1 ⋅1.05 −2.

Therefore,

P=

30,000 ⋅ qx ⋅1.05 −1 + 40,000 ⋅ px ⋅ qx+1 ⋅1.05 −2 + 50,000 ⋅ px ⋅ px+1 ⋅1.05 −3

=

1+ 1.1⋅ px ⋅1.05 −1 + 1.12 ⋅ px ⋅ px+1 ⋅1.05 −2

30,000 ⋅ 0.09 ⋅1.05 −1 + 40,000 ⋅ 0.91⋅ 0.12 ⋅1.05 −2 + 50,000 ⋅ 0.91⋅ 0.88 ⋅1.05 −3

≈

1+ 0.91⋅1.05 −1 + 0.91⋅ 0.88 ⋅1.05 −2

≈ 14,519.1584.

We conclude that

−1

− P ⋅1.12 ≈ 50000 ⋅1.05 −1 − 14,519.1584 ⋅1.12 ≈ 30,050.8660.

2V = 50000 ⋅1.05

Answer C.

=

May 2012 Course MLC Examination, Problem No. 10

For a universal life insurance policy on Julie, you are given:

(i) At t = 0, Julie will pay a premium of 100.

(ii) At t =1, Julie will pay a premium of 50 with a probability of 0.8 or will pay nothing

otherwise.

(iii) At t = 2, Julie will pay a premium of 50 with probability of 0.9 if she paid the

Copyright © 2012 by Krzysztof Ostaszewski. All rights reserved. No reproduction in any form is permitted without

explicit permission of the copyright owner.

premium at t = 1 or will pay nothing otherwise.

(iv) During the first three years, Julie will pay no other premiums.

(v) i = 0.04.

(vi) Assume no deaths or surrenders in the first three years.

Calculate the standard deviation of the present value at issue of premiums paid during the

first three years.

A. 30

B. 32

C. 34

D. 36

E. 38

Solution.

Let us write Y for the random present value at issue of premiums paid during the first

three years. The premiums can be paid only at time 0, or only at times 0 and 1, or only at

times 0, 1, and 2. Y is a discrete random variable with the following description:

Values of Y

Circumstances producing

Probability of the value

the value

100

No premium paid at time

0.20

t=1

Premium paid at time t = 1

50

0.80 ⋅ 0.10 = 0.08

100 +

≈ 148.08

but

not

paid

at

time

t

=

2

1.04

Premiums paid at all

50

50

0.80 ⋅ 0.90 = 0.72

100 +

+

≈ 194.31 possible times: t = 0, 1, 2

2

1.04 1.04

Based on this,

50 ⎞

50

50 ⎞

⎛

⎛

E (Y ) = 100 ⋅ 0.20 + ⎜ 100 +

⋅ 0.08 + ⎜ 100 +

+

⎟

⎟ ⋅ 0.72 ≈ 171.7496,

⎝

⎝

1.04 ⎠

1.04 1.04 2 ⎠

2

2

50 ⎞

50

50 ⎞

⎛

⎛

E (Y ) = 100 ⋅ 0.20 + ⎜ 100 +

⋅ 0.08 + ⎜ 100 +

+

⎟

⎟ ⋅ 0.72 ≈

⎝

⎝

1.04 ⎠

1.04 1.04 2 ⎠

2

2

≈ 30,938.80,

and

σ Y = Var (Y ) = E (Y 2 ) − ( E (Y )) ≈ 30938.80 − 171.7496 2 ≈ 37.96.

2

Answer E.

May 2012 Course MLC Examination, Problem No. 11

For a universal life insurance policy with death benefit of 10,000 plus account value, you

are given:

(i)

Policy

Monthly

Percent of

Cost of

Monthly

Surrender

Year

Premium

Premium

Insurance Rate Expense

Charge

Charge

Per Month

Charge

1

100

30%

0.001

5

300

2

100

10%

0.002

5

100

(12 )

(ii) The credited interest rate is i = 0.048.

(iii) The actual cash surrender value at the end of month 11 is 1000.

Copyright © 2012 by Krzysztof Ostaszewski. All rights reserved. No reproduction in any form is permitted without

explicit permission of the copyright owner.

(iv) The policy remains in force for months 12 and 13, with the monthly premiums of 100

being paid at the start of each month.

Calculate the cash surrender value at the end of month 13.

A. 1130

B. 1230

C. 1330

D. 1400

E. 1460

Solution.

The credited interest rate is 0.004 per month. We are given that the actual cash surrender

value at the end of month 11 is 1000, and that the surrender charge during the first year is

300, so that we can conclude that the account value at the end of month 11 is the sum of

these two values, 1000 + 300 = 1300. The cost of insurance in month 12 is 0.001 of

10000, i.e., 10, if paid at the end of the month. Therefore, the account value at the end of

the 12-th month is

AV12 months (1300 + 100 ⋅ (1− 0.3) − 5 ) ⋅1.004 − 10 = 1360.46.

The cost of insurance in month 13 is 0.002 of 10,000, i.e., 20, if paid at the end of the

month. Therefore, the account value at the end of the 13-th month is

AV13 months (1360.46.+ 100 ⋅ (1− 0.1) − 5 ) ⋅1.004 − 20 = 1, 431.24.

The cash surrender value is the account value after subtraction of the surrender charge of

100, i.e., 1,331.24. Note that while we subtracted the cost of insurance in both months,

there were no subtractions for death benefits in either, because we know that the policy

remained in force till the end of the 13-th month.

Answer C.

May 2012 Course MLC Examination, Problem No. 12

Employees in Company ABC can be in:

State 0: Non-executive employee

State 1: Executive employee

State 2: Terminated from employment

John joins Company ABC as a non-executive employee at age 30. You are given:

(i) µ 01 = 0.01 for all years of service.

(ii) µ 02 = 0.006 for all years of service.

(iii) µ12 = 0.002 for all years of service.

(iv) Executive employees never return to the non-executive employee state.

(v) Employees terminated from employment never get rehired.

(vi) The probability that John lives to age 65 is 0.9, regardless of state.

Calculate the probability that John will be an executive employee of Company ABC at

age 65.

A. 0.232

B. 0.245

C. 0.258

D. 0.271

E. 0.284

Solution.

Let us consider survival in terms of the years of future service. In order to be an executive

employee at age 65, John, who is 30 years old now, has to survive 35 years as an

Copyright © 2012 by Krzysztof Ostaszewski. All rights reserved. No reproduction in any form is permitted without

explicit permission of the copyright owner.

employee, and at some point between now and the end of those 35 years has to become

an executive employee and not get terminated for the remaining period during the 35

years. Note that he also has to live for those 35 years, i.e., be alive at age 65, but we are

told that the probability of that is 0.9 and is independent of the state he is in at age 65, so

we can simply calculate the probability of him being an executive employee at age 65

assuming he is alive, and then multiply that by 0.9, the probability that he will be alive, to

get the desired answer. In formula terms, we are simply looking for

35

0.9 ⋅ 35 p001 = 0.9 ⋅ ∫

01

µ

t

⋅

00

t p0

⋅

dt =

11

35−t p0

0 Survive as a non-executive Become an executive Survive as a executive

employee for t years

employee at time t

employee for the rest of 35 years

t

35

= 0.9 ⋅ ∫ e

−

∫ ( µs

01

)

+ µs02 ds

0

35

⋅ µt01 ⋅ e

0

35

= 0.9 ⋅ ∫ e

∫

− µ12

s ds

t

35

dt = 0.9 ⋅ ∫ e

(

) ⋅ µ 01 ⋅ e− µ

t

− µs01 + µs02 t

( 35−t )

dt =

0

−( 0.01+0.006 )t

⋅ 0.01⋅ e

−0.002( 35−t )

35

dt = 0.009e

−0.07

0

=

12

s

∫e

−0.014t

dt =

0

0.009e−0.07 (1− e−0.49 )

0.014

=a35 δ =14%

≈ 0.2320.

Answer A.

May 2012 Course MLC Examination, Problem No. 13

Lorie’s Lorries rents lavender limousines. On January 1 of each year they purchase 30

limousines for their existing fleet; of these, 20 are new and 10 are one-year old. Vehicles

are retired according to the following 2-year select-and-ultimate table, where selection is

age at purchase:

Limousine age (x) q[ x ]

x+2

q[ x ]+1 qx+2

0

0.100 0.167 0.333 2

1

0.100 0.333 0.500 3

2

0.150 0.400 1.000 4

3

0.250 0.750 1.000 5

4

0.500 1.000 1.000 6

5

1.000 1.000 1.000 7

Lorie’s Lorries has rented lavender limousines for the past ten years and has always

purchased its limousines on the above schedule. Calculate the expected number of

limousines in the Lorie’s Lorries fleet immediately after the purchase of this year’s

limousines.

A. 93

B. 94

C. 95

D. 96

E. 97

Solution.

For the limousines that were purchased new:

- Expected number of limousines just purchased (this number is certain) = 20.

Copyright © 2012 by Krzysztof Ostaszewski. All rights reserved. No reproduction in any form is permitted without

explicit permission of the copyright owner.

-

Expected number of limousines purchased one year ago =

(

)

= 20 1 p[ 0 ] = 20 p[ 0 ] = 20 1− q[ 0 ] = 20 ⋅ 0.9 = 18.

-

Expected number of limousines purchased two years ago =

(

)(

)

= 20 2 p[ 0 ] = 20 p[ 0 ] ⋅ p[ 0 ]+1 = 20 1− q[ 0 ] 1− q[ 0 ]+1 = 20 ⋅ 0.9 ⋅ 0.833 = 14.994.

-

Expected number of limousines purchased three years ago =

-

= 20 ⋅ 0.9 ⋅ 0.833⋅ 0.667 ≈ 10.0010.

Expected number of limousines purchased four years ago =

-

(

)(

)

= 20 3 p[ 0 ] = 20 p[ 0 ] ⋅ p[ 0 ]+1 ⋅ p[ 0 ]+2 = 20 1− q[ 0 ] 1− q[ 0 ]+1 (1− q2 ) =

(

)(

)

= 20 4 p[ 0 ] = 20 p[ 0 ] ⋅ p[ 0 ]+1 ⋅ p[ 0 ]+2 ⋅ p[ 0 ]+3 = 20 1− q[ 0 ] 1− q[ 0 ]+1 (1− q2 ) (1− q3 ) =

= 20 ⋅ 0.9 ⋅ 0.833⋅ 0.667 ⋅ 0.5 ≈ 5.0005.

Expected number of limousines purchased five years ago =

= 20 5 p[ 0 ] = 20 p[ 0 ] ⋅ p[ 0 ]+1 ⋅ p[ 0 ]+2 ⋅ p[ 0 ]+3 ⋅ p[ 0 ]+4 =

(

)(

)

= 20 1− q[ 0 ] 1− q[ 0 ]+1 (1− q2 ) (1− q3 ) (1− q4 ) =

= 20 ⋅ 0.9 ⋅ 0.833⋅ 0.667 ⋅ 0.5 ⋅ 0 = 0.

We also see that limousines purchased new any further back in the past are already out of

service. For the limousines that were purchased used:

- Expected number of limousines just purchased (this number is certain) = 10.

- Expected number of limousines purchased one year ago =

(

)

= 10 1 p[1] = 10 p[1] = 10 1− q[1] = 10 ⋅ 0.9 = 9.

-

Expected number of limousines purchased two years ago =

(

)(

)

= 10 2 p[1] = 10 p[1] ⋅ p[1]+1 = 10 1− q[1] 1− q[1]+1 = 10 ⋅ 0.9 ⋅ 0.667 = 6.003.

-

Expected number of limousines purchased three years ago =

-

= 10 ⋅ 0.9 ⋅ 0.667 ⋅ 0.5 = 3.0015.

Expected number of limousines purchased four years ago =

(

)(

)

= 10 3 p[1] = 10 p[1] ⋅ p[1]+1 ⋅ p[1]+2 = 10 1− q[1] 1− q[1]+1 (1− q3 ) =

(

)(

)

= 10 4 p[1] = 10 p[1] ⋅ p[1]+1 ⋅ p[1]+2 ⋅ p[1]+3 = 10 1− q[1] 1− q[1]+1 (1− q3 ) (1− q4 ) =

= 10 ⋅ 0.9 ⋅ 0.667 ⋅ 0.5 ⋅ 0 = 0.

We also see that limousines purchased used any further back in the past are already out of

service. We conclude that the expected number of limousines in the Lorie’s Lorries fleet

immediately after the purchase of this year’s limousines is:

20 + 18 + 14.994 + 10.001 + 5.0005 + 0 + 10 + 9 + 6.003 + 3.0015 + 0 ≈ 96.

Answer D.

May 2012 Course MLC Examination, Problem No. 14

XYZ Insurance Company sells a one-year term insurance product with a gross premium

equal to 125% of the benefit premium. You are given:

(i) The death benefit is payable at the end of the year of death, and the amount depends

Copyright © 2012 by Krzysztof Ostaszewski. All rights reserved. No reproduction in any form is permitted without

explicit permission of the copyright owner.

on whether the cause of death is accidental or not.

(ii) Death benefit amounts, together with the associated one-year probabilities of death,

are as follows:

Cause of Death

Death Benefit

Probabilities of Death

Non-accidental

5

0.10

Accidental

10

0.01

(iii) i = 0%.

Using the normal approximation without continuity correction, calculate the smallest

number of policies that XYZ must sell so that the amount of gross premium equals or

exceeds the 95th percentile of the distribution of the total present value of death benefits.

A. 378

B. 431

C. 484

D. 537

E. 590

Solution.

Let n be the number of policies that is sought in this problem. Let Xi denote the claim

n

amount for policy i, with i = 1, 2, …, n. Let S = ∑ Xi be the aggregate claim. We have

E ( Xi ) = 5 ⋅ 0.1+ 10 ⋅ 0.01 = 0.6,

i=1

E ( Xi2 ) = 5 2 ⋅ 0.1+ 10 2 ⋅ 0.01 = 3.5,

(

)

Var ( Xi ) = E ( Xi2 ) − E ( Xi ) = 3.5 − 0.6 2 = 3.14

2

for every i = 1, 2, …, n. Therefore,

E ( S ) = nE ( Xi ) = 0.6n,

Var ( S ) = nVar ( Xi ) = 3.14n.

Since the 95-th percentile of the standard normal distribution is 1.645, using the normal

approximation without continuity correction for S gives its 95-th percentile as

0.6n + 1.645 ⋅ 3.14n ≈ 0.6n + 2.9149 n.

The benefit premium for one policy is 0.6 and for all policies combined it is 0.6n. The

gross premium for one policy is 1.25 ⋅ 0.6 = 0.75, and for all policies combined it is 0.75n.

We want

0.75n ≥ 0.6n + 2.9149 n,

or

2.9149

n≥

≈ 19.4330,

0.15

equivalent to

2

⎛ 2.9149 ⎞

n≥⎜

≈ 377.6408.

⎝ 0.15 ⎟⎠

Since the answer has to be a whole number, n ≥ 378.

Answer A.

May 2012 Course MLC Examination, Problem No. 15

For a 20-year temporary life annuity-due of 100 per year on (65), you are given:

Copyright © 2012 by Krzysztof Ostaszewski. All rights reserved. No reproduction in any form is permitted without

explicit permission of the copyright owner.

(i) µ x = 0.001x, x ≥ 65.

(ii) i = 0.05.

(iii) Y is the present-value random variable for this annuity.

Calculate the probability that Y is less than 1000.

A. 0.54

B. 0.57

C. 0.61

D. 0.64

Solution.

We are looking for the probability

(

Pr (Y < 1000 ) = Pr 100

aK

65 +1

) (

< 1000 = Pr aK

65 +1

E. 0.67

)

< 10 .

If we set up an equation ak = 10, we obtain

0.5 ⎞

⎛

ln ⎜ 1−

⎝ 1.05 ⎟⎠

k=−

≈ 13.2532.

ln1.05

(

This means that the largest integer value of k = K 65 + 1 such that aK

k = K 65 + 1 = 13. Therefore,

(

Pr (Y < 1000 ) = Pr aK

65 +1

65 +1

)

< 10 is

)

< 10 = Pr ( K 65 + 1 ≤ 13) = Pr ( K 65 ≤ 12 ) = Pr (T65 < 13) .

We can calculate that probability from the given formula for the force of mortality

78

Pr (T65 < 13) = 13 q65 = 1− 13 p65 = 1− e

= 1− e−0.0005⋅78

2

+0.0005⋅65

2

∫

− µ x dx

65

78

= 1− e

∫

− 0.001x dx

65

= 1− e

−0.0005 x 2

x=78

x=65

=

≈ 0.6052.

Answer C.

May 2012 Course MLC Examination, Problem No. 16

For a special continuous joint life annuity on (x) and (y), you are given:

(i) The annuity payments are 25,000 per year while both are alive and 15,000 per year

when only one is alive.

(ii) The annuity also pays a death benefit of 30,000 upon the first death.

(iii) i = 0.06.

(iv) axy = 8.

(v) axy = 10.

Calculate the actuarial present value of this special annuity.

A. 239,000

B. 246,000

C. 287,000

D. 354,000

E. 366,000

Solution.

The annuity portion only of this special continuous joint life annuity on (x) and (y) can be

thought of as a continuous payment of 10,000 per year until the first death plus a

continuous payment of 15,000 per year until the second death. Therefore, the present

value of the annuity portion only is

Copyright © 2012 by Krzysztof Ostaszewski. All rights reserved. No reproduction in any form is permitted without

explicit permission of the copyright owner.

10,000axy + 15,000axy = 10,000 ⋅ 8 + 15,000 ⋅10 = 230,000.

But the special annuity also includes a death benefit of

30,000Axy = 30,000 1− δ axy = 30,000 (1− ( ln1.06 ) ⋅ 8 ) ≈ 16,015.4621.

(

)

The total of the two is 230,000 + 16,015.4621 = 246,015.4621.

Answer B.

May 2012 Course MLC Examination, Problem No. 17

Your company issues fully discrete whole life policies to a group of lives age 40. For

each policy, you are given:

(i) The death benefit is 50,000.

(ii) Assumed mortality and interest are the Illustrative Life Table at 6%.

(iii) Annual gross premium equals 125% of benefit premium.

(iv) Assumed expenses are 5% of gross premium, payable at the beginning of each year,

and 300 to process each death claim, payable at the end of the year of death.

(v) Profits are based on gross premium reserves.

During year 11, actual experience is as follows:

(a) There are 1000 lives inforce at the beginning of the year.

(b) There are five deaths.

(c) Interest earned equals 6%.

(d) Expenses equal 6% of gross premium and 100 to process each death claim.

For year 11, you calculate the gain due to mortality and then the gain due to expenses.

Calculate the gain due to expenses during year 11.

A. −5900

B. −6200

C. −6400

D. −6700

E. −7000

Solution.

Let us write Ga for the total actuarial gain, Ga M for the actuarial gain due to expenses,

Ga E for the actuarial gain due to mortality, Ga I for the actuarial gain due to interest, and

GaW for the actuarial gain due to withdrawals. In general, the formula for the actuarial

gain, assuming unit death benefit, is:

− AS = ( AS + G ) iˆ − i + ( Gc + e ) (1+ i ) − ( Gĉ + ê ) 1+ iˆ +

Ga = k+1 AS

k+1

k

k+1

k

k

k

k

k+1

(

(

Ga I

)

(

Ga E

)

)

(

)

(1)

(1)

+ q( 2 ) ( CV − AS ) − q̂( 2 )

+ qx+k

1− k+1 AS

(1− k+1 AS ) − q̂x+k

x+k k+1

k+1

x+k k+1 CV − k+1 AS .

Ga M

GaW

In this problem, we are told that the experience and assumed interest rate are equal, so

that Ga I = 0. Furthermore, the problem has this peculiar structure where it has no

reference to withdrawals, so we assume that withdrawals and cash value do not exist and

do not enter into the picture, so that GaW = 0. This leads to

(1)

(1)

.

Ga = ( Gck + ek ) (1+ i ) − ( Gĉk + êk ) 1+ iˆk+1 + qx+k

1− k+1 AS

(1− k+1 AS ) − q̂x+k

(

Ga E

(

)

)

Ga M

Copyright © 2012 by Krzysztof Ostaszewski. All rights reserved. No reproduction in any form is permitted without

explicit permission of the copyright owner.

Additionally, the problem does not give us any information about asset shares, so we

cannot calculate the second term, and expenses are also assessed on payment of death

benefit, resulting in interaction of mortality and expenses gains, which is not assumed in

the above standard formula. We resolve the first issue by noting that information to

calculate the reserve is given, so that we can calculate the gains based solely on reserves,

and assuming that the assets portion is irrelevant. We resolve the second issue by

following the order of calculations suggested by the wording of the problem: First

calculate the mortality gain, then calculate the expenses gain. But how do we get the

expenses gain from mortality gain? We subtract the mortality gain from the total gain, so

we will have to find the total actuarial gain, in aggregate, without referring to its sources,

to solve this problem. Let us also write G for the level annual gross premium, which is

equal to 125% of level annual benefit premium. The level annual benefit premium is

50,000A40 50 ⋅161.32

50,000P40 =

=

≈ 544.3894.

ILT 14.8166

a40

Therefore, the gross premium is

1.25 ⋅ 50,000P40 ≈ 1.25 ⋅ 544.3894 ≈ 680.4868.

The expense-loaded policy reserve at policy duration 10 is

⎛

⎞

⎜

⎟

⎜

300 ⎟ ⋅ A50 − (1− 0.05 ) ⋅G

a50 =

10V = ⎜ 50,000

+ Expenses

⎟

ILT

paid at

Fraction of premium

⎜ Benefit

⎟

paid

at

the

the end of the

after expenses

end of the ⎟

⎜⎝ year

of death

year of death ⎠

= 50, 300 ⋅ 0.24905 − 0.95 ⋅ 680.4868 ⋅13.2668 ≈ 3950.7275.

ILT

Also, the expense-loaded policy reserve at policy duration 11 is

⎛

⎞

⎜

⎟

⎜

300 ⎟ ⋅ A51 − (1− 0.05 ) ⋅G

a51 =

11V = ⎜ 50,000

+ Expenses

⎟

ILT

paid at

Fraction of premium

⎜ Benefit

⎟

paid

at

the

the end of the

after expenses

end of the ⎟

⎜⎝ year

of death

year of death ⎠

= 50, 300 ⋅ 0.25961− 0.95 ⋅ 680.4868 ⋅13.0803 ≈ 4602.4607.

ILT

Of course, you can also find the second reserve from the first using the standard recursive

formula

11V ⋅ p50 = ( 10V + G ⋅ 0.95 ) ⋅1.06 − 50, 300q50 ,

so that

( 3950.7275 + 680.4868 ⋅ 0.95 ) ⋅1.06 − 50, 300 ⋅ 0.00592 ≈ 4602.4920.

11V =

0.99408

This is actually a slightly different value, but this error does not matter than much. If the

actuarial assumptions are realized perfectly, the actuarial gain is zero. But if we substitute

the actual experience for actuarial assumptions, we obtain the total actuarial gain as

Copyright © 2012 by Krzysztof Ostaszewski. All rights reserved. No reproduction in any form is permitted without

explicit permission of the copyright owner.

⎛

⎞

⎜

⎟

Ga = ⎜ 3950.7275

+

0.94

⋅

680.4868

− 50,100

−

⎟ ⋅ 1.06

⋅ 0.005

Actual %

Gross premium ⎟ Actual

⎜

Actual payment Actual

10V

of premium

probability

upon death

⎝

⎠ accumulation

expense

with interets

of death,

5 out of 1000

−

4602.4607

⋅ 0.995

≈ 35.8596983,

Expected reserve, but for actual surviving

policies held at the end of year 10

per policy, and for one thousand polies the total actuarial gain

1000Ga ≈ 35,859.6983.

Note that we disregarded the surplus (and thus we do not work with asset shares), and we

basically calculated actual reserve at policy duration 11 based on experience, minus

expected reserve for surviving policies at the same policy duration. Now we need to find

the gain from mortality. It is found by using the actual mortality experience and assumed

expenses, giving:

⎛

⎞

⎜

⎟

Ga M = ⎜ 3950.7275

300 ⋅ 0.005

⋅ 680.4868

− 50,

−

+ 0.95

⎟ ⋅ 1.06

Assumed

Accumulation

Experience

Gross premium ⎟

⎜

Death benefit

10V

% of premium

at assumed

mortality

assumed

⎝

⎠ (and experience) plus

expense

expenses at death

interest rate of 6%

−

4602.4607

⋅ 0.995

≈ 42.0729611

Expected reserve, but for actual surviving

policies held at the end of year 10

per policy, or 42,072.9611 for 1000 policies. Based on the, the actuarial gain (for 1000

policies) due to expenses is

35,859.6983 − 42,072.9611 = −6213.2628.

This problem gives you a good perspective on calculation of actuarial gain based solely

on reserves. If interest, expenses, mortality and withdrawals interact with each other (and

that is always the case in reality), allocation of the total actuarial gain to its sources will

depend on the order of allocation. For example, if their order is: interest, expenses,

mortality, withdrawals, then:

(1) To compute the gain from interest, we assume that expenses, mortality and

withdrawals follow assumptions.

(2) Then to compute the gain from expenses, we assume interest follows experience,

while mortality and withdrawals follows assumptions.

(3) Then to compute the gain from mortality, we assume interest and expenses follow

experience, while withdrawals follow assumptions.

(4) Finally, to compute the gain from withdrawals, we assume that interest, expenses and

mortality follow experience.

Answer B.

May 2012 Course MLC Examination, Problem No. 18

For a fully discrete whole life policy on (50) with death benefit 100,000, you are given:

(i) Reserves equal benefit reserves calculated using the Illustrative Life Table at 6%.

(ii) The gross premium equals 120% of the benefit premium calculated using the

Copyright © 2012 by Krzysztof Ostaszewski. All rights reserved. No reproduction in any form is permitted without

explicit permission of the copyright owner.

Illustrative Life Table at 6%.

(iii) Expected expenses equal 40 plus 5% of gross premium, payable at the beginning of

each year.

(iv) Expected mortality equals 70% of the Illustrative Life Table.

(v) The expected interest rate is 7%.

Calculate the expected profit in the eleventh policy year, for a policy in force at the

beginning of that year.

A. 683

B. 719

C. 756

D. 792

E. 829

Solution.

Based on the data from the Illustrative Life Table, the gross premium for this policy is

24,905

G = 1.2 ⋅100,000P50 = 1.2 ⋅

≈ 2,252.50.

13.2268

Also, this policy’s reserve at policy duration 10 is

60 ) = 36,913 − 1,877 ⋅11.1454 ≈ 15,990.90.

10V = 100,000 ( A60 − P50 a

ILT

The reserve at policy duration 11 is

61 ) = 38, 729 − 1,877 ⋅10.9041 ≈ 17,809.80.

11V = 100,000 ( A61 − P50 a

ILT

The problem does not clearly say this, but while we are supposed to calculate the

expected profit for the 11-th policy year for a policy in force at the beginning of the 11-th

year, the value of the profit is supposed to be established as of the end of that policy year,

i.e., at duration 11. Note also that the calculation is on expected value basis, not based on

experience, and therefore it represents expected values based on the original design of the

policy. The expected value of the profit is

⎛

⎞

V

+

G

−

0.05G

+

40

⋅100,000 − (1− 0.7q60 ) ⋅ 11V =

60

⎜ 10

⎟ ⋅1.07 − 0.7q

⎝

⎠

Expenses

Expected mortality

= (15,990.90 + 2,252.50 − 112.65 − 40 ) ⋅1.07 − 963.20 − 0.99037 ⋅17,809.80 ≈ 756.

Answer C.

May 2012 Course MLC Examination, Problem No. 19

19.YouYou

pricing

disability

insuranceusing

usingthe

the following

following model:

are are

pricing

disability

insurance

model:

Healthy

Disabled

State 0

State 1

Dead

State 2

You assume the following constant forces of transition:

You assume the following constant forces of transition:

Copyright © 2012 by Krzysztof

Ostaszewski. All rights reserved. No reproduction in any form is permitted without

01

= 0.06owner.

(i) of theµ copyright

explicit permission

(ii)

µ 10 = 0.03

(i) µ 01 = 0.06.

(ii) µ10 = 0.03.

(iii) µ 02 = 0.01.

(iv) µ12 = 0.04.

Calculate the probability that a disabled life on July 1, 2012 will become healthy at some

time before July 1, 2017 but will not then remain continuously healthy until July 1, 2017.

A. 0.012

B. 0.015

C. 0.018

D. 0.021

E. 0.024

Solution.

The probability sought is

5

∫

µ10

x+t

⋅

11

t px

⋅

p )

(1−

5−t

00

x+t

dt =

0 A life disabled now will Then this life becomes

Then this life does not

be disabled continuously healthy at time t

remain continuously

until time t

healthy for the rest of 5 years

t

5

= ∫e

−

∫ (µ

0

0

t

5

= ∫e

0

5

−

10

)

+ µ12 ds

⎛

− ∫ ( µ 01 + µ 02 ) ds ⎞

10 ⎜

⎟ dt =

⋅ µ ⋅ 1− e t

⎜

⎟

⎝

⎠

∫ ( 0.03+0.04 ) ds

0

5

⎛

− ∫ ( 0.06+0.01) ds ⎞

⎜

⎟ dt =

⋅ 0.03⋅ 1− e t

⎜

⎟

⎝

⎠

5

(

)

5

= ∫ e−0.07t ⋅ 0.03⋅ 1− e−0.07( 5−t ) dt = 0.03∫ ( e−0.07t − e−0.35 ) dt =

0

= 0.03a5 δ =7% − 0.15e

Answer D.

−0.35

0

≈ 0.0209.

May 2012 Course MLC Examination, Problem No. 20

Jenny joins XYZ Corporation today as an actuary at age 60. Her starting annual salary is

225,000 and will increase by 4% each year on her birthday. Assume that retirement takes

place on a birthday immediately following the salary increase. XYZ offers a plan to its

employees with the following benefits:

• A single sum retirement benefit equal to 20% of the final salary at time of retirement for

each year of service. Retirement is compulsory at age 65; however, early retirement is

permitted at ages 63 and 64, but with the retirement benefit reduced by 40% and 20%,

respectively. The retirement benefit is paid on the date of retirement.

• A death benefit, payable at the end of the year of death, equal to a single sum of 100%

of the annual salary rate at the time of death, provided death occurs while the employee is

still employed.

You are given that δ = 5% and the following multiple decrement table (w =withdrawal;

r = retirement; and d = death):

Copyright © 2012 by Krzysztof Ostaszewski. All rights reserved. No reproduction in any form is permitted without

explicit permission of the copyright owner.

lx(τ )

d x( w )

d x( r )

60

100

21

0

61

78

13

0

62

64

7

0

63

56

0

6

64

49

0

5

65

43

0

43

Calculate the expected present value of Jenny’s total benefits.

d x( d )

1

1

1

1

1

0

Age x

A. 85,000

B. 92,250

C. 99,500

D. 106,750

E. 113,750

Solution.

In order to receive a benefit, Jenny can retire at ages 63, 64, or 65, or die at ages 60, 61,

62, 63 (without having retired previously), or 64 (without having retired previously). The

following table shows the calculation of the actuarial present value of retirement benefits

(note that the actuarial present value is calculated as salary times discount factor times

probability times (number of years of service times 20%), corrected for reduction, and

note that the benefit is paid at the beginning of the year of retirement (as opposed to the

death benefit, which is paid at the end of the year of death):

Age at

retirement

Salary

Discount

for present

value

63

225,000 ⋅1.04 3

e−3⋅0.05

Probability

No. of years

of service

times 20%

Reductio

n

Actuarial

present

value

60%

40%

4705

6

100

4

−4⋅0.05

64

80%

20%

6896

5

225,000 ⋅1.04

e

(r )

4 q60 =

100

5

−5⋅0.05

65

100%

0%

91674

43

225,000 ⋅1.04

e

(r )

5 q60 =

100

The sum of these actuarial present values is 4705 + 6896 + 91674 = 103,275. For the

death benefits, the actuarial present values are calculated as follows (death benefit, which

is salary at death, times the discount factor, times probability)

3

(r )

q60

=

Age at death

Salary

Discount for

present value

calculation

Probability

Actuarial

present value

60

225,000

e−0.05

1

100

1

(d )

1 q60 =

100

1

(r )

2 q60 =

100

1

(r )

3 q60 =

100

1

(r )

4 q60 =

100

2140

0

61

225,000 ⋅1.04

e−2⋅0.05

62

225,000 ⋅1.04 2

e−3⋅0.05

63

225,000 ⋅1.04 3

e−4⋅0.05

64

225,000 ⋅1.04 4

e−5⋅0.05

(d )

q60

=

2117

2095

2072

2050

Copyright © 2012 by Krzysztof Ostaszewski. All rights reserved. No reproduction in any form is permitted without

explicit permission of the copyright owner.

The total actuarial present value of death benefits is

2140 + 2117 + 2095 + 2072 + 2050 = 10,474.

The total actuarial present value of all benefits is

103,275 + 10,474 = 113,749.

Answer E.

May 2012 Course MLC Examination, Problem No. 21

For a fully continuous whole life insurance of 1000 on (x), you are given:

(i) Benefit premiums are 10 per year.

(ii) δ = 0.05.

(iii) µ x+20.2 = 0.026.

(iv) tV denotes the benefit reserve at time t for this insurance.

d

(v) ( tV ) at t = 20.2 is equal to 20.5.

dt

Calculate 20.2V.

A. 480

B. 540

3. 610

Solution.

Recall the Thiele’s differential equation

d ( tV )

= δ

⋅ tV +

P

dt

Premium

Interest on reserve

Change in reserve

(paid continuously)

4. 670

−

E. 730

− tV ) µ x+t

(S

.

Net amount at risk payout at death

We substitute numerical values at t = 20.2 and obtain

20.5 = 0.05 ⋅ 20.2V + 10 − (1000 − 20.2V ) ⋅ 0.026.

This is a simple linear equation with 20.2V being the unknown. We solve it and obtain

20.2V ≈ 480.26.

Answer A.

May 2012 Course MLC Examination, Problem No. 22

For a fully discrete 10-year deferred whole life insurance of 100,000 on (30), you are

given:

(i) Mortality follows the Illustrative Life Table.

(ii) i = 6%.

(iii) The benefit premium is payable for 10 years.

(iv) The gross premium is 120% of the benefit premium.

(v) Expenses, all incurred at the beginning of the year, are as follows:

Policy Year Percent of gross premium

Per policy

1

10%

100

2-10

3%

40

11 and later 0%

40

(vi) L0 is the present value of future losses at issue random value.

Copyright © 2012 by Krzysztof Ostaszewski. All rights reserved. No reproduction in any form is permitted without

explicit permission of the copyright owner.

Calculate E ( L0 ) .

A. −334

B. −496

C. −658

D. −820

E. −982

Solution.

The gross premium is

100000 10 A30

100000 ⋅ A40 ⋅ 10 E30

G = 1.2 ⋅

= 1.2 ⋅

=

a30:10

a30 − 10 E30 ⋅ a40 ILT

= 1.2 ⋅

ILT

161.32 ⋅ 0.54733

≈ 1367.77.

15.8561− 0.54733⋅14.8166

Therefore,

E ( L0 ) = −G

a30:10 + 100000 ⋅ 10 A30 + 0.07G + 0.03G

a30:10 + 60 + 40

a30 =

(

)

= G 0.07 − 0.97

a30:10 + 100000 ⋅ 10 A30 + 60 + 40

a30 ≈

≈ G ( 0.07 − 0.97 (15.8561− 0.54733⋅14.8166 )) +

+ 161.32 ⋅ 0.54733 + 60 + 40 ⋅15.8561 ≈ −658.06.

Answer C.

May 2012 Course MLC Examination, Problem No. 23

On January 1 an insurer issues 10 one-year term life insurance policies to lives age x with

independent future lifetimes. You are given:

(i) Each policy pays a benefit of 1000 at the end of the year if that policyholder dies

during the year.

(ii) Each policyholder pays a single premium of 90.

(iii) qx is the same for every policyholder. With probability 0.30, qx = 0.0 for every

policyholder. With probability 0.70, qx = 0.2 for every policyholder.

(iv) i = 0.04.

Calculate the variance of the present value of future losses at issue random variable for

the entire portfolio.

A. 800,000

B. 900,000

C. 1,000,000

D. 1,400,000

E. 1,800,000

Solution.

Let Q be the random probability of death for a policyholder. Then, for each of the 10

policyholders,

⎧⎪ 0

with probability 0.3,

Q=⎨

0.2 with probability 0.7.

⎩⎪

Note that the problem says that the probability of dying qx is the same, so that once a

value of Q is given, that value is qx , and it is the probability of dying for all

policyholders. Let Lk be the present value of future losses random variable for

policyholder number k, where k = 1, 2, …, 10. We have, for every k,

Copyright © 2012 by Krzysztof Ostaszewski. All rights reserved. No reproduction in any form is permitted without

explicit permission of the copyright owner.

⎧ −90

with probability 1− Q, ⎫

⎪

⎪

Lk = ⎨ 1000

⎬=

⎪ 1.04 − 90 with probability Q,

⎪

⎩

⎭

1000 ⎧⎪ 0 with probability 1− Q,

= −90 +

⋅⎨

1.04 ⎪ 1 with probability Q.

⎩

This effectively says that Lk equals a constant of −90 added to a multiple (by the factor

of 1000/1.04) of a Bernoulli Trial with probability of success of Q. Let us write

1000

1000

1000

L1 = −90 +

X1 , L2 = −90 +

X2 , …, L10 = −90 +

X10 ,

1.04

1.04

1.04

where each X k for k = 1, 2, …, 10, is a Bernoulli Trial with probability of success Q. Let

S be the random present value of future losses at issue random variable for the entire

portfolio. We have

10

10

1000 ⎞

1000 10

⎛

S = ∑ Lk = ∑ ⎜ −90 +

X k ⎟ = −900 +

∑ Xk .

⎝

1.04 ⎠

1.04 k=1

k=1

k=1

We observe that for Q = 0, each X k is equal to −900 with probability 1, while for

Q = 0.2,

10

∑X

k

is binomial with n = 10 and p = 0.2. We need to find the variance of S.

k=1

We have

Var ( S ) = E Var ( S Q ) + Var E ( S Q ) .

(

)

(

)

Note now that

⎧ −900

when Q = 0,which happens with probability 0.3,

⎪

E (S Q) = ⎨

1000

⎪ −900 + 1.04 ⋅ 2 when Q = 0.2,which happens with probability 0.7,

⎩

and

⎧ 0

when Q = 0,which happens with probability 0.3,

⎪

Var ( S Q ) = ⎨ ⎛ 1000 ⎞ 2

⎪ ⎜⎝ 1.04 ⎟⎠ ⋅1.6 when Q = 0.2,which happens with probability 0.7.

⎩

Therefore,

Var ( S ) = E Var ( S Q ) + Var E ( S Q ) =

(

)

(

)

2

⎛

⎞ ⎛ ⎛ 1000 ⎞ 2

⎞

⎛ 1000 ⎞

= ⎜ 0.3⋅ 0 + 0.7 ⋅ ⎜

⋅1.6 ⎟ + ⎜ ⎜

⋅ 2 ⎟ ⋅ 0.3⋅ 0.7 ⎟ ≈ 1,812,130.18.

⎟

⎝ 1.04 ⎠

⎝

⎠ ⎝ ⎝ 1.04 ⎠

⎠

Because Var( S Q ) equals to a Bernoulli Trial

with probability of success 0.7 multiplied by

2

⎛ 1000 ⎞

the number ⎜

⋅1.6

⎝ 1.04 ⎠⎟

Because E( S Q ) is a constant of −900

1000

plus

⋅2 multiplied by a Bernoulli

1.04

Trial with probability of success of 0.7

Answer E.

Copyright © 2012 by Krzysztof Ostaszewski. All rights reserved. No reproduction in any form is permitted without

explicit permission of the copyright owner.

May 2012 Course MLC Examination, Problem No. 24

For a three-year term insurance of 10,000 on (65), payable at the end of the year of death,

you are given:

(i)

x

qx

65 0.00355

66 0.00397

67 0.00444

(ii) Forward interest rates at the date of issue of the contract, expressed as annual rates,

are as follows:

Start End

Annual

time time

forward

rate

0

3

0.050

1

3

0.070

2

3

0.091

Calculate the expected present value of this insurance.

A. 105

B. 110

C. 113

D. 115

E. 120

Solution.

We will write sk for the annual effective spot rate for maturity k, and fk,l for the effective

annual forward rate from time k to time l. We are given f0,3 = s3 = 0.05, f1,3 = 0.07, and

f2,3 = 0.091. But

(1+ s3 )3 = (1+ f0,1 )(1+ f1.3 )2 = (1+ s1 )(1+ f1.3 )2 ,

so that

3

1+ s3 )

(

1.05 3

1+ s1 =

=

,

(1+ f1.3 )2 1.07 2

3

2

as well as (1+ s3 ) = (1+ s2 ) (1+ f2.3 ) , so that

3

1+ s3 )

(

1.05 3

2

(1+ s2 ) = 1+ f = 1.091 .

( 2.3 )

The expected present value of this insurance is

10000

10000

10000

⋅ q65 +

⋅ p ⋅ p ⋅q =

2 ⋅ p65 ⋅ q66 +

1+ s1

(1+ s2 )

(1+ s3 )3 65 66 67

10000

10000

⋅ (1− 0.00355 ) ⋅ 0.00397 +

3 ⋅ 0.00355 +

1.05

1.05 3

1.07 2

1.091

10000

+

⋅ (1− 0.00355 ) ⋅ (1− 0.00397 ) ⋅ 0.00444 ≈ 110.4586.

1.05 3

Answer B.

=

Copyright © 2012 by Krzysztof Ostaszewski. All rights reserved. No reproduction in any form is permitted without

explicit permission of the copyright owner.

May 2012 Course MLC Examination, Problem No. 25

An insurer issues fully discrete whole life insurance policies of 100,000 to insureds age

40 with independent future lifetimes.

You are given:

(i) Issue expenses are incurred upon policy issuance and are 20% of the first year

premium.

(ii) Renewal expenses are 6% of each premium, incurred on the premium due date,

starting in the second year.

(iii) The annual premium is calculated using the percentile premium principle and the

normal approximation, such that the probability of a loss on the portfolio is 5%.

(iv) A40 = 0.161.

(v) 2 A40 = 0.048.

(vi) a40 = 14.822.

(vii) i = 0.06.

(viii) The annual premium per policy for a portfolio of 2000 policies is 1215.

Calculate the difference in annual premium per policy for a portfolio of 2000 policies and

for a portfolio of 40,000 policies.

A. 37

B. 42

C. 48

D. 52

E. 56

Solution.

As the annual premium per policy for a portfolio of 2000 policies is given, we simply

need to find the annual premium per policy for a portfolio of 40,000 policies, call it G,

and then calculate the difference. Let us write Li for the loss at issue for policy i. We

have

Li = 100,000 ⋅1.06 K 40 +1 + ( 0.2 − 0.06 ) G − (1− 0.06 ) G

aK +1 =

40

K 40 +1

1− 1.06

≈

0.06

1.06

K 40 +1

≈ (100,000 + 16.6067 ⋅G ) ⋅1.06

− 16.4667G.

= 100,000 ⋅1.06 K 40 +1 + 0.14G − 0.94G

Therefore,

E ( Li ) = E (100,000 + 16.6067 ⋅G ) ⋅1.06 K 40 +1 − 16.4667G

(

= (100,000 + 16.6067 ⋅G ) ⋅ A40 − 16.4667G =

)

= 100,000 ⋅ 0.161+ (16.6067 ⋅ 0.161− 16.4667 ) G = 16,100 − 13.7930G,

Var ( Li ) = Var ((100,000 + 16.6067 ⋅G ) ⋅1.06 K 40 +1 − 16.4667G ) =

2

= (100,000 + 16.6067 ⋅G ) ⋅ ( 2 A40 − A40

)=

2

= (100,000 + 16.6067 ⋅G ) ⋅ ( 0.048 − 0.1612 ) ≈

2

≈ (100,000 + 16.6067 ⋅G ) ⋅ 0.02208.

Let L denote the total loss for the entire portfolio of 40,000 policies. Then (note that we

are using independence of policies for the variance calculation):

2

Copyright © 2012 by Krzysztof Ostaszewski. All rights reserved. No reproduction in any form is permitted without

explicit permission of the copyright owner.

E ( L ) = 40,000 (16,100 − 13.7930G ) ,

Var ( L ) ≈ 40,000 ⋅ (100,000 + 16.6067 ⋅G ) ⋅ 0.02208.

Because of independence of the policies, and identical distributions of individual policies’

losses, L is approximately normal, and

⎛ L − E (L)

⎛ E (L) ⎞

E (L) ⎞

0.95 = Pr ( L < 0 ) = Pr ⎜

<−

=

⎟ = Φ⎜

Var ( L ) ⎠

⎝ Var ( L ) ⎟⎠

⎝ Var ( L )

2

⎛

⎞

40,000 (16,100 − 13.7930G )

⎟.

= Φ⎜ −

2

⎜⎝

40,000 ⋅ (100,000 + 16.6067 ⋅G ) ⋅ 0.02208 ⎟⎠

The 95-th percentile of the standard normal distribution is 1.645, so that

40,000 (16,100 − 13.7930G )

−

= 1.645,

2

40,000 ⋅ (100,000 + 16.6067 ⋅G ) ⋅ 0.02208

and from this we calculate G ≈ 1178. The difference sought is 1215 – 1178 = 37.

Answer A.

May 2012 Course MLC Examination, Problem No. 26

For a special fully discrete whole life insurance on (35) you are given:

(i) Mortality follows the Illustrative Life Table.

(ii) i = 0.06.

(iii) Initial annual premiums are level for the first 30 years; thereafter, annual premiums

are one-third of the initial annual premium.

(iv) The death benefit is 60,000 during the first 30 years and 15,000 thereafter.

(v) Expenses are 40% of the first year’s premium and 5% of all subsequent premiums.

(vi) Expenses are payable at the beginning of the year.

Calculate the initial annual premium using the equivalence principle.

A. 290

B. 310

C. 330

D. 350

E. 370

Solution.

From the Illustrative Life Table

30 E 35 = 20 E 35 ⋅ 10 E55 = 0.28600 ⋅ 0.48686 ≈ 0.13924,

a35:30 = a35 − 30 E35 ⋅ a65 ≈ 15.3926 − 0.13924 ⋅ 9.8969 ≈ 14.0146,

1

A35:30

= A35 − 30 E35 ⋅ A65 ≈ 0.12872 − 0.13924 ⋅ 0.43980 ≈ 0.06748.

Let us denote the initial annual premium by G. We then calculate the actuarial present

value of premiums as

1 ⎞

1

⎛2

⎛2

⎞

G ⎜ a35:30 + a35 ⎟ ≈ G ⎜ ⋅14.0146 + ⋅15.3926 ⎟ ≈ 14.4734G,

⎝3

⎝3

⎠

3 ⎠

3

the actuarial present value of benefits as

1

1

⎛3 1

⎞

⎛3

⎞

60,000 ⋅ ⎜ A35:30

+ A35 ⎟ ≈ 60,000 ⋅ ⎜ ⋅ 0.06748 + ⋅ 0.12872 ⎟ ≈ 4.967.40,

⎝4

⎠

⎝4

⎠

4

4

Copyright © 2012 by Krzysztof Ostaszewski. All rights reserved. No reproduction in any form is permitted without

explicit permission of the copyright owner.

and the actuarial present value of expenses as

1 ⎞⎞

⎛

⎛2

G ⎜ 0.35 + 0.05 ⋅ ⎜ a35:30 + a35 ⎟ ⎟ ≈

⎝3

⎝

3 ⎠⎠

1

⎛

⎛2

⎞⎞

≈ G ⎜ 0.35 +0.05 ⎜ ⋅14.0146 + ⋅15.3926 ⎟ ⎟ ≈ 1.0737G.

⎝

⎠⎠

⎝

3

3

Using the Equivalence Principle, we obtain the equation

14.4734G = 4,967.40 + 1.07370G,

resulting in G ≈ 370.71.

Answer E.

May 2012 Course MLC Examination, Problem No. 27

For a universal life insurance policy with death benefit of 100,000 on (40), you are given:

(i) The account value at the end of year 4 is 2029.

(ii) A premium of 200 is paid at the start of year 5.

(iii) Expense charges in renewal years are 40 per year plus 10% of premium.

(iv) The cost of insurance charge for year 5 is 400.

(v) Expense and cost of insurance charges are payable at the start of the year.

(vi) Under a no lapse guarantee, after the premium at the start of year 5 is paid, the

insurance is guaranteed to continue until the insured reaches age 49.

(vii) If the expected present value of the guaranteed insurance coverage is greater than the

account value, the company holds a reserve for the no lapse guarantee equal to the

difference. The expected present value is based on the Illustrative Life Table at 6%

interest and no expenses.

Calculate the reserve for the no lapse guarantee, immediately after the premium and

charges have been accounted for at the start of year 5.

A. 0

B. 10

C. 20

D. 30

E. 40

Solution.

The account value (reserve) at policy duration 5 (which is the start of policy year 5) is

2029 + 200 − 0.10 ⋅ 200 − 40 − 400 = 1769.

The expected present value of the guaranteed coverage is the actuarial present value of

term insurance to age 49, which is

1

100,000A44:5

= 100,000 ( A44 − 5 E44 ⋅ A49 ) =

ILT

= 100,000 ( 0.19261− 0.73117 ⋅ 0.23882 ) ≈ 1799.

ILT

Note what happens here: The account value (i.e., retrospective reserve for a universal life

policy is 1769, while the company guarantees that life insurance coverage will continue

for the next five years, and that guarantee has actuarial present value of 1799, and that

extra cost needs to be reserved for). Therefore, the no lapse reserve is

1799 – 1769 = 30.

Answer D.

Copyright © 2012 by Krzysztof Ostaszewski. All rights reserved. No reproduction in any form is permitted without

explicit permission of the copyright owner.

May 2012 Course MLC Examination, Problem No. 28

You are using Euler’s method to calculate estimates of probabilities for a multiple state

model with states {0,1, 2}. You are given:

(i) The only possible transitions between states are:

0 to 1

1 to 0

1 to 2

12

(ii) For all x, µ x01 = 0.3, µ10

x = 0.1, µ x = 0.1.

(iii) Your step size is 0.1.

(iv) You have calculated that

(a) 0.6 px00 = 0.8370

(b) 0.6 px01 = 0.1588

(c) 0.6 px02 = 0.0042

Calculate the estimate of 0.8 px01 using the specified procedure.

A. 0.20

B. 0.21

C. 0.22

Solution.

The probability we are looking for is

D. 0.23

0.8

E. 0.24

px01 , but in notation of Models for Quantifying

(0)

Risk, it is 0.8 p01

, if we consider age x to be time 0. Recall the Kolmogorov Forward

Equation (we will continue using notation from Models for Quantifying Risk):

⎛

⎞

d

t

t

t

t

t

p( ) = ∑ r pik( )λ kj ( t + r ) − r pij( )λ jk ( t + r ) = ⎜ ∑ r pik( )λ kj ( t + r )⎟ − r pij( )λ j ( t + r ) . r ij

dr

⎝ k≠ j

⎠

k≠ j

In this case, we have

01

10

λ01 ( s ) = µ x+s

= 0.3, λ10 ( s ) = µ10

x+s = 0.1, λ12 ( s ) = µ x+s = 0.1,

(

)

02

20

21

λ02 ( s ) = µ x+s

= 0, λ20 ( s ) = µ x+s

= 0, λ21 ( s ) = µ x+s

= 0.

We also have the following specific Kolmogorov forward equations

d

0

(0)

(0)

(0)

(0)

p( ) = r p00

λ01 ( r ) − r p01

λ10 ( r ) + r p02

λ21 ( r ) − r p01

λ12 ( r ) =

r 01

dr

(0)

(0)

(0)

(0)

(0)

= 0.3 r p00

− 0.1r p01

− 0.1r p01

= 0.3 r p00

− 0.2 r p01

,

(

) (

)

(

)(

)

d

0

(0)

(0)

(0)

(0)

p( ) = r p01

λ10 ( r ) − r p00

λ01 ( r ) + r p02

λ20 ( r ) − r p00

λ02 ( r ) =

r 00

dr

(0)

(0)

= 0.1r p01

− 0.3 r p00

.

The Euler step method replaces the derivative on the left-hand side of the equation by a

difference quotient:

0

(0)

(0)

p( ) − 0.6 p01

= 0.7 p01

− 0.1588 ≈

0.7 01

(

)

()

()

≈ 0.1 0.30.6 p00

− 0.2 0.6 p01

= 0.03⋅0.8370 − 0.02 ⋅0.1588,

so that

()

p01

≈ 0.180934. Also,

0

0

0

0.7

Copyright © 2012 by Krzysztof Ostaszewski. All rights reserved. No reproduction in any form is permitted without

explicit permission of the copyright owner.

()

()

p00

− 0.6 p00

=

0

0.7

0

()

p00

− 0.8370 ≈

0

0.7

(

)

()

()

≈ 0.1 0.1r p01

− 0.3 r p00

= 0.1( 0.1⋅0.1588 − 0.3⋅0.8370 ) ,

0

0

so that

()

p00

≈ 0.813478.

Now we write the equation for the second step

0

(0)

(0)

p( ) − 0.7 p01

≈ 0.8 p01

− 0.180934 ≈

0.8 01

0

0.7

(

)

()

()

≈ 0.1 0.30.7 p00

− 0.2 0.7 p01

= 0.03⋅0.813478 − 0.02 ⋅0.180934,

0

0

resulting in

()

p01

≈ 0.20152366.

Answer A.

0

0.8

May 2012 Course MLC Examination, Problem No. 29

Your actuarial student has constructed a multiple decrement table using independent

mortality and lapse tables. The multiple decrement table values, where decrement d is

death and decrement w is lapse, are as follows:

(τ )

(d )

(w)

(τ )

l60

d60

d60

l61

950,000

2,580

94,742

852,678

(w)

You discover that an incorrect value of q60

′ was taken from the independent lapse table.

The correct value is 0.05. Decrements are uniformly distributed over each year of age in

the multiple decrement table. You correct the multiple decrement table, keeping

(τ )

(w)

l60

= 950,000. Calculate the correct value of d60

.

A. 47,310

B. 47,340

C. 47,370

D. 47,400

E. 47,430

Solution.

Based on the UDD assumption in the multiple decrement table, we have

(d )

( )

(τ )

p60

′ = p60

( )

q60

d

(τ )

q60

.

We calculate

852,678

≈ 0.89755579,

950,000

(τ )

(τ )

q60

= 1− p60

≈ 0.10244421,

2,580

(d )

q60

=

≈ 0.00271579,

950,000

(τ )

p60

=

so that

0.00271579

p60

′( d ) ≈ 0.89755579 0.10244421 ≈ 0.99713891.

We are also given that p60

′( w ) = 0.95. Now we will use the formula

Copyright © 2012 by Krzysztof Ostaszewski. All rights reserved. No reproduction in any form is permitted without

explicit permission of the copyright owner.

(w)

( )

(τ )

p60

′ = p60

( )

q60

w

(τ )

q60

(w)

to find q60

. We also must now corrected the probability

(τ )

p60

= p60

′( d ) ⋅ p60

′( w ) = 0.99713891⋅ 0.95.

We have

ln p60

′(w)

′(w)

(w)

(τ ) ln p60

(τ )

q60

= q60

⋅

=

q

⋅

≈

60

(τ )

ln p60

ln p60

′( w ) ⋅ p60

′(d )

(

≈ (1− 0.99713891⋅ 0.95 ) ⋅

)

ln 0.95

≈ 0.04992905.

ln ( 0.99713891⋅ 0.95 )

Based on this,

(w)

( w ) (τ )

d60

= q60

⋅l60 ≈ 0.04992905 ⋅ 950,000 ≈ 47432.5975.

Answer E.

May 2012 Course MLC Examination, Problem No. 30

For a special 20-year temporary life annuity-due payable monthly on (50), you are given:

(i) Mortality follows the Illustrative Life Table.

(ii) Deaths are uniformly distributed over each year of age.

(iii) 100 is payable at the beginning of each month from age 50 for 10 years.

(iv) 400 is payable at the beginning of each month from age 60 for 10 years.

(v) i = 0.06.

Calculate the expected present value of these annuity payments.

A. 24,000

B. 26,000

C. 28,000

D. 30,000

E. 32,000

Solution.

Note that the interest rate is 6%, the same as the one used in the Illustrative Life Table

(ILT), so we can use all values from the table. We find the following values from ILT:

α (12 ) = 1.00028,

β (12 ) = 0.46812,

10 E50 = 0.51081,

20 E50 = 0.23047,

a50 = 13.2268,

a60 = 11.1454,

a70 = 8.5693.

Furthermore,

(12 )

a50

= α (12 ) a50 − β (12 ) ≈ 1.00028 ⋅13.2668 − 0.46812 ≈ 12.8024,

10

(12 )

(12 )

a50

= 10 E50 ⋅ a60

= 10 E50 ⋅ (α (12 ) ⋅ a60 − β (12 )) ≈

≈ 0.51081⋅ (1.00028 ⋅11.1454 − 0.46812 ) ≈ 5.4557,

Copyright © 2012 by Krzysztof Ostaszewski. All rights reserved. No reproduction in any form is permitted without

explicit permission of the copyright owner.

20

(12 )

a50

=

20

(12 )

E50 ⋅ a70

=

20

E50 ⋅ (α (12 ) ⋅ a70 − β (12 )) ≈

≈ 0.23047 ⋅ (1.00028 ⋅ 8.5693 − 0.46812 ) ≈ 1.8676.

Now we are ready to calculate the quantity sought: the expected present value is

(

)

(12 )

(12 )

(12 )

1200 ⋅ a50

+ 3⋅ 10 a50

− 4 ⋅ 20 a50

=

= 1200 ⋅ (12.8024 + 3⋅ 5.4557 − 4 ⋅1.8676 ) ≈ 26,039.

Answer B.

Copyright © 2012 by Krzysztof Ostaszewski. All rights reserved. No reproduction in any form is permitted without