The Tablet Market

Not Carved in Stone

Consumer Trends and Market Segmentation

by Dominic Field, Antonella Mei-Pochtler, John Rose, and Joachim Stephan

A

lmost 18 months ago, we predicted

that tablets would become mass-market

devices within three years. (See “Tablets and

E-Readers: The Last, Best Chance for Digital

Content?” BCG article, August 2010.) Reality

has exceeded our expectations: consumers

worldwide have snapped up tablets in the

millions, often at the expense of other more

mature devices. In this fourth article in our

series on the post-PC era, we look at how

consumers’ tablet usage is creating new

opportunities as the market grows and

segments.

It may seem odd that the tablet market, in

which the leader’s share exceeds 80

percent, is still very much up for grabs.

Although the Apple iPad is unlikely to be

dethroned anytime soon, new research by

The Boston Consulting Group on tablet

and e-reader usage in the eight top markets worldwide confirms the trends we saw

developing more than a year ago and

points to a growing desire for choice in

functionality, price, and supporting ecosystem.1 The early success of Amazon’s

Kindle Fire offers further evidence that the

door is open to iPad competitors that can

offer attractive combinations of size,

features, and price, perhaps optimized

around a particular use or uses.

Consumers around the world increasingly

see tablets as multipurpose converged

devices that are their personal windows

onto the Internet. Tablet sales are now

expected to total some 370 million units

within the first five years, achieving a

much faster ramp-up than any other

consumer-electronics or mobile device.

Tablet ownership by U.S. households will

more than double by 2013. At the same

time, consumers are driving segmentation

of the market away from one-size-fits-all

models toward different devices for distinct

purposes.

More than 100 tablets have been introduced since the iPad first appeared,

including a host of introductions at the

January 2012 International Consumer

Electronics Show (CES). Consumers can

now choose among multiple models from

Acer, Archos, Asus, BlackBerry, HTC, LG,

For more on this topic, go to bcgperspectives.com

Lenovo, Motorola, Samsung, Sony, and

Toshiba (as well as Apple, of course), to

name a few. Tablets are taking sales from

other devices—most notably netbooks and

portable media players such as iPods but

also notebooks and PCs.

Ownership

Ownership is on the rise around the world,

as is intent to purchase. In the U.S., a

stunning 30 percent of respondents say

that they already own a tablet or an

e-reader, almost double the 16 percent of a

year ago. Although levels of ownership are

lower in other countries, the rate of

increase is even higher—nearly a fourfold

rise in the U.K., for example, to 27 percent,

and a tripling in both France and Spain.

Familiarity with tablets and e-readers is

high. In most countries, two-thirds or more

of consumers either own devices or are

familiar with them, representing doubledigit percentage increases since 2010. Half

of nonowners in the U.S. say that they

intend to buy a tablet or an e-reader in the

next year. Purchase intent is even higher

elsewhere, with every country surveyed

showing double-digit increases, save Japan,

which lags in tablet ownership. And in

China, among Internet users in major

cities, intent tops 70 percent. Actual sales

always trail statements of intent, but it is

clear that the tablet wave around the

world continues to build.

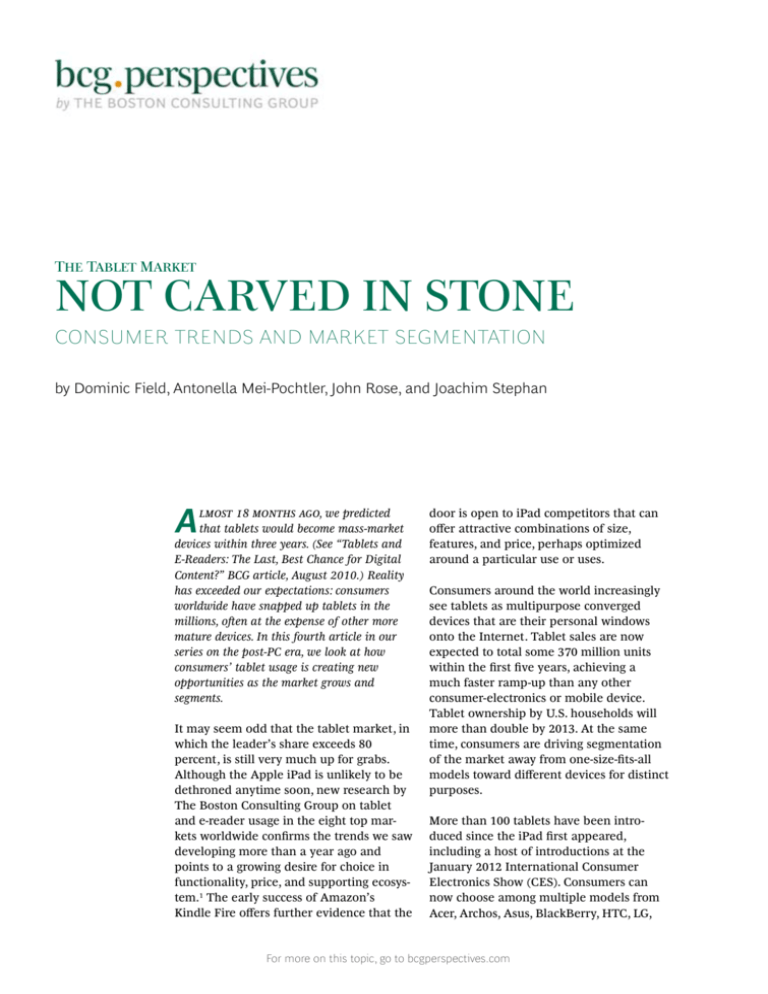

Tablets are taking—and will continue to

attract—share from other devices. Netbooks and portable media devices such as

the iPod will feel the biggest losses, but

PCs and notebooks are not immune.

Approximately half of consumers interested in purchasing a device in the next 12

months are looking at a tablet rather than

a netbook. (See Exhibit 1.) One-third are

considering a tablet over a home PC or laptop. Similarly, substantial shares of tablet

owners—between one-third and onehalf—think it is likely that their tablets will

replace their PCs, laptops, netbooks, and

portable media devices. One-third of

consumers are considering purchase of an

Exhibit 1 | Consumers Substitute Tablets or E-Readers for Current Devices

Strongly or somewhat likely (%)

Potential buyers

interested in

purchasing an

e-reader instead

of a . . .

50

0

34

33

Netbook

33

32

21

21

Portable

media device

21

Laptop or

notebook

21

20

Home PC

22

18

Smartphone

18

TV

Strongly or somewhat likely (%)

Potential buyers

interested in

purchasing a

tablet instead of

a...

100

50

0

53

53

Netbook

52

56

E-reader

45

43

35

Portable

media device

36

Laptop or

notebook

34

31

Home PC

27

29

Smartphone

20

20

TV

Strongly or somewhat likely (%)

Tablet owners

indicating their

tablet will replace

their . . .

50

0

38

41

Home PC

U.S.

38

49

Laptop or

notebook

35

41

Netbook

29

37

Portable

media device

27

36

E-reader

14

21

TV

13

20

Smartphone

Worldwide median

Sources: BCG e-reader survey (n = 8,700), November 2011; BCG analysis.

| Not Carved in Stone

2

e-reader instead of a netbook or portable

media device. One in five is also thinking

about choosing an e-reader over a PC,

laptop, or smartphone.

Convergence and Segmentation

Many consumers are planning to do more

with their tablets—read, watch, listen, surf,

e-mail—and they are gravitating toward

devices with convergent capabilities. At the

same time, interest in expanded capabilities for single-purpose e-readers remains

strong. Consumers like choice, and as the

tablet cements its position as a personal

entertainment and communications center,

they see value in both multipurpose tablets

and optimized single-function devices.

Consumers are assigning value to the differing device capabilities through price.

Sixty-eight percent of U.S. consumers say

that they prefer a multipurpose tablet such

as the iPad, Android-driven Samsung

Galaxy Tab, or Amazon-based Kindle Fire

to a single-purpose e-reader (for example,

the Amazon Kindle or Barnes & Noble

Nook). This is a 26 percent increase since

2010. Nine out of ten U.S. consumers plan

to use tablets for e-mail and Web surfing;

80 percent expect to watch videos. Only 17

percent prefer e-readers, a decline of 15

percent in the past year. Consumers in

other countries exhibit similar splits in

preference.

Consumers are backing their inclinations

with their wallets. U.S. consumers are

willing to pay from $140 to $240 for a

multipurpose tablet—an increase (at the

midpoint) of $35 since 2010. Their views

may have been shaped by the advent of

the $199 Kindle Fire, which had been

announced but was not yet shipping at the

time of the survey. The Kindle Fire’s early

results indicate that Amazon’s offering hit

a sweet spot. At mid-December 2011, the

company cited sales that had topped 1

million units per week for three straight

weeks. Wall Street estimates have Amazon

selling 5 million Kindle Fires in December.

In Europe, willingness to pay has jumped

about $100 in the past year and is now

generally in the $250 to $350 range. The

Chinese consumers surveyed said that they

were willing to pay from $280 to $440 for a

tablet, or $185 more than in 2010.

Despite this, the iPad, whose least expensive model is $499 in the U.S. (more in

other countries), is priced too high for

many consumers. The market remains

open for devices that may not fully match

the iPad’s one-size-fits-all functionality but

still provide the personal and portable

Internet access consumers crave.

By contrast, the willingness to pay for

e-readers is seeing a decline in most

countries. The right price for U.S. consumers is now from $60 to $100, or $25 lower

than in 2010. That said, e-reader sales

remain robust. Amazon, the market leader,

has successfully segmented its Kindle line

with a half-dozen models, priced from $79

to $349 in the U.S.

Consumers’ price expectations continue to

present a challenge for manufacturers.

Gartner estimates the materials cost alone

of the iPad 2 at $269, Motorola’s Xoom LTE

MZ600 at $330, and Barnes & Noble’s

Nook at $174. The Galaxy Tab’s materials

bill, according to iSuppli, is $205.2 The

Kindle Fire is widely reported to cost

Amazon more than $200 per unit to build,

but the e-tailer is clearly pursing a razorand-blades strategy with the expectation

that Kindle Fire users will generate sales

for its huge ecosystem of content.

Nonetheless, manufacturers are paying

heed. Among the tablets introduced at this

year’s CES, at least four are reported to be

priced from $170 to $250.

With strong ecosystems to support their

devices (or strong devices to support their

ecosystems, as the case may be), Apple and

Amazon have staked out strong competitive positions at opposing ends of the

market. A third major ecosystem, built

around Google’s Android operating system,

is growing, and it is possible that Microsoft,

with a Windows-based OS for tablets and

smartphones, may offer a fourth formidable competitor.

| Not Carved in Stone

3

There is also evidence that locally grown

ecosystems are taking hold. In China, for

instance, the market has long been dominated by local players, and given the

continued tight regulation of content, it

will likely stay that way. Chinese consumers are the most eager to purchase tablets

within the coming year, largely because

they are able to access far more content

online than they can on their TVs. Although a true “end to end” ecosystem has

yet to emerge in China, Internet portals

are aggressively amassing content rights

and becoming content aggregators. In the

past year alone, Internet giants Baidu and

Tencent jumped into the online video

market with their own branded products,

competing with top players such as Youku,

Tudou, and Sohu.

where people use their devices. More than

90 percent of owners use their tablets at

home in the evenings, principally for

personal purposes. In the U.S., 80 percent

use them in bed. (See Exhibit 2.)

Consumption of traditional media—books,

magazines, newspapers, TV, and film—has

plateaued or declined modestly in the past

year. Users continue to appreciate the

convenience tablets provide for subscriptions and portability. Willingness to pay for

digital books, newspapers, and magazines

remains steady except for slight decreases

in monthly newspaper subscriptions.

Books are the most popular written

content for tablets and e-readers. Chinese

survey respondents far outpace those in

other countries in readership of digital

magazines and newspapers.

Content and Consumption

Expectations and reality vary on video

viewing. About 80 percent of U.S. respondents say that they expect to watch videos

Content access and consumption worldwide are being driven by when, how, and

Exhibit 2 | Tablets Are Consumers’ Personal Windows on the Internet

Consumers use their tablets at home mainly in the evening and at night

Strongly or somewhat likely (%)

100

95

93

80

88

79

77

62

50

0

I use my

tablet at home

in the evening

I use my

tablet at home

during the day

I use my

tablet at

night in bed

Change since

December 2010 15

(%)

16

4

100

25

51

34

I use my

tablet while

I am at work

15

8

27

38

I use my

tablet during

dinnertime

I use my

tablet during

breakfast

–4

35

15

–9

8

I use my

tablet on the

way to work

–10

9

–24 –13

Consumers use their tablets mainly for personal activities

93 87

90 90

66

50

0

6

51

49

I use my

tablet during

lunchtime

19

(%)

60

48

Personal

e-mail

Social

networking

Surfing the

Internet for

personal use

U.S.

63 59

55

62 58

54 54

Reading

e-books and

e-magazines

51 51

Watching

videos

43 41

Playing

games

Listening

to music

32 38

30 33

29 30

26 24

15 16

7 11

Surfing the

Internet for

work use

Work

e-mail

Video

Using other

conferencing

soware for

for personal work purposes

use

Creating and

Creating and

Video

editing files for

editing files

conferencing

personal use

for work use for work use

Worldwide median

Sources: BCG e-reader survey (n = 8,700), November 2011; BCG analysis.

| Not Carved in Stone

4

on their tablets, while only 63 percent of

current device owners actually do so.

Chinese users are most likely to watch

videos, with 85 percent reporting this

usage.

There is plenty of anecdotal evidence of

tablets’ impact on the workplace, but two

factors in particular appear to be holding

back more widespread use for work-related

activities. One is speed: more than twothirds of all consumers said that faster

performance would likely increase their

tablet usage for work. The second factor is

the lack of a Windows-based device. In

mid-2011, U.S. and Chinese consumers

expressed their desire for a tablet running

Windows, and in this—our most recent—

survey, two-thirds of all consumers reported

that a tablet with Windows capability would

be likely to lead to more work-related usage.

T

he tablet wave is still forming.

Tablets have locked in a role as

personal digital devices because users

place a high value on the ability to send

e-mail, share a video, or read a magazine

wherever, whenever they choose—even in

bed. But this role is only the beginning.

New uses—some not yet invented, others

not even imagined—will fuel continued

growth and take usage in unforeseen

directions. Thus far, the surrounding

ecosystems of content, apps, and services

have played a big part in tablets’ popularity, and we expect this to continue, especially as new cloud-based services become

available. We don’t yet know what impact

a successful Windows-based device and

ecosystem will have—or how the development of local ecosystems, based in their

users’ languages and cultures, will shape

the evolution of those markets.

As we have pointed out before, agility will

be the watchword for technology and

media companies in this fast-changing

marketplace. Today, Apple and Amazon

(along with numerous app and content

developers) are the overwhelming winners

in the tablet market. However, both winners and challengers should keep a finger

firmly on the pulse of rapidly developing

consumer tastes and preferences, which

will almost certainly drive further growth,

fragmentation, and segmentation of the

market over the next 18 months.

Notes

1. BCG conducted the study in the fourth quarter of

2011, surveying some 8,700 consumers from the top

eight markets worldwide: China, France, Germany,

Italy, Japan, Spain, the U.K., and the U.S. The

consumers surveyed in all markets were from 18 to

65 years old, use the Web, and read books, magazines, and newspapers.

2. These estimates refer to the Apple iPad 2:

Wi-Fi-only, 16 GB; Motorola Xoom MZ600: 3G,

CDMA (Code Division Multiple Access); and

Samsung Galaxy Tab (GT-P1000).

About the Authors

Dominic Field is a partner and managing director in the Los Angeles office of The Boston Consulting Group. You may contact him by e-mail at

field.dominic@bcg.com.

Antonella Mei-Pochtler is a senior partner and

managing director in the firm’s Vienna office. You

may contact her by e-mail at mei-pochtler.antonella

@bcg.com.

John Rose is a senior partner and managing director in BCG’s New York office. You may contact him

by e-mail at rose.john@bcg.com.

Joachim Stephan is a partner and managing director in the firm’s Munich offioce. You may contact him by e-mail at stephan.joachim@bcg.com.

The Boston Consulting Group (BCG) is a global

management consulting firm and the world’s leading advisor on business strategy. We partner with

clients from the private, public, and not-for-profit

sectors in all regions to identify their highest-value

opportunities, address their most critical challenges,

and transform their enterprises. Our customized

approach combines deep in­sight into the dynamics

of companies and markets with close collaboration

at all levels of the client organization. This ensures

that our clients achieve sustainable compet­itive advantage, build more capable organizations, and secure lasting results. Founded in 1963, BCG is a private company with 74 offices in 42 countries. For

more information, please visit bcg.com.

© The Boston Consulting Group, Inc. 2012.

All rights reserved.

1/12

| Not Carved in Stone

5