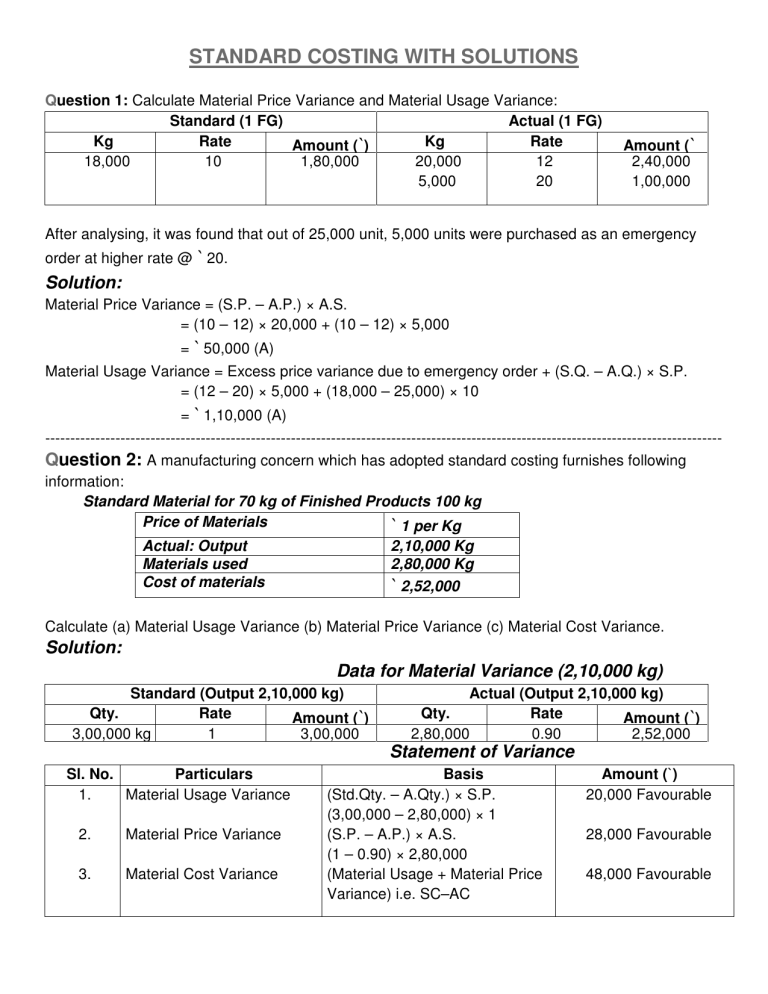

standard costing with solutions

advertisement