BUSINESS 42.408* A COST MANAGEMENT SYSTEMS

advertisement

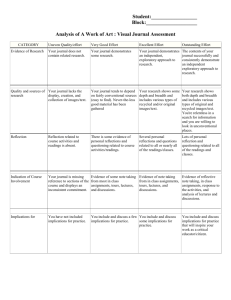

BUSINESS 42.408* A COST MANAGEMENT SYSTEMS WINTER 2002 INSTRUCTOR: Dr. Raili Pollanen Office: 820 DT, Tel. 520-2600, Ext. 2376 Office Hours: Wed.16:00 – 17:30; Thu. 12:00 – 14:00; and by Appointment E-mail: raili_pollanen@carleton.ca COURSE TIME AND LOCATION: Lectures: Thursdays, 14:30 – 17:30, 201 PA PREREQUISITES: Business 42.308* (with a grade of C- or better) The School of Business enforces all prerequisites. It is your responsibility to ensure that you meet the prerequisite requirements for this course. Lack of prerequisite knowledge may lead to failure in the course. If you think that you have taken courses, possibly in another institution, that are equivalent to the prerequisites specified for this course, you must show proof to the Undergraduate Adviser. Please bring in your transcript and course description(s). Failure to document this requirement can lead to mandatory deregistration any time before the last day of classes. Only the Undergraduate Program Supervisor of the School of Business can waive prerequisite requirements. COURSE OVERVIEW AND OBJECTIVES: This course focuses on managerial planning and control issues using case methodology. It extends the concepts and systems covered in managerial and cost accounting courses and also integrates relevant issues from other functional areas of organizations. Specifically, budgeting, cost management, and performance evaluation and reward systems are examined. Emphasis is placed on the need for different control techniques in different types of organizations and for balanced integrated systems comprising both financial and nonfinancial controls. 42.408* Cost Management Systems 2 REQUIRED TEXTBOOKS: Robert N. Anthony and Vijay Govindarajan, Management Control Systems, 10th Ed., McGrawHill/Irwin, 2001 (Packaged with readings from Robert N. Anthony and David W. Young, Management Control in Nonprofit Organizations, 6th Ed., McGraw-Hill/Irwin, 1999). Cost Management Systems: Readings Package, Winter 2001 (Photocopied package of additional readings for sale at the bookstore). REFERENCE RESOURCES: Guidelines for Managing Team Meetings (Available at http://www.business.carleton.ca/academic_programs/groupwork.html) Charles T. Horngren, George Foster, Srikant M. Datar, and Howard D. Teall, Cost Accounting, 2nd Can. Ed., Prentice Hall, 2000 (Used in the prerequisite 42.308* course). Gary Spraakman and Thomas Cheng, Current Trends and Traditions in Management Accounting Case Analysis, 3rd Ed., Captus Press, 1998 (On reserve in Library). L.S. Rosen, Introduction to Accounting Case Analysis, 2nd Ed., McGraw-Hill Ryerson, 1981 (On reserve in Library). TEACHING METHODOLOGY: Teaching methodology for this course encompasses assigned readings, case analyses, case presentations and discussions in class, and a group project. Students are expected to read the assigned chapter(s), to discuss the assigned cases in groups before each class, and to prepare written analyses and presentations of selected cases. The cases are then discussed in class to highlight and clarify key concepts. Students, working in groups, also have an opportunity to apply these concepts to an actual organization of their choice. The primary role of the instructor in this course is to encourage and facilitate student learning by helping students understand and apply key concepts and by providing them with regular feedback on their progress. It should be emphasized that diligent independent preparation of cases and active participation in group discussions of cases before class and in class are crucial to the development of effective problem solving skills in this field. 42.408* Cost Management Systems EVALUATION METHODS: Case Outlines (2 x 5%) – Group Case Outline – Individual Class Participation – Individual Case Presentation – Group Project Presentation – Group Project Report – Group Final Examination Case – Individual Total 3 10% 10% 10% 5% 5% 20% 40% 100% Case Outlines. Case outlines are one-page typed executive summaries of designated case analyses. They should contain the highlights of the case analyzed, including the following elements: introduction, analysis of main issues under appropriate subheadings, conclusion, and recommendations, if applicable. Select the cases from cases marked with + on the topical schedule, and hand in a completed summary at the beginning of the class. The individual outline case must be different from the group outline case and from the group presentation case. Class Participation. Class participation is determined equally by the quantity and quality of student involvement in class discussions. In each class, each student can gain up to three participation points. Participation in presenting designated cases does not constitute class participation, as it is evaluated separately. Furthermore, mere attendance without explicit contribution to discussions does not provide participation marks. Case Presentations. Case presentations are 15-20 minute professional presentations of designated cases. They should contain the highlights of the case analyzed in an organized manner. All group members must participate in presentations. As a group, select a case from cases marked with * on the topical schedule. Each presenting group should hand in a copy of the presentation materials and also distribute a copy to each other group, but no formal report is required. The presentation case for a group cannot be the same as the group outline case or the individual outline case by any group member. Project Report. A project report is a comprehensive written report of management control issues of a selected organization, completed in groups. The report should be 12 – 15 pages in length, doublespaced, excluding major tables, exhibits, appendices, and preliminary matter, and be professional in its style and format. The reports are evaluated for both content and style. Select an organization from any field, e.g., manufacturing, merchandising, service, nonprofit, or government, with which at least one group member is personally familiar, or for which relevant information is publicly available. Prepare an one-page written proposal for approval by the professor. In writing the report, assume the role of independent management consultants. Hand in two copies of the final report, if you wish a copy to be returned to you. Project Presentations. Project presentations are 20-30 minute professional presentations of the group 42.408* Cost Management Systems 4 projects. They should highlight the main points of the analyses and findings in an organized manner. All group members must participate in the presentation. Assume the role of management consultants presenting to the Board of Directors. Each group should distribute a copy of the executive summary to other groups. Final Case Examination. The final examination is a comprehensive case requiring a significant degree of integration of the material covered in the course. The case examination is three hours in length and is completed in the last class. A minimum mark of 45 percent must be obtained on it in order to pass the course. Requests for deferred final examinations must be directed to the Registerial Services office for assessment. Note: Due to the participative nature of case outlines, class discussions, case presentations, and the project, no make-up assignments are available for any reason. Only in a case of documented medical reasons, the weight of a component missed may transferred to the final examination. Each group member must complete and hand in a peer evaluation form. Each group should maintain ongoing records of their meetings, tasks assigned, and each member’s performance. Please refer to guidelines for team meetings at: http://www.business.carleton.ca/academic_programs/groupwork.html SPECIAL NEEDS ASSISTANCE: Students with a disability who require special accommodations should first contact a coordinator at the Paul Menton Centre to complete the necessary forms and then discuss their accommodation needs with the instructor. In order to allow sufficient time to make the necessary arrangements for examinations, these forms must be completed at least two weeks prior to the mid-term examination and by March 8, 2002 for the final examination. EXAMINATION POLICY: The University policy with respect to examinations is strictly adhered to. For examination purposes, students are responsible for all material in the assigned readings, cases, and class discussions and presentations, including any additional material provided by the instructor in class. Non-programmable calculators without alpha storage capability may be used on examinations. Supplemental or grade-raising examinations are not available in this course. ACADEMIC INTEGRITY: The University regulations and sanctions for instructional offences such as plagiarism and unethical conduct during examinations and graded class assignments are enforced, and all violations of the 42.408* Cost Management Systems 5 instructional offences policy must be reported. The Undergraduate Calendar defines plagiarism as follows: “to use and pass off as one’s own idea or product work of another without expressly giving credit to another.” Borrowing someone else’s answers and unauthorized possession of examinations, solutions to examination questions, or material designed to help answer examination questions during examinations also constitute violations of the policy on instructional offences. Examinations and graded individual assignments must be the exclusive work of the individual student and all graded group assignments the exclusive work of the members of that group. All group members are expected to participate equally in all group assignments. RELEVANT DATES: January 3, 2002 January 31, 2002* February 18 – 22, 2002 March 8, 2002 March 28, 2002* April 4, 2002 Classes begin Project outlines due for approval Winter break, no classes Last day for withdrawal from courses Project reports, presentations , and peer evaluations due Final Case Examination Note: *The due dates are firm. No late submissions are accepted. 42.408* Cost Management Systems 6 TENTATIVE TOPICAL OUTLINE AND SCHEDULE: Date Jan. Topic/Activity 3 Nature of Management Controls and Control Systems Readings: 10 17 24 31 ♦ Anthony and Govindarajan, Ch. 1, The Nature of Management Control Systems Control Environment and Control Tightness Readings: ♦ Anthony and Govindarajan, Ch. 2, Behavior in Organizations ♦ Reading #3, Merchant, Control Tightness (or Looseness) ♦ Reading #2, Pollanen, Management Controls and Their Organizational and Environmental Context: A Review with Managerial Emphasis Cases: 2-3: 1-4: Rendell Company+ Xerox Corporation (A)* Responsibility Structures Readings: ♦ Anthony and Govindarajan, Ch. 3, Responsibility Centers: Revenue and Expense Centers ♦ Anthony and Govindarajan, Ch. 4, Profit Centers Cases: 4-3: 3-2: Boise Cascade Corportion+ New Jersey Insurance Company* Responsibility Accounting and Transfer Pricing Readings: ♦ Anthony and Govindarajan, Ch. 5, Transfer Pricing ♦ Anthony and Govindarajan, Ch. 14, Multinational Organizations References: ♦ Horngren et al. Ch. 23, Management Control Systems, Transfer Pricing and Multinational Considerations ♦ Horngren et al., Ch. 24, Performance Measurement, Compensation, and Multinational Considerations Cases: 5-4: Strider Chemical Company+ 14-3: Nestle S.A.* Strategic Planning 42.408* Cost Management Systems Readings: 7 ♦ Anthony and Govindarajan, Ch. 7, Strategic Planning ♦ Anthony and Govindarajan, Ch. 12, Controls for Differentiated Strategies Cases: Feb. 7 14 7-3: Dairy Pak+ 12-3: 3M Corporation* Budget Control Systems Readings: ♦ Anthony and Govindarajan, Ch. 8, Budget Preparation ♦ Horngren et al., Ch. 6, Master Budget and Responsibility Accounting Cases: 8-1: Case #6, Package: Sound Dynamics, Inc.+ The Repertory Theatre (B): Strategic Budgeting* Activity-Based Cost Control and Management Systems Readings: ♦ Reading #4, Cooper and Kaplan, Activity-Based Costing: Introduction ♦ Reading #5, Cooper and Kaplan, The Promise – and Peril – of Integrated Cost Systems Cases: 7-1: Case #4, Package: Allied Office Products+ Cost Center Management at Air Command (B)* Winter Break, Feb. 18 - 22, no classes 28 Financial Performance Measurement Readings: ♦ Anthony and Govindarajan, Ch. 6, Measuring and Controlling Assets Employed ♦ Anthony and Govindarajan, Ch. 9, Analyzing Financial Performance Reports References: ♦ Horngren et al., Chs. 7 & 8, Flexible Budgets, Variances, and Management Control I & II ♦ Horngren et al., Ch. 16, Revenues, Sales Variances, and Customer Profitability Analysis Cases: 9-3: Galvor Company+ 42.408* Cost Management Systems 8 6-5: March 7 14 21 28 April 4 Industrial Products Corporation* Nonfinancial Performance Measurement and Management Compensation Readings: ♦ Anthony and Govindarajan, Ch. 10, Performance Measurement ♦ Anthony and Govindarajan, Ch 11, Management Compensation ♦ Reading #6, Simons, Building a Balance Scorecard References: ♦ Horngren et al., Ch. 13, Strategy, Balanced Scorecard, and Strategic Profitability Analysis ♦ Horngren et al., Ch 19, Cost Management: Quality, Time, and the Theory of Constraints Cases: 10-3: Enager Industries, Inc.+ 11-4: Wayside Inns, Inc.* Management Control in Service Organizations/ Management Control of Projects Readings: ♦ Anthony and Govindarajan, Ch. 13, Service Organizations ♦ Anthony and Govindarajan, Ch. 15, Management Control of Projects References: Horngren et al., Ch. 21, Capital Budgeting and Cost Analysis Cases: 13-1: O’Reilley Associates+ 15-1: Northeast Research Laboratory* Management Control in Nonprofit Organizations References: ♦ Anthony and Young, Ch. 2, Characteristics of Nonprofit Organizations ♦ Anthony and Young, Ch. 10, Budgeting (including Appendix) ♦ Anthony and Young, Ch. 12, Measurement of Output Cases: 8-3: Riverview+ 13-3: Harlan Foundation* Project Presentations Final Examination Case Notes: +Cases designated for summary reports and class discussion. 42.408* Cost Management Systems *Cases designated for presentations and class discussions. 9 42.408* Cost Management Systems 10 EVALUATION CRITERIA FOR PROJECT AND CASE REPORTS Criteria Mark 1. Introduction: relevant background; clear identification of key issues and/or problems; clear description of scope of research and report 10% 2. Analysis: clear identification of alternative courses of action, if applicable; clear description of criteria for evaluating alternatives or issues; thorough logical analysis of all relevant factors; application of relevant theoretical concepts and frameworks 40% 3. Conclusion and Recommendations: consistency of conclusions and/or recommendations with analysis; plausibility of recommendations, if applicable; identification of implementation considerations, if applicable 20% 4. Structure and Style: presence of all appropriate standard elements (e.g., cover letter, executive summary, table of contents, exhibits/illustrations, references, and appendices in long reports); use of appropriate headings; appropriate grammar, spelling, and typographical accuracy; highly professional appearance 20% 5. Overall Research Effort: scope of research; quality and quantity of references; appropriate supporting documentation 10% TOTAL/OVERALL 100% Comments 42.408* Cost Management Systems 11 EVALUATION CRITERIA FOR PRESENTATIONS Please evaluate each group’s performance based on the seven criteria in the table. Use the following as a guide in assigning scores to each criterion: 10=outstanding; 9=excellent; 8=very good; 7=good; 6=satisfactory; 5=minimally satisfactory; 4=somewhat unsatisfactory; 3=unsatisfactory; 2=very unsatisfactory; 1=extremely unsatisfactory. The overall presentation mark for each group is the arithmetic average of the scores submitted by all other groups and the professor. Group Number Criteria 1 2 3 4 5 6 7 8 9 10 1. Logical organization 2. Appropriateness to audience 3. Effective use of visual aids 4. Overall clarity 5. Effective use of time 6. Professionalism 7. Quality of content AVERAGE PEER EVALUATORS Name (Please print) Student Number Signature 1. _________________________ ___________________ ___________________________ 2. _________________________ ___________________ ___________________________ 3. _________________________ ___________________ ___________________________ 4. _________________________ ___________________ ___________________________ 5. _________________________ ___________________ ___________________________ 6. _________________________ ___________________ ___________________________ 7. _________________________ ___________________ ___________________________ 42.408* Cost Management Systems 12 Date: _____________________________________ CRITERIA FOR PEER EVALUATION Please evaluate each group member’s performance based on the ten criteria in the table below. Use the following as a guide in assigning scores to each criterion: 10=outstanding; 9=excellent; 8=very good; 7=good; 6=satisfactory; 5=minimally satisfactory; 4=somewhat unsatisfactory; 3=unsatisfactory; 2=very unsatisfactory; 1=extremely unsatisfactory. PLEASE PROVIDE ADDITIONAL COMMENTS ON THE REVERSE SIDE TO JUSTIFY YOUR EVALUATION OF EACH MEMBER. Group Member Criteria 1 2 3 4 5 6 7 8 1. Attendance at group meetings (No. of meetings = ) 2. Quality of contribution to group discussions 3. Quality of contributions to writing assignments 4. Quality of contributions to organizing assignments 5. Amount of time spent on group assignments relative to other members 6. Quality of initiative when something needed to get done 7. Reliability in completing assigned responsibilities 8. Leadership in completing assigned responsibilities 9. Commitment to the group 10. Your willingness to work with member again AVERAGE Date: ____________________________________ Name: ____________________________________ Signature: ____________________________________ Student Number: _______________________