GENERAL INFORMATION Section 29 of The Provincial Sales Tax Act

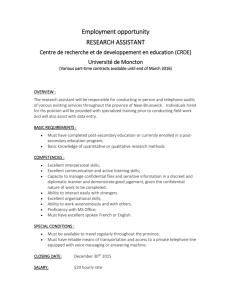

advertisement

Ministry of Finance Revenue Division 2350 Albert Street Regina, Sask. S4P 4A6 Phone: 1-800-667-6102 Fax: (306) 798-3045 NON-RESIDENT CONTRACTORS REQUEST FOR CONTRACT CLEARANCE SUPPLEMENTARY WORKSHEETS GENERAL INFORMATION This form contains supplementary worksheets for the “Non-Resident Contractors – Request for Contract Clearance”. In order to ensure taxes have been accounted for on the contract identified on that document and to ensure prompt issuance of a clearance letter, please complete all sections of this form (A-F inclusive). **Where similar records are available (i.e. job cost records, internal worksheets, etc), these may be provided in lieu of completing each section of the form.** If you have questions, or need assistance with completing this form, please call 1-800-667-6102, extension 0956. For further information regarding reporting requirements and calculations for non-resident contractors, please refer to Information Bulletin PST-38 located on our website at www.finance.gov.sk.ca/taxes/bulletins or refer to the detailed information outlined on the succeeding pages. Contractors involved in manufacturing should refer to Information Bulletin PST-37 – Information for Manufacturing Contractors. Please note that penalty and interest will be applied to overdue tax owing. Section 29 of The Provincial Sales Tax Act Non-resident contractors must become registered with the Saskatchewan Ministry of Finance in order to report any tax payable on materials, vehicles, tools, and equipment consumed or used in Saskatchewan. Bonding In accordance with Section 29 of The Provincial Sales Tax Act, a non-resident contractor working in Saskatchewan is required to post a guarantee bond or cash deposit in an amount equivalent to 5% of the total contract amount. It is the duty of the general contractor or principal to ensure that the non-resident contractor complies with this provision. Failure to do so renders the general contractor or principal liable for any taxes which the non-resident contractor may fail to remit. Contract Clearance on Final Payment Before the final payment is made on a contract, the sub-contractor should obtain a clearance letter from the Revenue Division and provide a copy of the letter to the general contractor or principal. If the contractor has not complied with the requirements of The Provincial Sales Tax Act, the general contractor or principal will be requested to withhold from any hold back, an amount equal to the tax due, and remit this amount to the Revenue Division. In the event that a non-resident contractor working in Saskatchewan does not comply with the Revenue Division, the general contractor or principal will be held accountable for the taxes owing. Supply Only Contracts Note there is no provision under The Provincial Sales Tax Act to issue clearances for supply only contracts. If a supplier invoices Saskatchewan PST on these types of contracts, tax is paid directly to them. If the supplier has not invoiced PST, the purchaser is required to self-assess the tax on their returns. SECTION A – Breakdown of Contract Costs Page 2 Please provide a copy of the invoice, purchase order, or portion of the contract detailing the commencement and completion dates, scope of work, and contract value including change orders. Please also complete the following table in order to provide a breakdown of the total costs for the contract. Labour Costs $ Subcontractor Costs $ Material Costs $ A more detailed breakdown of these costs should be provided in Sections B and C. Other Costs -please specify (eg. equipment rentals) $ Total Costs $ SECTION B – Sub-Contractor Information Please complete the following table to list all subcontractors working on site as well as all lawyers, engineers, architects, and geo-science firms hired for the contract. If additional space is needed, please use the back of this page or attach an additional list. Please note, copies of invoices may be requested for verification. Name Street Address City, Prov Postal Code Type of Work Performed Value of Contract Example Company 123 Street Edmonton, AB T5A 0A1 supply and install electrical $25,000.00 Labour Only Labour & Material Contract Start Date (mm/dd/yyyy) Contract End Date (mm/dd/yyyy) X 01/20/2010 10/30/2010 SECTION C – Calculation of PST due on Materials and Goods Consumed Page 3 The PST due on all materials, supplies, and equipment repair parts purchased outside Saskatchewan and brought into the province must be remitted on the laid-down cost which includes currency exchange, total freight charges to the final destination, customs and excise taxes and duties, but not the GST. The PST on all construction materials, supplies and equipment repair parts purchased in Saskatchewan must be paid to the vendor at the time of purchase. Contractors involved in manufacturing should refer to Information Bulletin PST-37 – Information for Manufacturing Contractors for information on how to calculate tax on the manufactured cost of materials. Please complete the following table to account for all materials purchased for the contract. If additional space is needed, please use the back of the next page or attach an additional list. Job cost records or similar accounting records may be provided in lieu of completing the table below. Please note copies of purchase invoices may be requested for verification. Laid Down Cost PST Paid To Supplier? wire $500.00 Yes - Return Period Tax was SelfAssessed In - lumber, freight $5,000.00 No $250.00 Jan-Mar 2010 - $3,000.00 No - - $150.00 Invoice Date Invoice Number Supplier Name 1/30/2010 1234 Example Company A Regina, SK 2/30/2010 4321 Example Company B Edmonton, AB 3/30/2010 4322 Example Company B Edmonton, AB lumber, freight Supplier Address Description of Goods Purchased Tax SelfAssessed (5%) Total Tax Payable Tax Payable (5%) - A SECTION D – Calculation of PST due on Vehicles, Tools, and Equipment Page 4 Non-resident contractors must report any PST payable on vehicles, tools, and equipment used in Saskatchewan. PST is calculated on these assets at a reduced rate using the methods described below in order to account for the period of use in the province. Please refer to Subsection 5(9.1) of The Provincial Sales Tax Act on our website at www.finance.gov.sk.ca/taxes/pst or Information Bulletin PST-38 – Non-Resident Contractors to obtain an explanation of each of the temporary use methods. An instruction sheet is also included at the end of this form which provides a detailed explanation of the temporary use formulas. Please note that only one method should be chosen for each vehicle, tool, and piece of equipment. If a vehicle is registered with the International Registration Program (IRP), no additional tax applies. However, please provide copies of the cab card for our records. For more information on IRP, please refer to Information Bulletin PST-50 – Information for Interjurisdictional Carriers which is available on our website at www.finance.gov.sk.ca/taxes/bulletins or contact the appropriate institution in your province. If additional space is needed, please use the back of the page or attach an additional list. Please also provide a copy of the bill of sale and/or lease or rental agreement for each item listed. Method 1 – Leased or Rented This method should be used for all leased or rented equipment. Year/Make/Model Monthly Lease Amount Date First Entered Province (mm/dd/yyyy) Date Exited Province (mm/dd/yyyy) Number of Months in Province (Rounded up) Total Taxable Value ([Monthly Lease Amount] X [Number Months in Province]) Return Period Tax was Self-Assessed In (Date or N/A) Example S/N: XXXXX 2006 Ford F350 $ 1,000.00 01/01/2010 02/03/2010 2 $ 2,000.00 Jan-Mar 2010 If Tax was NOT Self-Assessed, Enter Tax Payable ([Total Taxable Value] X 5%) - Example S/N: XXXXX 2007 Ford F350 $ 1,100.00 01/01/2010 02/03/2010 2 $ 2,200.00 N/A $ 110.00 Unit # Serial # 1 2 Total Tax Payable B Calculation of PST due on Vehicles, Tools, and Equipment (continued) Page 5 Method 2 – 1/3 Temporary Use (due each year the unit entered the province until fully tax paid) Unit # Serial # Year/Make/Model Purchase Amount (no depreciation allowed) 1 Example S/N: XXXXX 2006 Ford F350 $ 50,000.00 01/01/2010 02/03/2010 1 $ 16,666.67 $ 16,666.67 Jan-Mar 2010 If Tax was NOT Self-Assessed, Enter Tax Payable ([Total Taxable Value] X 5%) - 2 Example S/N: XXXXX 2007 Ford F350 $ 60,000.00 01/01/2010 02/03/2011 2 $ 20,000.00 $ 40,000.00 N/A $ 2,000.00 Date First Entered Province (mm/dd/yyyy) Date Exited Province (mm/dd/yyyy) Number of Years in Province (Rounded up) Taxable Value per Year ([Purchase Amount] divided by 3) Total Taxable Value ([Taxable Value per Year] X [Number Years in Province]) Return Period Tax was Self-Assessed In (Date or N/A) C Total Tax Payable Method 3 – Depreciated Cost (one time reduced payment) Purchase Date (mm/dd/yyyy) Date First Entered Province (mm/dd/yyyy) Number of Months Between Purchase and Entry [Maximum 40 Months] Depreciation Percentage (1.5% X [Number Months Between Purchase and Entry]) [Maximum 60%] Dollar Value of Depreciation ([Depreciation Percentage] X [Purchase Amount]) Taxable Value ([Purchase Amount] - [Dollar Value of Depreciation]) Return Period Tax was SelfAssessed In (Date or N/A) If Tax was NOT Self-Assessed, Enter Tax Payable ([Total Taxable Value] X 5%) Unit # Serial # Make/Model Purchase Amount 1 Example S/N: XXXXX 2006 Ford F350 $ 50,000.00 04/09/2006 01/01/2010 40 60 % $ 30,000.00 $ 20,000.00 Jan-Mar 2010 - 2 Example S/N: XXXXX 2007 Ford F350 $ 60,000.00 05/26/2008 01/01/2010 20 30 % $ 18,000.00 $ 42,000.00 N/A $ 2,100.00 Total Tax Payable D Calculation of PST due on Vehicles, Tools, and Equipment (continued) Page 6 Method 4 – 1/36 Temporary Use (due each 30-day period the unit entered the province until fully tax paid) This method is allowed only when provincial or state tax was already paid to another taxing jurisdiction. Harmonized Sales Tax (HST) is not a provincial sales tax; therefore this method is not allowed if HST was paid on the vehicles, tools, and equipment. No depreciation is allowed under this method. Year/Make/Model Purchase Amount (no depreciation allowed) Date First Entered Province (mm/dd/yyyy) Date Exited Province (mm/dd/yyyy) Number of Months in Province (Rounded up) Taxable Value per Month ([Purchase Amount] divided by 36) Total Taxable Value ([Taxable Value per Month] X [Number Months in Province]) Return Period Tax was Self-Assessed In (Date or N/A) Example S/N: XXXXX 2006 Ford F350 $ 50,000.00 01/01/2010 02/03/2010 2 $ 1,388.89 $ 2,777.78 Jan-Mar 2010 If Tax was NOT Self-Assessed, Enter Tax Payable ([Total Taxable Value] X 5%) - Example S/N: XXXXX 2007 Ford F350 $ 60,000.00 01/01/2010 02/03/2010 2 $ 1,666.67 $ 3,333.33 N/A $ 166.67 Unit # Serial # 1 2 Total Tax Payable E SECTION E – Calculation of Total Provincial Sales Tax Payable The following table should be completed by filling in the Total Tax Payable as calculated in Sections C and D. A Tax Payable on Materials & Goods Consumed (from Page 3) ----- Vehicles, Tools, and Equipment: B C D E Tax Payable on Leased or Rented Units (from Page 4) Tax Payable under the 1/3 Method (from Page 5) Tax Payable under the Depreciated Cost Method (from Page 5) Tax Payable under the 1/36 Method (from above) Total PST Payable Payment will be required prior to issuing a clearance letter. Please note that penalty and interest will be applied to overdue tax owing. Upon receipt of this form, you will be contacted to confirm the total PST payable. SECTION F – Bulk Fuel Imported into Saskatchewan Page 7 Please complete the following table to account for all bulk fuel purchased for the contract. If additional space is needed, please use the back of this page or attach an additional list. Job cost records or similar accounting records may be provided in lieu of completing the table below. Please note copies of purchase invoices may be requested for verification. If you require additional information regarding Saskatchewan Provincial Fuel Tax, please refer to Information Bulletin FT-1 located on our website at www.finance.gov.sk.ca/taxes/bulletins. Invoice Date Invoice Number Supplier Name Supplier Address Type of Fuel Purchased (i.e. gasoline, diesel, dyed diesel, etc) Number of Litres Purchased SK Fuel Tax Paid To Supplier? Tax SelfAssessed (15¢ per litre) Tax Owing (15¢ per litre) 10/30/2010 1234 Example Company C Winnipeg, MB diesel 10,000 No - $1,500 Fuel Tax Payable Upon receipt of this form, you will be contacted to confirm the total amount of Saskatchewan Provincial Fuel Tax Payable. Penalty and interest may be applied in some circumstances. Revenue Division 2350 Albert Street Regina, Sask. S4P 4A6 Ministry of Finance NON-RESIDENT CONTRACTORS INSTRUCTIONS FOR CALCULATIONS OF PST DUE ON VEHICLES, TOOLS, AND EQUIPMENT Method 1 – Leased or Rented Tax is due on the full monthly lease charge for each month or partial month the vehicles, tools, and equipment were in the province. For rented equipment, tax is due on the total rental charge pertaining to the time the vehicles, tools, and equipment were in the province. Method 2 – 1/3 Temporary Use Must be remitted each year the item enters the province until fully tax paid Tax due on owned vehicles, tools, and equipment that enter the province can be calculated using the 1/3 Temporary Use method. No depreciation is allowed under this method. The formula, which has been simplified in the enclosed worksheet, is as follows: A = (P / 3) X T Where A is the taxable value that the tax rate of 5% applies to. P is the purchase price before any deduction for trade-in. T is the number of 365-day periods, including any portion of a 365-day period (rounded up), that the vehicles, tools, and equipment were in Saskatchewan to a maximum of 3 years (3 years results in full taxation). Method 3 – Depreciated Cost One time reduced payment Assets are considered fully tax paid in Saskatchewan after tax is paid on the depreciated cost of the vehicles, tools, and equipment. Therefore, there will be no further tax obligation on the specific owned vehicles, tools, and equipment taxed under the depreciated cost method when brought into the province again in the future. Depreciation at the rate of 1.5% of the purchase price is allowed for each month between the purchase date and the first day the owned vehicles, tools, and equipment enter the province up to a maximum of 60%. This method is allowed when provincial or state tax has already been paid to another taxing jurisdiction as well as when provincial or state tax has not been paid to another taxing jurisdiction. The formula, which has been simplified in the enclosed worksheet, is as follows: A = P - (P X M X 1.5 %) Where A is the taxable value that the tax rate of 5% applies to. P is the purchase price before any deduction for trade-in. M is the number of months or part months from the date the vehicles, tools, and equipment were purchased to the date of entry into Saskatchewan to a maximum of 40 months (40 months results in the maximum of 60% depreciation). Page 8 Method 4 – 1/36 Temporary Use Must be remitted each 30-day period the item enters the province until fully tax paid This method is allowed only when provincial or state tax has already been paid to another taxing jurisdiction. Harmonized Sales Tax is not a provincial sales tax. Therefore, this method is not allowed if Harmonized Sales Tax was paid on the vehicles, tools, and equipment. No depreciation is allowed under this method. The formula, which has been simplified in the enclosed worksheet, is as follows: A = (P / 36) X T Where A is the taxable value that the tax rate of 5% applies to. P is the purchase price before any deduction for trade-in. T is the number of 30-day periods, including any portion of a 30-day period (rounded up), that the vehicles, tools, and equipment are in Saskatchewan to a maximum of 36 months (36 months results in full taxation). Page 9