Costco's Acquisition of Hain Celestial: Financial Analyses

advertisement

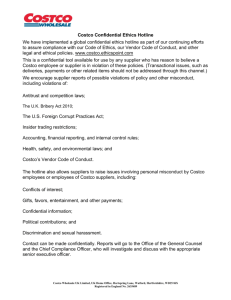

Costco’s Acquisition of Hain Celestial: Financial Analyses & Strategic Discussion Fozeya Almarzouqi, Alex Garza, Dustin Lynn, Mengting Ren, Carlee Smith, Cassie Vergel Table of Contents TABLE OF CONTENTS ..........................................................................................................................1 EXECUTIVE SUMMARY .......................................................................................................................2 COSTCO’S ACQUISITION OF HAIN .......................................................................................................3 STRATEGIC & CULTURAL FIT ...............................................................................................................4 BUSINESS OPERATIONS ................................................................................................................................... 4 INDUSTRY & MARKET..................................................................................................................................... 5 CULTURE & VALUES ....................................................................................................................................... 5 LEADERSHIP & STRUCTURE.............................................................................................................................. 6 BRAND AWARENESS ....................................................................................................................................... 8 SWOT ANALYSIS ........................................................................................................................................... 9 CONCLUSION ................................................................................................................................................ 9 VALUE-ENHANCEMENT STRATEGIES ................................................................................................. 10 ACCESS TO ORGANICS: REVENUE GENERATING STRATEGY .................................................................................. 10 DISTRIBUTION EFFICIENCY: COST CUTTING STRATEGY ........................................................................................ 13 EMPLOYEE RETENTION: COST CUTTING STRATEGY ............................................................................................ 16 POST-ACQUISITION VALUE OF HAIN AS PART OF COST ...................................................................... 19 ORIGINAL VALUATIONS FOR 2012.................................................................................................................. 19 POST-ACQUISITION: ORGANIC STRATEGY ........................................................................................................ 20 POST-ACQUISITION: DISTRIBUTION STRATEGY .................................................................................................. 21 POST-ACQUISITION: EMPLOYEE TURNOVER STRATEGY ....................................................................................... 23 POST-ACQUISITION .......................................................................................................................... 25 FINAL OFFER TO HAIN................................................................................................................................... 25 SUMMARY OF STRATEGY ............................................................................................................................... 25 1 Executive Summary With over six hundred warehouses in eight different countries, Costco continues to grow as a global wholesale powerhouse. As an innovative company, Costco is constantly looking for new ways to satiate the entrepreneurial spirit and to stay ahead of the trend. One way Costco can stay true to their drive is by acquiring Hain Celestial, valued at $2.75 billion. From here on, “Costco-Hain” will refer to the organization post-acquisition. Strategic and Cultural Fit Costco’s acquisition of Hain allows for Hain to reach out to a wider customer segment that they may not have reached previously as well as allows Costco to tap into a growing organic market. Furthermore, Hain has much to gain through the acquisition such as Costco’s strong company values manifested through their company culture as well as brand awareness. Furthermore, we envision an organizational structure that allows Hain a certain amount of autonomy to continue their operations where it is most productive while incorporating their weaker operations into our own. Although our hope is that the key executives of Hain will remain after the acquisition, we predict that a 58% pay cut will cause most executives to leave. Finally, as a company that boasts a reputable brand with a loyal following, Kirkland Signature, the adjacent acquisition will allow both Costco and Hain brands to keep their loyal customers while also meet the growing demand of new and old customers. Value Enhancement Strategies In acquiring Hain, we propose three main strategies that will enhance Hain’s value within Costco. First, we identify the Access to Organics strategy that aims to increase revenue for Costco-Hain by meeting customer demands for more organic foods through the already established Hain brand products. Having Hain products on Costco shelves will allow Costco customers to buy from a trusted organics brand while also provide a new customer base for Hain. Through these trends, we predict a 10% increase in organics revenue and thus a value of 2.2 billion added to Hain. The second strategy is Distribution Efficiency that will decrease expenses by 5% per year, adding a value of $365 million to Hain. Hain currently manufactures their products but relies on third party distributors, a risky distribution system that allows for little control for Hain. As Costco already has an incredibly efficient distribution system, we can reduce Hain’s operating costs by ridding of smaller, third party distributors that provide a risk for Hain and using Costco depots and distribution channels. Third, we plan to reduce costs through the Employee Retention strategy. Through research, we have concluded that Hain can only gain from Costco’s strong, positive company culture. Further research has shown that a positive work culture garners increased productivity, which can lead to increase revenue. In addition, happier employees lead to higher employee retention and thus lower expenses. Through this strategy, we add another 11 million to Hain’s value through an assumed 5% increase in employee retention. Post Acquisition Value for Hain Given our strategies and the valuations for each, we conclude that Hain’s added value is $2.6 billion. Hain’s original value of $2.75 billion combined with our added value of $2.6 billion leads us to suggest that Costco offer $5.35 billion for Hain’s acquisition. 2 Costco’s Acquisition of Hain “Costco Wholesale’s entrepreneurial ability to continuously reinvent itself has given it a powerful worldwide competitive advantage.” - Forbes With 50 million members around the world with a 90% renewal rate in the US and Canada (86% worldwide), Costco’s strength is largely due to its loyal membership and consumer base. Costco currently boasts 612 warehouses in eight different countries and continues to grow with the addition of 17 warehouses in fiscal 2012. Costco ensures quality products to their consumers at a low, wholesale cost while maintaining efficient operating costs through its rapid inventory turnover and world class distribution system. While Costco is widely successful as it is, as an innovative company with an entrepreneurial drive to stay ahead of the curve they are constantly looking for new ways to reach and satisfy consumer needs. One-way we believe we can be a leader in our industry is through acquiring organics and health products company, Hain Celestial. There are three main strategies identified that would enhance the value of Hain-Celestial as well as Costco’s value through the acquisition. Organics Distribution Employee Retention Costco-Hain 3 Strategic & Cultural Fit Business Operations Costco Popular worldwide, Costco is the leading retail warehouse in the US. Based out of Issaquah, WA, Costco is known for its efficiency in distribution and happy employees, and businesses look to Costco for “best practices” in its industry. Our business operates around “simplicity,” a “no-frills” operation with giant undecorated warehouses, and simply offering our consumers, or members, the lowest price possible. Seemingly simple, there are many elements behind the scenes that drive Costco’s operations. Hain Celestial Hain Celestial has experienced many acquisitions in its company lifespan, as it has merged and acquired dozens of brands globally. The brands it acquires are all well-known natural and organic brands and products that have loyal followers in the communities where available. With an expanding line of glutenfree products, they are one of the main food processors behind not only the gluten-free movement but also the organics and health food movements. Costco-Hain Strategic advice from the Harvard Business Review (HBS) states that when acquiring, “bet on portfolio performance.” In other words, a sound approach is to make multiple small acquisitions.1 As Costco looks to acquire and expand business production in an expanding organic market, Hain is a good business choice as it is an established, reputable company in the organics market. With this in mind, it is important for us, as Costco, to ensure a smooth integration of Costco’s number one focus, talent and employee retention as well as IT systems, HR policies, financials, management reporting, and more. According to Nolop, there are “bolt-on” and “platform” acquisitions. With bolt-on acquisitions like Hain, our focus is on probable business synergies and how they will affect revenues and expenses. Particularly with bolt-on acquisitions of independent dealers or distributors like Hain, we seek opportunities to strengthen our presence in attractive markets. We know that with Hain on board, their brands will improve our natural and organic product selection. We seek complementary technology that can help us gain a competitive advantage, and for Hain, we plan to implement our effective and efficient cross-dock depot distribution system to Hain’s distribution centers. Both Costco and Hain have food manufacturing and processing plants as well as distribution centers. Although labeled differently within each company - Costco “labs” & “depots” and Hain’s combined manufacturing and distribution centers - both companies have similar functions. Within Costco-Hain, we hope to sit down with food processing managers from similar departments to discuss standard operating procedures, machinery, and ultimately, learn from each other to find a common process. Each department and product may be different, but this way, by having a discussion about this at the beginning, we can attempt to streamline food production, have a better understanding of each company, and implement changes we see necessary. 1 Nolop, Bruce (2007). “Rules to Acquire By.” Harvard Business Review. Much M&A advice reference this article. 4 Industry & Market Nolop, in HBS, also recommends making “adjacent acquisitions” that correlate with increased shareholder value, as opposed to diversification into nonrelated areas, which reduces shareholder value. This is something Costco certainly takes to heart, as Costco has experimented many times with selling very diverse (and not always successful) brands of purses, rings, and designer clothing. Nonetheless, with the organic market growing almost 10% annually, it is evident that Costco should enter the organic market that they have already started investing (and producing) in through their Kirkland brand. Entry into and power in the organic market is something that Costco and its consumers want; thus by acquiring Hain, Costco-Hain will be able to produce some of the world’s most popular natural and organic foods “in-house,” thereby having the power to offer even lower prices than organics retailers elsewhere. Another Nolop piece of advice is to be clear on how acquisitions should be judged. Costco is looking to become a leader in organic products and grow even more rapidly than their current growth rate. Through our acquisition of Hain, Costco hopes to build on their reputation to become more environmentally friendly, organic, and sustainable. The financial impact of this expansion into organic markets and tapping into health-conscious consumer bases is explained in the first Value-added Strategy. Culture & Values Without a doubt, Costco has one of the best company cultures. Through CNBC’s recent documentary, Costco Craze, it is no secret that Costco has been identified as one of the best business practices and cultures in the industry. Costco resembles a family, making sure that everyone is on a first-name basis with another. In one example, Costco published a story of how one of their employees won the lottery, yet still decided to stay and work because they loved it so much there.2 Costco puts employees first, and will continue to do so with Hain’s new employees. Hain’s employees have not been as satisfied with their company culture as evident on many CareerBliss and GlassDoor ratings. By joining Costco, however, they can look forward to joining a wonderful new family, with subtle changes such as only including their first name on their nametag. With a stronger culture, we hope to retain the talent amidst the acquisition, and reduce turnover over the years, as strategized in our Value-added Strategies. Following approval of the acquisition, Costco will develop what HBS calls a “business unit sponsor” and core corporate development team. Costco pays the highest respect to their employees, and especially to their newly acquired ones. Our strengths in management, costumer insight, and cultural orientation can be applied to the new Costco-Hain. As Harding and Rouse emphasized, the cultures must “mesh together” to become one.3 Although Costco is the cultural acquirer with its strong employee loyalty, Costco’s corporate development team must listen and work intently on smoothing the transition to get new Hain employees on board. Organizational attributes go a long way toward making the integration work, and we hope that Costco’s strong culture will bond the Hain employees closer together and that they will consider themselves part of the Costco family. 2 3 Costco Wholesale Corp, Shareholder’s Annual Meeting Slide Show, www.costco.com/investorrelations Harding, D. and Rouse, T. (2007). “Human Due Diligence.” Harvard Business Review. Article from OAK. 5 One strong company value that we believe not only ties Costco and Hain together but also smooth the transition is both companies’ focus on green initiatives. Both put a large emphasis on cutting down the use of plastic and using more recyclable cardboard to hold their products. Many of Hain’s buildings are designed for sustainability and Costco is taking considerable measures to ensure waste management follows green initiatives (i.e. responsible disposing of rotisserie chicken oil). 4 Leadership & Structure Costco’s leaders are known for their low salaries; yet Hain, whose sales are 1.5% of Costco’s, has top executives earning $4 million more than Costco. Below is the salary breakdown for the top key executives. 4 Hain Celestial, 2013. http://www.myhaincelestial.com/gg_01.html 6 In this acquisition, we hope to keep all the key executives at Hain. Unfortunately, Hain executives staying after the acquisition entails a 58% salary cut for Hain executives; thus their staying seems unlikely. We predict that we will lose many of the key executives at Hain, and will need to replace them with others who are knowledgeable in natural and organic food production. New executives will take over as President, Vice President, etc. to oversee the, hopefully seamless, transition of the Hain division. Structurally, there will be changes as well. Consolidation of manufacturing centers may occur (Kirkland Brand food manufacturing alongside Hain brands) in some locations, and distribution centers will be aligned to follow the same efficient process that Costco has perfected. Administrative tasks will be streamlined and there will be Costco representatives and trainers going to each Hain administrative offices to facilitate the changes. With more offices and locations combined, we hope to better serve our employees with benefits, payroll, and other services. Otherwise, we allow Hain to run its own operations. Board of Directors Kirkland Executive Board Quality Assurance Admin (Finance, HR, IT, Legal) Markets Manufacturing America Asia Europe Australia Packaging Distribution Distribution Distribution Distribution Product Development Regional Depots Regional Depots Regional Depots Regional Depots Regional Warehouses Regional Warehouses Regional Warehouses Regional Warehouses 7 Board of Directors Executive Board US/ Canada/ Mexico UK Rest of World Admin Admin Admin Manufacturing Manufacturing Manufacturing Distribution Distribution Distribution Costco-Hain (tentative) Brand Awareness Our main brand at Costco is Kirkland Signature, a brand that has met the high expectations of their loyal followers time and time again. Kirkland sells premium products for a lower cost than the national brands, thereby resulting in greater margins. With trusted buyers within Costco who do extensive research in their field to bring the best products to Kirkland Signature, Costco has and will continue to differentiate itself from other retailers Hain speaks proudly of their dozens of well-known brands. In their annual report, they “believe that brand awareness is a significant component in a consumer’s decision to purchase one product 8 over another in highly competitive consumer products industries.” This is part of the reason why they have such well-known and well-loved products like Earth’s Best that is contracted with PBS Kids and Sesame Street, and Terra Blue, the official chips for JetBlue airlines.5 Bringing their popular brands into Costco warehouses at a cheap price would mean a large revenue jump (see revenue generating strategies). Adjacent acquisitions, as explained earlier, also have the advantage of being brand consistent. For a business to succeed, it must not only be well managed, but the business must also be trusted by the marketplace. Hain and Costco are both trusted and we are confident that Hain products certainly be well-received on Costco shelves. After all, if Costco trusts Hain, the customers will too. SWOT Analysis Our business and core corporate development team have developed the following SWOT analysis of what we see as the strengths, weaknesses, opportunities, and threats of the Costco-Hain acquisition. Brand Lack of experience in outside retail Access to products ($) Financials New industry Product diversification SWOT Trend in Organic Industry Trend of Organic Industry International Market Competition Conclusion As elucidated above, we at Costco have taken all of the aspects of both companies into consideration when proposing the acquisition and valuing the strategies. To follow Bolop’s rules, we’re not “shopping when we’re hungry.” We are an industry leader, a great company that is looking for more diversity in the products our consumers demand. We have implemented the right analytical tools and ensure their correct use, as evident in our Value-Added Strategies. Companies may develop “deal fever,” but we are levelheaded when it comes to acquisition deals – as we do not need Hain, but certainly see it as a profitable and reputable gain in our company. We plan to present this M&A plan to our business units as well as corporate development teams to ensure smooth transitions with people and in operations. 5 Hain-Celestial Group, 2012, Annual Report & 10K 9 Value-Enhancement Strategies Access to Organics: Revenue Generating Strategy Currently, Hain-Celestial distributes through third party food distributors and food catalogs; thus, it is hard to measure their direct reach to their consumer base. Nonetheless, their annual increase in sales indicates a growing demand for natural and organic foods. A recent consumer survey conducted by the Organic Trade Association (OTA) reported that 78% of American families buy organic products.6 According to the OTA’s 2011 Organic Industry Survey, organic food sales grew by 7.7% (fruits and vegetables specifically grew 11.8%), and organic non-food sales grew by 9.7%.7 Other sources reported 14% growth for organics8, and Whole Foods anticipates 15% growth in sales. The OTA also reported that mass-market retailers sold 54% of total organic food sales and natural retailers (Whole Foods) with 39%. There is a ranking of top organic mass market retailers based on products carried, but little is known about actual non-organic versus organic sales.9 6 OTA US Families’ Organic Attitudes Study, 2011, http://www.ota.com/pics/OTA_ConsumerSurvey_Top4Facts OTA Industry Statistics & Projected Growth, 2011, http://www.ota.com/organic/mt/business.html 8 Motley Fool, http://beta.fool.com/joryko/2013/01/22/hain-celestials-drop-your-buying-opportunity/21868/ 9 Largest Organic Retailers in North America, 2011, http://organic.about.com/od/marketingpromotion/tp/6Largest-Organic-Retailers-In-North-America-2011.htm 7 10 Largest Organic Retailers in North America: 1. Wal-Mart 2. Costco 3. Kroger 4. Super Target 5. Safeway Who Sells Organic Products in the US? 7% Mass Market Retailers Natural Retailers 39% 54% Other (Internet, farmer's market, catalogs, specialty stores) Foreign Markets Within their own operations, Costco and Hain proportionally depend on their primary, secondary, and other markets, including their international sales. Hain’s revenue, however, is approximately 1.5% of Costco’s revenues. This may be representative of the size of the effect it may have on Costco postacquisition. Nonetheless, it is still important to focus on foreign organic markets. According to OTA’s organic reports on Korea, Japan, Europe, and Canada, it appears that their markets are increasing demand for organic products. Unfortunately, few natural and organic food production companies are located abroad.10 11 Given the foreign market’s desire for organics, there is a large opportunity of expansion for Costco into Hain’s European locations through Hain’s recently acquired and traditional European brands, and Hain will be able to enter Asian markets through Costco’s warehouses and customers in Asia (Costco’s busiest retail warehouse is actually in South Korea). Costco 2012 Revenue Segments Total: $99 B Rest of World 12% Hain 2012 Revenue Segments Total: $1.4 B Rest of World 14% Canada 16% UK 14% US 72% US 72% Source: Annual Report & 10k of respective companies 10 OTA International Organic Markets, 2011, http://www.ota.com/pics/documents/koreaorganicreport.pdf USDA, Global Food Markets, 2012, http://www.ers.usda.gov/topics/international-markets-trade/global-foodmarkets/international-consumer-retail-trends.aspx 11 11 Consumer Demand Through meeting consumer demand and expanding organic markets together, we can confidently say that this strategy will add the most value to both Costco-Hain. People are always seeking ways to stay healthy. More specifically, baby boomers are increasingly focused on their health as they age and in attempts to avoid illnesses such as diabetes and heart disease, they are focusing on what they eat and view this as the utmost importance in how they shop. They see eating right, including organic food, as a key to being fit.12 Even with this increase in health consciousness, however, the price of organic foods is often a deterrent for purchasing such products. Especially in light of economic hardships, shoppers are still mindful of price. Along with the baby boomers, the economy is also impacted by millennials and their purchasing power where they are looking for the best deal in addition to quality products.13 This is where Costco can leverage their low prices. Kirkland Brand We do not discount, however, that Costco already has many products that are natural and organic, including those of their own Kirkland Signature brand. Currently, Costco carries about 150 organic products available at an average store.14 Food costs have consistently made up 21% of Costco’s net sales (excluding membership fees) according to the annual report. 10% of the products on display at a Costco warehouse (in a total of 4000 different products) are the Costco Kirkland Signature brand, which also has a strong and loyal following.15 Kirkland Signature has set higher standards than the industry in many products, yet still charges a lower price than the lower-quality brand names. Yet, even with so many Kirkland products that are organic, like the new organic animal crackers, we do not anticipate competition on the shelves with Hain products. Rather, we hope for Costco to cut costs on food production for those natural organic items that overlap with Hain, as well as cut off third party brands that offer products similar to Hain. This way, we cut costs on food production as well as more expensive products that overlap with our new acquisition. Qualitative factors will also justify the increased revenues for Costco-Hain as Hain products are being channeled to Costco warehouses domestically and abroad. Costco’s reputation will be improved as a natural, organic, and environmentally friendly retailer. Already an ethical company, Costco has only had several food sourcing issues, which can be alleviated in the public eye via its acquisition of a “better for you and the community” food production company. Benefits for Costco Offering cheaper Hain products to customers through Costco’s domestic and foreign warehouses will lead to a growth in revenue. From data, we compiled that there is approximately 4% of sales that come from organic foods, which we hope will grow at 10% (between organic industry, Whole Foods, and financial predictions as referenced at beginning of section). In the calculation, 96% of the sales will be increased at the predicted growth rate, and 4% will grow 10% faster. We will use 5% and 15% on the sensitivity analysis (See chart on next page). 12 Rise in the Natural Organic Food Market, 2013, http://www.streetdirectory.com/food_editorials/health_food/ organic_food/rise_in_the_natural_organic_food_market.html 13 Top Food Trends for 2013, 2012, http://supermarketnews.com/blog/top-10-food-trend-predictions-2013 14 Organic list at Costco as compiled by writer, http://www.thethriftymama.com/costco-organic-price-list.html 15 Costco Connection, 2010, http://www.costcoconnection.com/connection/200910 12 However, we know that Hain’s food processing sector will have to produce more products to fill Costco’s increasing demands. Nevertheless, for simplicity, we will assume that the increase in Hain’s costs will even out with Costco’s decrease in costs from not producing similar products and not buying from other food companies for similar products. Access to Organics Revenue Increasing Strategy: increase Organics Revenue by 10% (Organics is 4% of revenue) Value added: $2.2 million Distribution Efficiency: Cost Cutting Strategy As stated, the acquisition of Hain will not involve a complete envelopment of Hain into Costco. Hain will operate similarly to Kirkland in having their own brand, but will be able to reduce operating costs by taking advantage of a highly effective distribution system already developed and perfected by Costco. More specifically, Hain’s operating expenses will decrease by having access to Costco’s distribution channels and cross-docking methods. Decreasing operating expenses will be especially beneficial to Hain because of the increased operating expenses as a result of their recent acquisitions (mostly in UK and Canada). Costco’s current distribution system saves time and money by importing directly from the manufacturer. After products are received and sorted at the Costco-owned depots (regional distribution centers), they will be delivered straight to Costco warehouses (almost immediately). This way, Costco eliminates the 13 risks of a multi-step distribution system, simplifying the process and thus cutting costs. Costco currently has 12 depots in the US, four in Canada, and five internationally (30 warehouses/depot ratio overall)16. Costco’s efficient distribution system meets the demands of the high rate of inventory turnover in Costco warehouses, driven by Costco’s strategy of selling from select brands and simplifying distribution channels. Furthermore, Costco’s membership checks at warehouse entrances and their receipt check at the end prevents inventory loss, also contributing to higher inventory turnover. The cross-docking system at Costco depots is a system in which a large number of vehicles are delivering and picking up goods at the cross-dock facilities at any one time.17 Perfecting this process has decreased Costco’s depot operating hours from 16 to 9 hours (40% decrease in time), as compared to most 24hour distribution operation in the industry.18 Cross-docking research has shown that by implementing this system across an entire company’s distribution system, it can increase decrease distribution costs by 7%. 19 Current Risks for Hain Conversely, in 2012, 21% of Hain Celestial’s revenues were dependent on an independent distributor, United Natural Foods, Inc.20 by depending on an independent distributor, Hain is at risk losing a major revenue source if something were to happen to the independent distributors. Costco eliminates the risk by supplying the distribution channels in-house as opposed to relying on a third party. Hain can rely on Costco’s already efficient distribution system, and we can assume that whatever distribution related revenue could be made up by high inventory turnover in Costco warehouses. Another risk Hain has identified in their annual report is the increase in packaging costs. We already have an effective packaging system that is also sustainable. Not only does Costco require products to be protected in environmentally friendly plastic, but also structurally in a square shape whenever possible.21 We state in our packaging specification to suppliers that “Costco’s goal is to drive out costs by eliminating extra packaging, handling, and corrugate waste, whenever possible. However, when [square pallets] are required to transport and protect the product from damage, it is a requirement of doing business with Costco that the trays are useful in every way, including functional boxes for members to 16 Costco Wholesale Corp. Annual report & 10K http://logistics.about.com/od/tacticalsupplychain/a/cross_dock.htm 18 CNBC, 2012, The Costco Craze documentary 19 Cross-docking effectiveness, http://www.distributiongroup.com/articles/070111DCMwe.pdf 20 Hain Celestial Group Annual report & 10K 21 TBL Consulting, Costco Packaging Specifications, http://www.tlbconsulting.com/Costco_Packaging_Specs___ Addendums.pdf 17 14 carry out their purchases.” Hain claims in their annual report, “our business strategy is to integrate the brands in each of our segments under one management team and employ uniform marketing, sales and distribution strategies where possible.” Costco will be specifically addressing the uniformity of marketing, sales, and distribution by consolidating much of their and Hain’s operations under Costco. With implementation of Costco’s efficient distribution system, Costco-Hain can achieve economies of scale in distribution. Due to lack of access to certain information, we attempted to calculate those costs for Hain using Costco as a benchmark. We can rationalize that with Costco’s efficient cross-dock methods, an average year over year increase of 15% in expenses is “normal.” Thus, it may seem that Hain had a 10% “unnecessary” increase in costs. According to research (cited earlier), cross-docking systems on average decrease costs by 7%. In our valuation, we used 5% decrease in Cost of Goods over 5 years (3% and 7% for sensitivity analysis). We also took into consideration that expenses may rise in the first year of Costco-Hain due to system implementation. 15 Distribution Strategy: decrease distribution expenses by 5% (embedded within Cost of Goods for Hain) Value added: $365 million Employee Retention: Cost Cutting Strategy As described in prior sections, Costco has an incredibly strong culture that has lead to happy employees. According to its annual shareholder’s presentation, Costco’s annual employee turnover rate for its 96,000 full-time employees is 10%, with only 5.4% after the first year.22 This is extremely low compared to 22% turnover in retail and wholesale trade.23 On the other hand, the number of full time employees at Hain Celestial is 3,720 with no reported turnover or demographics. It is evident, however, that by Costco presenting their data to the public and shareholders, Costco certainly has something to boast about, whereas Hain may not. Both companies offer decent benefits, including medical, dental, vision plans, with paid holidays, 401(k), and life insurance. The one main difference between benefits would be that Costco employees may purchase stock in the company. When your company is doing so well, who wouldn’t want to invest? By financially investing in their company, employees are often more dedicated, motivated, and involved, which can also mean that employees will be less likely to leave.24 When comparing the employees’ reviews of both companies, for example through the GlassDoor website, it appears that our employees are more satisfied with the organization than employees of Hain Celestial. Moreover, the employee satisfaction rating for Costco was 3.7 out of 5, while the rating for Hain Celestial was 2.3.25 22 Costco Wholesale Corp, Shareholder’s Annual Meeting Slide Show, www.costco.com/investorrelations Society for Human Resources Management (SHRM), 2011, Employee Retention & Turnover Trends 24 http://smallbusiness.chron.com/benefits-employee-stock-options-company-2842.html 25 GlassDoor, www.glassdoor.com for both Hain and Costco 23 16 With these results, however, we must keep in mind that there is a gap in the number of employees who have reviewed their respective companies on GlassDoor. From our research, the total number of Costco employees who rated their company was 761 compared to 22 from Hain. At the same time, these results might enrich our argument that Costco’s culture is more pleasant for employees than Hain, since they were more passionate to share their feelings with others. We compared ratings below from both GlassDoor and CareerBliss, consolidated some categories, and then moved them to the same scale. As evident, Costco employees are much more satisfied with their jobs in all categories over Hain. As people become dissatisfied, they leave their jobs. According to Jeff Kortes, who specializes in human asset management, the best measure of employee turnover is about 25% or three months of annual salary (the amount of time it takes to recruit, hire, and train new employee).26 If Costco’s annual 26 Kortes, Jeff, 2011, http://www.lendio.com/blog/cost-turnover/ 17 turnover is 10% and Hain’s is approximately the industry standard at 20%, we believe that with Costco’s new culture and engagement of employees, we can cut Hain’s turnover by 5% (3% and 7% for sensitivity analysis). To calculate the value of reducing turnover by 5%, we researched Costco and Hain salaries. Costco’s selfreported average pay (from shareholder’s meeting) was $20/hour (about $40,000 a year), and Hain’s average pay is around $25,000 per year.27 After calculating the monetary value per year, it was difficult to apply that to the “Operating Expenses” line since it is not clear what percentage of that amount is due to “Salaries.” Thus, we applied the monetary reductions annually with the hope that as the cultures assimilate, turnover will be reduced even more. Turnover Reduction Strategy: reduce turnover by 5% as calculated (thereby reducing the Operating Expenses line on Hain’s spreadsheet) Value added: $11 million 27 http://www.indeed.com/salary/The-Hain-Celestial-Group.html This site had similar average Costco salary as selfreported, therefore we believe this to be a “trustworthy” source of average salary over GlassDoor and CareerBliss 18 Post-acquisition value of HAIN as part of COST Original Valuations for 2012 COST DCF Total Valuation of Costco: $42.6 B HAIN DCF Total Valuation of Hain: $2.75 B 19 Post-Acquisition: Organic Strategy Realistic: 10% growth Pessimistic: 5% growth 20 Optimistic: 15% growth Value-added for Organic Strategy: Post-acquisition: Distribution Strategy Realistic: decrease distribution expenses by 5% 21 Pessimistic: decrease distribution expenses by 3% Optimistic: decrease distribution expenses by 7% 22 Value-added for distribution strategy: Post-acquisition: Employee Turnover Strategy Realistic: reduce turnover by 5% Pessimistic: reduce turnover by 3% 23 Optimistic: reduce turnover by 7% Value-added for employee turnover strategy: 24 Post-acquisition Final offer to Hain $5.35 B $2.75 B original + $2.6 B value-added Payment method: $1.5 billion paid in cash, rest paid in stocks. With only $3.5 billion in cash and $1.3 in short term investments at Costco in 2012, we wanted to make a competitive offer with cash, but also hope to pay by stock. The seller is in no immediate need of cash, so we believe that mostly stock payments make a reasonable form of compensation. We, as the buyer, also expect there to be value-added strategies and synergies to improve the value of the stock. Although our shareholders are foregoing some of the synergy gains to be achieved by giving stocks to the seller, we want Hain to feel part of the company and believe that together, we will move forward profitably post-acquisition. Summary of Strategy As an industry leader in wholesale retail, Costco knows what their employees and members’ need. In recent years, there has been a growing demand for organics, as people become more health-conscious and environmentally friendly. We are confident that Hain, whose consumers have the same values as ours, will strategically and culturally fit into our organization. We have a tremendous respect for Hain’s brands and products, which is why we hope to diversify our products to include Hain and bring its employees and consumers into our family. Offering a variety of trusted natural and organic products, Costco hopes to increase its organic revenues by 10% in the 5-year post-acquisition strategy, bringing in an additional $2.2 billion. By merging distribution operations with Hain’s and implementing a more efficient cross-docking system, we hope to reduce Hain’s distribution expenses by 5%, adding on $354 million to the company. Finally, we will extend the way we treat our loyal employees to our new friends at Hain, and in turn hope to reduce turnover by 5%, resulting in about $11 million more. Together, our strategies turn into synergies, and Costco-Hain will be worth more than 1+1=2. In fact, we will have added an additional $2.6 billion in synergies, allowing us to fairly offer Hain $5.35 billion in cash and in stocks. We truly believe it is a fair price for Hain, and look forward to calling Hain “family.” 25