Nutrasweet and Laidlaw

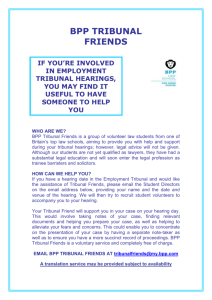

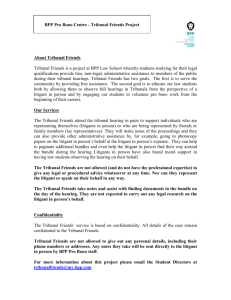

advertisement