Contracts_Burnham_2012 Spring

advertisement

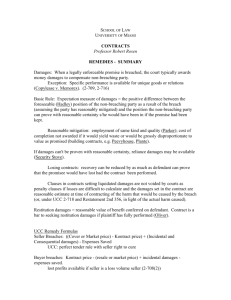

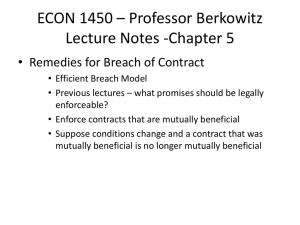

2012 SPRING BURNHAM CONTRACTS Contracts Outline Professor: Scott Burnham Statutes of Frauds: Certain oral agreements must be evidenced by writing to prevent fraud. -­‐ Restatement §110: Contracts Subject to the Statutes of Fraud: 1. A contract for an executor to answer for the duties of his decedents. 2. A contract to answer for the duty of another. For example if your parents co-­‐sign on your student loans. 3. A contract made on consideration of marriage 4. A contract made for the sale of an interest in land 5. A contract not performed w/I one year of the making -­‐ UCC 2-­‐201: Contracts Subject to the Statutes of Fraud: More than $500, must be evidenced by writing Between Merchants, a written confirmation is sufficient as a writing, if it is received and the party receiving it should know it contents and does not object within 10 days -­‐ What makes a memorandum evidence of an oral contract §131? (a) reasonably identifies the subject matter of the contract, (b) is sufficient to indicate that a contract with respect thereto has been made between the parties or offered by the signer to the other party (signed by the party to be charged), and (c) states with reasonable certainty the essential terms of the unperformed promises in the contract. -­‐ The UCC requires the written manifestation include: 1. A basis for believing the offered oral evidences rests on a real transaction 2. Evidence a contract for the sale of goods 3. Be signed 4. Specify the quantity DOES NOT NEED TO INCLUDE ALL MATERIAL TERMS § 134. SIGNATURE The signature to a memorandum may be any symbol made or adopted with an intention, actual or apparent, to authenticate the writing as that of the signer. Who needs to sign? The party asserting the defense needs to have signed as evidence against that party. -­‐ Exceptions to the SoF: 1. specially manufactured goods, 2. if the party admits that there was a contract in his pleading, 3. goods for which payment has been made and accepted, or which have been received and accepted. 4. Partial Performance 5. Estoppel 6. Reliance Page 1 of 19 2012 SPRING BURNHAM CONTRACTS Modifications: An amendment which addresses fewer than all the issues governed by the existing agreement. -­‐ Will discharge the original duties -­‐ There must be consideration for a modification. A modification is not enforceable if a party simply promises to do what they were already bound to do. The parties should either promise to do something different or rescind the current contract to create a new one. However, under the UCC 2-­‐209(1) there is no need for consideration to modify a contract for the sale of goods. Executory Contract-­‐ a contract where neither party has fully performed. Restatement §89: Modification of Executory Contract (only before either party performs) A promise modifying a duty under a contract not fully performed on either side is binding (a) if the modification is fair and equitable in view of circumstances not anticipated by the parties when the contract was made; or (b) to the extent provided by statutes; or (c) to the extent that justice requires enforcement in view of material change of position in reliance on the promise UCC 2-­‐209 No Oral Modification When a NOM clause occurs in a contract, agreement to a modification acts as a waiver of the clause. The waiver may be retracted if reasonable notice is given, however, only if the contract is executory (un-­‐enacted). Accord and Satisfaction: when on party has performed, but the other has not. Partially executed: A contract where one party has fully performed. The parties are in the position of the creditor and debtor at this point. (the person who performed is the creditor). This may arise out of a tort claim (for example, if I hit someone with my car, technically I “performed” and I owe them). Accord: a contract by which a creditor agrees to accept less than the amount due in exchange for extinguishing the debt. An agreement to discharge the obligation and the satisfaction is the legal "consideration" which binds the parties to the agreement. -­‐ Like any contract, there needs to be an: Objective manifestation of an assent (an offer) Consideration -­‐ There must be strong language indicating if the creditor accepts the payment they are accepting it as full payment. -­‐ Neither an undisputed nor liquidated debt can technically be accorded. However, if the creditor gives express written acceptance to an accord offer, then it is effectively the same thing. Satisfaction: If an accord is made and the debtor does not pay, the creditor may enforce the accord or the underlying contract. UCC § 3-­‐311 Accord and Satisfaction-­‐ a) There must have been an instrument of full satisfaction, the amount of the claim must be un-­‐ liquidated or subject to bona fide dispute, and claimant obtained payment b) Unless otherwise noted in c) the instrument must be accompanied by a written instruction saying the instrument is intended to be the full amount in payment c) – d) when a claim is discharged or not. Page 2 of 19 2012 SPRING BURNHAM CONTRACTS If the organization has not informed the debtor to send such communications to a particular office, then it can tender repayment within 90 days and avoid the accord. Substitute Contracts: Similar to accords, they are also applicable to partial executory contracts. A contract for an accord accepts performance of something less, a substitute contract accepts a promise of something less. Warranties: “[w]ords which in terms promise that an event not within human control will occur may be interpreted to include a promise to answer for harm caused by the failure of the event to occur. An example is a warranty of an existing or past fact” Rest. §2 There are two kinds of warranties, implied or express. Implied warranties are those which you “get” unless they are expressly contracted away. Implied Warranties: -­‐ Warranty of Good Title UCC 2-­‐312: The product is free of liens, encumbrances, and other security interests. i.e. the seller has good title to the product. o Seller may be exclude warranty with specific language or circumstances which give buyer reason to know the seller does not claim title—a general statement that there are no warranties is not enough. -­‐ Warranty Against Infringement UCC 2-­‐312(3): good is delivered free of rightful claim by a third party, by way of infringement. This warranty only applies when the seller is a merchant dealing regularly in this kind of trade. -­‐ Warranty of Merchantability UCC 2-­‐314: warrants the goods are merchantable (properly labeled, fit for the ordinary purpose of goods of that kind, etc.). Only applies to merchants dealing regularly in this kind of trade. o Seller may exclude warranty with language that mentions the merchantability and is conspicuous. Does not need to be in writing. -­‐ Warranty of Fitness UCC 2-­‐315-­‐ If the seller knew, or had reason to know, the goods would be used for a particular purpose, and the buyer is relying on the particular skill of the seller to guide them in that purpose, there is a warranty or fitness. o Seller may exclude warranty if the language is in writing and is conspicuous, does not need to use the word fitness though. Express Warranties: § 2-­‐313. Express Warranties by Affirmation, Promise, Description, Sample. (1) Express warranties by the seller are created as follows: • (a) Any affirmation of fact or promise made by the seller to the buyer which relates to the goods and becomes part of the basis of the bargain creates an express warranty that the goods shall conform to the affirmation or promise. • (b) Any description of the goods which is made part of the basis of the bargain creates an express warranty that the goods shall conform to the description. • (c) Any sample or model which is made part of the basis of the bargain creates an express warranty that the whole of the goods shall conform to the sample or model. (2) It is not necessary to the creation of an express warranty that the seller use formal words such as "warrant" or "guarantee" or that he have a specific intention to make a warranty, but an affirmation merely of the value of the goods or a statement purporting to be merely the seller's opinion or commendation of the goods does not create a warranty. Page 3 of 19 2012 SPRING BURNHAM CONTRACTS In an express warranty you must distinguish a warranty from “puffing” or statement of opinion. For example: “This car gets 25 miles to the gallon” is an express warranty, but “this car is a steal!” is puffing. Disclaimer of express warranties: § 2-­‐316(1). Exclusion or Modification of Warranties. (Words or conduct relevant to the creation of an express warranty and words or conduct tending to negate or limit warranty shall be construed wherever reasonable as consistent with each other; but subject to the provisions of this Article on parol or extrinsic evidence (Section 2-­‐ 202) negation or limitation is inoperative to the extent that such construction is unreasonable. For example, a contract for a car states: 1) There are no express warranties in this contract and 2)The breaks contain a 30 day limited warranty. 1 and 2 are reconcilable, since there will be a warranty only in the case of the breaks. The parol evidence rule will usually bar verbal claims where there is a merger clause and a disclaimer of verbal claims. Unanticipated Events: Non-­‐performance is excused if there is an unanticipated event making it impossible or nearly impracticable to perform, and the non-­‐compliant party is not guilty of breach. Restatement of Contracts 2d §§ 261 and 262: Usually used by sellers: § 261 Where, after a contract is made, a party's performance is made impracticable without his fault by the occurrence of an event the non-­‐occurrence of which was a basic assumption on which the contract was made, his duty to render that performance is discharged, unless the language or the circumstances indicate the contrary. (unless you assumed the risk). § 262 If the existence of a particular person is necessary for the performance of a duty, his death or such incapacity as makes performance impracticable is an event the nonoccurrence of which was a basic assumption on which the contract was made. Usually used by Buyers: §265-­‐ Frustration-­‐ The principle purpose is “frustrated”, making the contract unenforceable. (in other words, the contract can be performed, but it is no longer suited for the purposes I wanted it for, exmp: I rented an apartment that had a great view of a parade, but the unforeseen event of a tree falling in front of the window, made it unsuitable for my purposes). See Restatement § 272 – Relief? No damages, but reliance and restitution may come into play. Duty of Good Faith and Fair Dealing Restatement § 205 provides: Every contract imposes upon each party a duty of good faith and fair dealing in its performance and its enforcement. UCC § 1-­‐304. Obligation of Good Faith. Every contract or duty within [the Uniform Commercial Code] imposes an obligation of good faith in its performance and enforcement. UCC § 1-­‐201. General Definitions b)(20) "Good faith," except as otherwise provided in Article 5, means honesty in fact and the observance of reasonable commercial standards of fair dealing. A contract involving a merchant must have good faith which is both objective and subjective. Page 4 of 19 2012 SPRING BURNHAM CONTRACTS Objective test-­‐ the reasonable man Subjective test-­‐ honesty in fact Promise and Conditions: Promise. A promise is a manifestation of intention to act or refrain from acting in a specified way, so made as to justify a promisee in understanding that a commitment has been made. Restatement Second § 2(1). If a promise is broken a party may recover damages Condition. A condition is an event, not certain to occur, which must occur, unless its nonoccurrence is excused, before performance under a contract becomes due. Restatement § 224. Express Conditions – an explicitly stated condition Implied Condition-­‐ presumed by law based upon the nature of a particular transaction and what would be reasonable to do if a particular event occurred. Restatement 227. STANDARDS OF PREFERENCE WITH REGARD TO CONDITIONS (1) In resolving doubts as to whether an event is made a condition of an obligor's duty, and as to the nature of such an event, an interpretation is preferred that will reduce the obligee's risk of forfeiture, unless the event is within the obligee's control or the circumstances indicate that he has assumed the risk. (2) Unless the contract is of a type under which only one party generally undertakes duties, when it is doubtful whether (a) a duty is imposed on an obligee that an event occur, or (b) the event is made a condition of the obligor's duty, or (c) the event is made a condition of the obligor's duty and a duty is imposed on the obligee that the event occur,the first interpretation is preferred if the event is within the obligee's control. (3) In case of doubt, an interpretation under which an event is a condition of an obligor's duty is preferred over an interpretation under which the non-­‐occurrence of the event is a ground for discharge of that duty after it has become a duty to perform. A clause may be both a promise and a condition. When delivery occurs simultaneously this is the case. In the case of a promissory condition, both remedies are actionable. Relief when a condition is not met: The performance that was conditional does not become due. By definition a condition is an event that must occur before some performance is due. If the event does not occur, the performance is not due. Substantial Performance: (an immaterial breach) a party performs mostly, but not all the way. A promisor may recover if they substantially performed. The courts will consider (Rest. §241): • Extend of non-­‐performance • Whether the purpose was frustrated • Weighing the purpose to be served and the desire to be gratified • Excuse for deviation • $ ratio of tendered performance and promised performance The party may recover the amount they performed, less any damages. If a contractor successfully demonstrates substantial performance, the owner remains obligated to fulfill Page 5 of 19 2012 SPRING BURNHAM CONTRACTS payment, less any damages suffered as a result of the deficiencies in workmanship by the contractor. Divisible Contract: if a contract is divisible, into portions, the court may order compliance as far as the conditions for each portion was fulfilled, less any damages confered. (for example, if you order 10 shirts for $40, but only 6 were delivered, the court might order you to pay $24 dollars minus any damages). Waiver: If a party continually performs even though a condition is not met, that party waives the right to either demand the condition be met or to recover for the condition not being met. However, note this does not bar the party from claiming a breach. (this is the case where the creditor demands payment on the first even though they had been accepting payment on the 20th). Restitution: Rest. §374. If there was a benefit and the benefit was accepted the party may recover the value of the benefit conferred, but the value of the benefit is computed from the point of view of the non-­‐breaching party. For example: A contracts to make repairs to B's building in return for B's promise to pay $10,000 on completion of the work. After spending $8,000 on the job, A fails to complete it because of insolvency. B has the work completed by another builder for $4,000. When the work is done, the value of the building to B is increased by a total of $9,000, but B loses $500 in rent because of the delay. A may recover $4,500. (notice, if this were substantial performance, A would have recovered $5,500). Anti-­‐forfiture: Restatement §229 Excuse of a condition to avoid forfeiture: To the extent that the non-­‐occurrence of a condition would cause disproportionate forfeiture, a court may excuse the non-­‐ occurrence of that condition unless its occurrence was a material part of the agreement The UCC and remedies for conditional breach: Technically there is no such thing as substantial performance in the UCC. UCC § 2-­‐601 says a buyer may accept or deny any product which does not conform to the contract standards. Note that under 601 buyer may reject the goods regardless of substantial or unsubstantial performance. But notice under UCC § 2-­‐714 if buyer accepts he can recover damages after accepting non-­‐conforming goods. Anticipatory Repudiation: -­‐ also called an anticipatory breach, is a term in the law of contracts that describes a declaration by the promising party to a contract, that he or she does not intend to live up to his or her obligations under the contract. An AR will only be actionable if he communicates it to the promisee in definite and unequivocal terms. -­‐ The promisee may 1) do nothing, 2) demand reassurance, or 3) cancel the contract. -­‐ The UCC: 2-­‐609: (1) ….When reasonable grounds for insecurity arise with respect to the performance of either party the other may in writing demand adequate assurance of due performance and until he receives such assurance may if commercially reasonable suspend any performance for which he has not already received the agreed return. (2) Between merchants the reasonableness of grounds for insecurity and the adequacy of any assurance offered shall be determined according to commercial standards. Page 6 of 19 2012 SPRING BURNHAM CONTRACTS (3) Acceptance of any improper delivery or payment does not prejudice the aggrieved party's right to demand adequate assurance of future performance. (4) no performance after 30 days of adequate performance request = repudiation of contract. 2-­‐610: Anticipatory Repudiation When either party repudiates the contract with respect to a performance not yet due the loss of which will substantially impair the value of the contract to the other, the aggrieved party may (a) for a commercially reasonable time await performance by the repudiating party; or (b) resort to any remedy for breach (Section 2-­‐703 or Section 2-­‐711), even though he has notified the repudiating party that he would await the latter's performance and has urged retraction; and (c) in either case suspend his own performance or proceed in accordance with the provisions of this Article on the seller's right to identify goods to the contract notwithstanding breach or to salvage unfinished goods (Section 2-­‐704). 2-­‐611: (1) Until the repudiating party's next performance is due he can retract his repudiation unless the aggrieved party has since the repudiation cancelled or materially changed his position or otherwise indicated that he considers the repudiation final. (2) Retraction may be by any method which clearly indicates to the aggrieved party that the repudiating party intends to perform, but must include any assurance justifiably demanded under the provisions of this Article (Section 2-­‐609). (3) Retraction reinstates the repudiating party's rights under the contract with due excuse and allowance to the aggrieved party for any delay occasioned by the repudiation. Remedies: -­‐ Expectancy: Usually the remedies of a party will be the expectancy, or the financial equivalent of what the party would have received if performance had occurred. o Efficient Breach: it is more efficient for a party to breach than it would be to continue the contract. Damages: When claiming damages the plaintiff must show: o The breach substantially caused the loss for which they are claiming damages o The amount of damages is proved with reasonable certainty ! Previous similar agreements may be used as evidence. ! Remember in a contract for services if the purchaser breaches it would be profit + cost of services. Think about what this might mean in a non-­‐ucc contract. o The Rule of Foreseeability: The damages cause by the breach was foreseeable by a reasonable breaching party. ! Direct damages v. consequential damages (both must be foreseeable) o The Rule of Mitigation: The plaintiff could not have mitigated damages. Defendant is not liable for losses which could have been avoided. ! D may be liable for costs of mitigation though. -­‐ Specific Performance: At common law, to get equitable relief, a plaintiff must still show that the remedy at law is not adequate. Under UCC § 2-­‐716(1), "Specific performance may be decreed when the goods are unique or in other proper circumstances." -­‐ Restitution Rest. §344: the plaintiff's interest in the value of the benefit the plaintiff has conferred on the defendant; the goal of the award is to restore defendant to defendant's pre-­‐ contract position (see promise and condition, however, note that restitution may not only apply Page 7 of 19 2012 SPRING BURNHAM -­‐ -­‐ -­‐ -­‐ -­‐ CONTRACTS to the breaching party). A person may recover under restitution when it would be unjust for Seller to keep Buyer's money in this situation; restitution is often called "unjust enrichment." The Rule of Compensation: Punitive damages are never awarded in a breach case because the objective of contract law is not to punish the breaching party, to compensate the non-­‐breaching party. Consequential Damages: breacher is only liable if they could have reasonably foreseen. How might this be avoided in a contract? A plaintiff may not seek damages for a non-­‐material breach, however, they may seek performance. However, the courts will generally prefer monetary damages over specific performance. Parties may explicitly contract the kinds of remedies available to the parties. Interests and court costs have been recoverable under statutes. Recovery Chart: Buyer Who's got the goods Seller Who's in Breach Buyer Seller 2-­‐709, Buyer simply needs to pay the price of the goods Recovery under breach of warranty? (2-­‐601?) Cover Price: The cost to buy the good from someone else. 2-­‐706, Seller must resell the goods, and may recover the expectancy after resale 2-­‐712 (1): Buyer recovers expectancy (Cover price -­‐ K (K Price-­‐ Resale + Incidental Damages) price + incidentals + consequential damages – savings) Or 2-­‐708, Seller receives the (K price – the 2-­‐713 (1): Buyer recovers (Market price -­‐ K price + market value) incidentals + consequential damages – savings) Case Guide Chapter 17: McIntosh v. Murphy: The plaintiff had an oral agreement to work for defendant for a year. P traveled to work for D and after two months P was fired. P sued, and D claimed the statutes of fraud was not fulfilled since this was an oral contract. The court stated an oral promise which the promissor should reasonably expect to induce either action or forbearance on the part of the promisee is enforceable when injustice can be avoided only by enforcing the contract. See Restatement (Second) of Contracts § 217A. Southwest Engineering Co. v. Martin Tractor Co.: Plaintiff claimed defendant breached on a promise to deliver a generator for a military project. D claimed the contract was not enforceable since it was a contract worth over $500 for the sale of goods. P produced memos regarding the agreement. The court ruled A memo is enough to be a “be sufficient to indicate that a contract for sale has been made between the parties.” Which satisfies the conditions of the UCC. GPL Treatment Ltd., v. Louisiana-­‐Pacific Corp.: Defendant claimed the contract was not enforceable because of the statute of limitations, since the form was sent with a sign and return section which was not fulfilled. D claimed a merchant exception under the UCC. The court said the form did constitute a written contract. Chapter 21: Page 8 of 19 2012 SPRING BURNHAM CONTRACTS Watkins & Sons, Inc. v. Carrig: Plaintiff agreed to excavate D’s cellar, but when realizing the cellar job would be more difficult than expected he orally agreed with P to complete the job at a higher payment rate. D claimed the oral agreement modified the written agreement without consideration and was not enforceable. The court held that the oral agreement superseded the written agreement, because the parties rescinded the initial written agreement in favor of a new contract altogether. Austin Instrument, Inc. v. Loral Corp.: Plaintiff retroactively raised prices for components sold to a contractor and demanded new price be paid. Defendant had to fulfill their other contracts and could not otherwise obtain the components. The court ruled Defendant lost their rights to disaffirm the contract when they waited a long enough time after the contract had been entered into to bring the claim. Elements of Duress: an improper threat which leaves the party no reasonable alternative. Kibler v. Frank L. Garrett & Sons, Inc: D sent P a check for payment for P’s services of harvesting a field. They check was less than the agreed payment with a letter stating this was to be the payment. The court ruled the letter and the check did not clearly establish the D’s intention for accord and satisfaction, and P was under no burden to read such intent into the check or letter. Consolidated Edison Co. of New York v. Arroll: D contested his electric bill, and arbitrarily decided an amount which he would pay. He sent a check and a letter clearly stating his check was to be payment in full for the electric services. The court said this was ample notice of accord and satisfaction, and cashing the check shows the electric companies acceptance. Chapter 22: Murray v. Holiday Rambler, Inc.: (1) because the seller failed to provide the buyers with a motor home substantially free of material defects within a reasonable time, the limited remedy of repair or replacement of defective parts failed of its essential purpose and the buyers were entitled to revoke their acceptance of the motor home and to avail themselves of any other remedies under the Uniform Commercial Code; but (2) evidence failed to support a $2,500 award of damages for loss of use of the motor home, and (3) the buyers were entitled to recover prejudgment interest on their damage award at the legal rate of 5%. Magnusan v. Moss: ??? Chapter 23: Green v. McGrath: D and P had a contract to breed horses using D’s mare. The mare disappeared and P sued D for breach. The court found when subject matter of contract is destroyed or becomes unavailable, nonperformance is excused regardless of whether unavailability of subject matter is caused by malicious act of third person or by “act of God.” CNA International Reinsurance Company, Ltd., as Subrogee of Shapray Ltd., v. Phoenix: Lead actor died during production of film due to drug overdose. Insurance company sued actor for breach, claiming inability to perform was not a defense because actors death was his fault. The court said that death renders personal services contract impossible to perform applied, notwithstanding actor's purported fault Aluminum Co. of America v. Essex Group, Inc.: under Indiana's doctrines of impracticability and frustration of purpose, seller was entitled to reformation of long-­‐term toll conversion service contract where, following execution of the contract, seller's nonlabor production costs rose greatly beyond the forseeable limits of risk under nonlabor component of objective pricing formula which was tied to wholesale price index for industrial commodities and where, without judicial relief or economic changes that were not presently foreseeable, seller stood to lose in excess of $60 million out of pocket during remaining term of contract. Chapter 24: Page 9 of 19 2012 SPRING BURNHAM CONTRACTS Reid v. Key Bank of Southern Maine, Inc.: A bank, who had a relationship with a business man in which the man depended on the relationship to conduct business, suddenly refused to extend additional line of credit to the man and refused to discuss alternative solutions for foreclosure on the man’s accounts. The court ruled the bank did not exercise good faith dealings in the banker-­‐customer relationship. Jury was instructed on a subjective standard of good faith as, “honesty in fact”. Neumiller Farms, Inc. v. Cornett: Seller sued buyer when buyer rejected a delivery of potatoes on the grounds that potatoes were not satisfactory for chipping. The court said in order to refuse goods based on satisfaction the buyer must exercise good faith of a subjective standard, including evidence of reasonable commercial standards and fair trade. Dalton v. Educational Testing Service: Plaintiff took a standardized test twice. The testing company refused to submit his second score on the grounds that they believed someone else took the test. Plaintiff submitted evidence to the contrary, which defendant refused to accept as evidence. The court ruled the defendant had a good faith obligation to examine the evidence, and was thus in breach. Chapter 25: Dove v. Rose Acre Farms, Inc.: An employee made an agreement where he would receive a bonus if he showed up for work every day without being late. He became ill and could not show up for work, and did not receive the bonus. He argued the promise was impossible for him to fulfill. The court ruled showing up for work on time/all the time was a condition, not a promise. Therefore, since the condition was not met, the contract was invalidated. Billman v. Hensel: Buyer agreed to purchase a home and gave an earnest payment of $1,000. Buyer was unable to secure a mortgage because he could not show the bank he could produce the difference between the mortgage and the price of the home. Seller kept the earnest payment and buyer sued. The court ruled buyer did not make a reasonable and good faith effort to secure the necessary financing, and therefore could not rely upon the condition to relieve their duty to perform. Howard v. Federal Crop Insurance Corp.: A farmer had an insurance policy protecting damaged crops. Parts of his crops were damaged, but the rest he plowed and sold. There was a condition in his insurance contract which required fields to be left unplowed in order to recover under the policy. The court must decide if this is a condition or promise. If the clause is a condition, the contract would simply be forfeited. However, the insurer would be capable of recovering damages as a result of the harvesting, but the contract is not wholly void. When it is doubtful whether words create a promise or a condition precedent, they will be construed as creating a promise. Provisions of a contract will not be construed as conditions precedent in the absence language plainly requiring such construction. Restatement §227. Walker & Co. v. Harrison: Failure for a lessor to clean a sign, as constituted by the contracted agreement, did not constitute a material breach. Therefore, lessee was under an obligation to fulfill his promise by paying rent of the sign. United Campgrounds v. Stevenson: ???? Not really sure, something about a sign and a franchise agreement? Jacob & Youngs, Inc. v. Kent: In building a home, a contractor agreed to use a specific brand of pipe. It was discovered that he did not use this brand, but another comparable brand. Here the defect was insignificant in relation to the project, and the remedy of ripping out the pipes would cause more damages than necissary. The court ruled that in the circumstances of this case the measure of the allowance is not the cost of replacement, which would be great, but the difference in value, which would be either nominal or nothing. Chapter 26: Kreyer v. Driscoll: A contractor who only completed half the work on a construction project did not have a claim under substantial performance, because he did not complete the work to a point where it would Page 10 of 19 2012 SPRING BURNHAM CONTRACTS be nearly completed and it would unjust for the party to not pay. However, there was a claim under restitution or quantum meritum. O. W. Grun Roofing and Construction Co. v. Cope: When builder installed a roof which with tiles that did not match in color, the only acceptable solution would be for the owner to have a new roof reinstalled. Therefore, builder was not entitled to restitution for the work which he did on the home. Margolin v. Franklin: where dealer accepted payments from buyers on or before 27th day of each month rather than the 15th as required by sales agreement, and had automobile repossessed without giving buyers reasonable, definite and specific notice of its changed intention regarding acceptance of payments after the 15th, buyers' failure to make payment by the 15th was not breach of contract and dealer's taking of their automobile amounted to wrongful repossession and breach of contract. The dealer waived the right to strict compliance by developing a pattern otherwise. Alcazar v. Hayes: Insured notified an insurer a year after an accident on an uninsured motorist claim. The court ruled the delay in notice did not relieve the insurance company of their duties unless there was prejudice. The is a presumption of prejudice unless the insured can show otherwise. Graulich Caterer Inc. v. Hans Holterbosch, Inc.: Non-­‐conformity of second delivery of prepared food to sample, considered in light of necessity of buyer's furnishing high quality food to patrons of World's Fair pavilion, warranted cancellation of contract by buyer. Chapter 27: Taylor v. Johnston: After defendant sold a mere the plaintiff insisted on still breading their horse with the mare in recognition of a contract. Defendant gave notice the mare had been sold. The court stated this could have been seen as a repudiation, but behavior by the plaintiff and defendant after the fact resemble a retraction, and no recovery under repudiation can be made. AMF, Inc. v. McDonald’s Corp.: After several attempt to purchase working automated cash registers from a company, McDonalds demanded assurance. This was not given. The court ruled for McDonalds on the ground that there were adequate insecurities to support the anticipatory repudiation. Norcon Power Partners, L.P. v. Niagara Mohawk Power Corp.: a party has the right to demand adequate assurance of future performance when reasonable grounds arise to believe that the other party will commit a breach by non-­‐performance of the contract, even where the other party is solvent and the contract is not governed by the Uniform Commercial Code Chapter 28: Rashid v. Jolly: Seller brought an action against buyer of a mule for breach of the right of first refusal. The court ordered damages equaled $700 difference between the mule's market value and re-­‐sale price; seller was not entitled to attorney’s fees or punitive damages. Hadley: The crank shaft for a mill was broken, so they order a new one. Delivery of a crank shaft was delayed, causing a mill to be delayed, causing lost profits. The mill owner sues for the lost profits. Direct damages are awarded, but consequential damages were not since a reasonable carrier would not have known the late delivery would cause the loss in profit (since they might have thought they were ordering a spare part, or maybe multiple parts are broken). Spang Industries, Inc. v. The Aetna Casualty: A contractor entered into a contract to supply steal. They had a delivery date “to be mutually agreed upon” they decided it would be june 30. The delivery had to be delayed because of bad weather, and notified in Jan. The defendants claim there was no date in the contract, so they couldn’t reasonably anticipate a late due date. The court says the Hadley rule applies to modifications, so they could reasonably anticipate a late due date. Lee v. Joseph E. Seagram & Sons, Inc.: an argument about distributorship. There is an argument about certainty of the terms. There is a conflict as to what the damages amount should be, since there are no certain amounts. Defendant says because damages aren’t certain they are unrecoverable. The question Page 11 of 19 2012 SPRING BURNHAM CONTRACTS to the court is, is it possible to determine certainty where there is uncertainty. The court says they can project the value of the business based on past, similar businesses, for a reasonable time. The court here says ten years. Freund v. Washington Square Press, Inc.: Author made a contract to get a book published, and the Publisher breached. The court rules damages are not the cost of publication (this is a cost to the publisher not the author), or the promotion costs (he got his promotion when published the book later). The court says he is entitled to the lost royalties, but this is speculative, which the publisher would not be reasonably certain of. Plaintiff would have to prove reasonable certainty of any royalties. Contemporary Mission, Inc. v. Famous Music Corp.: Pretty much same scenario as Feund, but plaintiff were priests that produced musical, and the production company breached. The court says breach does not bar claims of recovery of royalties, but where there is evidence of royalties with reasonable certainty. The court also says they will be more lenient of the plaintiff when there were actual damages, which cannot be proven because of the actions of the defendant. Rockingham County v. Luten Bridge Co.: A bridge company is building a bridge for the city. The city tells the company they no longer need the bridge, but the company continues to build anyway, and then sues the city for the work. The court says the company should have mitigated the damages by stopping building when the city told them to stop. The bridge company was able to recover the profits of $10,000 Parker v. Twentieth Century-­‐Fox Film Corp.: Actress Shirley McClain had a contract to do a movie, and the company breached. The production company claimed McClain failed to mitigate, since she had a different offer for the same salary. The court says the job was too different, it was in a different country, for a different kind of movie, which McClain was not interested in. The court says this job was inferior because of location, and the skills it takes to make the movie, she would have to be a co-­‐star, instead of the star versus a more liberating role for a woman. Dissent: So long as the job does not lower the person’s station, it is a mitigation. The job was not inferior, just different. Aside from that, the superiority and inferiority of a job is really more of a fact question, not a question of law, that the appeals court shouldn’t be deciding. Chapter 29: Northern Indiana Public Service Co. v. Carbon County Coal Co.: Specific performance was not available as a remedy, since it was simply being used to coerce the government entity. Walgreen Co. v. Sara Creek Property Co.: Equitable remedy was appropriate, because otherwise it would be hard to settle. Southwest Engineering Co. v. United States: SW entered into a contract to have a radio tower built for the government. SW was late, they agreed on $100/day if the project was built late. The project was late, and the government said SW owed $8,300. SW said they did not owe anything, since no actual damages were made. The harm that was caused by the breach must be difficult to calculate otherwise amount must be a reasonable forecast of the breach, must be reasonable at the time the contract was made. Court says it does not matter what actual damages were, because they do not apply the hindsight rule. Court rules for the gov. Leeber v. Deltona Corp.: Buyer and seller engage in contract. Buyer has to pay $22,530 in down payment, and has a LD clause for $22,530. The sale price was $150,000. Buyer breached. However, seller re-­‐sells for $167,500. Actual damages resulting from the breach were $5,704. Loss of the commission for the finder’s fee, so they probably had to pay twice, creating damages. The buyer contests they should have to pay $22,530 if actual damages were less. Maine Rule: Finds LD at the time the contract was made. Florida Rule: four factors that would make LD not apply: Generally only looking at the time the contract was made, but if it seems unconscionable to award LD, the court will not follow Page 12 of 19 2012 SPRING BURNHAM CONTRACTS Rule Statements • In contracts law Article 2 applies to the sale of goods. Goods are defined as movable, personal property. Common law applies to any contracts which do not apply to Article 2. • A contract is a legally enforceable agreement. • An express contract is created by the parties words, oral or written. While, an implied-­‐in-­‐fact contract is created by the parties conduct, for example, sitting down at a barbers chair would constitute an implied contract. Quasi contract are not real contracts, but rather an order from the court that protects against unjust enrichment whenever contract law yields unfair results. Restitution, on the other hand is a last resort. • • • Bilateral contract are offers which can be accepted in any reasonable way. Starting performance in a bilateral contract is acceptance of the offer and carries with it an implied promise to finish the job. • Unilateral contracts are offers which can only be accepted by performing. The offeror accepts the contract by completing performance. However, once performance has begun, the offeree cannot revoke the their offer. If an offeree accepts, but improperly performs, then they have simultaneously accepted and breached the contract. In the case of a shipment contract, shipping the goods will be considered an acceptance. Shipment of non-­‐conforming goods is a simultaneous breach and acceptance. However, if the offeree notifies the offeror that they are sending non-­‐conforming goods as an accommodation, then this is not an acceptance and breach, but rather a counteroffer. All contracts are considered bilateral, unless it is explicitly stated that acceptance will be by performance, or in the case of a prize or reward. • An offer is a manifestation of an intention to be bound. Advertisements are not considered to be an offer. • Contracts for the sale of goods must at least include the quantity of goods to be sold. However, that quantity can be put in terms of buyer’s needs or suppliers abilities. • Price is not a required term for a contract, but if it is not listed it will be read as a reasonable price. • An offer lapses after a stated term or after a reasonable time has passed. An offeree’s silence is generally not considered an acceptance. • When an offeror revokes an offer, the offer is terminated. An offer can be revoked by the offeror any time before acceptance. An offer can be revoked by directly indicating to the offeree Page 13 of 19 2012 SPRING BURNHAM CONTRACTS that they have changed their mind, or by engaging in conduct that indicates the offeror has changed their mind, so long as the offeree is aware of the conduct. Revocations, are effective when they are received by the offeree. There are four exceptions to the general revocation rule. If an option contract is used it cannot be revoked. An option is contract, in and of itself, where the offeree pays the offeror to keep an offer open for a period of time. The offer must be left open for either the stated amount of time, or for a reasonable amount of time. If a firm offer is used it cannot be revoked. A firm offer is an promise by a merchant, in a signed writing, to keep an offer for a the sale of goods open either for a stated amount of time, or for a reasonable time, neither of which can exceed 3 months. If an offeree foreseeably relies on offer, then the offer is not revocable. The reliance must genuinely be foreseeable by the offeror. If an offeree begins performance of a unilateral contract, then the contract is not revocable. However, the contract is not formed until the performance is complete, and there is no requirement that the offeree finish performance. • • An offer is terminated when the offeree rejects it. When an offeree issues a counteroffer to an offer, this is a rejection of the initial offer, and an issuance of a new offer. Under the common law any thing different from the initial offer constitutes a rejection and counter offer, whereas under Article 2, additional terms do not constitute an acceptance. A counter offer is distinguished from mere bargaining; conjecture or questions constitute bargaining. A conditional acceptance operates as a rejection and counter-­‐offer. A conditional acceptance occurs when an offeree states that they will accept an offer, but only on a condition precedent. • The mirror image law states that at common law acceptance must mirror the offer completely. Any variation constitutes an counter-­‐offer. • Acceptance for the sale of goods does not require the mirror image rule. If an offeree adds or changes terms it does not prevent acceptance. However, the offeree’s terms will only be included in the contract terms if 1) both parties are merchants, 2) there is no material change in the contract, and 3) there is not objection from the offeror before acceptance or within a reasonable time after acceptance. • The death of either party before acceptance of the contract terminates a revocable offer. • The mailbox rule states that acceptance is effective when mailed. However, if an offer states acceptance will be effective by another means (i.e. when received) then the mailbox rule does not apply. The mailbox rule also generally does not apply to irrevocable offers, which require acceptance be received before the stated time when the offer lapses. The mailbox rule does not apply if an offeree sends a rejection prior to sending an acceptance, as the mailbox rule is intended to protect the offeree, who should not benefit from the rule if they reject the offer. Page 14 of 19 2012 SPRING BURNHAM CONTRACTS The parol evidence rule is a rule that keeps out evidence of prior or contemporaneous agreements that add, vary, or contradict a contract that is a fully integrated writing. A written contract is considered fully integrated if the parties intended the writing to be a final and complete expression of the agreement. The traditional test for a fully integrated writing looks at the face of the document. If it appears to be a complete expression of the parties agreement, then it is a fully integrated writing. The modern test additionally allows evidence to discern the parties’ actual intent. In any case, even if a document is a partially integrated writing, courts will not allow parol evidence. However, the parol evidence rule does allow evidence to correct a clerical error. It additionally allows in evidence in order to establish a defense against the formation of the contract, for example if the contract was formed under duress; this is attempting to show that a valid contract was never formed. Additionally, the parol evidence rule allows evidence to explain what the parties meant by a term, but usually only to explain vague or ambiguous terms. Later events are also exempt from the parol evidence rule, which only applies to evidence subsequent to the written agreement. A partically integrated writing is a written contract that includes the final statement of the terms, but not a complete statement of the terms. Usually courts will not allow parol evidence which contradicts the agreement, but may allow parol evidence which is supplemental. There is a presumption that most written agreements are at least partially integrated. • • • • • When terms are left undefined by the parties, the court may apply gap fillers. However, if the terms are simply vague or ambiguous the courts will use the following, in this order, to explain the terms: first, the course of performance (or how the parties acted under this contract), second, the course of dealing (how the parties have acted in prior dealings with each other), thirdly, the usage of trade (what others do in the trade in similar contracts) Under the sale of goods, an express warranty is a warranty by the seller either by his words or his conduct. Words constitute statements of fact, promises, and descriptions of the goods, but not opinions. Conduct might include the use of a sample or model. An express warranty must be part of the basis of the bargain, meaning the buyer could have relied on the express warranty. Express warranties cannot be disclaimed. Under the sale of goods, implied warranties are warranties that need not be expressly stated. The implied warranty of merchantability is a warranty which merchants make that a good is fit for its ordinary purpose. The implied warranty of merchantability only applies to merchants who deal in goods of the kind; the merchant must have special knowledge about the particular goods involved. On the other hand, the implied warranty for fitness warrants that a good is fit for the buyer’s particular purpose, and does not require the seller be a merchant. The seller must have knowledge of the buyer’s special purpose for the goods and that the buyer is relying on the seller to select suitable goods. A seller can disclaim any implied warranties. A disclaimer may be as simple as “as is”, but any disclaimer must be conspicuous. Also note, a seller can limit a buyer’s remedies for breach of any warranty if the limitation is unconscionable. However, it is prima facia unconscionable for a seller to limit remedies for personal injury in the case of consumer goods. Page 15 of 19 2012 SPRING BURNHAM • CONTRACTS Under the sale of goods, in determining who will bear the risk of loss, the contract rules. However, in the event that the contract is silent, the breaching party bears the risk of loss, even if the loss is unrelated to the breach. If the seller bears the risk of loss the seller must provide new goods to the buyer for no additional cost or be liable for breach of contract. If the buyer bears the risk of loss the buyer must pay for the goods. • • • If delivery is by a common carrier (i.e. UPS, American Aerlines) the seller bears the risk of loss until its delivery obligations are met. In a shipment contract, the seller bears the risk of loss until the goods are delivered to the common carrier. In a destination contract, the seller bears the risk of loss until the goods are delivered to a specific destination. When the term Freight on Board (FOB) is used, and it is followed by the place where the seller is located, it will be a shipment contract. If FOB is followed by any other location then it is a destination contract. If the contract is a non-­‐carrier contract, then the buyer will pick up, or the seller will deliver, the goods. If the seller is a merchant, then the seller bears the risk of loss until the buyer takes possession of the goods. If the seller is a non-­‐merchant, then the risk of loss transfer at the time of tender (the time when the goods are made available to the buyer). In a sale of goods contract, the seller must deliver perfect goods in the right place at the right time. In other words, the seller must be in perfect compliance with the terms of the contract. If tender is not perfect, the buyer has the right to reject or accept the goods. However, the seller has an option to “cure” the failure if the time to complete performance has not passed. If time has expired the seller does not have an option to cure, unless they had reason to believe, such as a evidence from past dealings with the buyer, that the buyer would accept non-­‐conforming goods. Additionally, the perfect tender rule does not apply to installment contracts. Installment contracts are contracts which require or authorize deliver in separate installments. In an installment contract, a byer only has the right to reject an installment if the installment substantially impairs the buyer, and it cannot be cured. The buyer only has the right to reject the entire contract if a defect substantially impairs the entire value of the contract. Under a sale of goods contract, the buyer impliedly accepts if they keep the goods without complaint after having an opportunity to inspect the goods. Once the buyer accept the goods, it is too late for the buyer to reject the goods, but, even after acceptance the buyer can still recover damages for the seller’s breach of contract. But, as an exception, if the non-­‐conforming good substantially impairs the value of the goods and the defect was difficult to discover, then the buyer can reject the goods after acceptance. In the sale of goods, if tender is not perfect, the buyer has three options: 1) the buyer may accept all the goods, 2) the buyer may reject all the goods, or 3) the buyer may accept any commercial units and reject the rest. Whichever option the buyer elects, the buyer may still get damages. If the buyer rejects goods, the buyer may return the goods to the seller at the seller’s expense. The buyer can get their money back if they have already paid for the goods. The buyer can also seek damages from the seller for the breach of contract. Page 16 of 19 2012 SPRING BURNHAM • • • • • • • CONTRACTS Under the common law, performance does not require perfect tender. Substantial performance is all that is required. In order to determine if a contract has been substantially performed the courts will consider the quality and quantity of the performance rendered; the courts will find a minor breach, i.e. substantial performance, so long as the oblige gains the substantial benefit of the bargain despite the obligor’s defective performance. The courts may look at the amount of the benefit conferred, the adequacy of damages, the extent of partial performance, the hardship of the. Under the common law, the injured party can recover damages for any breach, major or minor. However, only a material breach (i.e. non-­‐substantial performance) excuses the injured party from performance. An anticipatory repudiation is effectively a breach which occurs when there is an executory contract (a contract which has not been fully performed), and promisor unequivocally indicates that they cannot or will not perform. An anticipatory repudiation is treated as a total breach. The non-­‐ breaching party may treat the repudiation as a breach and sue, suspend performance, treat the repudiation as an offer to rescind the contract, or ignore the repudiation and encourage performance of the breaching party. However, when a party only has reasonable grounds to believe another party will not perform when the performance is due, this is not an anticipatory repudiation, and they party may only suspend performance and until they receive adequate assurance that the party will perform. A rescission is a mutual agreement to cancel a contract. The consideration for this new contract is that neither party will reap the benefits of the old contract. A rescission terminates a contract. A modification is an agreement to replace an existing contract with a new one. A modification discharges the original contract. If a modification of a contract is breached, there is no remedy available based on the original contract. An accord and satisfaction is an agreement to accept performance in future satisfaction of an existing duty. Satisfaction is performance upon the accord. Notice that an accord requires some sort of future satisfaction, otherwise, the agreement is not an accord, but rather a modification. If an accord is breached, then the non-­‐breaching party may recover under either the accord or the original contract. A novation substitutes one party in a contract for another. A novation requires the consent of all parties involved in the contract and the party to be substituted in. A novation relieves the substituted party of a duty to perform. An express condition is a condition, which limits contract obligations by other contract language. An express condition may be made by language such as “as long as”, “when”, or “provided that”. Express conditions require strict compliance with the express condition in order to impose an obligation on a party. Express conditions may be conditions precedent, concurrent, or subsequent. Conditions precedent must occur before the obligation is created; it is indicated by language such as “if X happens then _”. Conditions concurrent are conditions which so long as they occur, an obligation will exist; the are Page 17 of 19 2012 SPRING BURNHAM CONTRACTS indicated by language such as “As long as X, then _”. A condition subsequent is a condition which occurs subsequently; it is indicated by language such as “Until X, _”. An occurrence of a condition may be excused by the later inaction of the person protected by the condition. If a party fails to cooperate in practicing good faith to bring about a condition they may be obligated to perform, regardless of the express condition not being met. Additionally, if the party who is protected by the express condition knowingly and voluntarily surrenders the condition, then they waive the express condition, and have no right to demand compliance after the condition is waived. However, unless this waiver explicitly waives the express condition into perpetuity, then the waiver will not apply to future arrangements, unless a pattern of behavior indicates that the waiver does apply into the future. • • • • • • Clauses in a contract which require a parties “satisfaction” will be measured by a reasonable person standard, unless the contract deals with a art or a matter of personal taste. Specific performance is an equitable remedy that is only available if monetary damages are not sufficient to compensate the injured parties. Specific performance is usually available for contracts involving real property, because real property is considered unique. Specific performance is only available for the sale of goods if the goods are unique or there are “other proper circumstances”, for example, if there is no market available to buy substitute goods. Specific performance is never available for service contracts. However, injunctive relief may be available in order to bring about justice, for example, preventing the party from rendering the same service to others. Punitive damages are not awarded for breach of contract, because the purpose of contracts damages is to compensate the injured party, not to punish. Liquidated damages are pre-­‐established measures of damages at the contract formation. Liquidated damages will be upheld if, at the time of contract formation, damages were difficult to estimate, and the liquidated damages were a reasonable forecast of probable damages. Liquidated damages may not operate as a penalty. Under the common law, actual experience is irrelevant to the determination of if liquidated damages were reasonable at the time of contract formation, however, under article 2, actual experience may be used as evidence. Under the common law, expectation damages are the general measure of damages. They are intended to put an injured party in as good a position as if full performance were achieved. Notice that an injured party cannot recover damages they could have avoided, or mitigated, with reasonable effort. In the sale of goods damages are determined by expectation. Notice that an injured party cannot recover damages they could have avoided, or mitigated, with reasonable effort. If the buyer is damaged there are three options of recovering damages: The first is cover damages, which is the cost of the buyer to “cover” the goods, or to replace them with comparable goods, minus the contract price. The buyer must make a good faith effort to cover with comparable goods. Page 18 of 19 2012 SPRING BURNHAM • • • CONTRACTS The second is market damages. Market damages are a measure of the market price of the goods minus the contract price. This is used if the buyer does not choose to cover the goods in goods faith. For example, if they choose to purchase a better quality, more expensive good. The third is loss in value damages. This is the value of the goods as promised minus the value of the goods as delivered. This is used if the buyer chooses to keep the non-­‐conforming goods. In the sale of goods, damages if the seller is the damaged party the seller had four options. The first option is resale damages. This is the measure of the contract price minus the resale price. This measure is only available if the seller resells the goods in good faith. The second option is market damages. This is measured by the contract price minus the market price. This is used if the seller chooses not to resell the goods in good faith, or does not resell the goods. The third is lost profit. This is measured by the contract price minus the costs of the goods to the seller (i.e. their expected profit). This is called a lost volume dealer, and this measure is only available to sellers who well in volume, under the theory that a resale of the good would have been two sales of the good, but for the buyers breach. The fourth measure is the contract price. This measure is used if the seller cannot resell the goods, usually because the goods are customized. Incidental damages are the costs incurred by either a buyer or seller in transporting or caring for goods after a breach and arranging a substitute transaction. These damages are recoverable by either buyer or seller. Consequential damages are damages that were reasonably foreseeable to the breaching party at the time of the contract. These damages are available under the common law, but not article 2. Page 19 of 19