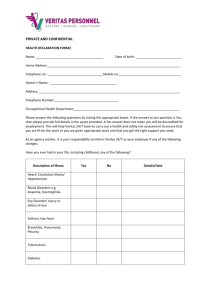

Voluntary Offer Document

advertisement