Safeguarding - Public Bank

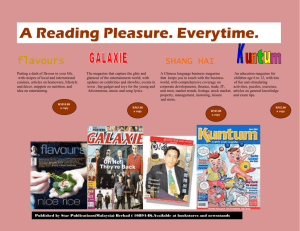

advertisement