Competing with the Right Strategy

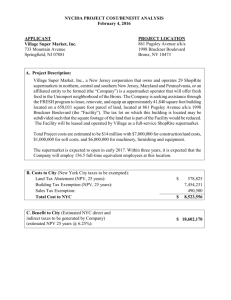

advertisement