ACCC crack-down on Misleading & Deceptive Advertising

advertisement

July 2009

ACCC crack-down on Misleading & Deceptive

Advertising

Overview

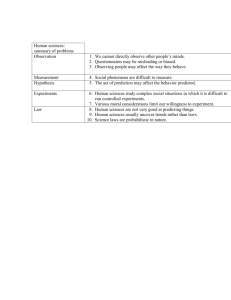

In the past few months, the Australian Competition and Consumer Commission ( ACCC ) has been involved in no

less than 10 cases targeting commercial misleading and deceptive conduct, illustrating the Commission's latest

crack-down on unfair business practices. Companies need to put into place proper checking procedures to ensure

that their advertising slogans comply with Part V of the Trade Practices Act 1974 (Cth) [1] or face the risk of

substantial penalties.

The Trade Practices Act prohibits any conduct or behaviour in business which misleads or deceives or is likely to

mislead or deceive consumers.

Advertising and marketing practices which have been the subject of recent actions by the ACCC for alleged

misleading and deceptive conduct include:

" Was/Now" Price Comparisons;

Country of Origin Claims;

Fine Print Disclosures; and

Recruitment Advertising.

Recently scrutinised misleading advertising

Comparative Advertising: "Was/Now" Price Comparisons

Comparing two prices is a powerful marketing tool commonly utilised by advertisers and sellers. Businesses can

compare current prices with previous prices, provided the price stipulated is genuine. These practices were the

subject of an unsuccessful Federal Court appeal by Ascot Four Pty Ltd in May 2009 against the ACCC whereby

the Full Court upheld the decision of the trial judge. [2] Ascot Four, former owner of Zamel's jewellers, produced

catalogues for the 2005 Christmas period which listed 11 items with a sale price next to a higher "strike through"

price. In August 2008, the Federal Court trial judge held that Ascot had falsely represented the strike through

prices; no consumer had ever paid the strike through price before the sale period. This conduct constituted a

breach of section 75AZC(1)(g) of the Trade Practices Act which prohibits false or misleading representations

being made in relation of the price of goods and makes it a criminal offence to do so. Ascot was fined $380,000.

Advertisers employing "was/now" pricing should ensure that:

1. The represented saving is genuine - the higher price must be a genuine pre-sale price;

2. A discounted price should be a temporary price - a lower "now" price which has run for longer than the

higher "was" price risks being misleading;

3. The "was" price has been applied to the goods for a reasonable period. [3]

Country of Origin Claims

Representing that a product is "Australian Made" or a "Product of Australia" can appeal to consumers wishing to

support the local economy. Businesses must ensure the appropriateness of any labelling, packaging, logo or

advertising that makes a statement about the country goods originate from to ensure such labelling does not

contravene s 52 [4] , s 53(a) or (eb) [5] ,or s 75AZC(1)(a) or (i) [6] of the Trade Practices Act. [7] Division 1AA

of Part V of the Trade Practices Act ('Country of Origin Representations') outlines the criteria to be satisfied to

avoid a contravention of these sections:

1. A business may make a general claim as to the country of origin such as "Made in Australia" or

"Australian Made" where: [8]

1. the goods have been substantially transformed in the country of origin; and

2. 50% or more of the production or manufacture costs are attributable to production or manufacture

in the country of origin.

Goods have been substantially transformed where there has been "A fundamental change… in form, appearance or

nature such that the goods existing after the change are new and different goods from those existing before the

change." [9] To be substantial, the transformation must be more than reconstitution or assembly and includes

processing of ingredients and production of an entirely different product. Costs of production or manufacturing

costs include expenditure on materials, labour and overheads.

1. Businesses may also choose to make a premium claim regarding a good's origin such as that the good is a

"Product of Australia" or "Produce of Australia". A business can only make such claims where: [10]

1. Each significant component/ingredient originates from the country of origin; and

2. All, or virtually all of the production processes have taken place in the country of origin.

2. A business may also represent the country of origin of goods by affixing a prescribed logo, such as the

green "Australian Made" triangle, where goods have been substantially transformed in the country of origin

and 50% or more of the production or manufacture costs are attributable to production or manufacture in

the country of origin. [11]

3. Where goods do not meet the above requirements it is possible to make a qualified statement about the

origin of the goods. It is becoming increasingly common for goods to consist of raw materials from one

country and for the manufacturing process to be carried out across several other countries, for example in

clothing or food production. It may be impossible to make a claim as to the country of origin of the goods.

In such cases a qualified statement may be made which is not misleading or deceptive. [12] For example,

where a product is manufactured in Australia from parts or ingredients from multiple other countries it may

be appropriate to make the qualified statement "Made in Australian from Australian and imported

components".

On 17 June 2009, the ACCC instituted proceedings against Australian Dreamtime Creations Pty Ltd ( ADC ), a

wholesaler and retailer of Aboriginal art, for making false representations about carved wooden artworks. The

ACCC alleges that the artworks were made in Indonesia and imported by ADC who sold them as "Australian

Made". The matter is scheduled for a directions hearing on 9 August 2009 before Mansfield J. The ACCC is

seeking declarations, injunctions, corrective notices and costs against ADC. [13]

Fine Print Disclaimers

Advertisements commonly contain fine print disclaimers through the use of an asterisk (*) or phrases such as

"conditions apply". Businesses must ensure that these disclaimers are specific, clear and highly visible as

information in fine print can be misleading if it contradicts the main message of an advertisement [14] and

therefore contravenes section 52 of the Trade Practices Act. Customer's attention should be clearly directed to the

most significant terms and conditions. In a recently successful action by the ACCC, the Federal Court held that

SMS-subscriber advertisements by AMV Holdings Ltd published in youth magazines Dolly , Girlfriend and TV

Hits were misleading and in breach of sections 52 and 53 [15] of the Trade Practices Act due to the placement of

fine print disclaimers in the busy layout of the magazines. [16] The advertiser failed to adequately disclose the

nature of the services being offered. In consequence, young consumers wanting to purchase a single ringtone,

wallpaper or game, unknowingly subscribed to ongoing, expensive services.

Recruitment Advertising

The Trade Practices Act 1974 (Cth) also operates to protect job seekers who may be misled by inaccurate

information about employment opportunities. [17] The ACCC advises that advertisers or publishers of

advertisements who overstate remuneration, place an advertisement under the wrong heading or fail to disclose

associated application costs, face heavy penalties under the Trade Practices Act, ranging up to $1.1 million in

cases of criminal prosecution for serious breaches. [18]

In May 2009, the ACCC brought proceedings against IT business Zanok Technologies Pty Ltd and its directors,

with respect to the promotion of advertisements, encouraging applicants to pay $4,700 for IT training courses in

order to secure employment. The ACCC alleges that the advertisements, placed on employment websites such as

MyCareer and Seek , were not offering job opportunities and there was no guarantee of a job at the conclusion of

the training courses. Zanok's conduct is claimed to be in breach of sections 51AA, [19] 52, 53B [20] and 58 [21] of

the Act and the ACCC is seeking injunctions, findings of fact and costs.

Stephens Lawyers & Consultants have a high level of expertise in trade practices law and compliance.

Our lawyers represent leading companies in both litigious and commercial matters.

For further information contact:

Stephens Lawyers & Consultants

Level 3, 530 Lonsdale Street

Melbourne VIC 3000

Phone: (03) 8636 9100

Fax: (03) 8636 9199

Email: stephens@stephens.com.au

Website: www.stephens.com.au

All Correspondence to:

PO Box 13286

Melbourne Law Courts

Melbourne VIC 8010

To register for newsletter updates and to send your comments and feedback, please email

stephens@stephens.com.au

Disclaimer: This newsletter is not intended to be a substitute for obtaining legal advice.

© Stephens Lawyers & Consultants. July 2009. Researched and written by Colette Downie and Tara Jenkins,

edited by Katarina Klaric.

[1] Part V of the Trade Practices Act ('Consumer Protection') contains various provisions aimed at regulating

unfair practices by businesses, such as s 52 (misleading and deceptive conduct), s 53 (false or misleading

representations).

[2]Ascot Four Pty Ltd v Australian Competition & Consumer Commission [2009] FCAFC 61.

[3]Price Comparison Advertising, 12 June 2009 ( http://www.accc.gov.au/content/index.phtml/itemId/876614 ).

[4] Section 52: Misleading or deceptive conduct

(1) A corporation shall not, in trade or commerce, engage in conduct that is misleading or deceptive or is likely to

mislead or deceive.

[5] Section 53: False or misleading representations

A corporation shall not, in trade or commerce, in connexion with the supply or possible supply of goods or

services or in connexion with the promotion by any means of the supply or use of goods or services:

(a) falsely represent that the goods are of a particular standard, quality, value, grade, composition, style or model

or have had a particular history or particular previous use;

…(eb) make a false or misleading representation concerning the place of origin of goods

[6] Section 75AZC: False or misleading representations

(1) A corporation must not, in trade or commerce, in connection with the supply or possible supply of goods or

services, or in connection with the promotion by any means of the supply or use of goods or services, do any of the

following:

(a) falsely represent that goods are of a particular standard, quality, value, grade, composition, style or model, or

have had a particular history or particular previous use; or

…(i)make a false or misleading representation about the place of origin of goods

[7]Advertising and selling, 1 January 2007, pg 21, ( http://www.accc.gov.au/content/index.phtml/itemId/303213 ).

[8] Section 65AB: General test for country of origin representations

If:

(a) a corporation makes a representation as to the country of origin of goods; and

(b) the goods have been substantially transformed in that country; and

(c) 50% or more of the cost of producing or manufacturing the goods (as the case may be) is attributable to

production or manufacturing processes that occurred in that country; and

(d) the representation is not a representation to which section 65AC (product of/produce of representations) or

section 65AD (prescribed logo representations) applies;

the corporation does not contravene section 52, paragraph 53(a) or (eb) or paragraph 75AZC(1)(a) or (i) by

reason only of making the representation.

[9] Section 65AE

[10] Section 65AC: Test for representations that goods are product of/produce of a country

If:

(a) a corporation makes a representation that goods are the produce of a particular country (whether the

representation uses the words "product of", "produce of" or any other grammatical variation of the word

"produce"); and

(b) the country was the country of origin of each significant ingredient or significant component of the goods; and

(c) all, or virtually all, processes involved in the production or manufacture happened in that country; the

corporation does not contravene section 52, paragraph 53(a) or (eb) or paragraph 75AZC(1)(a) or (i) by reason

only of making the representation.

[11] 65AD: Test for representations made by means of prescribed logo

(1) If:

(a) a corporation makes a representation as to the country of origin of goods by means of a logo specified in

regulations made under subsection (2); and

(b) the goods have been substantially transformed in the country represented by the logo as the country of origin

of the goods; and

(c) the prescribed percentage of the cost of producing or manufacturing the goods (as the case may be) is

attributable to production or manufacturing processes that occurred in that country;

the corporation does not contravene section 52, paragraph 53(a) or (eb) or paragraph 75AZC(1)(a) or (i) by

reason only of making the representation.

[12]Qualified claims, February 2006, pg 18-20, ( http://www.accc.gov.au/content/index.phtml/itemId/303666 )

[13]For more information, please see, 'News Release: ACCC institutes against seller of Aboriginal art for

misleading representations', 17 June 2009, ( http://www.accc.gov.au/content/index.phtml/itemId/877295 ).

[14]Advertising, selling and the Trade Practices Act - a small business overview , 1 January 2007 (

http://www.accc.gov.au/content/index.phtml/itemId/304501 ).

[15] Section 53: False or misleading representations

A corporation shall not, in trade or commerce, in connexion with the supply or possible supply of goods or

services or in connexion with the promotion by any means of the supply or use of goods or services:

… (aa) falsely represent that services are of a particular standard, quality, value or grade;

… (e) make a false or misleading representation with respect to the price of goods or services;

… (g) make a false or misleading representation concerning the existence, exclusion or effect of any condition,

warranty, guarantee, right or remedy.

[16]Australian Competition and Consumer Commission v AMV Holding Ltd [2009] FCA 605.

[17] Section 53B: Misleading conduct in relation to employment

A corporation shall not, in relation to employment that is to be, or may be, offered by the corporation or by

another person, engage in conduct that is liable to mislead persons seeking the employment as to the availability,

nature, terms or conditions of, or any other matter relating to, the employment.

Section 75AZE: Misleading Conduct in Relation to Employment

(1) A corporation must not, in relation to employment that is to be, or may be, offered by the corporation or by

another person, engage in conduct that is liable to mislead persons seeking the employment about the availability,

terms or conditions or, or any other matter relating to, the employment.

Penalty: 10,000 penalty units

(2) Subsection (1) is an offence of strict liability.

[18] Section 75AZE: Misleading Conduct in Relation to Employment

[19] Section 51AA:Unconscionable conduct within the meaning of the unwritten law of the States and

Territories.

(1) A corporation must not, in trade or commerce, engage in conduct that is unconscionable within the meaning of

the unwritten law, from time to time, of the States and Territories.

[20] Section 53B: Misleading conduct in relation to employment

A corporation shall not, in relation to employment that is to be, or may be, offered by the corporation or by

another person, engage in conduct that is liable to mislead persons seeking the employment as to the availability,

nature, terms or conditions of, or any other matter relating to, the employment.

[21]Section 58: Accepting payment without intending or being able to supply as ordered

A corporation shall not, in trade or commerce, accept payment or other consideration for

goods or services where, at the time of the acceptance:

(a) the corporation intends:

(i) not to supply the goods or services; or

(ii) to supply goods or services materially different from the goods or services in

respect of which the payment or other consideration is accepted; or

(b) there are reasonable grounds, of which the corporation is aware or ought reasonably to

be aware, for believing that the corporation will not be able to supply the goods or

services within the period specified by the corporation or, if no period is specified,

within a reasonable time.