Summary of Emerging Issues - 2007

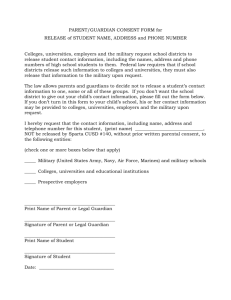

advertisement