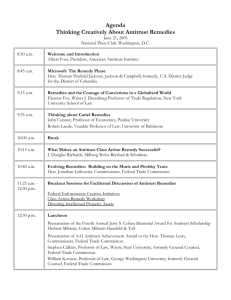

ANTITRUST IMMUNITY UP IN SMOKE: PREEMPTION, STATE

advertisement