U.S. Hotel Industry Overview

advertisement

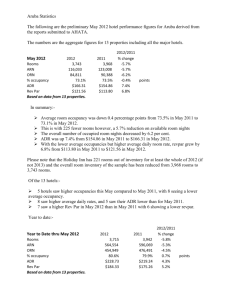

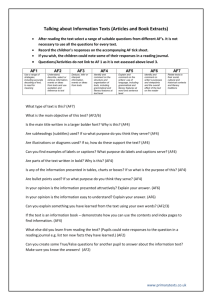

U.S. Hotel Industry Overview Vail R. Brown, CHMS Vice President, Global Business Development & Marketing IARE September 22, 2014 vail_str vbrown@str.com About STR • Founded in 1985 • STR Family of Companies Include: STR, STR Global, STR Analytics, HotelNewsNow.com, & Hotel Data Conference (Aug. 4-6, 2015) • The recognized leader in hotel performance benchmarking - Impartial, timely, confidential • Sample over 70% of total U.S. room supply; 52% of total global room supply. • Provide monthly, weekly, and daily STAR reports to over 50,000 hotels, representing close to 8 million rooms worldwide Get C.H.I.A Certified! Background: STR SHARE Center partnership with AH&LA Educational Institute Acronym: Certification in Hotel Industry Analytics About: Leading certification for hospitality and tourism More Info: sharecenter@str.com 5 Things to Know ….. 1. Industry Pulse from 30,000 ft. 2. Group Demand ‘Comeback’? 3. Best & Worst Market Performance 4. Pipeline Growth 5. Where Are We Headed? 1. Visit www.HotelNewsNow.com 2. Create Free Login 3. Click on “Data Presentations” 1 U.S. Pulse - Positive So Far U.S. Records Set in 2013! Most Rooms Available Most Rooms Sold Highest Rooms Revenue Highest ADR ($110) Highest RevPAR ($70) Full Year 2013 May 2014 RevPAR Growth 10% Highest May of any on record…ever! June 2014 Occupancy 71.7% Highest June occupancy this century! July 2014: Most Rooms Sold Ever! 113 Million Strong Demand Drives Very Strong RevPAR % Change • • • • • • Room Supply* Room Demand* Occupancy A.D.R.* RevPAR* Room Revenue* Total U.S. As of July 2014 YTD *All Time High for First 7 Months 65.1% $115 $75 0.8% 4.2% 3.4% 4.3% 7.8% 8.6% Demand Growth Accelerates. How Long Can That Last? 8.0% 8 4 3.4% 0.8% 0 -0.9% -4 Supply Demand - 4.7% -6.9% -8 1990 1992 1994 1996 1998 2000 2002 Total U.S. Supply & Demand % Change 12 Month Moving Average Jan. 1990 – July 2014 2004 2006 2008 2010 2012 2014 Steady ADR Growth As Room Demand Growth Continues 10 7.5% 6.8% 5 4.0% 0 Demand % Change -4.5% ADR % Change -5 -8.7% -10 1990 1992 1994 1996 1998 2000 2002 Total U.S., ADR & Demand % Change 12 Month Moving Average Jan. 1990 – July 2014 2004 2006 2008 2010 2012 2014 Room Revenue > $128bn $130 Billions $110 $90 $70 $50 $30 2007 2009 2011 Total U.S.: Rooms Revenue 12 Month Moving Average: January 2005 – July 2014 2013 Total U.S.: 2013 Revenue Variance from 2012 Source: 2014 STR Analytics HOST Almanac 2014 STR Chain Scales *Full list go to www.str.com • Luxury – Fairmont, Four Seasons, Ritz Carlton, JW Marriott • Upper Upscale – Sheraton, Hilton, Hyatt, Marriott, • Upscale – Radisson, Hilton Garden Inn, Residence Inn, Springhill Suites, Homewood Suites, Courtyard, Best Western Premier • Upper Midscale – Fairfield Inn/Suites, Holiday Inn, Clarion, Hampton Inn/Suites, Best Western PLUS • Midscale – Country Inn & Suites, Best Western, Candlewood Suites, Quality Inn/Suites • Economy – Extended Stay America, Red Roof, Days Inn, Microtel A Tale of 2 Supply Growth Scenarios Supply % Change Demand % Change 6.6 3.8 4.3 4.0 3.5 3.0 1.6 1.5 0.8 0.4 0.4 -0.7 Luxury Upper Upscale Upscale U.S. Chain Scales: Supply / Demand % Change As of July 2014 YTD Upper Midscale Midscale Economy ADR Growth Strong Across The Board Occupancy % Change ADR % Change 5.0 4.7 4.7 4.4 3.9 3.6 3.7 3.7 3.9 3.0 2.3 0.7 Luxury Upper Upscale Upscale U.S. Chain Scales: OCC / ADR % Change As of July 2014 YTD Upper Midscale Midscale Economy Actual RevPAR Catches Up To Prior Record Highs $226 $213 $217 2007 2013 2014F $123 $113 $116 $93 $84 $87 $68 $62 $64 Luxury Upper Upscale Upscale U.S. Chain Scales: Absolute RevPAR $ 2007 & 2013 & 2014 Forecast as of August 2014 Upper Midscale $44$43$46 Midscale $31 $30$32 Economy 2 Group Demand ‘Comeback’? Group Transient Segmentation Contract Total U.S.: Group Occupancy Share Decreases 2005 57% 2013 43% Group Transient U.S. Transient and Group Occupancy as Share of Total OCC 2005 and 2013 (Share does not include contract) 36% 64% Group Demand Is (Finally!) Recovering 5% 4% 3% 2% *2013 Easter Comp Demand 1% ADR -1% -2% 2012 2013 Group Demand and ADR % Change, 12 MMA, 1/2012 – 7/2014 2014 July 2014 1.8 million more group rooms sold than in the prior 12 month Transient Continues To Grow Share of Occupancy 70% Group mix Trans Mix 60% 50% 40% 30% 2005 2007 2009 U.S. Transient and Group Occupancy Mix of Total OCC 2005 thru July 2014 2011 2013 Transient Room Premium Back to 2008 Levels $204 Transient Group $194 $194 $186 $177 $178 $173 $172 $168 $164 $161 2008 2009 $166 $161 $157 2010 U.S. Customer Segmentation ADR $ 2008 – YTD July 2014 2011 2012 2013 YTD 2014 3 U.S. Market Performance Markets With Demand Growth > 4% Top U.S. Markets Demand Growth %, July 2014 YTD The Chinese Guest Still to Come… Not all growth or declines are created equal…many factors Market OCC % ADR % Change Nashville, TN 72.8 13.2 San Francisco/San Mateo, CA 83.2 11.3 Denver, CO 76.2 8.1 Seattle, WA 75.4 7.6 Boston, MA 74.3 7.1 Chicago, IL 67.9 1.7 Norfolk/Virginia Beach, VA 55.5 1.7 New Orleans, LA 71.2 1.6 Philadelphia, PA-NJ 68.5 0.2 Washington, DC-MD-VA 70.3 -1.2 Actual OCC & ADR % Change in Top 25 5 Best / 5 Worst Performing Markets ending July 2014 YTD 4 Pipeline Accelerates Under Contract STR Pipeline Phases In Construction – Vertical construction on the physical building has begun. (This does not include construction on any sub-grade structures.) Final Planning – construction will begin within the next 12 months. Planning – construction will begin in more than 13 months. Unconfirmed (formerly Pre-Planning) - Potential projects that remain unconfirmed at this time. Under Contract Pipeline- 12% Increase Phase 2014 2013 % Change In Construction 108 75 44% Final Planning 124 126 -1% Planning 155 144 8% Under Contract 388 345 12% Total U.S. Pipeline, by Phase, ‘000s Rooms July 2014 and 2013 Most In Upscale & Upper Midscale 40.4 30.9 67% 15.4 10.3 5.1 3.5 Luxury 0.8 Upper Upscale Upscale Upper Midscale Total U.S. Pipeline, Rooms Under Construction ‘000s Rooms, by Scale, June 2014 Midscale Economy Unaffiliated Construction In Top 26 Markets: 15 With 2%+ Of Supply Rooms U/C % Of Existing Chicago, IL 2,292 2.1% Minneapolis-St Paul, MN-WI 832 2.2% New Orleans, LA 826 2.2% Los Angeles-Long Beach, CA 2,187 2.2% San Diego, CA 1,381 2.3% Dallas, TX 1,826 2.3% Washington, DC-MD-VA 2,507 2.3% Boston, MA 1,379 2.7% Denver, CO 1,250 2.9% Nashville, TN 1,157 3.1% Anaheim-Santa Ana, CA 2,394 4.4% Seattle, WA 1,937 4.7% Miami-Hialeah, FL 2,653 5.4% Houston, TX 4,672 6.2% New York, NY 13,989 12.5% Market U.S. Pipeline, Top 26 Markets, U/C Rooms as % of Existing Supply, July 2014 New Hotels w/ 50,000+ Sqft Meeting Space 12 9 5 2 2 2 2013 YTD 2014 0 2008 2009 2010 2011 Total U.S. Count of New Hotels with 50k+ Sqft of meeting space By year, 2008 – YTD 2014 2012 5 Where are we headed? Positive RevPAR Growth For The Foreseeable Future 9% 10 8.6% 5 112 Months 0 -5 46 Mo. 65 Months -2.6% -10 -10.1% -15 -16.8% -20 1990 2000 Total U.S., RevPAR % Change, 12 MMA 1/1990 – 7/2014 2010 U.S. Outlook 2014 Forecast 2015 Forecast Supply 1.0% 1.3% Demand 3.6% 2.1% Occupancy 2.6% 0.7% ADR 4.2% 4.4% RevPAR 6.9% 5.2% Total United States Key Performance Indicator Outlook (% Change vs. Prior Year) 2014 - 2015 2014 Year End Outlook Occupancy (% chg) ADR (% chg) RevPAR (%chg) Luxury -0.1% 4.6% 4.5% Upper Upscale 2.0% 4.4% 6.5% Upscale 2.0% 4.4% 6.5% Upper Midscale 2.6% 3.3% 6.0% Midscale 3.0% 3.5% 6.6% Economy 2.9% 3.9% 6.8% Independent 2.8% 4.6% 7.5% Total United States 2.6% 4.2% 6.9% U.S. Chain Scales As of August 12th , 2014 2015 Year End Outlook Occupancy (% chg) ADR (% chg) RevPAR (%chg) Luxury 0.2% 4.8% 5.0% Upper Upscale 0.5% 4.8% 5.3% Upscale 0.2% 4.7% 5.0% Upper Midscale 0.1% 3.5% 3.6% Midscale 1.0% 3.6% 4.6% Economy 1.0% 3.5% 4.5% Independent 0.9% 4.3% 5.2% Total United States 0.7% 4.4% 5.2% U.S. Chain Scale *as of August 12th , 2014 2014 Year End RevPAR Forecast -5% to 0% 0% to 5% 5% to 10% 10% to 15% 15%+ Chicago Anaheim Atlanta Nashville New Orleans Detroit Boston New York Houston Dallas Norfolk Los Angeles Denver Philadelphia Miami San Francisco Washington Minneapolis Seattle Oahu Tampa Orlando Phoenix San Diego St. Louis Top 25 U.S. Markets, August 2014 Forecast (Markets sorted alphabetically) 2015 Year End RevPAR Forecast -5% to 0% 0% to 5% 5% to 10% 10% to 15% New York Atlanta New Orleans Norfolk Philadelphia Washington Anaheim Boston Chicago Dallas Denver Detroit Houston Los Angeles Miami Minneapolis Oahu Orlando Phoenix San Diego San Francisco Seattle St. Louis Tampa Nashville Top 25 U.S. Markets, August 2014 Forecast (Markets sorted alphabetically) To Recap… • • • • • Life is Great! ‘Fish While the Fishing is Good’ Demand Growth: Strong & Steady Group Demand: Still Wild Card (but better!) Supply growth: Not an Issue, yet YE RevPAR Forecast: Rosy! Questions: vbrown@str.com Slides: www.HotelNewsNow.com Thank you!