Understanding Costco

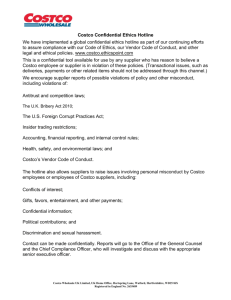

advertisement