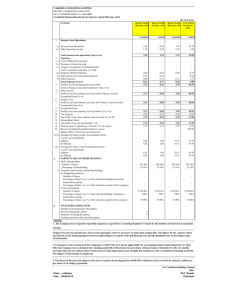

Rs/Lacs Rs/Lacs 1 a Net Sales/Income from Operations 7,036.53

advertisement

FERRO ALLOYS CORPORATION LIMITED REGISTERED OFFICE: D. P. NAGAR, RANDIA - 756 135 DIST: BHADRAK (ORISSA) UNAUDITED FINANCIAL RESULTS QUARTERLY REPORTING OF SEGMENTWISE REVENUE, RESULTS AND CAPITAL EMPLOYED FOR THE FOR THE QUARTER ENDED 30TH JUNE, 2009 QUARTER ENDED 30TH JUNE, 2009 UNDER CLAUSE 41 OF THE LISTING AGREEMENT Rs/Lacs Rs/Lacs QUARTER ENDED PARTICULARS QUARTER ENDED YEAR ENDED 30TH 30TH 31ST JUNE JUNE MARCH 2009 2008 PARTICUILARS 2009 YEAR ENDED 30TH 30TH 31ST JUNE JUNE MARCH 2009 2008 2009 (AUDITED) 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 a b Net Sales/Income from Operations Other Operating Income TOTAL (1) Expenditure a (Increase)/Decrease in stocks in trade and work in progress b Consumption of raw materials c Purchase of traded goods d Employees cost e Depreciation / Amortisation f Power and Fuel g Minining, Handling and Other Production Expenses h Freight, Shipment and Sales Expenses i Other expenditure TOTAL (2) Profit from Operations before Other Income, Interest & Exceptional items (1-2) Other Income Profit before Interest & Exceptional Items (3+4) Interest (Net) Profit after Interest but before Exceptional Items (5-6) Exceptional Items Profit/(Loss) from Ordinary Activities before tax (7+8) Tax Expenses a Current Tax b Wealth Tax / Fringe Benefit Tax c Adjustment for earlier period taxation d Provision for Deferred Tax TOTAL (10) Net Profit /(Loss) from Ordinary Activities after tax (9-10) Extraordinery Items Net Profit/(Loss) for the period (11-12) Cash Profit Paid Up Equity Share Capital (Face Value Re.1/- per Share) Reserves excluding Revaluation Reserves as per balance sheet of previous accounting year Earnings Per Share (EPS) (Not annualised) a Basic and Diluted EPS before Extraordinary items b Basic and Diluted EPS after Extraordinary items Public shareholding Number of Shares Percentage of shareholding Promoters and promoter group Shareholding a Pledged/Encumbered - Number of Shares - Percentage of Shares (as a% of the total shareholding of promoter and promoter group) - Percentage of Shares (as a% of the total share capital of the company) b Non-Encumbered - Number of Shares - Percentage of Shares (as a% of the total shareholding of promoter and promoter group) - Percentage of Shares (as a% of the total share capital of the company) 7,036.53 111.75 7,148.28 8,861.12 8,861.12 21.48 2,726.20 487.27 249.23 1,776.84 1,092.85 328.90 882.08 7,564.85 (1,225.32) 1,634.95 430.65 235.60 1,767.33 1,077.26 253.17 804.57 4,978.21 (416.57) 633.63 217.06 30.40 186.66 186.66 131.17 0.75 (23.49) 108.43 78.23 78.23 303.97 1,852.68 3,882.91 (67.51) 3,815.40 (35.50) 3,850.90 3,850.90 1,376.03 3.45 (21.68) 1,357.80 2,493.10 2,493.10 2,707.02 1,852.68 31,022.62 150.28 31,172.90 (AUDITED) 1. a (937.62) 7,235.73 b 2,056.48 990.84 6,697.64 4,752.53 1,288.82 4,432.85 2. 26,517.27 a 4,655.63 56.07 b 4,711.70 50.22 4,661.48 4,661.48 1,736.03 34.30 (1.58) 32.53 1,801.28 2,860.20 2,860.20 3,883.57 3. 46325636 25.00% 1.35 1.35 46325636 25.00% Ferro Alloys 4,671.55 5,038.09 20,817.42 Chrome Ore 2,364.98 3,823.03 10,205.20 Total Less : Inter Segment Revenue Net Sales / Income from operations 7,036.53 1,066.35 5,970.18 8,861.12 1,212.13 7,648.99 31,022.62 3,011.33 28,011.29 (568.66) 1,624.38 2,348.34 785.72 217.06 2,191.02 3,815.40 2,363.36 4,711.70 Segment Results Profit / (Loss) before Tax, and Interest from each segment. Ferro Alloys Chrome Ore Total LESS : i) Interest ii) Other Unallocable Expenditure net off iii) Unallocable Income Total Profit / (Loss) before Tax 30.40 - 186.66 (35.50) - 3,850.90 50.22 - 4,661.48 1,852.68 12548.62 0.04 0.04 Segment Revenue (Net Sales / Income from each segment) 1.54 1.54 46325636 25.00% 3,506,710 3,506,710 2.52 2.52 1.89 1.89 135,435,895 135,435,895 97.48 97.48 73.11 73.11 Capital Employed (Segment Assets-Segment Liabilities) (Based on estimates in terms of available data ) a Ferro Alloys 1,927.59 3,429.09 2,469.34 b Chrome Ore 13,491.23 13,983.30 12,717.22 c Unallocated 1,426.80 (658.94) 1,527.65 Total 16,845.62 16,753.45 16,714.21 NOTES : 1) Information on investor complaints for the Quarter-(Nos.): Opening Balance - Nil, Received and Resolved during the Quarter - 17, Closing Balance - Nil. 2) The Statutory Auditors have carried out the limited review of the results for the quarter ended 30th June '09. 3) The above results, as reviewed by the Audit Committee, have been approved by the Board of Directors of the Company at its meeting held on 25th July, 2009 For FERRO ALLOYS CORPORATION LIMITED, R.K.SARAF CHAIRMAN & MANAGING DIRECTOR PLACE : NEW DELHI DATE : 25TH JULY, 2009 Corporate Office : Corporate One - Suite 401, Plot No.5, Jasola, New Delhi - 110 044