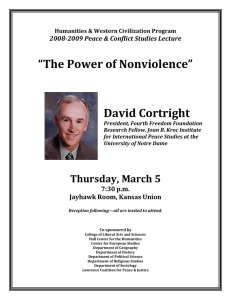

2012 - University of Notre Dame

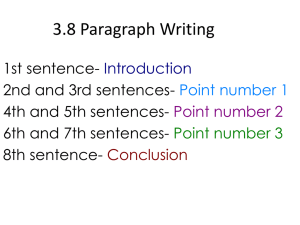

advertisement