Course: Secured Transactions Date: Fall 2002 Professor: Stewart

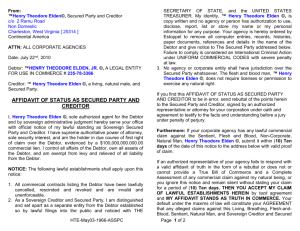

advertisement