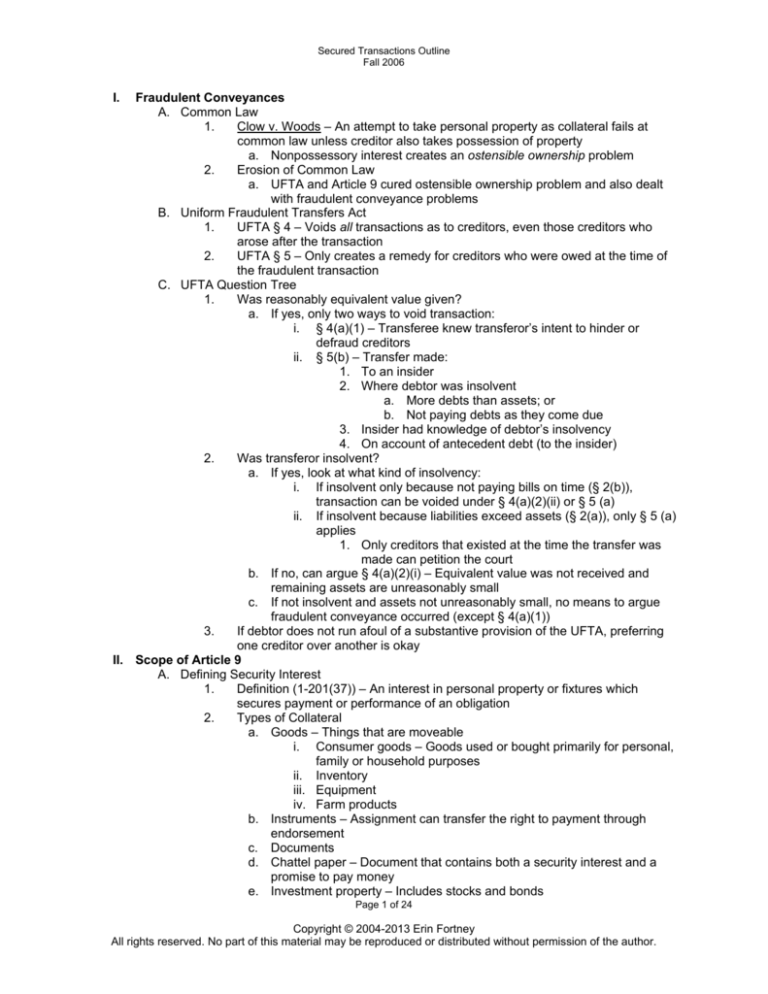

Secured Transactions Outline

Fall 2006

I.

Fraudulent Conveyances

A. Common Law

1.

Clow v. Woods – An attempt to take personal property as collateral fails at

common law unless creditor also takes possession of property

a. Nonpossessory interest creates an ostensible ownership problem

2.

Erosion of Common Law

a. UFTA and Article 9 cured ostensible ownership problem and also dealt

with fraudulent conveyance problems

B. Uniform Fraudulent Transfers Act

1.

UFTA § 4 – Voids all transactions as to creditors, even those creditors who

arose after the transaction

2.

UFTA § 5 – Only creates a remedy for creditors who were owed at the time of

the fraudulent transaction

C. UFTA Question Tree

1.

Was reasonably equivalent value given?

a. If yes, only two ways to void transaction:

i. § 4(a)(1) – Transferee knew transferor’s intent to hinder or

defraud creditors

ii. § 5(b) – Transfer made:

1. To an insider

2. Where debtor was insolvent

a. More debts than assets; or

b. Not paying debts as they come due

3. Insider had knowledge of debtor’s insolvency

4. On account of antecedent debt (to the insider)

2.

Was transferor insolvent?

a. If yes, look at what kind of insolvency:

i. If insolvent only because not paying bills on time (§ 2(b)),

transaction can be voided under § 4(a)(2)(ii) or § 5 (a)

ii. If insolvent because liabilities exceed assets (§ 2(a)), only § 5 (a)

applies

1. Only creditors that existed at the time the transfer was

made can petition the court

b. If no, can argue § 4(a)(2)(i) – Equivalent value was not received and

remaining assets are unreasonably small

c. If not insolvent and assets not unreasonably small, no means to argue

fraudulent conveyance occurred (except § 4(a)(1))

3.

If debtor does not run afoul of a substantive provision of the UFTA, preferring

one creditor over another is okay

II. Scope of Article 9

A. Defining Security Interest

1.

Definition (1-201(37)) – An interest in personal property or fixtures which

secures payment or performance of an obligation

2.

Types of Collateral

a. Goods – Things that are moveable

i. Consumer goods – Goods used or bought primarily for personal,

family or household purposes

ii. Inventory

iii. Equipment

iv. Farm products

b. Instruments – Assignment can transfer the right to payment through

endorsement

c. Documents

d. Chattel paper – Document that contains both a security interest and a

promise to pay money

e. Investment property – Includes stocks and bonds

Page 1 of 24

Copyright © 2004-2013 Erin Fortney

All rights reserved. No part of this material may be reproduced or distributed without permission of the author.

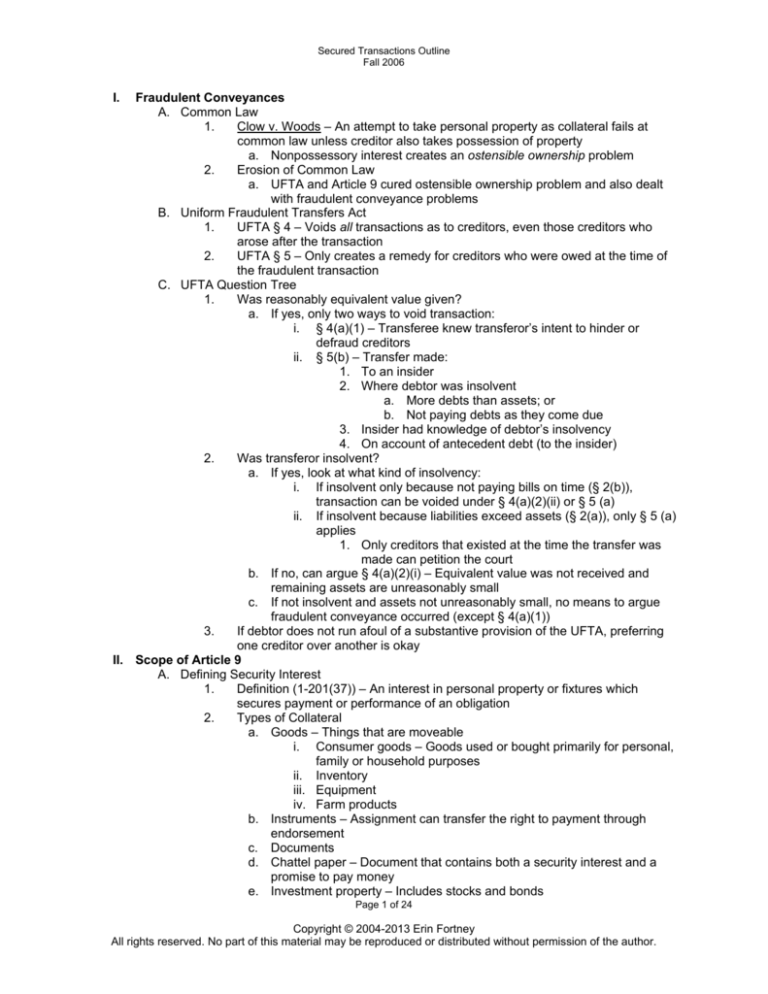

Secured Transactions Outline

Fall 2006

f.

Accounts – Right of payment for goods or services leased or sold

i. Includes healthcare insurance receivables

g. Letter of credit rights

h. Deposit accounts

i. Commercial tort claims

i. Claims filed by organizations

ii. Business-related, nonpersonal injury claims filed by individuals

j. General intangibles – Covers other personal property that doesn’t fit into

other categories and includes:

i. Intellectual property rights

ii. Business goodwill

iii. Licenses (i.e., liquor licenses and FCC licenses)

iv. Software not embedded in goods

v. Payment intangibles – General intangibles under which account

debtor’s primary obligation is the payment of money (i.e. oral

promise to repay a loan, contingent contractual rights; annuity

contracts)

vi. Right of Publicity – Probably no reason why someone’s publicity

rights cannot be categorized as a general intangible and taken

as collateral

1. Potential Constitutional Problem – Prohibition against

involuntary servitude

vii. Domain Names – Probably similar to trademark in that other

assets associated with business goodwill need to be taken as

collateral as well

1. Execute transfer documents at the time SA is signed and

keep transfer documents in vault – Only send to ICANN

in case of default

B. Included Transactions

1.

Transaction that creates a security interest in personal property or fixtures by

contract

2.

Agricultural lien

3.

Sale of accounts, chattel paper, payment intangibles or promissory notes

a. Accounts = Income stream from the sale of goods

i. Perfection

1. Insubstantial amount – Automatic perfection

2. Substantial amount or all – Must file to perfect

ii. Excludes chattel paper

iii. Differentiate from Secured Loan

1. Distribution of risk

2. Ability to negotiate terms

b. Chattel Paper = A record that evidences both a monetary obligation

(promise to pay) and a security interest in specific goods (i.e. furniture

purchased from furniture store on credit)

i. Perfection

1. File; or

2. Physical possession of chattel paper

a. Best to take possession in order to defeat any

other perfected interest in chattel paper

ii. Excludes accounts

c. Securitization – Must be structured as a true sale (with attorney’s letters)

in order for creditor to immediately repossess collateral in bankruptcy (In

re LTV Steel Co.)

4.

Consignment

C. Excluded Transactions

1.

Pre-emption

Page 2 of 24

Copyright © 2004-2013 Erin Fortney

All rights reserved. No part of this material may be reproduced or distributed without permission of the author.

Secured Transactions Outline

Fall 2006

2.

3.

4.

5.

a. Copyright

i. General Rules:

1. Copyright Office is the correct place to file when it is

possible

2. Unregistered Copyrights – File with Secretary of State

a. Caveat: Once copyright is registered with

Copyright Office, state filing is no longer valid!

3. Disputes – Look to Copyright Act §205 for an answer. If

no answer there, go to state filing system.

ii. Rights granted – Negative right to prevent others from copying or

displaying the work

iii. Copyright Office – Proper place to record copyrights and

transfers of copyrights

1. 9-311 – UCC-1 filing in a state office is not sufficient

where federal statute or treaty provides a national or

international filing system

2. Most copyrights are never recorded, thus recording

record of transfer of copyright in Copyright Office is

impossible

iv. Priority

1. Conflicting Transfers – Where neither party recorded a

transfer with the Copyright office, Copyright Act §205(d)

doesn’t provide an answer as to who prevails (only

applies where one or both recorded)

a. Federal law does not pre-empt where it is silent

b. Patent

i. General Rule: Advise clients to file both with the Secretary of

State and in the Patent Office

1. Patent Act – Priority rule applies only to disputes as to

ownership and assignment

2. Silent as to lien creditors and secured parties – Go to

Article 9

ii. Patentable Subject Matter

1. Machines

2. Articles of manufacture

3. Compositions of matter

4. Processes

iii. Patent Act

1. Allows filing for transfers of ownership, including

“hypothecation” (putting something up as collateral)

2. Priority Rule – Only applies to subsequent purchasers

and mortgagees; not to lien creditors or in bankruptcy

a. Where neither party records, last in time wins

c. Trademark

i. General Rule: Advise clients to file in state where debtor is

located and in Trademark Office

ii. Prohibition on Assignments in Gross – Cannot sell a trademark

without associated business goodwill

1. Constitutes abandonment as a matter of law

2. Can foreclose on trademark along with associated

goodwill

Statutes that expressly create a separate system

Interests in health insurance policies

Landlord’s lien

Right of recoupment or set-off – 9-109 excludes recoupment and set-off but

points to other code provisions

Page 3 of 24

Copyright © 2004-2013 Erin Fortney

All rights reserved. No part of this material may be reproduced or distributed without permission of the author.

Secured Transactions Outline

Fall 2006

6.

7.

8.

9.

a. Bank (9-340(a)) – Bank with set-off rights prevails over a secured party

i. Exception (9-340(c)) – Where secured party has a security

interest in a deposit account perfected through control

1. Gaining Control – Must get authenticated document

signed by secured party, debtor and bank

b. Account Debtor

i. Consumer Goods (9-404(1)) – Where an account debtor

purchases consumer goods and the goods don’t meet

specifications and account debtor stops paying – Account debtor

does not have to honor any assignments debtor makes

ii. Separate Deal (9-404(2)) – Where an account debtor stops

paying debtor due to problems in an entirely separate transaction

– Account debtor will not have to honor any assignment unless

the secured party gives account debtor notice before account

debtor’s cause of action accrues against debtor

1. Look at two dates:

a. Date notice is sent by secured party to account

debtors

b. Date debtor defaulted on obligation to account

debtor

c. No Priority Rule – Article 9 does not give a priority rule where a debtor

obtains a judgment against an account debtor, but still owes the account

debtor for something else

Assignment of right to payment under contract

Real estate transactions

Bailments

a. Definition (2-403) – Any entrusting of goods to a merchant who deals in

goods of any kind gives the merchant the power to transfer the rights of

the entruster free of any interest

i. Only protects buyers in the ordinary course of business (not

secured parties)

b. Filing Requirements

i. Conditional Sale/Consignment – Transferor must file

ii. Lease/Bailment – Transferor is not required to file

c. Characteristics (Medomak)

i. No purchase price specified

ii. K does not say “sale”

d. Example

i. True Bailment – Buy cloth and take it to tailor to have suit made

ii. True Security Interest – Advance tailor money to purchase cloth

and get a signed SA permitting purchase money lender to

repossess cloth if suit doesn’t meet specifications

True Leases

a. Test: Whether, at the time K was entered into, the parties assumed

lessee would end up as owner of goods

i. Factors:

1. Nominal purchase option

a. Nominal = Buy or renew lease are the only

choices and buying is cheaper

b. Judged at the time K entered into

c. BUT, nominal purchase option after optional

additional lease term does not make transaction

a security interest (Marhoefer)

2. Economic life of goods

3. Renewal option higher than market rate

4. Option to buy is fair market price

Page 4 of 24

Copyright © 2004-2013 Erin Fortney

All rights reserved. No part of this material may be reproduced or distributed without permission of the author.

Secured Transactions Outline

Fall 2006

b. Filing Requirements – No need to file

c. Rent to Own – Generally treated as leases by courts

III. Attachment

A. Generally

1.

Process by which security interest is made effective as between the two parties

2.

Definition – Debtor has authenticated a writing granting the creditor an interest

in described collateral that secures debtor’s performance, value is given by the

creditor and the debtor acquires rights in the collateral.

B. Requirements for Attachment

1.

Authenticated Security Agreement

a. Definitions

i. Authenticated = Signed, or contains something indicating debtor

adopts it (9-102(a)(7))

1. Definition permits electronic

signatures/acknowledgements

ii. Record = Information in tangible form or electronically stored and

retrievable (9-102(a)(69))

iii. Effect of Signature

1. Individual – When individual signs, he has posted

personal property as collateral for loan for business

2. Company – Must be signed by an actual person,

generally an individual acting on behalf of company

b. Grants Interest

i. Intent – Must be intent on the part of the parties to establish a

security interest

ii. In re Clark – No security interest because agreement that debtor

would not remove or transfer liquor license did not give creditor

rights in the license

c. Written Agreement

i. Holistic Approach (In re Bollinger) – A financing statement, taken

together with other documents and correspondence, can be

sufficient to evidence SA

1. FS alone, however, is insufficient

2. Many courts do not follow this approach

d. Adequate Description of Collateral

i. Standard: Can it be determined from the description what

collateral was intended?

ii. Security interest attaches only to collateral described in SA

(Martin Grinding)

iii. Better to categorize collateral using UCC categories

1. Providing a laundry list is not a good idea because of

interpretive problems (In re Laminated Vaneers)

iv. No Supergeneric Descriptions (9-108(c)) (i.e. “any property”)

1. Broad terminology OK

2. Supergeneric descriptions OK in FS (9-504)

v. Tort claims must be listed separately

vi. After-Acquired Property – Security agreement may cover afteracquired property (9-204(a))

1. Security agreement must generally specify that it covers

assets to be acquired in the future

a. Exception: Inventory

i. Term implies not only present inventory,

but that to be acquired in the future

2. Floating Lien – Debtor can acquire and dispose of

individual items or assets; lien “floats” until debtor

acquires rights in collateral

Page 5 of 24

Copyright © 2004-2013 Erin Fortney

All rights reserved. No part of this material may be reproduced or distributed without permission of the author.

Secured Transactions Outline

Fall 2006

2.

3.

3. Exceptions:

a. Consumer Goods (9-204(b)(1)) – Security

interest does not attach to consumer goods

unless debtor acquires rights in them within 10

days after secured party gives value

b. Commercial Tort Claims (9-204(b)(2))

e. Oral Agreement – An oral security agreement will suffice only when:

i. Secured party has control of collateral (9-203(b)(3)(d))

ii. Secured party has possession of collateral (9-203(b)(3)(B))

Debtor Has Rights in Collateral – Debtor cannot put up as collateral something

in which it has no rights

a. Exception: Can put up collateral owned by someone else with consent of

the owner (In re Whatley)

i. Statute of Frauds – Guaranteeing the debts of another requires a

written K

ii. To clarify, can either:

1. Make addendum to K by individual giving consent for

corporation to post collateral, or

2. Have two separate transactions

Value Given to Debtor

a. Generally – Any kind of value is usually sufficient, including a promise to

give money

b. Timing – If giving value is the last event to occur, may be helpful to fix

the specific time at which value is given

c. Future Advances (9-204(c)) – Security agreement may provide that the

collateral secures future advances

IV. Perfection

A. Generally

1.

Process by which security interest is made effective against the rest of the

world (unsecured creditors and subsequent secured creditors)

2.

General Rule – Perfection requires all attachment requirements plus

requirements set forth in §§ 9-309 – 9-315

3.

Categorization of Collateral

a. Important because action taken to perfect depends on classification of

the collateral

i. In re Vienna Park – Contingent right to receive money (i.e.

escrow account) is not money. Must file to perfect; possession is

not sufficient.

4.

Bottom Line – Just file.

B. Methods of Perfection

1.

Perfection by Filing

a. General Rule - All security interests must be perfected by filing

i. Collateral Perfected by Filing

1. Goods

2. Accounts – Filing is only means of perfecting

a. Exception: Insignificant number of debtor’s

accounts automatically perfects (9-309(2))

3. Agricultural Liens

4. Documents

5. Instruments

6. Chattel Paper

7. General Intangibles – Filing is only means of perfecting

ii. Exceptions:

1. Interests that are automatically perfected under 9-309

2. Compliance with another type of statute (i.e. purchasing

a car) (9-311)

Page 6 of 24

Copyright © 2004-2013 Erin Fortney

All rights reserved. No part of this material may be reproduced or distributed without permission of the author.

Secured Transactions Outline

Fall 2006

3. Possession of collateral under 9-313

4. Control of deposit accounts under 9-314

5. Assignment of security interest

a. Assignee steps into shoes of prior secured party

iii. Filing Permissible Where Possession Previously Required (9312)

1. Chattel Paper

2. Instruments

3. Exceptions:

a. Deposit accounts (must control)

b. Money (must possess)

b. Requirements of Filing Statement:

i. Name and address of debtor

1. FS indexed under debtor’s name

ii. Name and address of secured party

iii. Description of the collateral (if collateral is real property-related,

must describe real property as well)

iv. Debtor’s authorization – Debtor does not need to sign FS, but

debtor’s authentication of SA is automatically authorization for

secured party to file FS (9-509(b))

c. Debtor’s Name (9-503)

i. Corporation – File against debtor corporation’s name of record

ii. General Partnership – File against all partners comprising debtor

if it does not have a name (9-503(a)(4)(A))

1. Large firm with hundreds of partners – File against

individual or organizational name (i.e. King & Spalding)

iii. Trade Name – Filing against trade name is insufficient (9-503(c))

iv. Safe Harbor (9-506(c))

1. If a search of the recording office under the debtor’s

correct name, using filing office’s standard search logic,

would still disclose the financing statement with debtor’s

(incorrect) name, the error in debtor’s name does not

make the financing statement seriously misleading

a. Standard Search Logic – Uncertain what it is

where you can perform search with computer

d. Secured Creditor’s Name – Complies with requirements even if it

contains minor errors or omissions so long as it is not seriously

misleading (9-506(a))

i. Examine from perspective of a potential lender

ii. Address must merely be “adequate under the circumstances” (9516)

iii. Omission of Related Secured Creditor – Probably seriously

misleading (In re Copper King Inn)

1. Omission of a related secured creditor likely to mislead a

potential creditor

2. Raises possibility of insider collusion

3. Distinguish: Joint Venture – Probably not seriously

misleading because JV completely controlled by other

listed creditors

iv. Use of Agent or Representative – Permissible to use the name of

an agent or representative in the FS

e. Identification of Collateral (9-504)

i. A description of collateral in a FS is sufficient if:

1. Description reasonably identifies what is described (9108); or

Page 7 of 24

Copyright © 2004-2013 Erin Fortney

All rights reserved. No part of this material may be reproduced or distributed without permission of the author.

Secured Transactions Outline

Fall 2006

2.

2. Provides an indication that the FS covers all assets or

personal property

ii. Supergenerics Permitted (9-504(2))

iii. After-Acquired Property and Future Advances – FS is effective to

encompass transactions under a SA not in existence and not

contemplated at the time notice was filed, if description of

collateral in FS broad enough to encompass them. FS also valid

to cover AAP whether or not mentioned in the SA

1. But, SA must be clear that AAP is collateral and that

FAs are meant to be collateralized

f. Governing Laws – Location of Debtor

i. General Rule – Rules of perfection governed by location of

debtor (9-301(1))

1. Corporations and “Registered Organizations” – Located

in the state of incorporation (9-307(e))

2. Organizations Other than Corporations – Located in

place of business (if only one) and chief executive office

(if more than one) (9-307(b)(2)-(3))

a. Place of Business – Where debtor “conducts its

affairs”

3. Individuals – Located at primary residence (9-307(b)(1))

4. Federal Government – Located in District of Columbia

(9-307(h))

5. Foreign Debtors – If foreign debtor’s country has Article

9-type filing system, that country’s law governs. If

debtor’s country does not have Article 9-type filing

system, debtor deemed to be located in District of

Columbia (9-307(c))

ii. Exceptions:

1. Security interest in timber to be cut (9-301(2)-(3)) –

Location of collateral governs

2. Minerals – Location of wellhead/minehead governs

3. Goods covered by certificate of title – State issuing

certificate governs (9-303)

4. Deposit Accounts – Law of depository bank’s jurisdiction

governs (generally specified in agreements between

debtor and bank; otherwise, bank’s chief executive

office) (9-304)

5. Investment property perfected by control

6. Letter of credit rights

7. Agricultural liens

iii. Mellon Bank Test for Determining Chief Executive Office

1. Where does the debtor manage the main part of its

business?

a. Look at publicly visible signs of location

(letterhead, press releases, etc.)

2. Where would creditors reasonably be expected to

search for credit information?

iv. Priority – Rules of priority governed by location of collateral

Automatic Perfection Upon Attachment (9-309)

a. Security interest automatically perfects upon attachment for:

i. Purchase-money security interest in consumer goods (9-309(1))

(i.e., goods purchased using a credit card)

1. Security Agreement Required – Even though filing not

required, secured party still required to have an

authenticated security agreement

Page 8 of 24

Copyright © 2004-2013 Erin Fortney

All rights reserved. No part of this material may be reproduced or distributed without permission of the author.

Secured Transactions Outline

Fall 2006

ii.

3.

Sale or assignment of an insignificant number of debtors

accounts or payment intangibles

iii. Promissory notes

b. Temporary Automatic Perfection of Proceeds (9-315) – A security

interest in proceeds is automatically perfected if a security interest in the

original collateral was perfected

i. 20-Day Grace Period – Automatic perfection lasts for 20 days.

Security interest becomes unperfected on the 21st day unless:

1. The following conditions are satisfied:

a. A filed financing statement covers original

collateral;

b. Proceeds are collateral in which a security

interest may be perfected by filing in the office in

which the FS has been filed; and

c. Proceeds are not acquired with cash proceeds;

2. The proceeds are identifiable cash proceeds; or

3. The security interest in proceeds is perfected other than

under 9-315(c) when the security interest attaches to the

proceeds or within 20 days thereafter

Perfection by Possession (9-313)

a. Security interest may be perfected by possession with regards to:

i. Tangible negotiable documents

ii. Goods

iii. Instruments

iv. Tangible chattel paper

1. Chattel paper = Writing that evidences a security interest

+ promise to pay

v. Money – must possess to perfect

1. Money = medium of exchange; cash (must be currency

that is currently used in any country as a medium of

exchange)

b. Timing (9-313(e))

i. Perfection occurs when secured party takes possession of

collateral

ii. Perfection continues only so long as secured party maintains

possession of collateral

rd

c. Possession by a 3 Party

i. Collateral in Possession of Person Other than Debtor (9-313(c))

1. SP “takes possession” of collateral in possession of a

person other than debtor, SP or lessee when:

a. Person in possession authenticates a record

acknowledging it holds possession of collateral

for SP’s benefit; or

b. Person takes possession of collateral after

having authenticated a record acknowledging

that it will hold possession of the collateral for

SP’s benefit

2. Only applies when bailee is not the formal legal agent of

the secured party

3. Does not apply to goods covered by a document

a. Overruled Marlow v. Rollins Cotton Co.

4. In re Coral Petroleum, Inc.

ii. Bailments (9-313(h))

1. A secured party having possession of collateral does not

relinquish possession by delivering collateral to a 3rd

party so long as 3rd person is instructed:

Page 9 of 24

Copyright © 2004-2013 Erin Fortney

All rights reserved. No part of this material may be reproduced or distributed without permission of the author.

Secured Transactions Outline

Fall 2006

a. To hold possession of collateral for secured

party’s benefit, or

b. To redeliver collateral to the secured party

d. Rights and Duties of Secured Party in Possession of Collateral

i. Duty of Reasonable Care – Secured party must use reasonable

care in storing and preserving collateral (9-207(a))

1. Duty of reasonable care cannot be waived or disclaimed

2. Includes duty to insure

ii. Right to Reimbursement of Expenses (9-207(b)(1))

iii. Accounting for Rents, Issues, and Profits (9-207(c))

iv. Risk of Loss (9-207(b)(2)) – Borne by debtor to extent secured

party’s insurance is insufficient

v. Right to Repledge (9-207(c)(3)) – Secured party can repledge

collateral to a 3rd party

vi. Right to Use Collateral (9-207(b)(4)) – Secured party can use

collateral only:

1. For purposes of preserving collateral or its value

2. Pursuant to court order

3. Except for consumer goods, as agreed to by the debtor

4.

Perfection by Control (9-314)

a. Secured party can perfect through control of:

i. Deposit account

1. Requirements for Control of Deposit Account (9-104):

a. Secured party is bank with which deposit

account is maintained;

b. Debtor, secured party and bank have agreed in

an authenticated record that the bank will

comply with instructions originated by the

secured party directing disposition of the funds

in the deposit account without further consent by

the debtor; or

c. Secured party becomes bank’s customer with

respect to the deposit account

ii. Letter of credit rights

iii. Electronic chattel paper

iv. Accounts – There used to be no means of filing as to accounts

and control was the only way to perfect. (Benedict v. Ratner)

Now, must file as to accounts.

b. Timing

i. Perfection occurs when secured party obtains control of

collateral

ii. Perfection continues only while secured party has control of

collateral

5.

Unique Methods of Perfection

a. Motor Vehicles

i. Perfection typically accomplished through a notation on the title

1. Security interest remains perfected if vehicle was in the

jurisdiction when the security interest attached

ii. Motor Vehicles as Inventory – Works the same as regular

inventory (goods)

C. Continuation of Perfection

1.

Possession – Continues so long as secured party retains possession

2.

Control – Continues so long as secured party retains control

3.

Filing – Effective for a period of five years from date of filing

a. Continuation Statement (9-515) – Must be filed within the six months

preceding the expiration of the filing statement

Page 10 of 24

Copyright © 2004-2013 Erin Fortney

All rights reserved. No part of this material may be reproduced or distributed without permission of the author.

Secured Transactions Outline

Fall 2006

i.

4.

Must identify original FS by file number and must either:

1. Indicate it is a continuation statement, or

2. Indicate that it is filed to continue the effectiveness of the

identified statement

ii. Adds another five years to the effectiveness of original FS

iii. Relation Back – Priority date relates back to original date of filing

iv. Filing a new FS is not sufficient – does not provide notice of a

superior interest

Continuation of Perfection After Transfers and Changes

a. Changes in Location

i. Change in Location of Collateral (9-316)(a)(3) – Collateral

remains perfected for one year but secured party must make a

new filing in the new jurisdiction before that time is up

1. Law of new jurisdiction governs priority

ii. Change in Location of Debtor

1. Location of Debtor (9-301) – Governs where to file

a. 9-307 – Governs where debtor is located

2. Debtor Moves (9-316(a)(2)) – New filing needs to be

made as to the debtor in the new jurisdiction within four

months

b. New Debtor

i. Name Changes (9-507(c)) – If debtor changes its name such

that the FS becomes seriously misleading under 9-506:

1. Original FS is effective to secure collateral acquired

before and within four months after the name change;

and

2. Original FS is not effective to secure collateral acquired

more than four months after the name change unless an

amendment to the FS is filed within four months of

name change rendering it not seriously misleading

ii. Incorporations, Mergers and Transfers (9-508) – Where Debtor

incorporates and transfers all assets and debts to corporation,

security interest survives and new debtor becomes party to the

original SA

1. Secured party of original debtor has priority over debtor

of new entity (9-325 provides exception to first to file

rule)

2. Priority (9-326) – FS that continues to be effective under

9-508 against the new debtor is subordinate to an

interest in the same collateral filed against the new

debtor

c. Transferred Collateral (9-325) – Security interest survives perfected even

when collateral is transferred to another owner

i. A security interest created by a debtor is subordinate to a

security interest in the same collateral created by another person

if:

1. The debtor acquired the collateral subject to the security

interest created by the other person;

2. The security interest created by the other person was

perfected when debtor received the collateral; and

3. There is no period thereafter when the security interest

is unperfected

ii. Exception: Buyer in the Ordinary Course of Business (9-320(a))

1. A buyer in the ordinary course of business from a

dealer’s inventory takes free of any perfected security

interests held by dealer’s creditors.

Page 11 of 24

Copyright © 2004-2013 Erin Fortney

All rights reserved. No part of this material may be reproduced or distributed without permission of the author.

Secured Transactions Outline

Fall 2006

2. Does not matter whether buyer knew inventory was

covered by a security interest, so long as buyer does not

know that sale is in violation of terms of the SA

3. Requirements for Buyer in Ordinary Course of Business:

a. Ordinary Purchase – Buyer must buy goods out

of inventory in the ordinary course of business

b. New Value – Buyer must give new value, not

merely cancel out old indebtedness

c. No Knowledge – Buyer must buy in good faith

and not know the sale is a violation of the terms

of the SA between seller and seller’s creditor

4. Interest Created by Seller – Security interest in item sold

must have been created by the buyer’s seller

d. Good Faith Purchaser (9-320)

i. Buyer in the Ordinary Course of Business (9-320(a)) (see above)

ii. Buyer of Consumer Goods from Other Consumers(9-320(b))

1. A buyer of consumer goods from a person who used or

bought the goods for use primarily for personal, family or

household purposes, takes free of a security interest,

even if perfected, if the buyer buys:

a. Without knowledge of the security interest

b. For value

c. Primarily for the buyer’s personal, family or

household purposes; and

d. Before the filing of a financing statement

covering the goods

iii. Buyer Not in the Ordinary Course of Business – Future

Advances (9-323(d)-(e))

1. A buyer not in the ordinary course of business takes free

of increases in the security interest due to future

advances unless the advances are made within 45 days

following the sale and are made either without

knowledge of the sale or pursuant to a commitment that

was entered into without such knowledge

e. Future Advances (9-323)

V. Priority

A. General Effectiveness (9-201)

1.

A security agreement is effective according to its terms between the parties,

against purchasers of the collateral and against creditors

B. Rights To Collateral Against Competing Interests

1.

General Rule – First to file or perfect wins (9-322(a)(1))

a. Continuation of Priority – A timely filed Continuation Statement preserves

original priority date

2.

Subordination Agreement – Competing secured creditors can enter into a

subordination agreement that alters the normal (statutory) priority rules.

3.

Rights Against Unsecured Creditors – Secured creditors take first and then

unsecured creditors share remaining assets pro rata

a. Pro Rata Rule

i. Total the unsecured claims against the assets

ii. Total the assets

iii. For each creditor, give that creditor the fraction of assets that the

creditor holds for the claims

4.

Rights of Junior Secured Creditors

a. Marshaling

i. Elements:

1. Parties are creditors of the same debtor;

Page 12 of 24

Copyright © 2004-2013 Erin Fortney

All rights reserved. No part of this material may be reproduced or distributed without permission of the author.

Secured Transactions Outline

Fall 2006

5.

2. There are two funds belonging to that debtor; and

3. Only one of the creditors has the right to resort to both

funds

ii. If elements are met, a junior secured creditor can invoke

marshaling against a senior secured creditor, forcing the SSC

to get its debt satisfied from the singly-charged fund first before

going against the doubly-charged fund

1. Unsecured junior creditors cannot invoke marshaling

iii. Marshaling and Article 9 – Marshaling not specifically sanctioned

by Article 9, but 1-103 permits courts to impose principles of

equity on top of the UCC so long as they are not supplanted by

the UCC

Purchase-Money Security Interests – PMSI created when value is extended to

debtor to purchase a specific asset

a. Scope of PMSI – Only extends to money lent to purchase specific assets

i. MBank Alamo v. Raytheon – Seller provided machines to Debtor

to re-sell, taking a security interest in accounts generated from

sales of machines. Court held Seller not a purchase money

lender because it did not lend money to debtor to acquire

accounts (instead extended equipment to debtor to sell to get

accounts).

1. 9-324 favors financers in accounts over PMSIs in

inventory

ii. 9-324(b) – Accounts are not traceable proceeds of a PMSI in

inventory

b. PMSI Superpriority (9-324(a)) – Perfected PMSI in goods other than

inventory or livestock has priority over a conflicting security interest in the

same goods if PMSI is perfected when debtor receives possession of the

collateral or within 20 days thereafter

i. Prevails against other security interests, regardless of time or

method of perfection of those interests

ii. Limitation – Priority limited to the extent of the “purchase money”

used in acquisition of the collateral

c. Consumer Goods – Automatically perfects; thus PMSI superpriority takes

effect at that time as well

d. Inventory (9-324(b))

i. PMSI in inventory has priority in inventory and identifiable

proceeds provided:

1. PMSI perfected when debtor receives possession of the

inventory

a. No 20-day grace period for perfection

2. Secured party sends an authenticated notice to the

holder of the conflicting security interest

3. Holder of conflicting security interest receives notification

within five years before the debtor receives possession

of inventory; and

4. Notification states that the person sending it has or

expects to acquire PMSI in inventory of debtor and

describes inventory

ii. Proceeds – PMSI superpriority extends to identifiable inventory

cash proceeds received on or before delivery of inventory to the

buyer, chattel paper proceeds and instrument proceeds

iii. Article 9 Consignments – Treated as PMSIs in inventory

e. Competing PMSI Creditors – As between a seller and a lender who both

have PMSI in the same collateral, seller has priority over lender (9324(g))

Page 13 of 24

Copyright © 2004-2013 Erin Fortney

All rights reserved. No part of this material may be reproduced or distributed without permission of the author.

Secured Transactions Outline

Fall 2006

f.

6.

7.

Refinancing and Transformation of PMSI

i. Refinancing (9-103(f)) – Refinancing does not destroy purchase

money characteristic of security interest

1. Billings v. Avco Colorado Industrial Bank – PMSI is not

extinguished upon refinancing if parties intended for it to

remain PMSI

a. Rationale: Permitting PMSI to be extinguished

upon refinancing makes creditors less likely to

extend credit to struggling debtors

2. Exception: Consumer goods

a. Code punts issue of consumer goods to the

courts (9-103(h))

g. Application of Payment in Non-Consumer Goods Transactions (9-103(e))

i. If the extent to which a security interest is PMSI depends on the

application of a payment to a particular obligation, the payment

must be applied:

1. In accordance with any reasonable method of

application to which the parties agree;

2. In the absence of parties’ agreement, in accordance with

any intention of debtor manifested at or before time of

payment; or

3. In the absence of agreement between parties and

debtor’s intention, in the following order:

a. To the obligations that are not secured; and

b. If more than one obligation is secured, to

obligations secured by PMSIs in the order in

which those obligations were incurred

After-Acquired Property – Priority generally dates back to original filing

a. Exception: Consumer Goods (9-204(b)) – Security interest does not

attach under an after-acquired property clause to consumer goods

unless debtor acquires rights to them within 10 days after the secured

party gives value

Future Advances – Priority generally relates back to original filing

a. Exceptions

i. Where Security Interest Automatically Perfects (9-323(a)) –

Priority dates from time of advance (i.e. credit card cash advance

– dates from time of advance, not from prior purchases made

with credit card)

ii. Lien Creditors (9-323(b)) – Secured creditor must make

advances within 45 days of lien arising

1. Advances made after 45 days do not have priority over

lien creditor

2. GA – does not have this rule

a. Most likely that GA is a notice jurisdiction –

Once lien creditor notifies bank, Bank can no

longer lend and gain priority over those

advances

iii. Advances Based on Commitment (9-323(e)) – Where secured

party makes an absolute commitment to lend a specific amount

of money at regular intervals, each advance relates back to

original date, regardless of 45 day period

1. 45 day period doesn’t apply; otherwise secured party

would break contract

b. Use of “Floating Secured Parties” Prohibited

Page 14 of 24

Copyright © 2004-2013 Erin Fortney

All rights reserved. No part of this material may be reproduced or distributed without permission of the author.

Secured Transactions Outline

Fall 2006

i.

8.

In re E.A. Fretz Co. – A company cannot include “future divisions

and affiliates” in its security agreement to permit assignment of

interest in order to gain priority

1. Secured parties’ names and addresses must be listed on

the FS

2. Policy: Banks will not lend money due to fears that junior

secured creditors can jump in front of them through

shady dealings

Proceeds of Collateral (9-315)

a. Proceeds as Collateral – Secured party can take security interest in

proceeds of assets without taking security interest in assets themselves

i. But, interest does not attach until proceeds are realized (Horse

Hypo)

1. Might be voidable preference if proceeds are acquired

within 90 days of bankruptcy

b. Temporary Automatic Perfection – A security interest in proceeds is

automatically perfected if a security interest in the original collateral was

perfected

i. 20-Day Grace Period – Automatic perfection lasts for 20 days.

st

Security interest becomes unperfected on the 21 day unless:

1. The following conditions are satisfied:

a. A filed financing statement covers original

collateral;

b. Proceeds are collateral in which a security

interest may be perfected by filing in the office in

which the FS has been filed; and

c. Proceeds are not acquired with cash proceeds;

2. The proceeds are identifiable cash proceeds; or

3. The security interest in proceeds is perfected other than

under 9-315(c) when the security interest attaches to the

proceeds or within 20 days thereafter

ii. Intervening Cash Proceeds (9-315(d)(1)) – Refile!

c. Commingled Proceeds

i. Identifiable Proceeds – Commingled Proceeds are identifiable

proceeds:

1. If the proceeds are goods, to the extent provided in 9336; and

a. Commingled Goods (9-336) – Secured parties

whose goods are commingled into one mass

share pro rata in the resulting mass

2. If the proceeds are not goods, to the extent that the

secured party identifies the proceeds by a method of

tracing, including application of equitable principles

[punts to state law]

ii. Deposit Accounts

1. Proceeds in Bank Account vs. Secured Party with

Control of Account (9-327) – Secured party with control

over bank account will always defeat perfected secured

party who has interest in the money in the account as

proceeds

2. Lowest Intermediate Balance Rule – Determines what

money in deposit account is subject to a perfected

security agreement

a. Proceeds = Oil (float to top)

b. Existing Funds = Water (sink to bottom)

Page 15 of 24

Copyright © 2004-2013 Erin Fortney

All rights reserved. No part of this material may be reproduced or distributed without permission of the author.

Secured Transactions Outline

Fall 2006

c.

9.

10.

11.

Money drains from bottom – Non-proceeds drain

first, then proceeds

3. Proceeds in Bank Account Divided Between Competing

Creditors – UCC punts to state law

a. Four Possibilities:

i. First to File (9-322)(b)(1))

ii. Pro Rata

iii. First In/First Out (FIFO)

iv. Last In/First Out (LIFO)

4. Transferee of Funds from Deposit Account (9-332(b)) –

Takes money free from any security interest in the

deposit account unless transferee was acting in collusion

with the debtor in violating rights of secured party

5. Special Priority Rule (9-322(c))

a. A security interest in collateral which qualifies for

priority over a conflicting security interest under

9-327 – 9-330 also has priority over a conflicting

interest in:

i. Any supporting obligation for the

collateral; and

ii. Proceeds of the collateral if:

1. The security interest in

proceeds is perfected;

2. The proceeds are cash

proceeds of the same type as

the collateral; and

3. In the case of proceeds of

proceeds, all intervening

proceeds are cash proceeds,

proceeds of the same type as

the collateral or an account

relating to the collateral

Claimants to Deposit Accounts

a. Priority of Deposit Accounts (9-327) – Where secured party with interest

in deposit account perfected by taking control, that interest has priority

over a secured party that does not have control

b. Set-Off Rights Against Deposit Account (9-340)

Lien Creditors

a. General Rule – Lien creditors are junior to perfected security interests

(but superior to unperfected security interests).

i. Secured party must perfect before lien arises

ii. When does an unsecured creditor become a lien creditor?

1. Most States – Attachment, garnishment or levy

a. Priority date not necessarily date lien arises

(assets seized)

2. GA and CA – Lien arises when it is recorded by the court

a. Special statute grants priority over perfected

secured creditors when lien is recorded

b. Future Advances – Once secured party has knowledge of lien, it has 45

days to make any additional advances to the debtor

i. Exception: No 45-day rule where there was a pre-lien

commitment to extend advances at regular intervals

Trustee in Bankruptcy

a. Types of Bankruptcy

i. Chapter 7 – Liquidation

ii. Chapter 11 – Reorganization

Page 16 of 24

Copyright © 2004-2013 Erin Fortney

All rights reserved. No part of this material may be reproduced or distributed without permission of the author.

Secured Transactions Outline

Fall 2006

b. Effect of Bankruptcy Petition

i. Automatic Stay – Stays civil actions, debt collections,

repossessions, attempts to perfect, set-offs, and Tax Court

proceedings

1. Relief from Stay – Must ask for permission from court

and can make two arguments:

a. Lack of adequate protection; or

b. Debtor has no equity in property and the

property is not needed for a successful

reorganization

2. Adequate Protection – Periodic cash payments,

additional or replacement liens, administrative priority

constituting “indubitable equivalent” for depreciation or

consumption of collateral

3. Interest – Oversecured parties entitled to interest at

contract rate; undersecured parties no entitled to interest

on lost opportunity cost

ii. Trustee as Lien Creditor – Can avoid lesser interests

1. Preferences – Trustee can avoid some last-minute

transfers

iii. Turnover – Trustee may force secured creditor to turn over

repossessed goods in which debtor still has redemption rights

c. Trustee Avoiding Powers

i. Post-Petition Effect of Security Interest (BC 552)

1. Property acquired by the estate or by the debtor after

bankruptcy filing is not subject to any lien resulting from

any security agreement entered into by the debtor before

the commencement of the case

ii. Fraudulent Conveyances (BC 548)

1. Uniform Fraudulent Transfer Act

2. Presumption of Fraud (BC 548(a)(2)) – Transfers of

property made within two years of filing of bankruptcy

petition by an insolvent debtor for less than fair

consideration are presumed fraudulent

3. Intent to Defraud (BC 548(a)(1))

iii. Preferences in Bankruptcy (BC 547)

1. Test for Preferences (BC 547(b)) – Transfer must:

a. Be to or for the benefit of a creditor

b. Be for or on account of an antecedent debt

i. Transfer = time of attachment if

perfected within 30 days

ii. If perfection occurs after 30 days, debt

is antecedent BUT

iii. No earlier than when debtor acquires

rights in the collateral

c. Have been made while debtor was insolvent

i. Insolvency presumed within 90 days

prior to filing of bankruptcy petition

d. Have been made on or within 90 days of the

filing of the petition

i. Or within one year of filing of petition if

creditor is an insider

e. Make the creditor better off than if no transfer

had been made and the creditor had only

enjoyed what rights it had in the collective

proceeding

Page 17 of 24

Copyright © 2004-2013 Erin Fortney

All rights reserved. No part of this material may be reproduced or distributed without permission of the author.

Secured Transactions Outline

Fall 2006

f.

12.

13.

No Safe Harbor (BC 547(c)):

i. Debts and payments incurred in the

ordinary course of business

ii. PMSI perfected within 30 days

iii. Inventory or accounts acquired by

debtor which do not increase the value

of those categories of collateral beyond

their value at the start of the preference

period

2. Floating Lien in Bankruptcy – Voidable preference

because transfer does not occur until debtor gains rights

in collateral, and is made on account of antecedent debt

a. Can be saved by BC 547(c) safe harbor –

Inventory or accounts acquired that do not

increase the value of those categories of

collateral beyond their value at the start of the

preference period

i. Inventory and accounts constantly

changing – Not a last-minute grab or a

tardy perfection

d. Valuation in Bankruptcy (Associates Commercial Corp. v. Rash) – Where

asset is necessary for effective reorganization in Chapter 11 (cram

down), secured party cannot repossess and sell. Must value asset in

order to determine what adequate assurance and indubitable equivalent

of asset would be

i. Standard: Replacement value (what debtor would have to pay on

open market to obtain the asset)

1. Almost always more than foreclosure value

2. Value of asset measured by value to debtor

ii. Rationale: Alternative is not what secured party wants, justifying

additional compensation for involuntary participation

State Law Lienors (9-109(d)(2)) – Article 9 does not apply to liens, other than

agricultural liens

a. Priority (9-333) – State lien will only have priority over a perfected

security interest under Article 9 if it is a possessory lien

Federal Tax Liens

a. Steps Taken by IRS

i. Lien naturally arises when tax is assessed

1. Assessment = invisible ministerial act by IRS when it

determined the amount of tax debtor owes

2. This alone permits IRS to defeat an unsecured creditor

3. Most commonly arises when employers stop making

withholding and FICA contributions

ii. IRS must file either in a state office designated by the laws of

the state or if the state doesn’t specify or specifies two different

places, with the clerk of the district court in the judicial district in

which the property subject to lien is situated to defeat:

1. Purchaser

2. Holder of security interest

3. Mechanic’s lienor

4. Judgment lien creditor

iii. Filing lasts for six years from date of assessment

b. Future Advances – Future advances made within 45 days after IRS files

have priority over IRS

c. Qualified Property (Rice Investment Co. v. US) – Chattel paper,

accounts, and inventory acquired within 45 days of IRS filing

Page 18 of 24

Copyright © 2004-2013 Erin Fortney

All rights reserved. No part of this material may be reproduced or distributed without permission of the author.

Secured Transactions Outline

Fall 2006

i.

14.

15.

Secured party can prevail as to qualified property, but must be

able to prove assets are qualified property

Fixtures

a. Definition – Good that has become so related to real estate that an

interest in it arises under real estate law

i. Three-Part Test for Fixtures (Wyoming State Farm Loan Board v.

Farm Credit System Capital Corp.)

1. Real or constructive annexation of the article in question

to the realty

2. Appropriation or adaptation to the use or purpose of that

part of the realty with which it is connected

3. Intention of the party making the annexation to make the

article a permanent accession to the freehold

a. Standard: Intent of annexor measured by the

objective intent of an ordinary reasonable

person based on the facts and circumstances of

the case

ii. Mobile Homes – Depends on context (i.e., existence of poured

foundation, hooked up to utilities, etc.)

b. Priority (9-334)

i. No security interest in construction materials when incorporated

into improvements on land

1. Interest exists as long as materials are not used (i.e. pile

of lumber or stack of bricks)

ii. Purchase Money Priority (9-334(d)) – A perfected security

interest in fixtures has priority over a conflicting interest of an

encumbrancer or owner of the real property if the debtor has an

interest of record in or is in possession of the real property and:

1. Security interest is a PMSI

2. Interest of the encumbrancer or owner arises before the

goods become fixtures; and

3. Security interest is perfected by a fixture filing before the

goods become fixtures or within 20 days after

iii. Priority of Interest in Fixtures over Interest in Real Property (9334(e))

Other Issues Between Secured and Unsecured Creditors

a. Non-Encumbrance Clauses

i. Intentional Interference with Contractual Relations – Where one

party intentionally and improperly interferes with performance of

rd

a K by inducing or otherwise causing a 3 person not to perform

a contract

ii. First Wyoming Bank v. Mudge – Where Bank knew of nonencumbrance clause on buyer’s property, yet knowingly induced

buyer to disobey clause, Bank liable in tort for intentional

interference with contractual relations

b. Unjust Enrichment

i. Ninth District Production Credit Ass’n v. Ed Duggan, Inc. –

Where feed provider provided feed to cattle at feedlot for benefit

of secured party and secured party did not pay, liable for unjust

enrichment because feed was necessary for maintenance of

collateral (cattle)

ii. 1-103 – Common law imposed upon Article 9 if it is equitable and

not supplanted by Article 9

VI. Default

A. Defining Default

1.

Contractual Specification – Generally, K specifies what constitutes breach, i.e.:

Page 19 of 24

Copyright © 2004-2013 Erin Fortney

All rights reserved. No part of this material may be reproduced or distributed without permission of the author.

Secured Transactions Outline

Fall 2006

a. Missing a payment on this or another loan

b. Breach of warranty or representation

c. Reasonable grounds for insecurity with respect to debtor’s performance

of obligations

d. Being levied against

e. Bankruptcy

f. Voluntary suspension of business by debtor

g. Collateral becomes unsatisfactory in character or value

h. Any material adverse change in financial condition (even if current on

payments)

2.

Contract is Silent – Default is probably uncured material breach – A breach of

the K and a reasonable person would assume the breach will not be cured

B. Overview of Rights After Default

1.

Article 9 Provisions

a. 9-601 – Permits secured party to go to court and repossess at the same

time; assures secured party they have no further obligation if they buy

collateral at sheriff sale

b. 9-602 – Possible to waive certain duties

i. Cannot waive important duties, i.e. right to an accounting, right to

be free from breach of peace

c. 9-603 – Allows secured party to stipulate how some of the standards will

be satisfied

i. Must be commercially reasonable

d. 9-605 – No duties arise until secured party knows identity and location of

debtor

i. Can rely on last-known location of debtor

ii. No duty to search further

e. 9-607 – Secured party’s rights in accounts and deposit accounts

i. Person in control of deposit account can take money out upon

default to apply to balance of debt

ii. After notice to account debtors, they have to pay the secured

party directly

f. 9-608 – How proceeds from account debtors and deposit accounts must

be applied

i. First – Collection expenses (including attorney’s fees)

ii. Second – Satisfaction of debt itself

iii. Third – Satisfy debts of other subordinate secured parties or

lienholders if they have provided secured party with

authenticated notice

iv. Finally – Remaining funds, if any, goes to debtor

g. 9-609 – Right to repossess or render equipment unusable

i. Subject to breach of peace limitation

h. 9-610 – Duties owed by secured party after repossession

i. Must dispose of assets in a commercially reasonable manner

1. Limitation applies to method, manner, time and place of

sale

ii. Secured party my purchase collateral at a public sale but may

not purchase at a private sale unless collateral is subject to

standard price quotations

i. 9-611 – Notice of disposition

i. Secured party must provide notice as to disposition of collateral

to:

1. Debtor and secondary obligors (guarantors and sureties)

2. If collateral is not consumer goods, to everyone who

makes an authenticated claim and any secured parties

and lienholders who are on file

Page 20 of 24

Copyright © 2004-2013 Erin Fortney

All rights reserved. No part of this material may be reproduced or distributed without permission of the author.

Secured Transactions Outline

Fall 2006

j.

9-612 – Timeliness of notice

i. Notice must come within a reasonable time and in a reasonable

manner

1. Safe harbor (nonconsumer goods) – 10 days of notice

before earliest possible disposition date is reasonable as

a matter of law

2. No safe harbor for consumer goods

k. 9-613 – Contents of notice

l. 9-615 – Application of proceeds of disposition under 9-610

i. Same as application in 9-608

m. 9-616 – Explanation to debtor of calculation of surplus or deficiency

n. 9-617 – Quality of title received if collateral purchased from secured

party

i. Transferee of value – Gets all of debtor’s rights in collateral

ii. Discharge of secured party’s interest

iii. Discharge of subordinate secured parties’ interest or subordinate

liens

iv. Do not take free of a security interest that is superior to that of

secured party

1. Exception: Take free of interest if purchased at sheriff’s

auction

o. 9-623 – Debtor has right to redeem up until the moment of disposition so

long as it makes good its obligations completely

i. Redemption must include collection costs, attorney’s fees, etc.

p. 9-624 – Debtor can waive certain rights after default:

i. Notice

ii. Commercial disposition

iii. Redemption

1. Exception: Consumer cannot waive this right

2.

Post-Default Options

a. Sue, sheriff levies and sells (no commercial reasonableness necessary)

– Deficiency recoverable

b. Repossess, give notice, sell in commercially reasonable manner, return

surplus or sue for deficiency [debt – sale price + costs]

c. Repossess, give no notice, sell in commercially reasonable manner

[Easterbrook v. Ripple]

d. Repossess, give notice, sell in non-commercially reasonable manner,

prove value at time of sale, get deficiency [debt – value + costs]

e. Repossess, give no notice, sell in non-commercially reasonable manner,

prove value at time of sale, get deficiency [debt – value + costs]

f. Keep collateral in full satisfaction [notice + acceptance or 20 days of

silence]

g. Keep collateral in partial satisfaction, sue for deficiency [no consumer

transactions; no acceptance by silence]

C. Repossession (9-609)

1.

Right to Repossess (9-609(a)) – After default, a secured party has the right to

a. Take possession of the collateral; and

b. Without removal, render equipment unusable

2.

Limitation: Breach of the Peace (9-609(b)(2)) – A secured party that proceeds

without judicial process may do so only if it proceeds without breach of the

peace

a. Defining Breach of the Peace

i. Permission Not Required – Secured party not required to ask

permission before repossessing on public street or private

driveway

Page 21 of 24

Copyright © 2004-2013 Erin Fortney

All rights reserved. No part of this material may be reproduced or distributed without permission of the author.

Secured Transactions Outline

Fall 2006

1. No per se rule that repossessing from someone else’s

property is a breach of the peace, either

2. “Trickery” is permitted

ii. Debtor Uncooperative – If debtor confronts and objects, further

action by secured party is a breach of the peace

1. Secured party must then go through judicial process

iii. Fact-based Inquiry

1. Location (public place, outside private property, garage,

business, home?)

2. Time (day, night?)

3. Debtor (present without objection, absent, present and

objecting, intimidated, assaulted?)

a. Present and Objecting – De facto breach of

peace

4. Notice (notice, no notice?)

5. Manner (trespass, clean trespass with no damage,

trespass with damage?)

b. Consequences of Wrongful Repossession

i. Debtor can sue for conversion or trespass (if anything damaged)

ii. Debtor can recover costs of wrongful repossession

iii. Debtor cannot get the collateral back

3.

Repossession of Accounts (9-607)

a. Account Debtors – Secured party may give notice to account debtors

i. Right to Demand Proof – Before paying secured party, account

debtor has right to demand proof before obligation to pay arises

ii. Required to Pay SP – After proper notice, account debtor is

required to pay secured party under 9-406

iii. Non-Assignment Clauses Void – Any attempt to make account

non-assignable is void

b. Deposit Accounts – Secured party with control can withdraw funds from

deposit account to satisfy debt

c. Application of Proceeds (9-608)

i. After collecting money from accounts or deposit accounts,

secured party must apply proceeds in the following order:

1. Apply money to collection expenses (including

reasonable attorney’s fees)

2. Satisfy the debt itself

3. Balance (if any) to satisfy debts of other subordinate

secured parties or lienholders if they have notified

secured party by authenticated letter

4. Balance (if any) to debtor

D. The Commercially Reasonable Sale (9-610)

1.

Commercially Reasonable Disposition (9-610(b)) – Every aspect of the

method, manner, time, place and other terms must be commercially

reasonable.

2.

Purchase by Secured Party (9-610(c)) – Secured party may purchase

collateral:

a. At a public disposition (auction)

b. At a private disposition only if the collateral is of the kind that is sold on a

recognized market or is the subject of widely distributed standard price

quotations

3.

Notice Requirement (9-611) – Secured party must provide authenticated notice

of the sale to debtor, sureties, and other creditors of record

a. Exceptions

i. Perishable collateral

ii. Collateral is of a type sold in a recognized market

Page 22 of 24

Copyright © 2004-2013 Erin Fortney

All rights reserved. No part of this material may be reproduced or distributed without permission of the author.

Secured Transactions Outline

Fall 2006

b. Oral Notice Insufficient – Must be some sort of authenticated written

notice

c. Contents of Notice:

i. 9-613 – Notice is sufficient if it provides:

1. Description of debtor and secured party

2. Description of collateral

3. Method of sale (public or private)

4. Time and place of a public sale or time after which a

private sale will be made

5. Statement that the debtor is entitled to an accounting

ii. Additional Notice for Consumer Goods:

1. Liability for a deficiency

2. Telephone number to find out what amount is due to

redeem collateral

3. Telephone number or mailing address from which

additional information is available

d. Timing of Notice (9-612) – Must be sent after default and a reasonable

time before date of disposition of collateral

i. Safe Harbor for Nonconsumer Transactions – Notice sent at

least 10 days before earliest possible disposition of collateral

cannot be attacked on the basis of timeliness

ii. Consumer Transactions – No safe harbor

1. Reasonableness of notice determined on a case by case

basis

4.

Surplus and Deficiency (9-615) – Debtor entitled to surplus proceeds after

disposition. Secured party entitled to deficiency where proceeds are not

sufficient to satisfy debt

a. Legal Consequences of Failure to Provide Adequate Notice

i. Majority Rule (9-626) – Amount earned by sale = amount of debt

1. Rebuttable Presumption can be overcome by showing:

a. Commercial reasonableness (where problem is

notice)

i. Result – Recover full deficiency

b. Expert appraisal (where problem is commercial

reasonableness of sale)

i. Result – Recover partial deficiency if

appraisal is greater than sale price

2. Current law as to all transactions except consumer

goods

a. UCC – Punts to state law to choose which rule

to apply to commercial goods

3. In re Excello Press

ii. Minority Rule (Easterbrook) – Debtor only has a remedy under 9625

1. Debtor, rather than secured party, bears burden of

finding appraisers and proving sale did not fetch as

much as it should have

iii. Absolute Bar Rule (vast minority) – If secured party does not

provide notice, it is absolutely barred from asking for a deficiency

judgment

E. Retention of Collateral in Satisfaction of Debt (9-620)

1.

General Rule – Secured party may elect to keep the collateral in full or partial

satisfaction of the debt, provided requirements of 9-620 are met

a. Exception: Consumer Goods (9-620(e))

Page 23 of 24

Copyright © 2004-2013 Erin Fortney

All rights reserved. No part of this material may be reproduced or distributed without permission of the author.

Secured Transactions Outline

Fall 2006

i.

2.

3.

4.

5.

Where collateral consists of consumer goods and debtor has

paid at least 60% of the price or loaned amount, the secured

creditor must sell the collateral within 90 days of repossession

Notice Requirement – Secured party must provide notice to debtor and all

other secured parties and parties that provide authenticated notice of debt due

and owing

a. Misbehavior policed by good faith and notice requirements

b. Notice requirement cannot be waived

Effect of Objection – If, within 20 days after notice is sent, any person entitled

to notice objects to secured party’s proposal to keep collateral in satisfaction of

debt, secured party must dispose of collateral by sale

Retention in Partial Satisfaction

a. A partial retention in satisfaction occurs if:

i. Secured party gives authenticated notice to debtor and other

parties (same as full satisfaction)

ii. Debtor consents in an authenticated record

iii. No other perfected secured parties object within 20 days of when

authenticated notice was sent

b. Exception: Consumer Goods (9-620(g))

i. A secured party may not accept collateral in partial satisfaction of

a debt if the transaction is a consumer transaction

Good Faith Requirement?

a. Reeves v. Foutz and Tanner, Inc. – Pawn shop wrongfully kept plaintiff’s

collateral and owed a surplus to plaintiff because pawn shop had every

intention of reselling the collateral rather than keeping it in satisfaction of

the obligation

b. Article 9 does not prohibit keeping collateral in satisfaction and then

selling

i. FTC Ruling – Can still comply with 9-620 and not be able to keep

the collateral in satisfaction of a debt if you intend to resell it right

away

ii. Article 9 Good Faith Provisions – Do not come into play unless

there is a large discrepancy between debt and value of collateral

c. Instance of bad facts making bad law

Page 24 of 24

Copyright © 2004-2013 Erin Fortney

All rights reserved. No part of this material may be reproduced or distributed without permission of the author.